Will Liquidity Prevail In The Markets?

Stock-Markets / Financial Markets 2019 Jan 27, 2019 - 05:42 PM GMTVIX challenged Short-term resistance at 21.77 on Tuesday, but eased back toward long-term support at 16.51 at the close on Friday. The Primary Cycle [C] that may have just started may be a multiple of the Primary Wave [C] of February 2018.

(RealInvestmentAdvice) All Quiet on the Western Front is a 1929 novel which describes German soldiers’ extreme physical and mental stress during World War I, and subsequent detachment from civilian life felt by many soldiers upon returning home. This novel was eventually made into a major motion picture.

The phrase “all quiet on the Western Front” has become a colloquial expression meaning stagnation, or lack of meaningful change, in any context.

Many financial markets ended 2018 with considerable volatility. The stock market, as measured by the S&P 500 index, fell from its peak in early October to a December 26th low by over 21%.

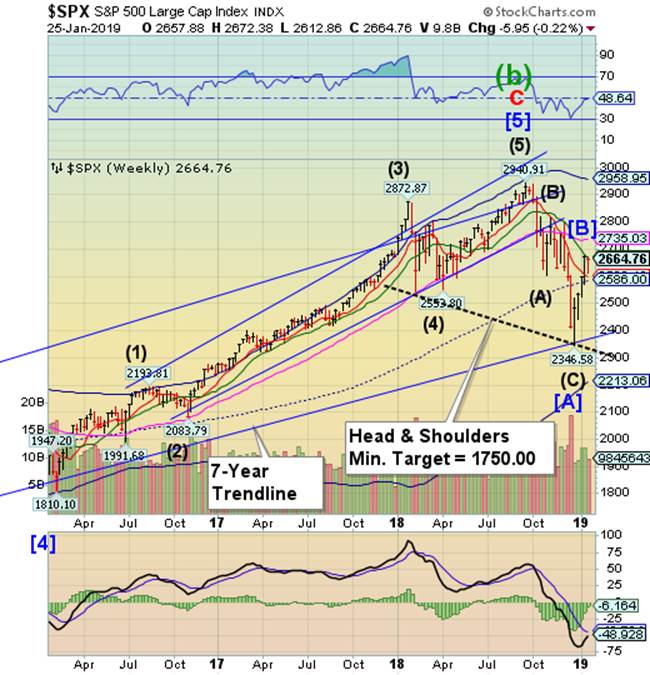

SPX stalls at Intermediate-term resistance.

SPX declined to Short-term support at 2599.18 on Tuesday, then bounced back to retest Intermediate-term resustance at 2665.37, leaving a flat week. Wave [B]s are rogue waves that often do the unexpected. In this case it appears to most investors to have solidified the bullish case. The Cycles Model disagrees. There is a probable Head & Shoulders neckline that, if reached in the next few weeks, may indicate the target of this decline.

(Bloomberg) This week brought something new for stock investors whiplashed by December’s drubbing and subsequent January snap-back: a lull in the action.

The S&P 500 Index inched 0.2 percent lower this week as earnings season kicked into high gear, its smallest weekly move since October. That leaves the gauge up 6.3 percent in January after the 9.2 percent tumble in December.

But is this the pause that refreshes, or the eye of the hurricane? The equity rally “has lost some of its sparkle as the mood turns slightly more risk-off than a week ago,’’ Aliza Mason, an equity derivatives strategist at Grupo Santander, wrote in a note. That’s left investors stuck “halfway between hope and despair.’’

NDX challenges Intermediate-term resistance.

NDX declined to Short-term support at 6561.25, then bounced to challenge Intermediate-term resistance at 6764.69, closing above it. The Cycles Model suggests that NDX is either at or very near the end of its rally. There is a potential Head & Shoulders formation that, if triggered, may erase up to 3 years of gains. Stay tuned!

(ZeroHedge) In the span of a day, China has gone from threatening to crash US markets if President Trump doesn't agree to a trade deal to helping the US rebut reports that trade talks weren't going as smoothly as President Trump and the Wall Street Journal had let on. During a press conference on Thursday, Ministry of Commerce Spokesman Gao Feng denied reports that a meeting involving high-level trade officials in Washington had been cancelled (the FT had cited US frustrations with China's reluctance to cave on demands relating to curbing IP theft and certain structural reforms) - backing up Larry Kudlow, who sparked a brief rally just before the close on Wednesday when he appeared on CNBC to deny these reports.

Kudlow said yesterday that the most important meeting, between a Chinese delegation led by Vice Premier Liu He, the country's top economic official, was still slated to take place in Washington next week.

High Yield Bond Index closes again above Intermediate-term resistance.

The High Yield Bond Index declined to its trendline near 195.00, then rallied again above the Intermediate-term resistance at 197.17 and making a new retracement high. The 2 ½ year trendline is due for a retest that, if broken, may clear the way to a potential Head & Shoulders formation that may wipe out up to two years of gains.

(Benzinga) Investment-grade corporate bonds are rallying to start 2019, but concerns remain about a potential raft of downgrades for BBB-rated bonds.

Those bonds, which represent a major chunk of the U.S. corporate bond market, are rated one to three notches above junk territory and almost half of those bonds cling to a rating that is just one level above high-yield status.

Concerns about the vulnerabilities of BBB-rated corporates were among the factors behind a 2018 decline of 3.8 percent for the Markit iBoxx USD Liquid Investment Grade Index, one of the most widely followed gauges of high-quality corporate debt. That benchmark allocates over half its weight to BBB-rated debt.

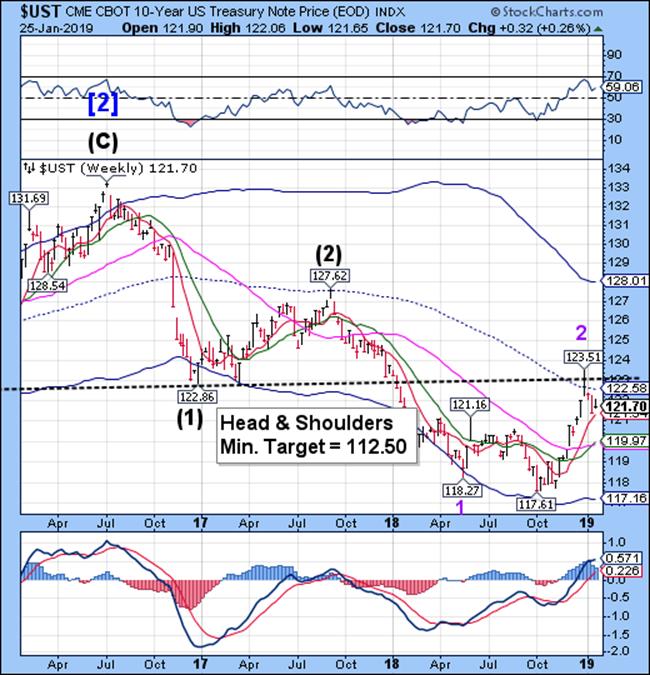

Treasury bonds have an inside week.

The 10-year Treasury Note Index fell somewhat, but stayed within the parameters of the prior week’s high and low. The breakout either above mid-Cycle resistance at 122.58 or beneath Short-term support at 121.31 may give us the direction of the move in the next two weeks.

(CNBC) U.S. government debt yields rose on Friday after President Donald Trump announced that he had reached a deal with congressional lawmakers to reopen the federal government for three weeks.

The yield on the benchmark 10-year Treasury note was up at 2.755 percent at 1:11 p.m. ET, while the yield on the 30-year Treasury bond rose, trading at 3.06 percent. Bond yields move inversely to prices.

The short-term resolution would leave open the possibility that lawmakers fail to come to terms and end up at another impasse in mid-February.

The Euro hanging by a thread.

The Euro fell this week, but managed to levitate back to its weekly opening price. The decline may resume next week. There is a potential Head & Shoulders formation beneath 112.00 that suggests a downside target that may be attained in the next month.

(RTE) The euro was headed for a second weekly decline today after the head of the European Central Bank said economic growth was likely to be weaker than previously expected.

ECB President Mario Draghi blamed factors ranging from China's slowdown to Brexit for the slowdown.

The central bank left the bloc's interest rates unchanged as expected yesterday.

The euro, which has traded in a range of $1.12 to $1.16 for the past three months, weakened as investors questioned whether the ECB would be able to raise interest rates this year, as its current guidance indicates.

EuroStoxx approaches a trendline.

The EuroStoxx rally challenged Cycle Bottom support at 3101.07 before rallying back above Intermediate-term resistance at 3139.24. The Cyclical strength extended until this weekend, with weakness to follow through the middle of February.

(CNBC) European stocks traded higher on Friday, amid a rally among technology shares and as investors continued to monitor U.S.-China trade developments.

The pan-European Stoxx 600 index rose 0.6 percent during trade, with tech stocks and trade-sensitive sectors like autos and basic resources among the top gainers.

The FTSE 100 was the only major bourse to close lower, dragged by Vodafone’s disappointing earnings and a rise in the value of sterling against the dollar.

Europe’s tech sector saw big gains even after U.S. chipmaker Intel posted earnings and guidance that missed analysts’ expectations. Semiconductor firm Siltronic was up more than 5 percent, while competitors STMicro and Infineon were more than 4 and 2 percent higher respectively by the close.

.The Yen consolidates at the lows.

The Yen traded in place for most of the week as it gathers strength for the next upswing. The Cycles Model suggests a continued probe to the upper trendline over the next two weeks

(MarketWatch) Don’t underestimate the Japanese yen’s status as a haven — and its ability to buoy the currency despite lackluster economic fundamentals.

Granted, with consumer price inflation at stubbornly low levels and economic growth dented, the yen doesn’t necessarily sound like the best bet among major currencies. But ample liquidity could allow the yen to defend its haven status and attract investments irrespective of economic data, analysts said.

In times of geopolitical or financial turmoil, the yen USDJPY, -0.08% tends to gain versus its peers, according to conventional wisdom. Seeking protection from Brexit in a sterling-yen GBPJPY, +0.93% trade has been a favorite suggestion from pound bears, for example.

The secret to Japan’s ability to live up to its haven status despite sluggish data centers on liquidity.

Nikkei meets resistance.

The Nikkei challenged Short-term resistance at 20771.87, closing just above it. The Cycles Model appears to be inverting in the next week or so. The bounce may be running out of time.

(EconomicTimes) Japan's Nikkei ended almost flat on Thursday weighed down by a fall in index heavyweight Fast Retailing, but strong earnings from Texas Instruments boosted chip-related shares, supporting the broader market.

The Nikkei share average dipped 0.09 percent to 20,574.63, hit by a 3.1 percent fall in Fast Retailing, which accounts for more than 9 percent of the Nikkei. But it managed to stay above its 25-day moving average at 20,451.

The broader Topix was up 0.36 percent at 1,552.60, with chip-related shares and financials leading the gains.

U.S. Dollar declines toward mid-Cycle support.

The USD rally failed at Intermediate-term resistance, declining toward mid-Cycle support at 95.18. The USD remains on a sell signal. The Cycles Model suggests weakness for the next 2-3 weeks.

(Investing.com)- The U.S. dollar pushed higher against a basket of its rivals on Thursday but gains were held in check by concerns over global growth, the U.S. government shutdown and the ongoing U.S.-China trade war.

"Trade tensions are the most dominant factor for investor sentiment right now and will drive market flows," said Nick Twidale, chief operating officer at Rakuten Securities.

Twidale added that investor risk appetite will only improve once concerns over the partial U.S. government shutdown and trade tensions fade. Trade tensions were evident again Thursday as access to Microsoft (NASDAQ:MSFT)'s Bing search engine was blocked in China.

Gold makes a weekly key reversal.

After two “inside” weeks, Gold made a weekly key reversal that may allow it to rally to 1320.00 or higher. The key reversal now suggests a Cycle inversion instead of a decline, as originally anticipated. The Head & Shoulders formation is still valid, however, unless a new high is made.

(CNBC) Gold jumped over 1 percent to a more than seven-month high on Friday, briefly surpassing the $1,300 mark, as the dollar slid ahead of a U.S. Federal Reserve meeting next week where the central bank is widely expected to leave interest rates unchanged.

Spot gold rose 1.29 percent to $1,297.13 per ounce as of 1:58 p.m. ET, having earlier touched a peak of $1,300.30, its highest since June 15, 2018. The metal was on course for its best week in four.

U.S. gold futures settled $18.30 higher at $1,298.10 per ounce.

“The major catalyst supporting gold is a big drop in the dollar, amid expectations the Fed will reiterate a pause to its hiking cycle next week,” said Fawad Razaqzada, an analyst with Forex.com.

Crude may rally another week.

Crude oil appears to have completed its corrective bounce to the top of the December high. However, it appears that the current Cycle is inverting and may be extending for another week.

(Bloomberg) Attempted coups and alternative governments in petrostates like Venezuela are typically the stuff of oil price rallies. Thus far, the political crisis in Caracas — really just the latest escalation of the long-standing crisis engulfing the country — has prompted a twitch in crude oil prices rather than a full-on spasm of fear.

In part, that reflects a market that priced in Venezuela’s slumping oil output ages ago. But it also reflects apparent weakness in one of oil’s most important markets: gasoline. And further turmoil in Venezuela may actually exacerbate this.

The latest oil inventory numbers from the Energy Information Administration, released Thursday, showed weakening U.S. gasoline demand and stocks of the fuel hitting record levels. Little wonder gasoline cracks — a simple proxy for the profit on refining crude oil into the fuel — have hit their lowest level since late 2010:

Shanghai Index challenges Intermediate-term resistance.

The Shanghai Index challenged Intermediate-term resistance a 2598.58, closing just above it in what appears to be an irregular correction. A period of strength may have just ended this week. It may resume its decline with a potential bottom near 2000.00-2200.00.

(Bloomberg) China’s stock market is likely to resume its recent sell-off in 2019, with existing government efforts to boost the economy set to fall short, forcing a fresh dose of measures to accelerate growth as the stock market tumbles, according to Bank of America Merrill Lynch.

If growth data continue to disappoint, the Hang Seng China Enterprises Index could fall to 7,600, a decline of 30 percent from closing levels on Friday, and the Shanghai Composite by about 20 percent to a bottom of 2,100, said David Cui, BofAML’s head of China equity strategy. Only after investors are convinced that more effective stimulus is in place will the market be able to recover substantially, he added.

“The current stimulus isn’t strong enough to erase the slowdown in growth,” he said in a roundtable interview in Hong Kong on Friday. “The bottom for growth probably will be a year later than most people currently anticipate.”

The Banking Index makes its final surge.

-- BKX consolidated early in the week, then had what may be its final burst of strength on Friday. The Liquidity Model turns negative this weekend. The Cycles Model suggests the decline may resume the retest of the December low over the next 3 weeks. The structure may become more bearish.

(CrainsNewYork) The biggest issuers of U.S. corporate bonds are easing up on selling new securities, which could translate to gains for investors holding the debt.

Banks and other financial companies have sold around $50 billion of bonds so far this year, down more than 40% from the same period a year ago. For the largest U.S. banks the decline has been even steeper – they sold just $12 billion of debt after earnings, about a third of sales at the same point last year.

Debt sales are falling after banks have largely sold enough debt to meet the requirements of a Federal Reserve regulation, and tax cuts have lifted their cash flow, reducing their borrowing needs. Many foreign banks, typically major January issuers, have sat out amid Brexit jitters and rising hedging costs in currency markets. U.S. and foreign financial companies represent about a third of the $5 trillion high-grade bond market.

(Politico) Big banks are bracing for their CEOs to be called to testify soon at what could be an intense House hearing led by new Financial Services Chairwoman Maxine Waters, sources familiar with the matter said.

The details of the hearing, anticipated to happen by this spring, have not been finalized, but lawmakers and bank representatives are expecting it.

The banks that are seen as likely to be invited to participate include JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, Goldman Sachs and Morgan Stanley. Spokespeople for several of the banks declined to comment, and others didn't respond.

In a preview of the kind of tone the lenders should expect to face, Rep. Emanuel Cleaver (D-Mo.) told POLITICO he wanted to hear from the executives "why we bail them out and can't experience any meaningful support from them in times of trouble."

…and see the article in ZeroHedge.

(ZeroHedge) Like the old saying goes: Mo' money, mo' problems.

In the latest sign that times are getting tougher for finance professionals, UBS's army of wealth managers might need to forgo buying that new sports car or - god forbid - consider moving their kids to slightly less prestigious private schools this year as the bank has reportedly informed some of its bankers in Asia and Europe that they could see their bonuses cut by as much as 20%, according to Bloomberg.

The cuts come amid a rash of layoffs and compensation cuts in the financial services industry as the explosion of volatility in Q4 did the industry no favors from a profitability standpoint (contrary to the conventional wisdom that volatility is good for the bottom line).

All the best!

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at http://mrpracticalinvestor.com/ to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIOhttp://mrpracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.