Examining the Stock Market’s Late-cycle Behavior

Stock-Markets / Cycles Analysis Sep 27, 2018 - 11:15 AM GMTBy: Troy_Bombardia

Lots of traders and investors have been talking about the U.S. stock market’s “late-cycle” behavior recently. I think a lot of them are missing the more important point.

Lots of traders and investors have been talking about the U.S. stock market’s “late-cycle” behavior recently. I think a lot of them are missing the more important point.

Yes, we are certainly in the late innings of this bull market. HOWEVER, the bull market probably has 1 year left.

For example, Citadel’s Ken Griffin told Bloomberg that the bull market rally has AT LEAST 1.5 – 2 years left. Citadel is one of the few hedge funds that consistently outperforms.

Legendary fund manager Jeremy Grantham (who has predicted every bubble over the past several decades) conducted an excellent interview with Business Insider recently. Here are the 3 takeaways from his interview:

- Stating that the “stock market is in a bubble” or this is “late-cycle” is useless unless you plan on buying and holding for 10 years (which, if you’re reading this website, that’s probably not your plan).

- There’s no difference in getting out too early (before the top) vs. getting out too late (after the top). In fact, it is often more harmful to sell on the way up rather than on the way down. This is because you are far more likely to sell too early than to sell too late.

- The pace of the bull market’s final rally = the pace of the bear market’s first decline. This is because bull markets tend to “melt up”. Hence, getting out too early means that you could miss out on big gains.

With that being said, let’s examine this late cycle. We did a market study on Consumer Confidence yesterday. Based on this study, the bull market has 1-1.5 years left. Using this analogy, that would take this bull market to Q3 2018 – Q1 2019.

AAII Cash Allocation

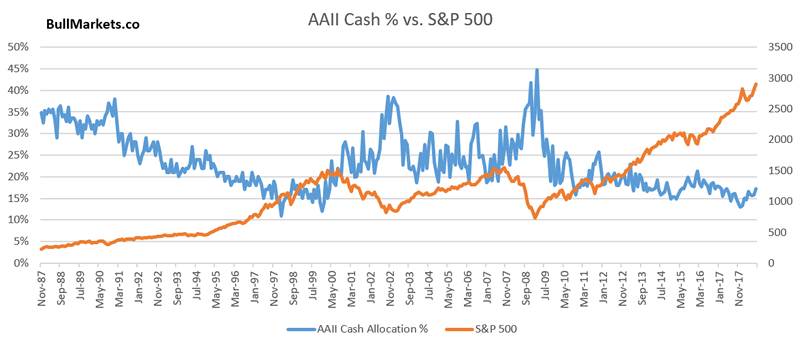

AAII is one of the most widely cited investor sentiment surveys. Investors’ cash allocation has been extremely low recently.

It’s worth noting that investors’ cash allocation has been consistently low throughout this ENTIRE bull market. (Cash allocation is currently <18%).

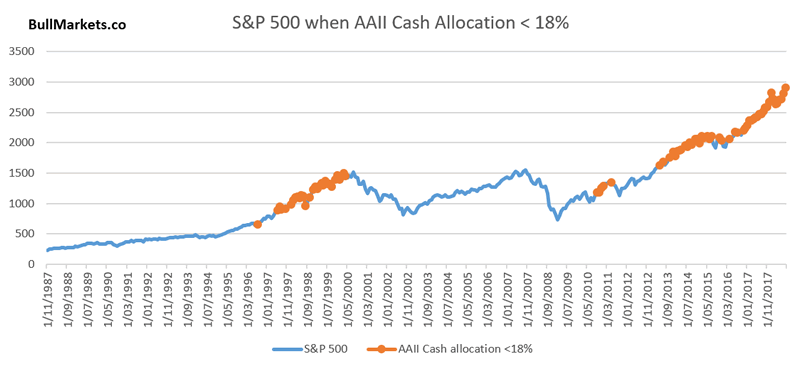

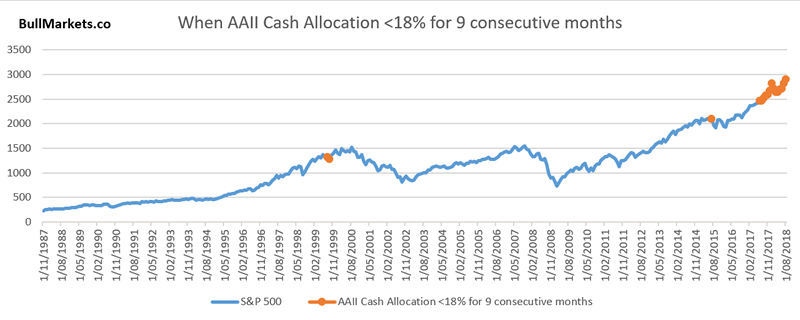

Cash allocation has been under <18% for 22 consecutive months. The only semi-comparable streaks were:

- November 2014-July 2015 (9 months)

- December 1998 – September 1999 (10 months)

In both historical cases, the S&P began a bear market or “big correction” within the next 6 months.

I wouldn’t place too much emphasis on this.

- This data is limited: 1987 – present

- Sentiment surveys are always less useful than the market’s own price action and fundamentals.

Initial Claims

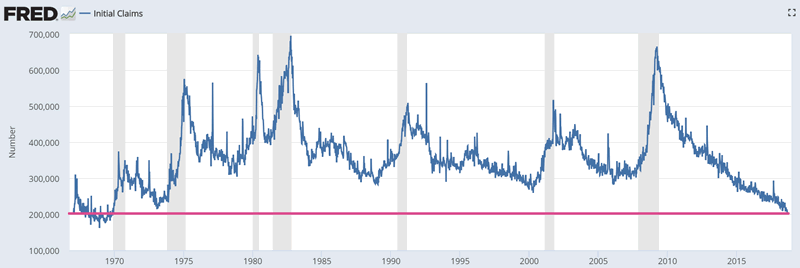

Initial Claims is one of the best leading indicators for the U.S. stock market and economy (which I explain in my book).

Initial Claims are very low right now.

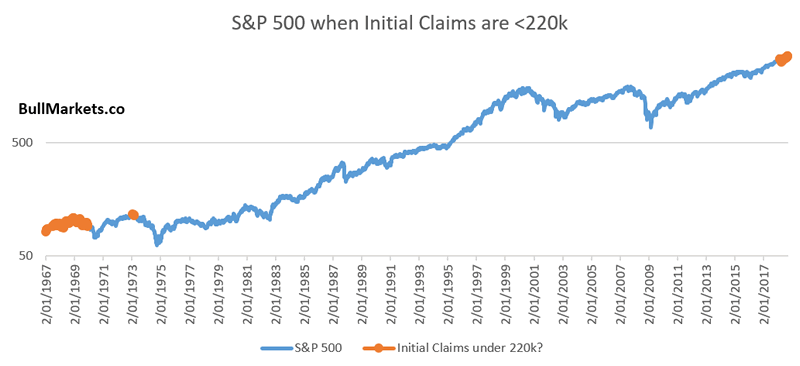

Here are all the historical cases of Initial Claims being below 220k, mapped onto a chart of the S&P 500.

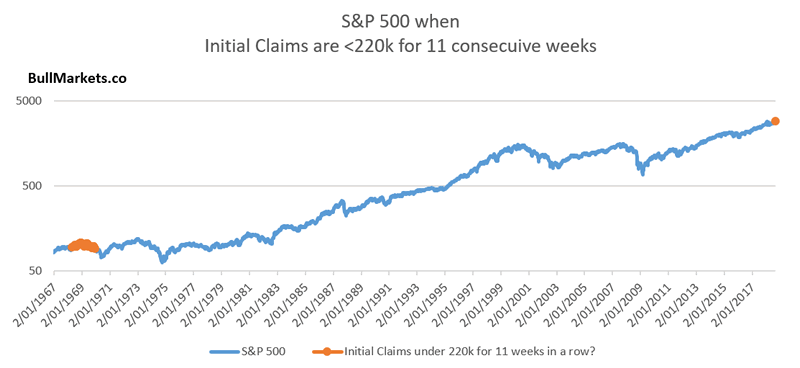

Initial Claims have been below 220k for 11 weeks in a row.

This has only happened leading up to the December 1968 bull market top. In that bull market, this first occurred in April 1968, 7 months before the bull market topped.

Conclusion

We are certainly in the late-cycle of this bull market.

The Medium-Long Term Model has recently taken 1 BIG step to flipping from “long term bullish” to “long term bearish”. It is still bullish, but at this rate, will probably turn bearish sometime in the first half of 2019 (probably Q2 2019).

Click here for more market studies.

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.