Trump’s Next Target: World Trade Organization

Politics / Global Economy Nov 26, 2018 - 05:06 PM GMTBy: Dan_Steinbock

In the past few months, the Trump White House has started trade wars against its major trade partners, particularly China, and security allies. Without international opposition, the next target will be the World Trade Organization.

In the past few months, the Trump White House has started trade wars against its major trade partners, particularly China, and security allies. Without international opposition, the next target will be the World Trade Organization.

As the White House began to escalate the U.S.-Sino trade war last spring, President Trump’s trade adviser Peter Navarro was asked on CNN whether the United States is planning to leave the World Trade Organization (WTO).

The controversial advocate of American neo-protectionism known for his China-bashing books and documentaries, Navarro said that “a lot of problem has been the World Trade Organization, which is over 160 countries, and a lot of them simply don’t like us and so we don’t get good results there.”

When Navarro was asked whether the U.S. will ultimately leave the WTO, he dodged the question saying that it was “a provocative question.” But it was a fair question.

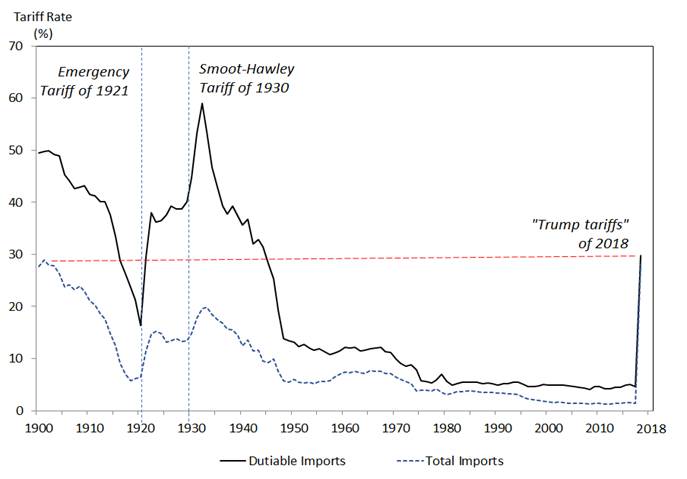

At the turn of the 1930s, Washington opted for the Smoot-Hawley Tariff to re-energize the U.S. economy. In reality, the 1930 Act made the Great Depression even worse paving the way to World War II. In fact, if today’s “Trump tariffs” were to prevail and broaden, they would be at the level of those U.S. tariffs that last prevailed around 1945. With its “America First” stance, the Trump administration aims to reverse seven decades of world trade expansion in just seven months (Figure).

That’s what Trump’s trade hawks are after and that’s why they are targeting the WTO (which contributed to the dead-end of the recent APEC Summit). The goal is to bury the WTO – or to “reform” and “modernize” it into an “America First” WTO.

Figure How “Trump Tariffs” Reverse 7 Decades of History in 7 Months

How Obama paved way to Trump’s anti-WTO attacks

Ironically, the U.S. was the key architect of the WTO; the 164-member international organization established in 1995 that replaced the General Agreement on Tariffs and Trade (GATT), which was created in 1948. Today, the WTO oversees global trade rules and resolves trade disputes on the basis of international trade law and practices. It covers some 98% of global trade.

In the postwar era, successive rounds of trade liberalization promoted great expansion of trade. As a result, the average most-favored nation applied tariff of WTO members fell from 25% in 1994 to less than 10% today - before the Trump era.

As president, Trump prefers bilateral agreements to exploit US economic might – not multilateral, international cooperation. As a candidate, he already called WTO trade deals a “disaster” urging the U.S. to “renegotiate” or “pull out” from such agreements. Along with the WTO, Trump’s trade hawks targeted China. As Trump declared in Iowa in 2016, “China is not a market economy.” But what’s less understood that he built his attack on his predecessor’s legacy.

Trump’s attack against the WTO and China was preceded by the refusal of former President Obama, the EU and Japan to grant China its market economy status (MES) as the key clause in China’s 2001 agreement to join the WTO expired on December 11, 2016. It is this distortion of market realities –which paralleled the Obama-Clinton “pivot to Asia” - that now fuels Trump’s tariff wars and the effort to undermine the postwar international trading regime. Trump has greatly benefited from the decisions of those who now criticize him.

When China joined the WTO on December 11, 2001, it was written into the agreement that member states could treat China as a “non-market economy.” Due to the size of the Chinese economy, government intervention, and state-owned enterprises, advanced economies argued that Chinese domestic price comparisons must be ignored and “constructed values” be used to gain a “true picture” of China’s economy. That’s why, since the early 2000s, the surrogate figures have permitted wide discretion and manipulation of price data, which was then used as the basis for anti-dumping charges; i.e., tariffs up to 40% higher than normal anti-dumping duties. On the campaign trail, Trump exploited precisely such figures when he pledged he would introduce 45% tariffs against Chinese products.

In the Trump White House, not only China but all emerging and developing economies are potential targets, as evidenced by the Trump administration’s criticisms of emerging economies claims of special treatment under WTO rules for developing countries.

The WTO is just the latest, though very symbolic, target of those who see America as a “victim” of "unfair" trade – in contrast to the historical record.

America First Versus WTO

Setting the scene, the White House has suggested that the U.S. may ignore WTO rulings that are not in its favor, amid alleged concerns that dispute settlement infringes on U.S. sovereignty. It is a curious premise: If every member country of the WTO would opt for a similar approach, a Hobbesian “war of all against all” would replace international cooperation – in the name of “fair trade.”

Starting already with the Obama administration, the U.S. has been blocking new appointments to the WTO's Appellate Body (AB), which is responsible for appeals. As more judicial terms are set to expire, AB may no longer meet its quorum after December 2019. The tactic basically exploits WTO to dig its own grave.

Unsurprisingly, the Trump administration’s overall approach has sparked questions regarding the future of U.S. leadership and participation in the WTO, as well as the role of Congress in U.S. trade policy. Yet, although unease about the ‘America First’ world trade is growing, many countries still seek bilateral deals with the U.S. Such opportunism enables the Trump administration to divide and rule over its allies.

In the absence of effective Democratic opposition, a sustained effort by President Trump to withdraw the U.S. unilaterally from the WTO – if legal under U.S. law – would devastate America’s foreign trade and debilitate the WTO. It would certainly accelerate the major U.S. contraction or severe recession that already looms in the horizon. The more global its impact, the greater the likelihood that it will herald the kind of headwinds and horrors that led to the postwar WTO in the first place.

There is a way to defuse such challenges, but that requires unity and cooperation among and between the major advanced and emerging economies – not against America, but with America (most Americans disapprove “America First” policies).

The world can live without “America First” supremacy. But the world cannot live without relatively open free trade.

Dr Steinbock is the founder of the Difference Group and has served as the research director at the India, China, and America Institute (USA) and a visiting fellow at the Shanghai Institutes for International Studies (China) and the EU Center (Singapore). For more information, see http://www.differencegroup.net/

© 2018 Copyright Dan Steinbock - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Dan Steinbock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.