Fiat Currency Inflation, And Collapse Insurance

Currencies / Fiat Currency Aug 23, 2018 - 04:49 PM GMTBy: Raymond_Matison

FIAT CURRENCY INFLATION, AND COLLAPSE INSURANCE

Insurance against fiat currency

Insurance against fiat currency

Billions of people covering a vast land mass around the globe do not have insurance of any sort. Why? It is because they own few assets. No house, no car, just a hovel with no electricity or water at the foothills of some nondescript mountain. By contrast, those who live in advanced economies have assets worthwhile protecting against loss. Thus, we in America have homeowners insurance to protect against the loss of our dwelling, auto insurance to protect against the involuntary conversion of our movement conveyance into scrap metal, and to protect our financial assets against a lawsuit which could strip us of our savings and investment assets in the face of our fault in an automobile accident. Further, we protect our family’s income and savings by purchasing life or disability insurance. We buy insurance because we do have assets, and believe it worthwhile to protect those assets against unforeseeable loss, when the cost of that insurance is affordable.

Why is it then, that we do not protect our assets against the major foreseeable and persistent source of asset loss – that of loss in the value of our currency. Should we not have protection against inflation and the resulting loss of value or purchasing power in our fiat currency represented in our pension funds, stock or bond funds, or savings and money market account assets? We know and acknowledge that inflation robs us of our savings each and every year. Since 1971, even using the contrived statistics used in calculating the Consumers Price Index, the value of a 1971 collar is just worth $0.16 today. That is a very significant loss in value over a relatively short period of time.

We should also protect against the far less frequent, but more significant potential of sudden and near total loss in confidence and value of our dollar. The loss of value due to inflation is a persistent annual event, while rapid substantial loss of a fiat currency in countries around the globe has averaged roughly every forty years. The brutal facts are that no fiat currency in the history of the world has maintained its value. No fiat currency has ever existed in the history of the world that has not failed. Yes, the occurrence of the event is infrequent, but the loss severe. Because our nation in the last decade has accrued a record amount of national debt, the threat of a catastrophic decline in the value of the dollar is increasingly palpable. Therefore, we should insure also against this potential loss event. Since this is insurance against the loss in value of our fiat currency, we will henceforth call it “fiat insurance”.

Availability of fiat insurance

It is likely that the vast majority of people do not have fiat insurance, because one cannot call up an insurance broker or an insurance company to buy such coverage. Insurance companies simply do not have a contract providing restitution for loss in currency value. Traditional insurance is not available, but there are ways of protecting against this potential loss event. And of course, we should have such fiat insurance to protect against both the slow inflationary and more sudden catastrophic loss of value in purchasing power of our entire financial, dollar denominated assets.

Professional money managers of mutual funds hedge their investments in order to protect against rapid or significant loss. This is usually achieved by the use of financial derivatives such as puts and calls. Such hedging is not advised for the average individual investor because of its program sophistication and cost. However, the average investor has a very viable means of purchasing protection against the loss in the value of a currency – by the purchase of physical gold and silver.

Ideally, purchase of popular mainstream gold or silver coins roughly in the dollar amount one pays for auto or homeowners insurance coverage should have already taken place accumulating over the last decade or two. Think of it as paying a premium every year for buying fiat insurance, but with a huge distinction. Traditional insurance paid via an annual premium expires at the end of the policy term with a residual value of zero. However the purchase of this fiat insurance by the purchase of some precious metal coins not only maintains its value, but accumulates over a period of years to a meaningful value as more coins are purchased, saved and stored.

If one does not already have 5-20% of one’s total financial assets in precious metals, then it is advisable, in addition to buying fiat insurance each year henceforth, to make a one-time investment that would represent a meaningful start to such precious metal allocation. It is also possible to allocate some pension or IRA plans to precious metals investments that would increase protection against the loss in fiat currency.

Historical market price of precious metals

Precious metals have famously held their purchasing value for over two thousand years.

One anecdotal observation is that in Roman times a senator could purchase his fancy garb for an ounce of gold, and today an ounce of gold will still purchase a fine suit. Contrary to a piece of paper with fine printing on it, gold will never decline nor maintain a value of zero, which has been the ultimate fate of every paper fiat currency ever issued.

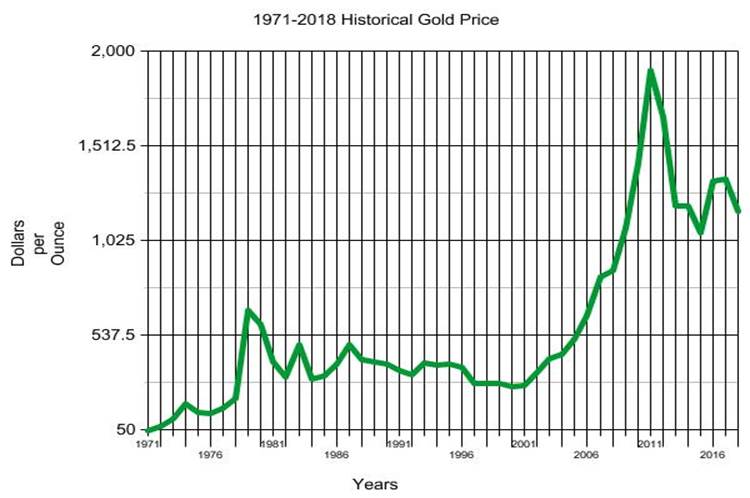

The following chart shows the history of the price of gold since 1971, after the government’s promise to exchange $35 for an ounce of gold among foreign country central banks was broken and discontinued. This default by the U.S. ushered in a new economic period of dramatically increased money printing commensurate with an increase in Treasury debt, and extension of consumer credit. Our national debt today exceeds $21 trillion, with confident projections by economists that government debt will rise to approach $30 trillion over the next decade. The increasing realization that the U.S. will not be able to repay its national debt provides the expectation that our fiat currency will eventually collapse, as the price of precious metals explodes.

First, note that in the late 1970’s when inflation was running at a double digit rate, the price of gold rose about 5 times in a relatively short time period. Note also that this chart shows a five times increase in the price of gold after the meltdown in global markets in 2007, driven by the massive default of mortgage backed securities. As the price of gold started to “run away” in both of these periods, it had to be suppressed in order to maintain trust in the fiat currency.

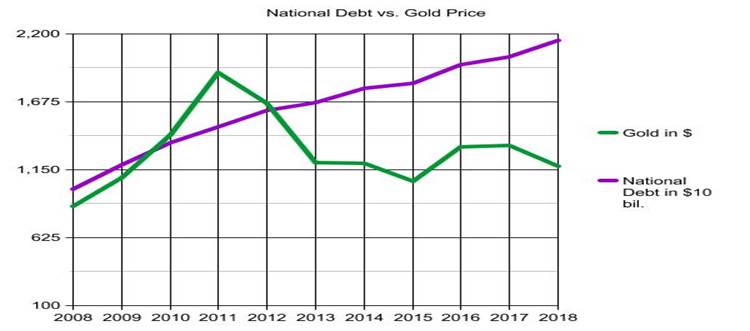

The next chart shows the increase in national debt since 2010, and contrasts it with the stagnant or declining gold price. Note that national debt first exceeded $1 trillion in 1982 (not shown), or two hundred six years after the nation’s founding. However, from 2008 when national debt was $10 trillion, it has exploded to an estimated $21.5 trillion as of the present moment. Since our nation’s tax base is at $3.4 trillion, and the interest on national debt is at $456 billion which over the next decade with more normalized interest rates is expected to rise to $1 trillion, the probability in repayment of the government’s debt is truly between slim and none.

During the course of years 2011-2018, the market price of gold and silver has been declining. More dramatically, there is a wide increasing divergence between our growth of national debt and the decline in the market price of precious metals. This divergence cannot happen or be maintained for so many years in a free market. Free markets are consistently analyzed for their logic and price rationale. Such divergence between the debasement of our currency and depressed gold price cannot long endure in un-manipulated markets. Therefore the wise conclusion is that we do not have a free market; instead it is manipulated and controlled.

A rise in gold price in terms of dollars would confirm that unwise government spending, unremitting wars, and persistent borrowing and printing of currency are destroying the dollar and its value; therefore, from the government’s and FED’s perspective, to maintain the illusion that the currency is still sound, any significant rise in the market price of gold must be suppressed, manipulated, controlled, and stopped.

Market manipulation

How long will precious metals markets be suppressed? For as long as it is possible.

Central banks, elites, and our government intent on maintaining their control will necessarily manipulate exchange regulations and markets for as long as it is feasible.

Markets won’t be free until market control can no longer be maintained. Thus markets will not rise until that control is destroyed by outside economic or military forces, internal collapse, or revolt driven by angry, bankrupted citizen patriots.

The vast majority of America’s sincere citizens naively believe that our government exists to protect us and to increase our financial and social wellbeing. It is a sobering realization that government is not in existence to help or protect you. At its best, government simply gets out of the way of citizen’s activities allowing them to forge their own lives and futures without regulatory interference while shielding the public against unfair corporate or foreign policies which reduce individual opportunities. At worst it implements sanctions, overthrows foreign governments which do not support its policies, starts wars, increases taxes for redistribution, implements financial repression against its own citizens, borrows money on behalf of unwilling taxpayers which cannot be repaid, and impoverishes every citizen as it ruins its currency. Unfortunately, all of these unsavory actions have been increasingly taking place in and by America and its leadership over the last several decades.

Government now exists to protect the privileged jobs of politicians and government employees who benefit by remaining in power and keeping their influential positions. Politicians have demonstrated their corruption by not protecting the public, but pandering and protecting our large corporations who dominate international markets which arguably don’t need any protection on account of their global reach and incredible monopolistic market power. This misguided policy fosters Fascism rather than strengthening a democratic republic.

If redress to the people of this country is to ever take place from these egregious actions, then the political, business, and financial systems will need to be changed. It is clear that such change in control will not take place from enlightenment of those in control today, so it means that eventually this change will take place through internal collapse, confrontation, and possibly a bloody civil war. Such is an environment where fiat insurance is not only desirable, but unconditionally necessary.

Manipulation and analyst recommendations

The multitude of investment advisors specializing in precious metals have for many years suggested that the rise in precious metal markets “is just around the corner”. They will suggest that “now” is the time for a quick, profitable trade. They will declare that the precious metals asset class is now ripe for profitable investment. They will show that precious metals charts have formed a strong base from which to rise. This advice has continued for nearly ten years – before the peak and decisive persistent decline of precious metals prices in 2011. For how many years will you continue to listen to such advice before suspecting that this advice is wrong? How many dollars must you lose before learning that the strategy of the last ten years by these pundits has been incorrect? They have all been wrong, and they will continue to be wrong until the market manipulation is ended.

Ironically, these analysts are right – conceptually. However, all these analysts are grossly wrong – on timing. Market manipulation will stop only when the forces of government and FED action can be eliminated or overcome. Precious metals prices could start rising next week, or it may take many years - for this timing is unknowable. As a historical reference, it took Rome roughly four hundred years to decline before its empire collapsed. Therefore, it could still take many years as the dollar influence diminishes, before precious metals can be priced by a free market.

Current real role of precious metals

For the reasons just stated, we contend that precious metals should never be considered as a distinct investment asset class. Instead gold and silver are money which over time adjusts its market value so as to protect the holder of precious metals against fiat currency debasement – both inflation and currency collapse. It is insurance against a failing fiat currency, and unsound government policies. You should not care at what price you buy this insurance, nor be concerned as to what is the current price of previously purchased precious metal coins.

Therefore, do not buy precious metals for the purpose of expecting them to rise so that you can make a profit. Don’t buy them to make a quick profitable trade. Do not buy them to make a profitable long term investment. Do not buy precious metals to become rich. You buy precious metals so that you do not become poor! It is when manipulation can no longer take place that precious metal prices will explode, rising dramatically over a relatively short period of time.

When our fiat currency ultimately fails, you will be “richer” than the person who does not own any precious metals; but realistically that other person will have become poor, while you will have simply maintained your purchasing power because of your fiat insurance expressed in ownership of gold and silver coins. You should not be a precious metals investor – instead buy gold and silver to protect yourself against the sins of government and central banking. Buy precious metals so as not to become poor. Own them through the purchase of fiat insurance.

Central bank gold ownership

All of the world’s central banks own and hold gold as an asset. If it didn’t have any value, these central banks would not own gold, period. But they do own gold! And some banks, such as those in China, Russia, and India have been particularly aggressive in buying more gold reserves. In fact, the BRICS nations of Brazil, Russia, India, China, and South Africa, have just entered into a historical multinational joint venture, which is structured as a government and private investment partnership. The pre-production investment for the open mine pit is estimated at $500 million which is expected to produce about 6.5 tons of gold per year. Who would invest in such a partnership if gold had no future value? Follow the actions of these experts who truly do understand gold and money and are intent in adding to their gold reserves.

Prices for precious metals may rise, but they will also fall. Remember that precious metals have been underperforming for over ten years. That performance will not change until markets are free of manipulation. When that change comes, it will likely come as a sudden and dramatic rise instituted by the government as it was in 1935 when over a weekend president Roosevelt announced the dollar’s devaluation by increasing the price of gold from $20.67 to $35.00 an ounce, and in 1971 when the gold window was closed and the market price of gold subsequently exploded. At that time your precious metals value in terms of dollars will multiply. However this will be an event to savor only with mixed emotions. When your precious metals values explode higher, the cost of a gallon of milk or gas (and everything else) may be five or ten times higher as well.

The true value of gold

Most people are at least vaguely familiar that our currency once was backed by gold. In fact, at one time every paper dollar in circulation was backed by gold. Historically and theoretically, dividing America’s holdings of gold by its governmentally set price determined how much paper currency could be issued. When historically gold had a price of $35 per ounce, thirty-five paper dollars could be printed for each ounce of gold – if the backing of the paper currency was at 100%. If the gold backing was only at 50%, then the Treasury could print $70 paper dollars.

Utilizing the same approach, if there is a given amount of currency printed and circulating, and a certain amount of gold – we can then determine what the price of gold should be to maintain a given percentage of gold backing to the currency. For example, if $70 of paper currency has been printed, and there is one ounce of gold – gold’s price would be $70 per ounce, if that currency was backed at 100%.

The U.S. Treasury supposedly has 8133 tons of gold (237.2 million troy ounces). No one actually knows if this is still true as there has been no audit of this gold for over sixty years. Because the gold may have been leased and sold by the lessee, we cannot be certain that the gold is there or recoverable. At one extreme, the amount of currency in circulation, according to the St. Louis Federal Reserve Bank is $1.62 trillion. Therefore, at a 100% gold backing of currency, the price of an ounce of gold should be $6,830 ($1.62 T / 237.2 mil. oz).

However, this low number is deceptive, since when money issuance was no longer constrained by gold backing, credit issuance grew far more than currency, and money is unlikely to have a 100% gold backing. The extension of credit is equivalent to printing fiat currency. With more than $7 trillion held by foreign banks, total credit extension approximating $70 trillion, and a national debt more than $21 trillion (not counting our unfunded liabilities), the actual price of gold per ounce necessary to back the dollars created by our debt issued currency could easily be over sixty times higher, than the $6,830 figure at 100% gold backing. By this reasoning at the other extreme, with all of this fiat money and credit creation at only a 10% gold backing - would require gold to be priced at $42,025 per ounce.

Such a price rise would never be permitted by the deep state, as gold would now play a key role in the wealth of a nation. Not only do we not know how much gold is still owned by America itself, but we would surely be enriching competing large countries such as India and China who have always seen gold as a store of wealth. In addition, we would be empowering our “enemies” such as Russia and Iran who have been accumulating gold, and are seeking an alternative to the stranglehold of the dollar in international trade. They also see the dollar and foreign exchange markets as America’s most efficient weapon in maintaining its global dominance.

Comparing gold and oil dollar values

Most people know that gold and silver coin was legal money. The Coinage Act of 1792 authorizes Eagle coins to be the value of ten dollars containing 3712.5 grains of silver, or 247.5 grains of gold (480 grains equals one troy ounce). Silver and gold were legal money. Even after the confiscation of gold from its citizens by our own government in 1931, gold was still understood to be money, and had value. Central banks and governments have been leading citizens away from the perception that gold is money. It may have succeeded in convincing Americans that our Federal Reserve note is money, it has not been able to convince the rest of the world.

Historically, various commodity items have been used as money. After the Second World War in Europe for a short time even cigarette packages, liquor, and nylon stockings served fairly efficiently as substitutes for a modest amounts of money. Oil also has many attributes of money: it represents a finite commodity, it has demonstrated to have a store of value, it is divisible within certain limitations, and its in-ground volume constitutes an asset. It is not the point of this comparison to argue that oil is money, but simply to point out that the relationship of gold to oil is such that over time comparisons of an ounce of gold in terms of barrels of oil provides insight into their relative value.

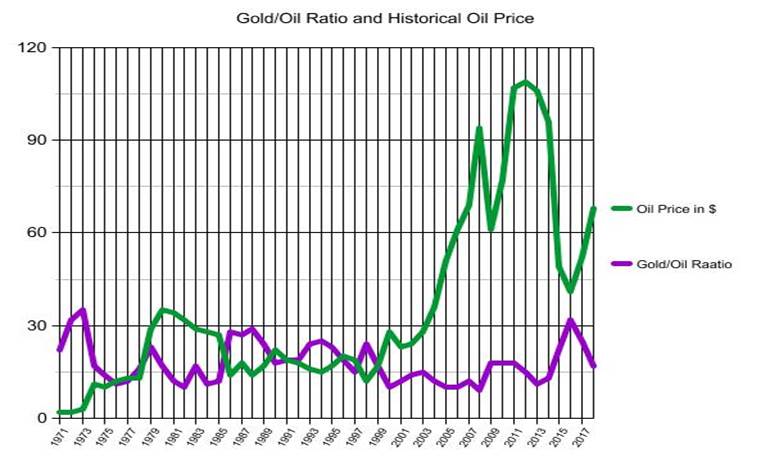

The following chart shows the relationship of gold and oil in dollars from 1971-2018. Over this time period, this value has ranged 9-35 ounces of gold per barrel of oil, but has a tighter range of 12-18. At recent prices of gold and oil, this ratio stands at eighteen. Utilizing this historically established range of values, it is easy to see that gold in terms of oil could still increase, meaning that the price of gold in dollars can also decline. As a result, analysts calling for near term rise in the price of gold could still be wrong – before, eventually, they are right.

Comparing housing to gold

Historically, gold has also been compared to the average price of a home. As a home can vary more in size and attributes far more than the differences in the grade of oil, this comparison is less accurate than the comparison of gold to oil. However, over many years it does provide a reasonable guide as to the range in value of housing in terms of gold.

Over the last century the average home price varied between 100 to almost 500 ounces of gold. This takes in periods where housing prices are highly inflated, deflated, and where precious metals are either over or under priced. The more normal relationship between an average house price in terms of gold ranges between 200-400 ounces. Therefore, when the ratio is outside this range we can use this information for our financial advantage as this ratio will eventually conform back to the norm. When this ratio is above 400, it implies that house prices are overvalued or gold is undervalued; when this ratio is below 200 it implies that house prices have declined while gold price has become dearer.

The median and average of a new home presently is $302,000 and $363,000; as the price of a used home was $276,900 and $314,900 respectively. Therefore, at present it takes 236 ounces of gold to purchase an average priced used home. Please note that the price of gold in terms of dollars is and has been depressed by intentional market manipulation. It is also worth noting that because of the FED’s low interest rate setting policy, house prices have been inflated. For these reasons the ratio of gold to house value is high and could decline significantly, meaning that when housing prices decline due to higher interest rates and gold rise on account of international currency concerns one may be able to purchase house for as little as one hundred ounces of gold. You may not be interested in purchasing another house, but when gold’s value rises you will be able to pay off your own existing mortgage more easily. This is yet another reason to keep purchasing fiat insurance.

Factors affecting the price of precious metals

Potential conflict among nations that could escalate to physical war has almost always caused precious metals prices to rise. Over recent decades we have been exposed to propaganda that our national security is endangered by terrorist or otherwise dangerous governments. By contrast, we admit to promoting democracy around the world, yet in that process America has been accused of covertly overthrowing existing, elected governments whose policies are not in line with ours.

It is statistically very unusual that in a world of 196 countries one of our greatest allies is a country which is a repressive absolute monarchy wherein hands can be chopped off for stealing a loaf of bread, a head cut off for changing one’s religious beliefs, as teenage girls can be forced to become one of several wives to an older man, while rape of a woman can be punished by public stoning of the victim. However, because this country provides us with energy supplies, and is the keystone support to the international petrodollar reserve currency, we overlook the absence of its democratic institutions, as we militarily protect its monarchy.

Similarly, in the statistical conundrum we find that three countries have become high profile enemies of America – Iran, Russia, and Venezuela. Each of these countries hold elections to select their leaders – regardless how faulty the electoral process or the contenders are seen by others. It just so happens that these three countries are the largest holders of global oil reserves, which could influence oil prices, global dollar currency acceptance, and U.S. economic hegemony. Surely this conflation of oil and enemies must be just a coincidence?! The fourth most important enemy, North Korea, has both the potential of firing nuclear weapons at the U.S. endangering our population, even as it too may have enormous oil reserves off it shores, and rare earth minerals in its mountains. Wrecking the economies of such countries and replacing their governments with leadership more friendly to American interests while extending credit for reconstruction and using foreign exchange derivatives to beat down their currencies making the debt difficult to repay would allow us to influence, control, or plunder that wealth for the benefit of our oligarchs. Therefore, surely, all of this just must be a rare statistical coincidence!

No single country can stand up to the U.S. economic and military might. However, the experience of countries over decades has been such that they are now grouping together in order to stand up to the U.S. for their own benefit. Recent examples include China and Russia continuing the buy oil from Iran, while the EU has defied president Trump’s trading sanctions on Iran. China’s Belt and Road Initiative with its funding banks now has grown to include over seventy country members. This speaks volumes about the gradual development of an alternative currency to the dollar, which will reduce dollar’s global influence and dramatically give rise to ascending precious metal prices.

See: BRICS? No, CRISIS - http://www.marketoracle.co.uk/Article53009

China versus U.S. trade war

By incessant propaganda we are made to believe that many countries in the world have some nefarious plans against the United States. They want us to believe that we are in some undefined war with many countries, and that there is hate between country inhabitants.

We do not hate or are at some kind of war with the Chinese, Russians, Iranians, Syrians, or any other country’s citizens, nor do they hate or are at war with us. We are at the mercy of our own politicians and their handlers who promote such theories for their and other elitist economic benefit and continued control. It is propaganda.

Instead, we are in economic competition with the citizens and the leaders of these other countries. It is when we do not get our way that the propaganda machine cranks out the hate/war thesis, and cranks up fear and the prospect of physical war.

How we do in this competition will be dependent over the long term as to how intelligently we devise our strategic goals, and execute our national policies.

Historically, U.S. private industry hired the brightest, most productive workers and paid them a premium wage over government employees. At that time U.S. manufacturing and exports were leading the world. Government hired less qualified employees and paid them a lower than market wage. This arrangement was supplemented by the unwritten agreement that government employees would not lose their jobs when private industry employees were exposed to being laid off during a business cycle contraction.

Today politicians have learned that they can buy political loyalty and votes by increasing salaries of government employees. As a result, government employees now earn a significantly higher salary that industry employees, yet still maintain the assurance that they will not lose their jobs in an economic decline. Sounds good for the government employees, but how about the rest of the country?

Remember that we are in economic competition with other countries. So what is the hiring practice of our largest economic competitor China? China has a system of nationwide annual competition of examinations for hiring and training the highest scoring contestants as mandarins who become bureaucrats, government employees, and regional leaders. Thus, it seems that the winners of this competition guarantees that Chinese government will hire the best and the brightest as their cadre and promote the most effective people to senior government positions.

In the U.S., many highly educated and bright people join some government agency to make their careers. However, the surrounding employees often can be of such low education or quality, lacking even basic writing skills that in frustration these more able individuals will quit. So over the long term of these two competing countries, how is this likely to work out for the U.S.?

We have repeatedly been told recently that China has been taking unfair advantage of the U.S. in trade for decades. Did China force America’s multinational corporations to move their manufacturing operations to the east? Did China demand on the threat of war that U.S. corporations buy goods from China? How could this weak economic and military power of decades ago impose its will on the U.S.? Did the U.S. not issue over $1 trillion of debt – fancily printed paper of ultimately questionable future intrinsic worth - to the Chinese as payment for the goods that Chinese workers produced with real material and labor? So excuse me, how did China take advantage of the U.S. in trade?

Trade wars and FED interest rate policy effect on precious metals price

A trade war by its very definition will reduce the amount of imports and exports globally. A reduction in sales volume for a company, an industry, or an economy has always been related to a reduction in profits. In turn, a reduction in profits has almost always led to a decline in financial markets.

The Federal Reserve Bank has been reducing the level of interest rates for thirty years. Now with interest rates at historic lows, it started to increase rates at a modest 25 basis points several times last year, with indications that such increases will continue during 2018 and perhaps 2019 as well. Higher interest rates may reduce bond and stock prices.

Each of these events could affect financial markets; however, the combined effect of a trade war and the tightening by the FED would likely bring forth a depression which would devastate these markets. This would be a catalyst positively affecting gold and silver prices in which fiat insurance rides to the rescue.

President Trump has proactively and courageously moved to change America’s trade policies to benefit its domestic employment, and suggested policies for the Federal Reserve Bank. These policies are not without risk. Even if successful, these policies cannot undo the structural damage that has been done to the “ship of state”. Undermining the economy with its debt-based currency by decades of debt expansion and dollar devaluation, this ship of state is taking on water. The captain can still move the ship forward, but as it takes on more water, the fate of this ship’s future is certain.

Conclusion

Our nation is experiencing a long-subverted social environment, a corrupted money and banking system, and an undermined economy. Mid course corrections are not possible, because the entrenched political and elite ideological swamp in Washington D.C. - which includes our previously trusted but currently politicized CIA, FBI, and Justice Department – are ignoring the will of its citizens. A Phoenix may rise from the ashes, but first we will need, unfortunately, to experience the fire which creates those ashes.

Since our financial system is beyond the point at which it can be repaired or its debts repaid, it means that this system with its debt-based currency will eventually join the fate of all other historical fiat currencies. While this process continues gradually, the nominal value of the stock market can be maintained or pushed up by the long-term decline in the value of our currency. However, when people finally fully understand this decades-long money scam, lose faith in the currency and finally act to protect against it by selling assets denominated in dollars to purchase any physical assets, the decline in its store of value will evaporate crashing those markets.

When this event takes place, all dollar denominated assets will implode - stocks, bonds, and savings accounts. But the greatest devastation will come from meltdown of every citizen’s presently inadequately funded pension plan, which will impoverish everyone, retired or not. Considering the widespread pandemonium it will cause - political, banking, and social disruption will rule everywhere. This will not be a time to look forward to even for those who have fiat insurance. But fiat insurance will help you survive and transcend this approaching cataclysmic period. In the meantime, fiat insurance will give you peace of mind.

Raymond Matison

Mr. Matison was an Institutional Investor magazine top ten financial analyst of the insurance industry, founded Kidder Peabody’s investment banking activities in the insurance industry, and was a Director, Investment Banking in Merrill Lynch Capital Markets. He can be e-mailed at rmatison@msn.com

Copyright © 2018 Raymond Matison - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.