US Retail Sales Panic Data Could Be Just a Glitch

Economics / Retail Sector Mar 10, 2019 - 03:31 PM GMTBy: John_Mauldin

Recession antennae popped up everywhere on February 14.

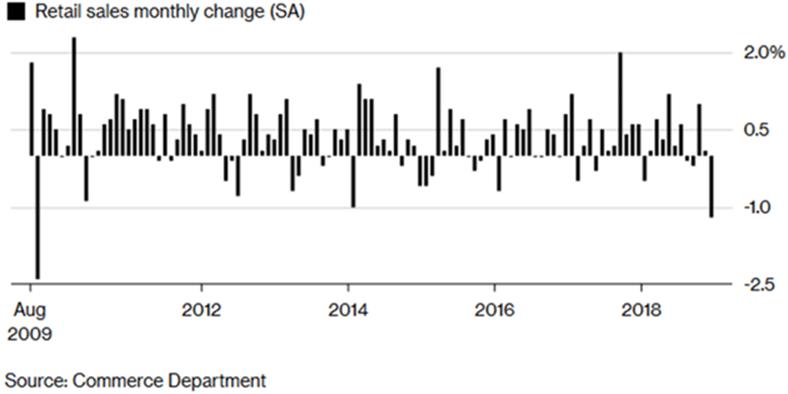

The Commerce Department reported retail sales fell 1.2% in December. It was the worst month-over-month decline since 2009:

Chart: Bloomberg

Now, there are reasons to doubt this report’s significance.

This Might Have Been a Glitch

First, the report came out four weeks later than scheduled due to the government shutdown. And so it’s more subject to revision than normal.

It also conflicts with private-sector data like Redbook, which climbed sharply in December. And even if the data is right, this is only one month and one month doesn’t make a trend.

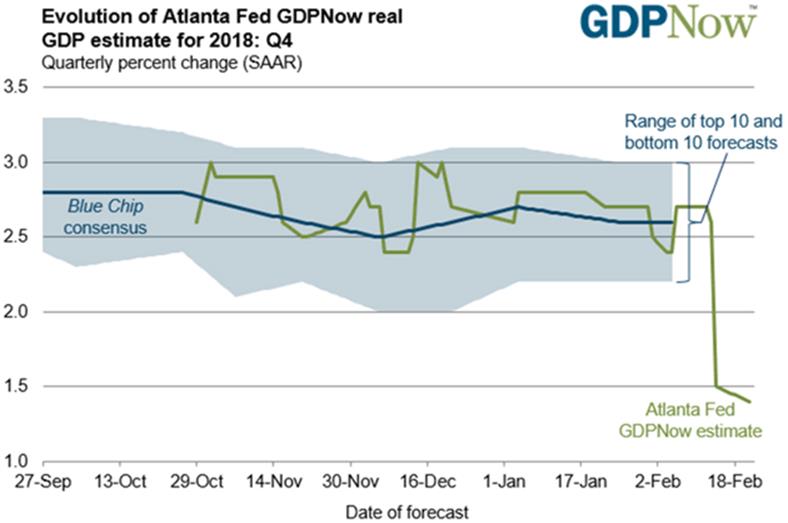

Despite this, retail sales are an important input to recession models like the Atlanta Fed’s GDPNow.

That model’s estimate for Q4 2018 instantly plunged from 2.7% just two weeks earlier to 1.5%. Ugh.

That will be a dramatic weakening if the final Q4 GDP report confirms it, but I doubt it will.

I think this report is a glitch and will fade away as other data comes in.

But even if it’s right, 1.5% GDP growth isn’t a recession. It would mean 2018 was an okay though not spectacular year.

In the worst case, a recession call is at least six months away. (By definition, it takes two negative GDP quarters to mark one.)

This illustrates an important point: The recession outlook is a moving target. It changes as we get new data.

Forecasts should change with it, and I don’t blame anyone who lets new information change their mind. It might make me trust them even more.

I Don’t See a Recession in 2019

My own outlook has been consistent: The current growth phase is getting old and will end as they all do. But we probably have another year or so.

That is about as far out as my data reads can actually give us any statistical confidence.

Macro events like Federal Reserve error, trade war, ugly Brexit, and others could hasten the decline. But as of now, the US and the developed world seem likely to sustain at least mild growth through 2019.

Get one of the world’s most widely read investment newsletters… free

Sharp macroeconomic analysis, big market calls, and shrewd predictions are all in a week’s work for visionary thinker and acclaimed financial expert John Mauldin. Since 2001, investors have turned to his Thoughts from the Frontline to be informed about what’s really going on in the economy. Join hundreds of thousands of readers, and get it free in your inbox every week.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.