Trump Is Not Thrilled. But What about Gold?

Commodities / Gold and Silver 2018 Nov 02, 2018 - 05:28 PM GMTBy: Arkadiusz_Sieron

Trump is going to influence the US monetary policy or even to destroy the Fed’s independence. This is what many analysts say after the recent President’s comments. But are they right? We invite you to read our careful examination of Trump’s remarks about the Fed’s policy and find out what does it imply for the independence of the US central bank and the gold market.

Trump is going to influence the US monetary policy or even to destroy the Fed’s independence. This is what many analysts say after the recent President’s comments. But are they right? We invite you to read our careful examination of Trump’s remarks about the Fed’s policy and find out what does it imply for the independence of the US central bank and the gold market.

Trump Is Not Thrilled. But What about Gold?

“I’m not thrilled with his raising of interest rates, no. I’m not thrilled.” This is what President Trump said in an interview with Reuters on August the 20th, 2018. The financial markets did not like his comments and the US dollar declined in a response. Investors worry that Trump’s growing discontent may lead to clashes between the White House and the US central bank, and potentially to weakening or even to the loss of the Fed’s independence. In such a scenario, we could see higher inflation, as central bank’s independence promotes price stability.

Are these concerns justified? Well, unfortunately yes, at least to some extent. When politicians alter monetary policy for their own goals, it never ends well (for the economy, gold usually shines then). You can ask the Turks who suffer now because of the depreciation of the Turkish lira, resulting from President Erdogan’s influence on the central bank.

OK, I know what you are going to say: the United States are not Turkey. That’s true, but there are ugly precedents even in the US (actually, the entire premise of Fed’s independence is in a sense absurd, as the central bank was created by the Congress and the seven members of the Board of Governors are nominated by the POTUS and confirmed by the Senate). For example, there was a clash between President Lyndon Johnson and Fed Chair William McChesney Martin, which supposedly included physical assault (as the story goes, Johnson summoned Martin to his Texas ranch and physically shoved him around his living room).

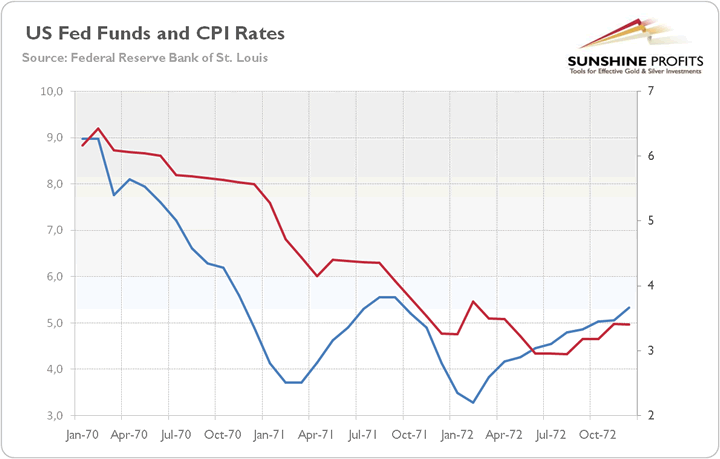

But the most notable episode occurred in the 1970s, when President Richard Nixon pressured Arthur Burns, the chairman of the Federal Reserve nominated by Nixon himself, to engage in expansionary monetary policies in the run-up to the 1972 election. The released Nixon tapes revealed that President pressured Burns to keep interest rates low to help prevent the rise in unemployment rate. As one can see in the chart below, the federal funds rate has been declining since 1970 when Burns became the Fed Chief and it was kept low later, despite relatively high inflation rate.

Chart 1: US federal funds rate (blue line, left axis, in %) and the CPI annual rate of change (red line, right axis, in %) from 1970 to 1972.

The disastrous results of the Fed’s monetary policy in the 1970s are well known: there was stagflation, i.e. high inflation and high unemployment with slow economic growth, which was not defeated until Paul Volcker became the next Fed Chair. As a reminder, there was a gold bull market in the 1970s.

Although Trump’s comments were not appropriate, it should be now clear that he is far from Nixon’s level of interference. Investors have to remember that Trump is a Twitter President, who often behaves unconventionally. And we should not forget about the context of his remarks. In that interview with Reuters, the full quote was as follows:

I’m not thrilled with his raising of interest rates. No, I’m not thrilled. We’re at a - we’re negotiating very strongly – I don’t call it a trade war – we’re negotiating very powerfully and strongly with other nations. We’re going to win. But during this period of time, I should be given some help by the Fed (…)

Hence, it should be clear that Trump was not thrilled with the raising of interest rates only in the context of trade battles he was leading. We mean his accusations that other nations weaken their currency, which supposedly help their exports, while the US dollar appreciates, partially due to the Fed’s tightening cycle, hurting the economy.

Moreover, also in an interview with Reuters, Trump said that “I don’t have an accommodating Fed. Am I happy with my choice? I’ll let you know in four years. I’ll let you know in seven years.” And in a July interview with the CNBC, Trump said that he was happy about rising interest rates. However, he also added that “but at the same time I’m letting them do what they feel is best.” All this suggests that Trump is not going to interfere with the Fed’s independence or to replace Powell. It is bad news for the gold market.

By the way, Powell seems to be unmoved so far and he is going to continue the gradual tightening policy. Actually, Trump may talk a lot, but the way for a president to influence the Fed is solely through his nominations and… potentially dismissals. President has already picked four people for the board to date: Randal Quarles, Marvin Goodfriend, Richard Clarida, and Michelle Bowman. Importantly, none are known as decidedly dovish, which indicates that Trump could just play the role of complaining about the Fed’s policy in the political theater.

When it comes to dismissals, the common perception is that POTUS can’t fire the governors once he takes office. But the Federal Reserve Act says that governors, including the Fed Chair, may be removed for cause by the President. The bill does not define what the word “cause” actually means, but no Fed chief in the modern era has been removed under that provision. Moreover, investors should remember that the Senate must confirm all replacements, so remaking the central bank through appointments is not an easy task.

The key takeaway is that Trump made some critical remarks about Powell and the Fed. Some analysts started to worry about the Fed’s independence. For the precious metals bulls, the clash between the White House and the US central bank would be positive. The weaker independence means acceleration in inflation, and possibly higher gold prices.

However, Trump’s actions did not follow the words. He nominated so far moderate to hawkish people to the Fed Board. Trump might be aiming to make a theatrical impression with his comments, but he is limited by the legal system and rule-drive institutions. Gold investors should place less weigh on President’s remarks. The sharp words cut like a sword, but they are, at least so far, a small threat to the Fed’s independence.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.