Preparing for THE Gold Price Bottom - Buy-and-Hold on Steroids

Commodities / Gold and Silver 2018 Aug 29, 2018 - 04:47 PM GMTBy: P_Radomski_CFA

All investors start their adventure in the capital markets with dreams of immediate wealth, luxurious cars, yachts, holidays in five-star hotels and making all the people around happy in a million ways. Virtually all investors have to lose a lot of money before they learn hubris and realistic expectations. Some give up investing completely, others become very conservative and claim that you can only count on long-term buy-and-hold types of investments.

All investors start their adventure in the capital markets with dreams of immediate wealth, luxurious cars, yachts, holidays in five-star hotels and making all the people around happy in a million ways. Virtually all investors have to lose a lot of money before they learn hubris and realistic expectations. Some give up investing completely, others become very conservative and claim that you can only count on long-term buy-and-hold types of investments.

Some of the people who survive the first – unavoidable – losses never give up their initial dreams and continually seek ways to make them come true. Are they doomed to fail spectacularly over and over again? Skeptics will say that searching for the Holy Grail of speculation has no sense and that the market is simply a complicated tool to drain naive investors of their capital. Enthusiasts, on the contrary, will try to convince you not to listen to the skeptics since you shouldn’t “blame the floor if you can’t dance.”

Where does the truth lie? There are approaches which can bring investors closer to their goals. Each of them has its price. The approach I describe later on in this article applies to the main part of the precious metals investment portfolio – long-term investments. Because of that, it can strongly influence overall returns.

The price to pay is the time and knowledge necessary to conduct research. An additional condition is that this approach is not applicable to all markets. To spice things up, using it doesn’t mean exiting investments, so the main tenet of the classic approach to long-term investing is preserved. This means you don’t have to worry that you will miss out on part of the bull market in precious metals, or on part of the gains.

To allocate their capital that way, investors usually simply buy their asset of choice (e.g. gold) and then wait many years to sell. Sometimes, they decide to buy several or a dozen assets (e.g. gold, silver and mining stocks) to limit the risk. However, in both cases they rarely decide to change the once-chosen proportions over the whole investment horizon. It doesn’t have to be like that! You can think differently. And you can profit more.

In the previous article of this series, we showed that for many precious metals investors (naturally, we can’t speak for everyone) it may be optimal to invest in an asset mix consisting of gold, silver, large gold and silver mining stocks, and smaller companies exploring their potential deposits of precious metals. But, once we have bought these assets, can we forget about them?

As long as their prices are going up and down at roughly the same rate over time, this could seem justified. It is a common belief that in the short run the price moves might differ in particular parts of the precious metals sector, but the differences become negligible in the long run.

It is a secret, known only to a handful of investors, that this isn’t the case.

Knowing when miners are going to lead the metals, or the other way around, is the key to multiplying gains.

It suffices to buy the asset which will appreciate the strongest and then to shift in the portfolio from this asset to another one which is about to “take up the baton”. When the rate of change of prices diverges again, we shift the composition of the portfolio again. We repeat this for any bigger move. As time goes by, it will turn out that thanks to these temporary shifts between assets, the gains are much higher compared with a buy-and-hold approach, even though we have never really closed our investment position, only adjusted it cleverly. There will be additional transactional costs associated with the above strategy, but they seem negligible compared to the potential gains.

Do you want to increase the chance of making your dreams come true? The dreams which made you an investor in the first place? If you want to do it right, you have meticulous research to do. You will need to build an econometric model, optimize its parameters, test it on various datasets… Or you can read the next dozen or so paragraphs. The good news is that we have already done all this for you.

Show Me the Profits!

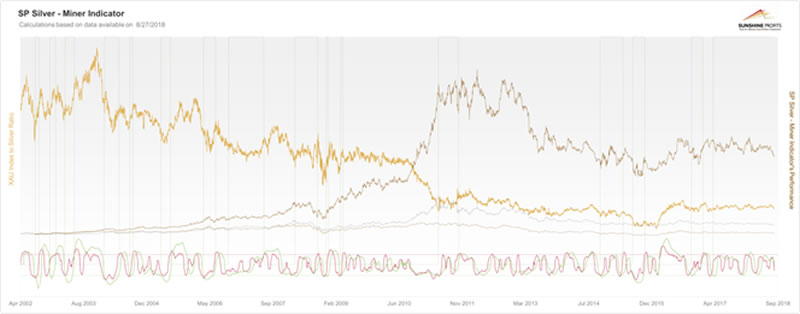

What’s even better, we’ll start with the analytical dessert and we’ll show you the indicator that we designed for moving from silver to mining stocks and vice-versa and we’ll tell you how much it could have improved an investor’s profitability. You can see the indicator (comprised of two separate indicators) in the lower part of the chart below.

On a technical note, the chart below is huge, and it has to be this way – there are too many details that need to be featured together for the chart to be small. It would not be readable in any smaller resolution. If it’s not clearly visible and you can’t click on it to zoom it, you can do so on our website, using this link. If the link doesn’t work, simply Google “buy-and-hold on steroids SunshineProfits.com.”

Before discussing the details, let’s discuss the results.

Between July 30, 2002 and August 27, 2018, silver moved from $4.66 to $14.89, and the XAU Index moved from 61.71 to 68.79. Percentagewise, silver increased by 220% and the XAU Index increased by 11%. The XAU to silver ratio declined from 13.24 to 4.62.

So, what was the rate of return of moving from the XAU to silver and vice-versa according to the signals from the SP Silver-Miner Indicator?

Almost 2,000%.

Yes, we didn’t push the zero button too many times. Approximately one thousand eight hundred percent of profit. Precisely 1,764%.

What? But how? That’s impossible!

Excited? Outraged? Good. We wanted to get your attention. Now that we have it, we have some explaining to do.

That’s the amount that we get based on optimized parameters. “Optimized parameters”, meaning ones that provide the best results in the dataset that we have. It’s just like customizing a car’s engine, suspension, tires and everything else in order to get the best time on a track that you can’t test before the race, but you know tracks that are similar to it. The only thing that you’d know is that the length of the track is the same as for the similar ones.

You’d take your car and drive over and over again on the similar tracks fine-tuning the engine’s specifics, suspension etc. until you minimize the time on the test tracks. You’d know the average time that you got and you’d know that you did your best to prepare yourself for the real race.

But, would it be reasonable to expect your time on the race track be as good as the best average time on the test tracks? No. But if you did your absolute best during fine-tuning, you’d know that whatever the time was going to be, it was going to be good and it shouldn’t deviate from your best times a lot. You’d also be in a good position to win this race as most other drivers wouldn’t even know about any fine-tuning processes.

Moving back to silver, miners and our indicator, we shouldn’t expect the ridiculously high performance to be repeated to the letter, but it seems reasonable to assume that the rate of return will be high.

A technique that can be helpful in checking if the indicator really works (if its performance is not an accidental result of data mining bias) and in getting a more realistic view on the likely rate of return is called sensitivity analysis. In short, it’s a fancy name for playing with the variables. In the case of our car race analogy, it would be checking what happens to the lap time if we change the engine’s dynamics just a little. Then we do the same with the suspension. Then with the gearbox and other parameters. And so on. If the result changes in a rather chaotic way (making the suspension harder is causing the lap time to double), it suggests that something is very wrong.

In the case of the indicator, we didn’t check the engine or suspension – we checked how the final outcome depends on changing numerical parameters. For instance, when a moving average is used in the formula, we checked if changing the amount of days that it’s based on by a few days changes the outcome dramatically. It doesn’t. The changes are gradual and rather proportional to the size of deviation from optimum. That’s exactly what we wanted to see as a confirmation that it all makes sense.

As far as the final outcome is concerned, depending on the changes, the final profitability moved between approximately 500% and 1400%. Interestingly, it almost never moved below 0% - that required ridiculous changes in the indicator (for instance so that it almost never provided any signals).

Before moving to the indicator’s details, we would like to emphasize that it’s not designed to trade in and out of the precious metals sector – it’s designed to (partially) change the portfolio allocation from mining stocks to silver and vice-versa. Consequently, being long the ratio means being invested in mining stocks instead of being invested in silver. A sell signal means selling mining stocks and buying silver. Then one keeps the white metal until a buy signal is seen. A buy signal means selling silver and buying back mining stocks with the proceeds. And so on and so forth.

The first buy signal from the indicator flashed on July 30, 2002 and we’ll start our comparison from this date. The buy signal means going long gold and silver mining stocks with the XAU Index weights (we will write “buy XAU” later on to make the text clearer). The XAU is at 61.71 and silver is at $4.66. We get the first sell signal on August 30, 2002, which means selling mining stocks and buying silver with the proceeds. The XAU is at 69.46 and silver is at $4.57. We just made profits on mining stocks and if we had had silver instead, we would have a small loss.

The next buy signal is on November 26th, 2002. Consequently, we’re selling silver and buying XAU (gold stocks and silver stocks) with the proceeds. The XAU is at 63.23 while silver is at $4.47. Based on this trade we lose $0.1 in silver, which is about 2.2%. However, at the same time we don’t lose on the XAU’s decline in value from 69.46 to 63.23, which would be about 9%. We just significantly limited our losses.

The procedure repeats over and over again – we’re moving from one part of the precious metals sector to the other and – while sometimes we lose – we usually either multiply gains or limit the losses. The overall impact on the portfolio is as we stated above – until August 27, 2018, the simulated performance based on optimized parameters of the portfolio consisting of only silver and XAU provided a profit of over 1,700% – over 8 times higher than the one of silver and over 153 times (yes) higher than the one of the XAU Index.

Now you see why we call it buy-and-hold on steroids.

All right, you already got the analytical dessert and you know it’s worth getting to know our indicator a bit closer.

Reading the Chart

Moving back to the chart, the easiest way to examine the signals and their usefulness is to focus on the XAU to silver ratio (yellow line in the main part of the chart) and the vertical dashed, green lines that represent changes in the position. The dashed green lines are connected at the top of the chart during the times when there is a long position in the XAU and in the remaining cases, there is a long position in silver instead.

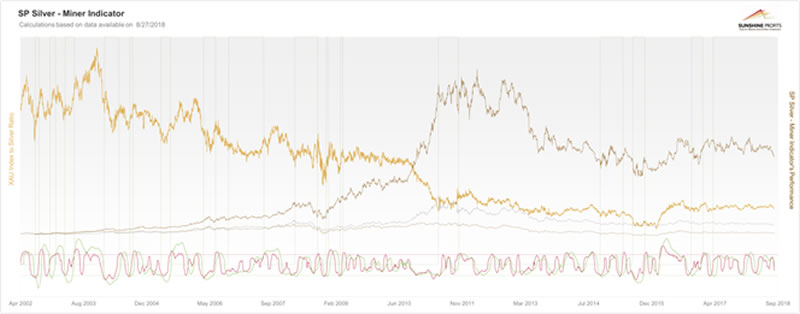

For your convenience, we’re posting the same chart again below.

The first vertical dashed green line means “we’re buying mining stocks” and the second dashed green line means “we’re selling mining stocks and we’re buying silver”. The third one means that we’re buying miners again (and selling silver), the fourth one means that we’re once again selling miners and buying silver. And so on.

As a confirmation – the first 3 times when we were holding mining stocks were near-perfect times to be long them, while the fourth one was not.

Now that you see the signals clearly, let’s look at the lower part of the chart and move to what actually generates them.

A buy signal is generated, when the green indicator moves below the dashed green horizontal line. The sell signal is generated, when the red indicator moves above the dashed red horizontal line. That’s it. No other development generates any signals – just the above. Please take a moment to look at the chart again and note that the signals described in this paragraph correspond to the green vertical lines that we described earlier in this section.

The only thing that you can see on the above chart that we haven’t covered yet are the 3 lines that can be seen in the chart’s background. These lines represent the following:

- The highest one (dark brown): performance of the portfolio comprising of only XAU miners or silver, depending on the signal from the SP Silver-Miner Indicator.

- The middle one (silver): performance of silver.

- The lowest one (light brown): performance of the XAU Index.

The above can illustrate how the indicator works and how big the outperformance of both individual assets was in our simulated scenario.

Regarding the former, please compare the performance of the highest indicator-based line with both individual assets, with emphasis on the differences during different stages (holding the XAU vs. holding silver). The vertical green lines will be very helpful in this case. The point is that during the “holding the XAU” stage, the indicator-based portfolio performance is just like the one of the XAU Index, and during the “holding silver” stage, the indicator-based portfolio performance is just like the one of silver.

OK, great, but it would be nice if we could somehow zoom in, when you’re plotting everything on the same performance axis, I almost can’t see the movement of silver or XAU – the indicator-based portfolio.

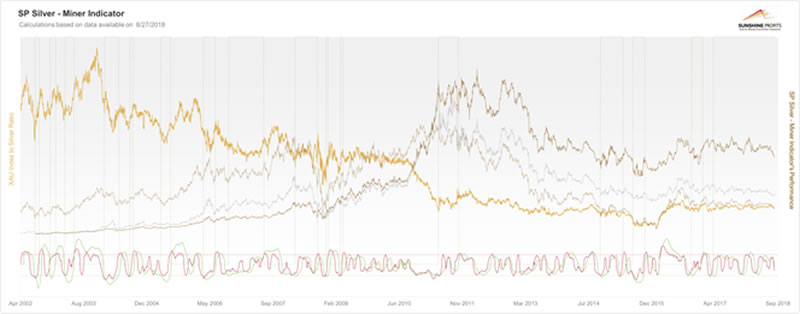

The chart in the above form features the 3 lines (1. Indicator-based XAU-or-silver portfolio, 2. Silver, 3. XAU) in their natural relationship (without any alterations). Now, to make it easier to compare the performances (and to show that the portfolio really does take its value right from either silver or XAU), we’ll going to artificially increase the performance (multiply its price increases and declines) of silver 4 times and the performance of the XAU Index 8 times. In other words, the performance of the indicator-based portfolio will appear to be more in line with silver’s and XAU’s performances – please keep in mind that it’s not the case – the actual performance of the white metal was 4 times worse and the performance of the XAU Index was 8 times worse.

When the SP Silver-Miner Indicator is in the “buy mode” (XAU is favored instead of silver), you can clearly see that the dark brown performance line (indicator-based portfolio) is parallel to the light brown line representing the XAU Index. You can see it most clearly right after silver’s 2011 top – the XAU declines, but not as significantly as silver and you can see that the indicator-based portfolio was affected only moderately, not as critically as silver was.

Conversely, when the SP Silver-Miner Indicator is in the “sell mode” (silver is favored instead of the XAU), you can clearly see that the dark brown performance line (indicator-based portfolio) is parallel to the silver line representing silver. You can see it most clearly in the period before silver’s 2011 top. While the XAU Index moved higher rather gradually, silver’s rally took the form of a parabolic upswing. The same was the case with the performance of the indicator-based portfolio.

Again, the chart above doesn’t show the real relationship and relative performances. Interestingly, even if the performance of silver is increased 4-fold and the performance of XAU is increased 8-fold (we multiplied the sizes of rallies and declines), the dynamic portfolio based on the SP Silver-Miner Indicator still wins.

Looking under the Hood

The SP Silver-Miner Indicator is actually a combination of two indicators: the green buy indicator and the red sell indicator. They are both based on a similar dataset (unsurprisingly, it’s based on silver and the XAU – considered individually, and in the form of a ratio), but there are some differences. Creating a separate indicator for buying and selling was necessary, because the mechanisms behind the ratio are not symmetrical on the way up and down. Both mining stocks and silver stocks tend to move from oversold to overbought and vice-versa, but the shapes of the moves differ. Miners tend to be quick in the first part of their moves, while silver catches up and soars in the final part of the move. Different shapes and different dynamics require different algorithms and even slightly different datasets.

We will not disclose the exact formulas publicly, but we can say that the algorithm benefits from using mechanisms that can also be found in the MACD and ROC indicators along with the use of moving averages and standard deviation. And no, it’s not as simple as a weighted average of the above. It’s more like a MACD histogram that’s based on the ROC’s moving average that’s adjusted according to the standard deviations for both markets. Plus a few extra details. Let’s just say that designing this indicator took months and that saving the Excel file with the chart and the calculations takes quite a while.

Before you ask, yes, we checked all popular indicators applied to the XAU to silver ratio and we tested many parameters and their performance was average at best – not even close to what we were able to achieve by creating an indicator that’s dedicated solely to trading between the XAU and silver.

That has been the most difficult indicator to create among the ones that we have ever developed, and it is the case not only because we were extremely careful while making assumptions (as we know that this indicator will be used with the most important part of the portfolio – the investment part). It was so difficult, because it’s not designed to detect price extremes. At times it does detect them as a side effect (for instance, the 2011 top in silver), but it’s not the goal. The goal is to move from one part of the market to the other during the move and magnify the gains. For instance, in the case of rallies, we usually initially have a strong rally in mining stocks that’s followed by a big catch-up in silver. By moving from miners to silver before the catch-up, we profit from both outperformances. That’s the moment that we’re trying to catch. Predicting gold’s tops and bottoms is something that is done based on many other factors and we don’t want to get into the details here.

The very important implication, however, is that since moving between the markets is not based on detecting the tops and bottoms, then this technique can be used rather independently from regular timing factors. In other words, investors don’t have to choose between being always “long on steroids” and timing the market with the aim of detecting the major turning points. Both can be applied at the same time.

The ways of applying both techniques can vary, but for instance, one could move the exposure to the precious metals market from 50% to 100% or even 200% (using leveraged instruments if that is one’s preference) based on technical, cyclical, fractal etc. factors (thus staying long for the entire time, but with varying exposure levels). At the same time, one could be moving from being exposed mostly to mining stocks to being exposed mostly to silver, in line with the signals from the SP Silver-Miner Indicator.

The overall performance would benefit from both:

- Catching the big price moves in the precious metals market (assuming good medium- and long-term signals).

- Moving from mining stocks to silver and vice-versa.

Please keep in mind that all the mentioned benefits could be reaped while being invested in the precious metals market at all times (to a varying degree, but still). Do you want to benefit from the biggest moves in the precious metals sector? Do you prefer not to over-trade? Would you like to keep your exposure to the precious metals sector and stay prepared for the explosive potential of this market at all times? While nobody can promise any kind of performance and there is significant risk in all investments, the above strategy seems to fit all the above requirements, while significantly multiplying gains at the same time.

Man Has to Know His Limits

It’s not part of the original quote, but a man should know his indicator’s limits as well.

We have already disclosed one of the limits – the above simulation is based on optimized parameters and the implication is that the final results may not be as astronomical as described above. Nonetheless, based on our research, it seems that the results should still be more than satisfactory.

The second limit is actually helpful. Yes. The limit is that the indicator is not particularly good for detecting the exact bottoms. That’s not a failure as that’s not the purpose of the indicator. The reason that it’s helpful is that if – based on multiple long-term-oriented factors and signals – it’s highly likely that the precious metals market is at a major bottom, then while increasing the exposure to the sector (opening or adding to the existing investment position), it might be best to move to mining stocks even if the indicator is not yet flashing a “buy” signal.

The December 2015 bottom and the 2008 bottom were not accompanied by “buy” signals (there was one shortly in 2008, though) and if one had moved to mining stocks and kept this investment intact for about 3 months regardless of the indicator, they would have boosted the portfolio’s gains even more.

In other words, there seems to be only one case when the indicator could have worked better – the key bottoms – and we have a plan B for such cases. When the situation moves back to normal, the indicator should boost the performance in the regular way.

Please keep in mind that during the past 16 years or so, there were only 2 cases when implementing plan B was really useful and, at the same time, missing it wasn’t that costly, so it may be better to stick to the indicator unless something really extreme takes place.

Again, the plan B is to go long mining stocks if there are multiple signs pointing to a major buying opportunity as they tend to outperform in the initial part of the rally.

Moreover, being tied to the precious metals market, the performance of the indicator-based portfolio is based on the performance of the entire precious metals market. If the PMs continue to decline in the coming years, then one should not expect any fireworks even when applying the SP Silver-Miner Indicator. It’s likely to limit losses, but it may not be able to generate decent gains if the PMs are not moving higher on average. In other words, this indicator was designed to help to make the most of the gold and silver bull market. If there’s no bull market, it’s not likely to save the portfolio on its own (all investing means risk). However, once the bull market in the precious metals market returns, the SP Silver-Miner Indicator is likely to prove extremely useful for gold and silver investors.

Finally, at times, the moves from one part of the precious metals sector to the other can be relatively fast, so it’s important that one is able to utilize the Indicator’s signals without delay. Consequently, investors who have very little time to manage their portfolios and don’t have a trusted professional that could do it for them, might want to either pass on using the above indicator at all or dedicate a relatively small amount of capital to this particular strategy.

Summary

The buy-and-hold approach is the most popular way to invest for the long run, also among the precious metals investors. It’s also a way to miss on a huge part of the profits that could be made if one made a few adjustments to the classic buy-and-hold approach. In this article we have featured our latest tool for making the most of the upcoming bull market in the precious metals – the SP Silver-Miner Indicator.

Nobody can promise anything regarding any investment outcome and neither do we. There’s risk in any trading, and one can lose capital regardless of the tools used. However, even if the Indicator’s performance is not as spectacular as in the featured scenario, it’s still something that could significantly boost one’s long-term profits.

The best thing is that it can all be done while staying invested in the precious metals market, similarly to the classic buy-and-hold approach.

Thanks to the SP Silver-Miner Indicator, investors can have their golden cake and eat it too.

Want to take a golden slice? If you haven’t already signed up to our free gold newsletter, it may be a good idea to do so now – you’ll stay updated on our free articles (including the follow-ups to the above article) and you’ll also get 7 days of free access to our premium daily Gold Alerts as a starting bonus. Sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Tools for Effective Gold & Silver Investments - SunshineProfits.com

Tools für Effektives Gold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and best silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.