Gold, Silver HUI Stocks Precious Metals Analysis

Commodities / Gold and Silver 2018 Sep 28, 2018 - 02:10 PM GMTBy: Gary_Tanashian

In honor of the men staring at silver’s daily chart, let’s highlight NFTRH 518’s Precious Metals segment this morning. We have 60% of the new trading week in the books and not much has changed for the PMs since this was written. You’ll notice that this man who stares at charts gets a little wordy at the end. There is much context that would-be gold bugs need to have in hand.

In honor of the men staring at silver’s daily chart, let’s highlight NFTRH 518’s Precious Metals segment this morning. We have 60% of the new trading week in the books and not much has changed for the PMs since this was written. You’ll notice that this man who stares at charts gets a little wordy at the end. There is much context that would-be gold bugs need to have in hand.

First, the intro per our anniversary series of posts…

To celebrate NFTRH’s 10 year anniversary (Friday, Sept. 28) I’d like to present one segment from this week’s report, NFTRH 518 each day until Friday. These excerpts will give you an idea of what it takes to provide a top tier, best of breed product. But there is much more to a single weekly report than will be shown here publicly. Oh and don’t forget the dynamic in-week market updates as events dictate.

All for 30% less per day than you spend on your single cup of small regular coffee at Dunkin Donuts! Think about that. I mean, I don’t want to downplay the importance of coffee – it makes NFTRH run – but what is the value of consistent, focused and proven market intelligence at your fingertips day to day, week to week and year after year?

Precious Metals

Last week:

Here is how I see the precious metals situation. It’s one or the other of…

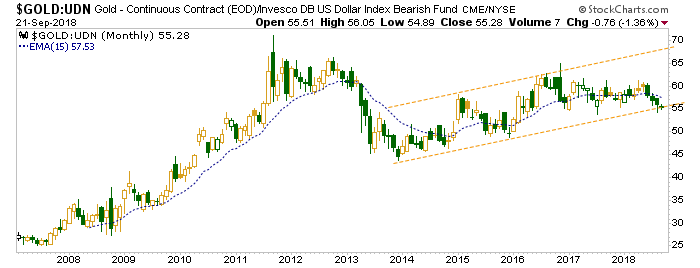

- US dollar declines short-term and the precious metals bounce with the rest of the anti-USD trade, or…

- US dollar rises (likely along with the Gold/Silver ratio) and the precious metals decline again into a real buying opportunity.

Thing 1 carried the day (week). I don’t care (well, actually I do but work with me here…) how many gold bugs leave the subscriber base while I am not able to give a long-term green light, but we are going to track the proper fundamentals, not the imaginary ones. And this bounce along with China, copper, global stocks, US stocks and everything else in the cyclical world is not proper. Not until all that crap tops out.

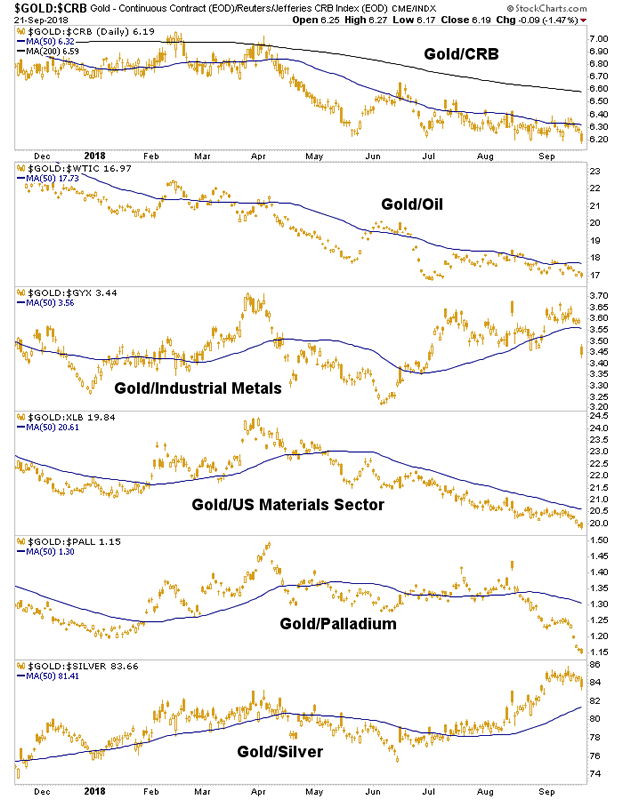

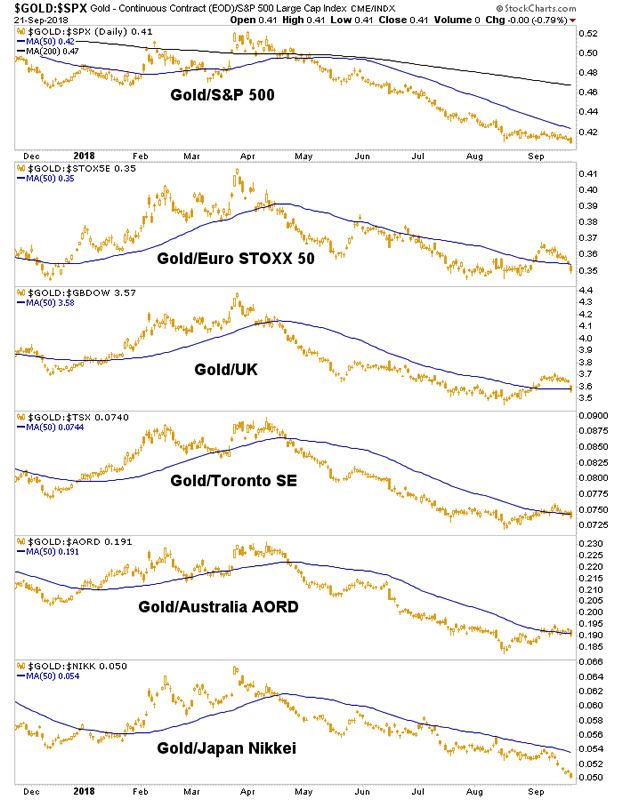

It. Is. A. Bounce… until it proves otherwise by seeing gold rise against CRB, SPX, ACWX and while we’re at it, global currencies.

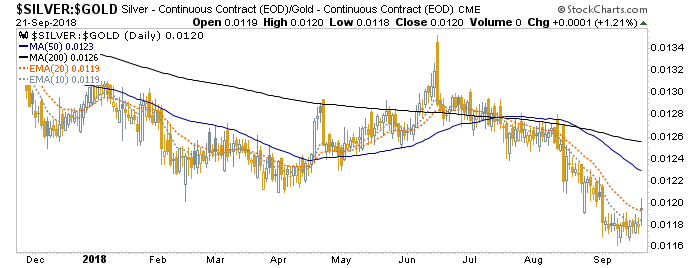

So for now it’s just a bounce, and the [daily] Silver/Gold ratio did make a positive hint of Friday.

As is often the case, the sector will rally with cyclical assets if the rally is anti-USD and/or inflationary. This is not long-term positive signaling for the gold miners, however. Quite the contrary. So if you’re in them, enjoy the bounce – insofar as it continues – but be prepared to sell (if you are not positioning L/T) because if the other stuff liquidates the gold miners likely will as well, perhaps before hand and perhaps even more intensely.

Here is the view vs. stock markets; also not pleasing if you are a gold bug wanting to buy [gold stocks and gold related investments; it’s always a good time for physical gold as a value anchor & insurance] for the right reasons. Now, this pretty cyclical picture [risk ‘on’] could come apart tomorrow and then we’d pound a table, fundamentally. But here at NFTRH we have got to deal with what we see, not what we hallucinate. There’s enough of that going on in the gold “community” already.

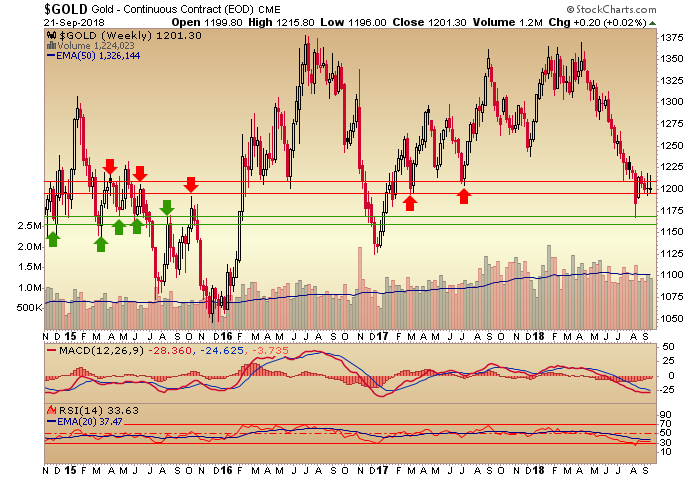

Gold weekly is still stuck in the resistance zone during the inflationary cyclical bounce. Gold’s lack of participation is actually not such a bad thing when you think about it.

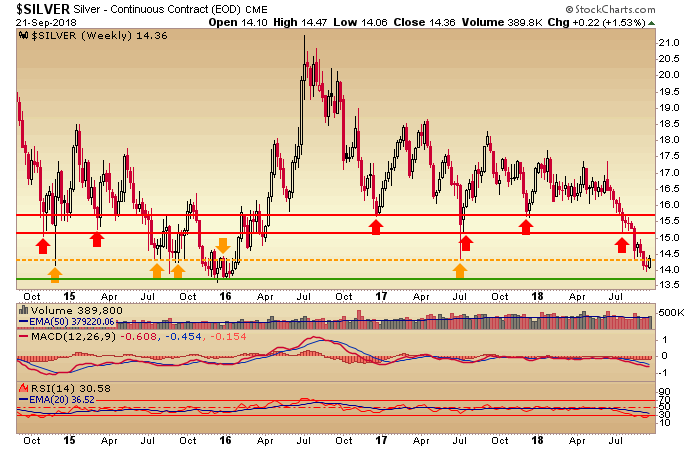

Silver however, would need to get going and lead during an inflationary play.

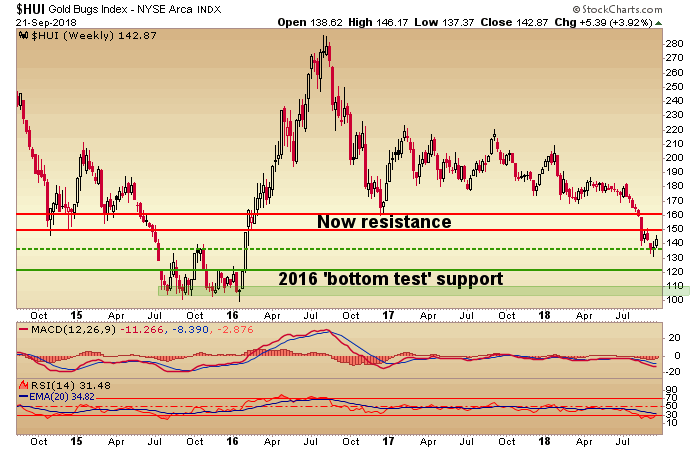

HUI got within 4 points of initial resistance at 150.

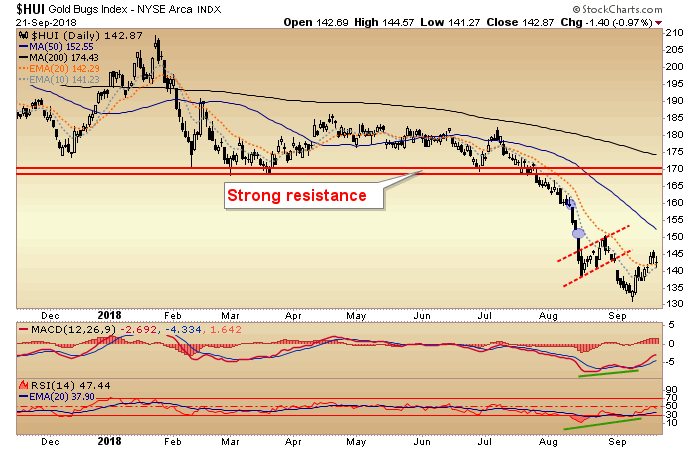

The daily chart shows that resistance area to coincide with the SMA 50. Folks, if it bounces again and funda do not change, I’d have some caution there.

I am going to skip the cavalcade of gold stock charts because well, on balance they are lousy (with some exceptions). I cannot in good conscience put too much into this sector at a time like this, when it’s bouncing and the fundamentals are not engaged. We looked for a bounce and finally it came. Unfortunately, it came as part of an anti-USD global asset bounce. It’s not legit.

I am not saying run out and sell gold stocks if you own them. I am saying don’t hold them if you think that inflation is going to drive all commodities up while the global economic cycle remains positive.

There are all kinds of different investors. One might have bought the hard spike down to the first support area of HUI 135 a couple weeks ago with the idea of adding more on a further crash to 100-120. But one is currently doing this against poor fundamentals.

Ah, but the story gets more complicated. Because, this…

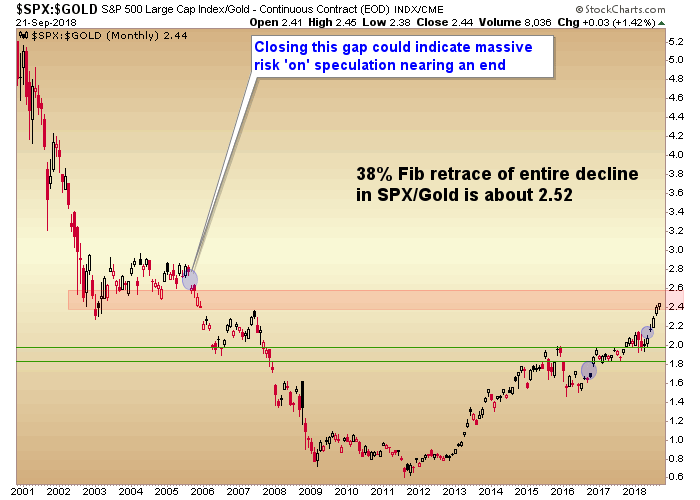

One might be anticipating the end of a cycle and patiently adding quality names. That’s legit. What is illegitimate is this inflation pumping by the worst of the gold herd. There appears to be late stage cyclical stuff going on but these candles measure in months. For instance, even if SPX/Gold is close to topping out at the 2005 gap how many more months will it take for pure, unbridled speculation and greed to play out? And how unpleasant could it be all along the way for the lowly gold bug? Know who you are and how strong you are before positioning on forward expectations.

Subscribe to NFTRH Premium (monthly at USD $33.50 or a 14% discounted yearly at USD $345.00) for an in-depth weekly market report, interim market updates and NFTRH+ chart and trade setup ideas, all archived/posted at the site and delivered to your inbox.

You can also keep up to date with plenty of actionable public content at NFTRH.com by using the email form on the right sidebar and get even more by joining our free eLetter. Or follow via Twitter @BiiwiiNFTRH, StockTwits or RSS. Also check out the quality market writers at Biiwii.com.

By Gary Tanashian

© 2018 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.