Gold Stocks Remain in a Downtrend

Commodities / Gold and Silver Stocks 2019 Jan 21, 2019 - 02:34 PM GMTBy: Jordan_Roy_Byrne

Last week we discussed the difference between a rally and bull market.

Gold stocks have been in a rally.

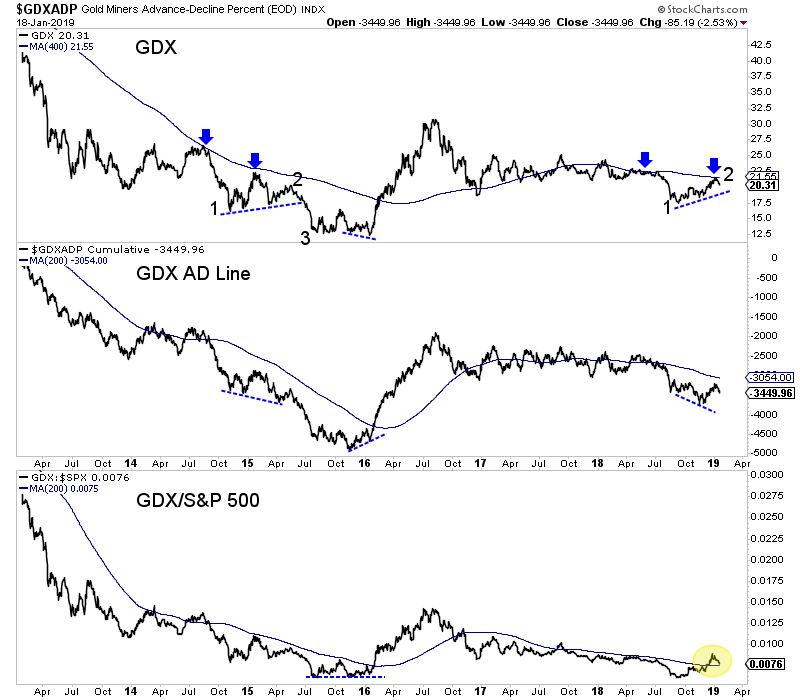

That rally is now over as gold stocks peaked at their 400-day moving averages days ago and sliced through their 200-day moving averages Friday.

Take a look at the charts of any gold stock index (GDX, GDXJ, HUI) and it’s clear they are in a downtrend.

Go back two to three years. You’ll see lower highs and lower lows. That’s a downtrend!

Until that changes, we have to respect that.

The change will come when the market knows the Fed is done hiking and anticipates the start of rate cuts.

Going back 65 years, I counted 13 times when the Fed went from rate hikes to rate cuts. The average gain in gold stocks during 11 of those periods was 172%.

The moves higher began an average and median of three to four months after the time of the last hike.

If the final hike is in March or June then the bull run should begin around the average time frame. If December 2018 was the final hike, then obviously the move higher could begin after the average or median period.

The immediate risk is the gold stocks could be starting another leg lower. In the chart below, we see similarities between GDX today and where it was in Q2 2015.

At both junctures the market had finished rallying after breaking down from a long consolidation. Note the points 1,2,3 and also the similarities in the advance-decline line. One positive difference is GDX relative to the stock market has surpassed its 200-day moving average.

In summation, we are looking for one more leg lower before a potential historic buying opportunity in precious metals. How much lower and for how long could depend on how soon the market is certain the Fed is done hiking.

There’s no need to chase anything now as there will be plenty of time to get into cheap juniors that can triple and quadruple once things really get going. Recall that many juniors began huge moves months after epic sector lows in January 2016, October 2008, May 2005 and November 2000. Don’t chase the wrong stocks right now.

To prepare for an epic buying opportunity in junior gold and silver stocks in 2019, consider learning more about our premium service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.