One Direction More Likely for Bitcoin Price

Currencies / Bitcoin Nov 12, 2018 - 06:42 AM GMTBy: Mike_McAra

The recent period of sideways trading may make traders impatient or even discouraged altogether. At any rate, those who crave more action in Bitcoin could be driven out of the market. But this is no time to bet on Bitcoin staying docile.

The recent period of sideways trading may make traders impatient or even discouraged altogether. At any rate, those who crave more action in Bitcoin could be driven out of the market. But this is no time to bet on Bitcoin staying docile.

If the recent months haven’t exactly been rosy for Bitcoin traders, there are avenues which might offer more optimistic news. Unlikely avenues, perhaps. A report by Morgan Stanley suggests that Bitcoin might have become an asset class for institutional investors. In an article on CoinDesk, we read:

Institutional investors are increasingly getting involved in bitcoin and other cryptocurrencies – while the number of retail investors in the space is staying stagnant – according to a new report by Morgan Stanley.

In an update to "Bitcoin Decrypted: A Brief Teach-In and Implications," the global banking giant's research division delved into the last six months of bitcoin and highlighted certain trends it noticed. The report is dated October 31.

Perhaps most notably, the report emphasized its writers' view of the market's "rapidly morphing thesis," which began by defining bitcoin as "digital cash" and noting that investors had full confidence in it, to a solution for issues in the financial system, to a new payment system to ultimately a new institutional investment class.

Various issues and discoveries around the bitcoin ecosystem have caused the thesis to evolve, including the permanent ledger recording all transactions, a number of hacks, hard forks, new technologies which are cheaper than bitcoin, market volatility and other concerns, the report explains.

As such, the market's current thesis appears to be that bitcoin is a "new institutional investment class," and has been for almost a year, the authors wrote. The amount of crypto assets under management has been increasing since January 2016, with $7.11 billion currently being stored by hedge funds, venture capital firms and private equity firms.

This is quite interesting as it shows that the demand for Bitcoin might be changing from one driven by individual speculation to one where institutional investors are gaining exposure to Bitcoin just as they do to other assets. It would seem to us that this is not exhausted. It might be the case that a lot more capital could enter the Bitcoin market in the years to come. One hurdle is the process of acquiring Bitcoin. There’s no easy vehicle to do that and institutional investors have to use tailor-made solutions with other financial institutions to enter the market. But this is not that different to what we had in gold and silver before the ETF era. And just as the launch of the GLD ETF gave access to the market to a broader spectrum of investors, any Bitcoin ETF or other Bitcoin-based vehicles might channel the institutional demand into the Bitcoin market.

78.6% Fibonacci Retracement in Play

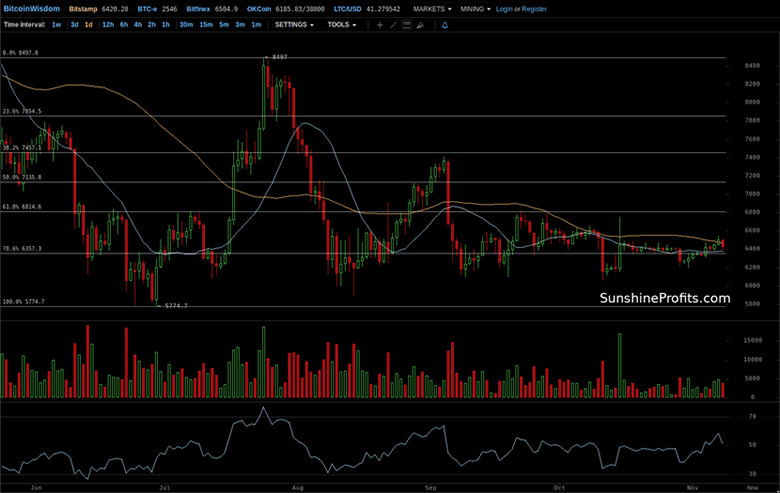

On BitStamp, we saw a move up but today’s action is quite different in that Bitcoin has gone down more visibly.

Recall our previous comments:

(…) The main thing, apart from the price move, that suggests a bullish outcome is the move above the 78.6% Fibonacci retracement level based on the July rally. However, this move has not been confirmed just yet. This means that any bullish indications here are not yet present. If we take a look at the volume, the move up hasn’t been confirmed by it either. This suggests that the appreciation we’re seeing now might not be anything more than just a counter-trend correction. Even if the 78.6% level is broken to the upside, this doesn’t have to have immediately strong bullish implications as the 61.8% level would be the point where Bitcoin could be stopped either way.

The move above the 78.6% Fibonacci retracement is now confirmed, but this only has mildly bullish indications at this time. Actually, Bitcoin has been on the move down to this level. How the currency acts at this retracement is potentially more important. If we do see a breakdown back below this level, this could be the bearish trigger we’ve been waiting for. At the same time, a move up is not immediately strongly bullish as the 61.8% retracement is a level which could stop a potential move higher.

Tenuous Position

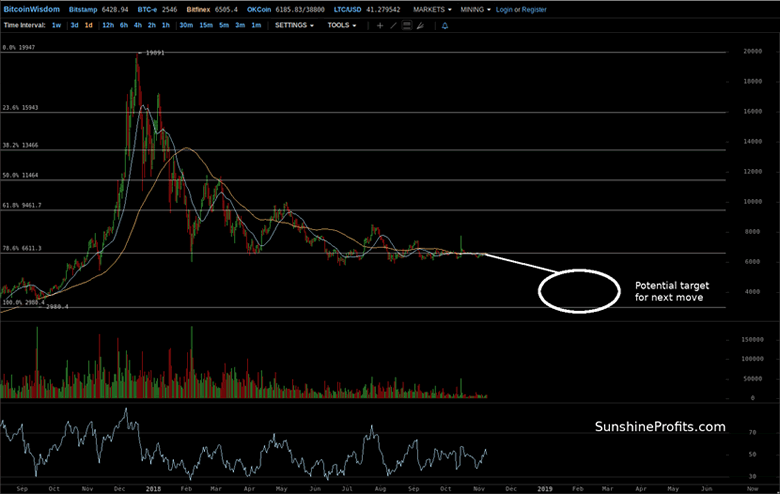

On the long-term Bitfinex chart, the price action is pretty much the same as we wrote in our last alert.

A quick reminder:

The recent appreciation is still part of the dance around the 78.6% Fibonacci retracement level based on the move from around $3,000 to $20,000 – the all-time high. The 78.6% level is turning out to be the level to which Bitcoin is “glued.” This has been the case, with exceptions, since August. Particularly, since September we have seen limited volatility, with one exception. What this might mean is that trading in the proximity of the 78.6% retracement has now become the default mode. Any significant move away from this level might break this regime. Consequently, any visible move away from this level could herald the beginning of a new powerful action in the currency. With Bitcoin in a long-term downtrend and below the 78.6% retracement in a confirmed breakdown, the situation remain bearish.

No real change here. The recent action still fits in quite well with the scenario in which Bitcoin stays glued to the 78.6% Fibonacci retracement… until it doesn’t. Any stronger move away from this level might provide a trigger for the next move. In the current environment, it seems that this trigger might be to the downside.

Summing up, when Bitcoin deviates from the current sideways course, a more sizable decline might transpire.

If you have enjoyed the above analysis and would like to receive free follow-ups, we encourage you to sign up for our daily newsletter – it’s free and if you don’t like it, you can unsubscribe with just 2 clicks. If you sign up today, you’ll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts. Sign up now.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.