Macroeconomic Outlook for 2019 and Gold

Commodities / Gold & Silver 2019 Jan 18, 2019 - 04:14 PM GMTBy: Arkadiusz_Sieron

Will 2019 be better than 2018 for the yellow metal? We invite you to read our today’s article, painting the macroeconomic outlook for 2018 and learn whether fundamental factors will become less or more friendly toward gold.

Will 2019 be better than 2018 for the yellow metal? We invite you to read our today’s article, painting the macroeconomic outlook for 2018 and learn whether fundamental factors will become less or more friendly toward gold.

What will 2019 be like? We do not know the precise answer, but we notice a few important economic trends that will shape the new year.

1. Interest rates will continue to rise.

2. However, the Fed’s monetary tightening will slow down.

3. Just when the ECB will start normalizing its own monetary policy.

4. And when the stimulus of the US fiscal policy will start to dissipate.

We will analyze them now for you, as we believe that investors need a clear guide to navigate themselves through choppy waters of our volatile economy. Without a broader fundamental perspective, it’s easy to get lost in the thicket of daily news.

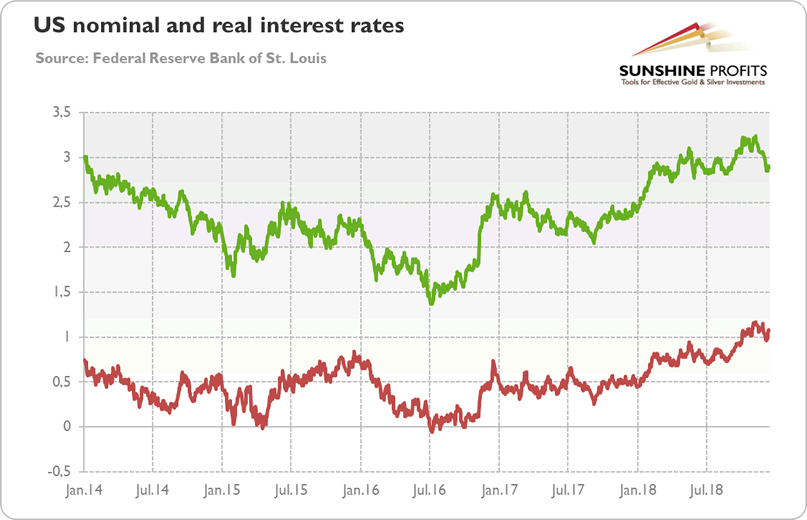

As we predicted, the long-term interest rates climbed in 2018 (see the chart below). We expect them to rise further this year. This is because the Fed will continue its tightening cycle, even if it pauses for a while. Higher short-term rates should translate into higher real long-term rates.

Chart 1: US nominal (green line) and real (red line) interest rates from January 2014 to December 2018.

Moreover, the US fiscal deficit will exert upward pressure on the interest rates, as Treasury will have to compete for limited funds. And with stronger inflationary pressure in 2018 than in the last few years, people may demand higher inflation premium, pushing the interest rates further. This trend will exert downward pressure on the gold prices, as higher rates mean a raise in opportunity costs of holding gold. They also support the US dollar, the greatest enemy of the yellow metal. At the same time, we do not expect that inflation will get out of control, so the demand for gold as an inflation hedge should remain in dormancy.

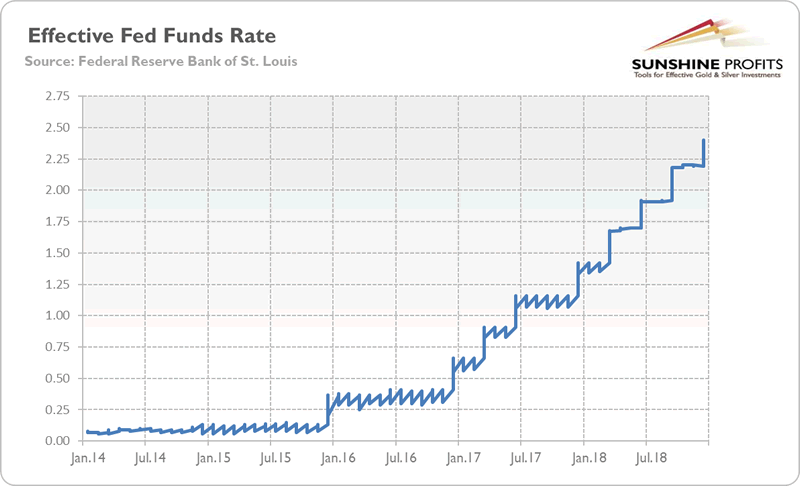

However, the Fed’s monetary tightening will slow down. The Fed started moving away from ZIRP in 2015, hiking its interests rates in December by 0.25 basis points. In 2016, the US central bank raised them also once, in 2017 – three times, and in 2018 – four times, as one can see in the chart below.

Chart 2: Effective Federal Funds Rate (daily, in %) from January 2014 to December 2018.

According to the latest dot plot, we will see two hikes in 2019, and one in 2020. It means that the peak is behind the Fed. As investors are forward looking, they will look ahead – and see less hawkish Fed (and some of them could even expect upcoming recession and, thus, the US central bank slashing rates), which should help gold.

Moreover, in 2019, the ECB should start raising its policy interest rates. The European normalization will be very gradual, as the Eurozone is more fragile than the USA. However, the ECB will starts its tightening when the Fed runs out of steam – that coincidence may support the euro against the greenback. Gold – in terms of the USD - should benefit from this turn of events.

At the same time, US fiscal stimulus will start to diminish this year, before fading out in 2020. Trump’s tax cuts became effective in January 2018, so their positive impact will simply ease off, especially that some taxpayers will be actually hit by the new tax bill (of course, Trump may strike a deal with Democrats about greater federal expenditures on infrastructure, but their impact would appear only with delay, in 2020/2021, at the earliest).

To sum up, the positive impact of the tax cuts passed in late 2017 will fade just when the financial conditions tighten. Although the Fed will become more dovish, the US policy mix will become more restrictive. This is why many analysts fear that recession will hit the economy in the near future. We are less pessimistic, but slowdown is certainly possible. The slower pace of economic growth – combined with fewer Fed interest rate hikes and the first ECB’s hike – should create macroeconomic environment more friendly for gold than in 2018. Hence, we should see better price performance next year.

To be clear: we are not saying that bullion will start to rally. What we are saying is that fundamental factors should become less friendly toward US dollar and more friendly toward gold. However, as Yogi Berra once said, “It’s tough to make predictions, especially about the future.” You see, economic systems, like biological or climatic systems, are extremely sensitive to initial conditions, which could be very volatile. But markets are even more challenging for forecasting, as they are driven by us, people, with all their complexities, emotions and psychology. Rainy clouds do not feel fear and do not form expectations – but we, people, do. And this is extremely difficult to forecast. Hence, keep in mind that even if our appraisal of fundamental trends turns out to be correct, the price of gold may deviate due to psychological and trading factors. Gold might also plunge first, based on technicals and then soar back up, helped by the improving fundamentals.

Therefore, we just painted for you our baseline fundamental forecast for 2019. But a lot may happen on the way – then, of course, we will adjust our view and inform you promptly. Stay tuned!

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.