UK Savings Market Boosted by Islamic Banks - Top Fixed Rate Bonds

Personal_Finance / Savings Accounts Apr 01, 2019 - 02:57 PM GMTBy: MoneyFacts

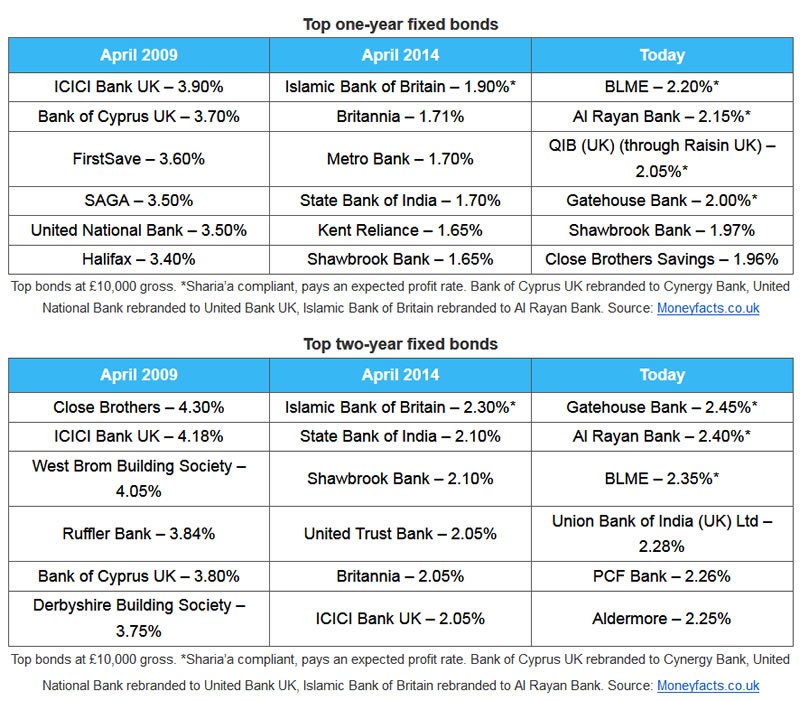

Savers searching for a safe home for their cash may have noticed a change in the companies offering the top deals over the past decade, not only seeing new faces of challenger banks, but also that many more market-leading positions are being held by Islamic banks.

Two sectors within the savings market to gain special attention have been the one and two-year fixed bond sectors. Indeed, the latest analysis by Moneyfacts.co.uk shows that the current Best Buy deals within each of these two sectors are dominated by Islamic banks offering market-leading returns, and this has led to more competition from other brands looking to maintain a prominent position within the charts.

Rachel Springall, Finance Expert at Moneyfacts.co.uk, said:

“Savers who look away from Islamic banks will be missing out on the best returns for their cash. In addition, savers who do choose a Sharia’a compliant account will be investing ethically thanks to steadfast Islamic law principles.

“Islamic banks don’t pay interest, but they do pay an expected profit rate, and this can be comparable to other savings accounts, so savers would be wise to consider these deals. In fact, savers can get an expected profit rate of 2% or more on a one-year fixed bond with Islamic banks, but not the equivalent in interest from other mainstream brands. It’s also worth knowing that Gatehouse Bank stated it has never failed to pay its expected profit rate.

“It’s worth remembering that the Islamic banks within the Best Buys are fully covered by the Financial Services Compensation Scheme and regulated by the Financial Conduct Authority. Therefore, in times of economic uncertainty, savers can take assurance that, were an Islamic bank to default, they would have the same level of protection as with any other provider under the same scheme.

“Islam teaches that money has no intrinsic value, so individuals cannot be charged or earn interest, but savers do not need to follow the religion to apply for a savings account with an Islamic bank. In fact, an estimate by Gatehouse Bank revealed that 70% of their savings customers are non-Muslim.

“Currently, Al Rayan Bank, Bank of London and The Middle East (BLME), Gatehouse Bank and QIB (UK) – the latter through Raisin UK – sit as the top four best rates on the market for one-year fixed rate bonds, whereas if we look back to just five years ago, only Islamic Bank of Britain (now branded as Al Rayan Bank) was in the market. Further still, 10 years ago there wasn’t one Islamic bank offering deals in this sector.

“Clearly, the rise of the Islamic banks and subsequent rate improvement in the savings market should be celebrated, and as competition intensifies with challenger brands increasing rates to get a more prominent market position, it's good news for savers all round.”

moneyfacts.co.uk is a financial product price comparison site, launched in 2000, which helps consumers compare thousands of financial products, including credit cards, savings, mortgages and many more. Unlike other comparison sites, there is no commercial influence on the way moneyfacts.co.uk ranks products, showing consumers a true picture of the best products based on the criteria they select. The site also provides informative guides and covers the latest consumer finance news, as well as offering a weekly newsletter.

MoneyFacts Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.