US Consumer Debt Is Actually in Better Shape Than Ever

Interest-Rates / US Debt Mar 01, 2019 - 03:41 PM GMTBy: Jared_Dillian

I saw a headline last week:

I saw a headline last week:

“More Americans Are Behind On Their Car Loans Than Ever Before”

Sounds ominous. It’s even worse when you dig into it.

Seven million car loans were more than 90 days past due in the fourth quarter of last year. That’s more than during the Great Recession, when unemployment was twice as high.

A lot of the perma-bears seized on this, saying how the economy sucks because everyone is defaulting on their car loans.

Not really.

Myth #1: Auto Delinquencies Mean the Economy Sucks

The economy may indeed suck, but it’s not because of the car loans.

People are defaulting on car loans because underwriting standards declined significantly a few years ago.

There are a lot of subprime auto dealers around Myrtle Beach. These are the types of places where you buy a car for $2,000 and end up paying $6,000 in interest.

I might add that car dealerships are not subject to regulation by the CFPB. That’s why they have been uber-aggressive in lending money. They will get you in that car, no matter what it takes.

No wonder people are defaulting!

It really has nothing to do with the economy. Cars are more expensive, and people are buying more SUVs, which are even more expensive.

Now that we’ve debunked that myth, let’s find another one.

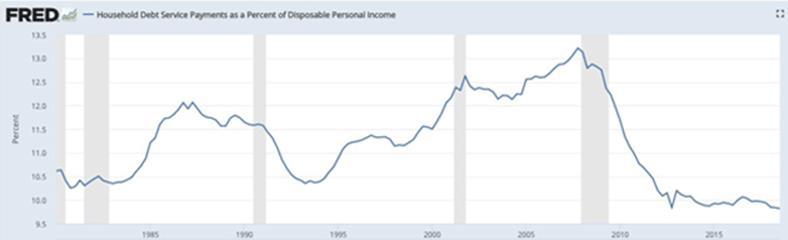

Myth #2: Household Debt Is Out of Control

I came across a Morgan Housel tweet when I was sitting on the couch over the weekend.

Shot:

Household debt surges to an all-time high!

Source: @morganhousel

Chaser:

Household debt payments as a percentage of disposable income surges to an all-time low!

Source: @morganhousel

There is a fair bit of alarmism in the personal finance “community” about the state of American households’ balance sheets. Things are not that bad. They are better than ever, actually.

And people are getting smarter about stuff. They have been getting smarter about credit cards for a while. Credit scores keep putting in new highs!

People Have to Save More

Where we need to improve is in savings. Gosh darn it, people just do not save.

You have situations like the government shutdown, where a bunch of people did not pass Go and went straight to the food bank.

They show how many people actually do live paycheck to paycheck—even government workers. Which is a bit discouraging.

And when I say “save,” I do not mean invest. I mean cash in the bank.

Ten years of ZIRP destroyed a generation of savers. But it makes sense to save, even if interest rates are zero. For reasons that should be obvious.

Stuff happens. If you don’t have cash lying around, you will be stuck.

How much cash do you need lying around? Six months of pay, or $10,000, whichever is more.

Ten-thousand dollars may sound like a lot of money to a lot of people, but it is attainable—if you save. And $10,000 covers pretty much all unforeseen circumstances.

What this means is that a $3,000 car repair isn’t going to end up on your credit card. It won’t send you into a debt tailspin from which you can never recover.

Yes, there is unemployment insurance if you lose your job. I would not count on it! I would not count on anything.

Sure, there is a social safety net. But you should get in the habit of not depending on it. Because ideally you should not be dependent on anyone or anything.

I don’t think many people in my generation believe that Social Security will be around in its current form when it is time to retire. So we had better save for retirement.

My personal opinion: I do think Social Security will be around in 20 years, but it will probably end up being means-tested.

Things Are Good, but They Could Be Better

Part of the reason households have decent balance sheets is because we’ve had a 10-year expansion.

We haven’t had a recession in a while, and we’ve forgotten what a recession is like. Who knows, maybe we are Australia—maybe we will go 27 years without a recession.

If you spend your whole life preparing for something bad to happen, you will… end up with a big pile of money. There are worse things, for sure.

Savings is power. Savings is like plutonium, just a big pile of potential energy with no half-life. It’s stored opportunities. It waits, until you decide what you want to do with it.

And if you decide you really have no use for it, you can just give it away.

Which is better than paying interest on a car loan.

Free Report: 5 Key ETF Trading Strategies Every Investor Should Know About

From Jared Dillian, former head of ETF trading at Lehman Brothers and renowned contrarian analyst, comes this exclusive special report. If you’re invested in ETFs, or thinking about taking the plunge into the investment vehicle everyone’s talking about, then this report is a clever—and necessary—first step. Get it now.

By Jared Dillian

© 2019 Copyright Jared Dillian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.