The PetroDollar Matrix

Currencies / US Dollar Aug 26, 2018 - 03:49 PM GMTBy: Andy_Sutton

At the forefront of the media’s attention today is Russia. We’re not really sure why, (well, of course we are) but it seems that Russia has become the new boogeyman. Everything is Russia’s fault. I’ve even heard rumors that the National Weather Service has plans to blame Russia for all the confounded rain in the Northeast and Mid-Atlantic this summer. We know – right away you’re thinking this is going to be about Russia but it’s really not. It’s about what the media isn’t telling you. It’s why (we believe), Trump’s Tweets, Ivanka’s Sweets, Russiagate, the left’s hate, the right’s hate (aka, establishment theatre) are all taking the headlines while a very disturbing trend is left in plain sight. It’s the 800-pound gorilla in the room during any discussion involving economics and geopolitics, but nobody wants to talk about it.

At the forefront of the media’s attention today is Russia. We’re not really sure why, (well, of course we are) but it seems that Russia has become the new boogeyman. Everything is Russia’s fault. I’ve even heard rumors that the National Weather Service has plans to blame Russia for all the confounded rain in the Northeast and Mid-Atlantic this summer. We know – right away you’re thinking this is going to be about Russia but it’s really not. It’s about what the media isn’t telling you. It’s why (we believe), Trump’s Tweets, Ivanka’s Sweets, Russiagate, the left’s hate, the right’s hate (aka, establishment theatre) are all taking the headlines while a very disturbing trend is left in plain sight. It’s the 800-pound gorilla in the room during any discussion involving economics and geopolitics, but nobody wants to talk about it.

The rhetorical question of how to kill a shadow comes to mind. Simply shine light on it. Today we’re going to talk about shadows. Not shadow governments or shadow banking or any of that stuff. Call this a shadow concept. Ding ding!! You win! Gene, can you show our contestant what he’s just won??? A New Car!!!! Credit Bob Barker and his voice behind the curtain. I’m sure someone remembers the guy’s name. Come on, all you gameshow watchers. Ok, we’ll get serious. We’re going to talk about the PetroDollar.

What is the PetroDollar – Some Background

We have talked for a decade about the Unites States and its appetite for debt. Recent publications dealing with the inevitable return to trillion-USDollar annual federal budget deficits are bringing the debt contagion back to the forefront of national and global attention. But it wasn’t always this way. What if we told you that if you went back to 1986 that the US national debt was under $1 Trillion? It’s true. It took America 199 years to run up its first trillion in debt. The next 20+ have come rather quickly – roughly 32 years, following the mathematical functions that deal with multiplier effects and fractional reserve banking. The US national debt WILL NOT be paid off. Not in the current financial/economic system. That is the first point that we need to make absolutely clear. Perhaps you’re saying ‘tell me something I don’t know’, but there are many who have bought into this ridiculous idea that all this spending is actually just an investment and when the payday comes, we’ll be rolling in dough, free of debt.

Or those who believe that we actually get richer when the government borrows because we have cash in hand. It’s an asset, right Mike Norman? This quisling and his acolytes don’t look at the other side of the balance sheet where the liability shows up – debt payable. Or maybe they’re actually assuming what we stated above – that the debt will never be paid, but we’ve never been able to squeeze that out of them. Mike is an easy target, but this is the kind of stuff floating around out there in the world of information concerning these matters and it is blatantly wrong. Any accountant will tell you that for every debit there is a credit; government accounting practices included whether that’s how it is reported or not.

Brief History of the PetroDollar

Without getting into a dissertation, which would be easy, we’re going to give you the basic premise which served as the foundation for the term ‘PetroDollar’. In case we weren’t clear previously, the PD is not a tangible item. It’s a concept, a premise, the result of an agreement.

Cut to the chase: Prior to 1971, the US settled its external debts in gold. So, if in a particular month, America had a trade deficit gold came out of the coffers of the USTreasury to pay the deficit. Conversely, if America had a surplus, gold came back into the USTreasury. However, after the magnificent 1950s, we entered what was called the ‘Great Society’ of the 1960. Welfare and public assistance became widely used. Medicare and Medicaid were introduced, and the federal government took a more active role in the education system. At the K-12 level, this was completely unconstitutional, by the way.

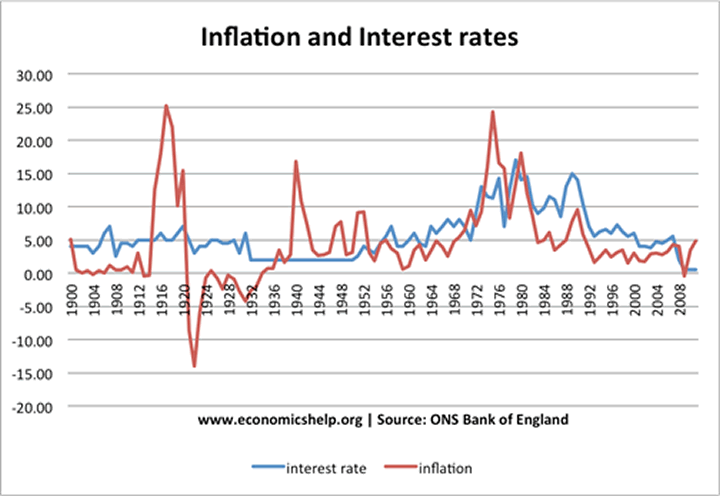

As you can imagine, the surpluses of the 1950s quickly became the deficits of the 1960. America was bleeding its dominance in the world along with its gold. By 1971, there was no gold left. We realize there is a great debate about how much gold there actually was (if any) in the name of the Treasury, but the system was operating on that premise. Not long after the gold standard was shelved, the first waves of price inflation hit consumers. As early as 1972, the consumer price index started to increase. Why? A loaf of bread was still a loaf of bread. The answer is that the money supply began to grow as money was printed to make good on trade deficits. The end of the gold standard meant the beginning of monetary inflation. Monetary inflation leads to price inflation. This is not some esoteric concept attributed to a school of economic thought. It is a rule or law of economic science.

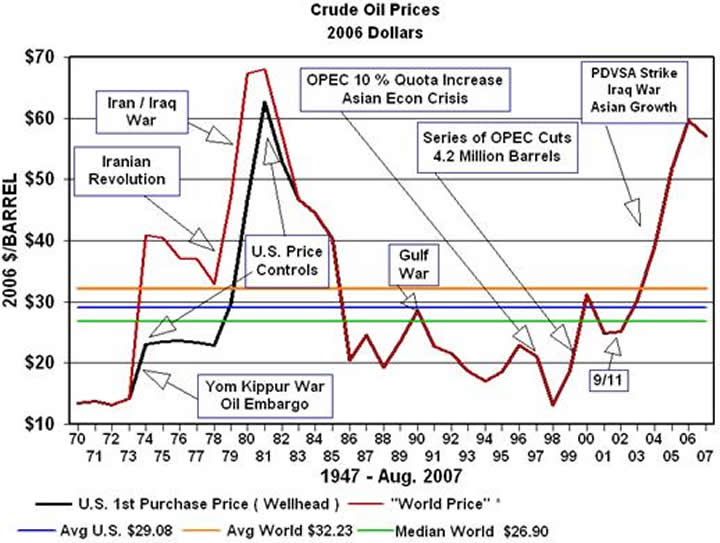

An action that followed closely on the heels of the end of the gold standard is that the price of oil began to increase. Why? The sellers of oil knew that the USDollar was being inflated to settle external US debts and the sellers of oil understood that this meant the value of the USDollar was going to drop as a result. Value=purchasing power. Oil sellers didn’t want the purchasing power of their barrels of oil to drop. Think about all the blood that has been shed and far behind that in priority, the resources wasted because of that reality. We realize it isn’t quite that cut and dry, but there is no contesting the importance of that statement in the geopolitical strife that has followed.

What actually occurred next is hotly debated. We are citing a 2016 Bloomberg article as our mainstream resource. In short, the US and Saudi Arabia made a deal. The US would give the Sauds exclusive access to the US oil market in exchange for the Saudis taking their oil revenues and buying USTreasury bonds. The US needed external demand for USDollars to stop the runaway inflation and it also needed creditors because America was running persistent deficits. This deal resulted in almost all oil transactions globally being denominated in USDollars, hence the concept of the PetroDollar. This is an oversimplified explanation, but it should suffice to give readers a working knowledge of the events of that time.

Fast Forward – 2018

The past 44 years have not changed any of what we wrote in the last paragraph except that the Saudis no longer have exclusive access to the US oil market, but they are certainly a preferred vendor or have achieved favored nation status as it’s called in global trade parlance. In that time, America has run up $21.3 trillion in debt. Some of it is not counted in what is called ‘publicly held debt’ because Medicare borrowed from Social Security or the National Institutes of Health, however, since the government as a whole is flat broke and running deficits in perpetuity, the intergovernmental borrowings will be met externally, if at all.

With the federal government heading towards persistent trillion-USDollar deficits and states, municipalities, schools, and individuals hot on the tails of the feds, America has a voracious appetite for debt. At the federal level, the deficits will be financed by issuing Treasury bonds and receiving USDollars in exchange. So, all the countries with an overall trade surplus with America have USDollars sitting around. They’ve been buying American debt (bonds). When a company goes bankrupt, creditors always come before equity holders in terms of liquidation and being made whole. By issuing Treasury bonds, our country is being sold right out from under us. Here’s the kicker. Let’s say American pension funds and other retirement pools are used to buy some of those Treasury bonds – and they have – by the billions. Then we are told by the media ‘See, we borrowed it from America; we owe the debt to ourselves, therefore it doesn’t count’. The same was true of War Bonds. Sold to Americans – again, we owe it to ourselves, so it doesn’t count. Bollocks!

The Irresistible Force

The take-home message here is that we’ve been in a trend for 44 years and it isn’t going to change. It is only going to get worse. The government isn’t even trying to hide it. It used to be a shameful thing to owe someone money. If you had to borrow, you shook the person’s hand, looked them in the eye, made a solemn promise to repay – and you did it as quickly as possible, foregoing unnecessary spending until the debt was paid. There was a stigma to being in debt. To borrowing. A half century of clever marketing, media bias, and government lies compounded by a growing lack of willingness to take responsibility on the part of Americans has desensitized the issue. The stigma is gone. Not only that, but by inflating how we have, we’ve actually been ripping other countries off. That is the proximate cause of the embargoes of the 1970s. America will continue to go deeper into debt.

The Immovable Object

Now, with all that groundwork laid, let’s take a look at what some countries have decided to do in response. We are sure you’ve heard of Iran, Russia, China notably, and others, cutting deals to do oil trading in Yuan/Renminbi or Rubles or gold. This cuts out the concept of the PetroDollar – Oil for USDollars. Or Goods/Service for USDollars. Who cares, right? Not a big deal. Half of America probably can’t find Iran or Syria on a map. It is a big deal. When countries stop using the USDollar for their transactions, they have no reason to keep a supply of USDollars. Now, if the USDollar were backed by gold, ok. But it’s backed by the ‘Full Faith and Credit of the US Government’. Our good friend Joe Cristiano is ready to totally lose it by this point. Continuing on, if countries don’t feel the need to hold a supply of USDollars – or even to just cut their reserve by some portion – this lessens the demand for USDollars globally.

Russia recently cut its holdings of USTreasury bonds by $47.4 billion this past April. Russia dumped the dollar for gold. $47.4 billion is not a lot. It’s a drop in the bucket. But symbolically, it is a huge move. More recently, Turkey followed suit; dumping treasuries. It has dumped 50% from its holdings of a year ago, and even more symbolically, it’s remaining stash of American debt trash has dropped under the $30 billion level, which the Treasury uses to consider a country a ‘major holder’. Turkey will most likely (in our opinion) use the proceeds to purchase/support its flagging currency the Lira.

The emerging problem is going to become very evident to every American if these trends continue. Again, Turkey’s $28.8 billion in Treasury holdings and Russia Treasury dump are mere blips in the $15 trillion Treasury bond market. Think of this another way, that is $15 trillion the USTreasury owes to the holders of those bonds plus interest. Now, many times holders of bonds will opt to roll their bonds over into new issues upon expiration, but they have the option to cash out – and many are.

Collision Course

The crux of this delicate matter is that the US needs lots of Dollars to finance its big government projects, militaristic imperialism (much of it to protect the fading PetroDollar), and social/corporate welfare programs. The federal government runs no surplus, so the Dollars must be borrowed. This creates demand for the dollar, but it does so at a consequence: further indebtedness. As countries continue to move away from the USDollar, there will be less buyers for all these USTreasury bonds. A trillion dollars’ worth of new USTreasury bonds hitting the market every year for the foreseeable future is a big deal. Debt Monetization, welcome to the show! In this scenario, the not-so-USFed buys the bonds from the USTreasury and creates new dollars from nothing to make the purchase. Inflation, you’re the next contestant on the show!” To this point, much of the not-so-USFed’s monetary inflation had been exported – through the PetroDollar concept. With the USDollar as the world’s reserve currency, there was plenty of demand. The inflation went elsewhere and caused problems. With countries moving away from the USDollar, more of this inflation will return to roost on American soil.

Again, most of you will know what debt monetization is, and that it has been going on for some time now, at varying levels. It is not report – directly. You have to dig for it, but it’s there. Even more ominous is that when the not-so-USFed buys USTreasury bonds, the private bank becomes part owner in America. So, we’re not just selling out our countries to foreigners. We’re selling it to private banks as well. At the end of the day it isn’t really about the USDollar. It is about power. With all the debt America is in, the ONLY way to continue the sham is to monetize the debt – which they will and (among other things) try to enforce the PetroDollar, Dollar Standard, or Dollar Hegemony via the barrel of a gun. The following will not be a popular statement; however, it is a true one. Saddam Hussein made the mistake of trying to sell his country’s oil for something other than USDollars. Hussein was a reprobate and generally not a very nice guy, but much of the reason he got so much attention was because of the attempt to dodge the PetroDollar. If all tyrants around the globe got equal attention, places like Burkina Faso and Liberia just to mention a few would be well known locations at every American dinner table.

In the sake of fairness, there is a counter-argument to what we are stating here. We provide a link so you can decide for yourself if we have a problem or if America will be the first country in history to borrow its way to prosperity and dominance on the global stage.

Graham Mehl is a pseudonym. He is not an ‘insider’. He is required to use a pseudonym by the policies of his firm when releasing written work for public consumption. Although not an insider, he is astonishingly bright, having received an MBA with highest honors from the Wharton Business School at the University of Pennsylvania. He has also worked as an analyst for hedge funds and one G7 level central bank.

Andy Sutton is a research and freelance Economist. He received international honors for his work in economics at the graduate level and currently teaches high school business. Among his current research work is identifying the line in the sand where economies crumble due to extraneous debt through the use of economic modelling. His focus is also educating young people about the science of Economics using an evidence-based approach.

By Andy Sutton

http://www.andysutton.com

Andy Sutton is the former Chief Market Strategist for Sutton & Associates. While no longer involved in the investment community, Andy continues to perform his own research and acts as a freelance writer, publishing occasional ‘My Two Cents’ articles. Andy also maintains a blog called ‘Extemporania’ at http://www.andysutton.com/blog.

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.