Dow Stock Market Trend Forecast to September 2019

Stock-Markets / Stock Markets 2019 Apr 09, 2019 - 09:28 AM GMTBy: Nadeem_Walayat

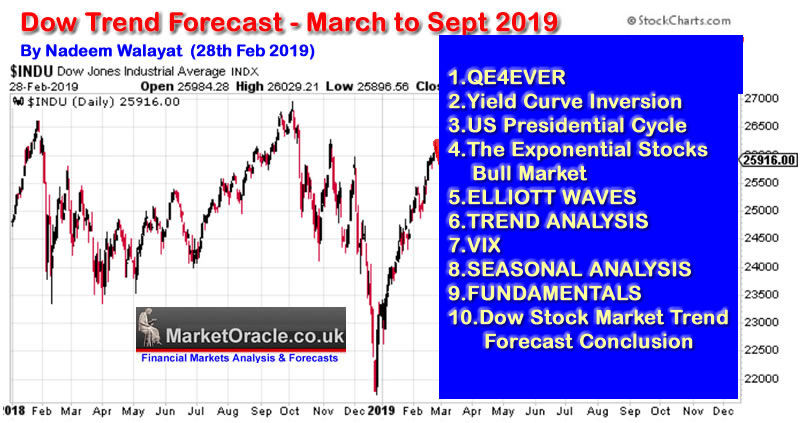

This is the last in a 10 part series that concludes in a detailed trend forecast for the stock market into September 2019. However the whole of this analysis has first been made available to Patrons who support my work.

So for immediate First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Formulating a Stock Market Forecast

So in this last analysis comes

Now comes the hard part, to convert all of the above analysis and more into a trend forecast for as far distant into the future as I can reliably conclude.

Presently the stock market is pending a breakout higher, so technically remains stuck in a trading range. The Presidential cycle is strongly bullish for stocks. Suggests stocks are going to have a very strong year, and so far the markets are not disappointing by last trading at 25,916. So it looks like we are definitely going to see a NEW ALL TIME HIGH, so the Dow looks set to trade above 27,000.

How high? 30k? Could the Dow get to 30k? Well sitting here in the middle of a trading range its difficult to say what the Dow will do once it breaks out of its trading range. An achievable target for a 20% gain would be 28,000, though I would not be surprised to see 29k, whilst 30k would be a push as that would represent a 29% gain on the start of the year (23,300)!

28,000 = +20%

29,000 = +24.5%

30.000 = +29%

In terms of a trend pattern, well several technical indicators are bearish so imply an imminent correction to somewhere between 24,500 and 23,000. I think 24,500 is more probable given the strength of the rebound which implies the market wants to go higher rather than lower.

Seasonal's didn't prove reliable last year, and so far are not for at least the first 3 months of 2019, which ironically implies to expect them to be more reliable for much of the remainder of the year.

Thus I am leaning towards a trend lower during March, higher into Mid May, a wobble during June / July followed by a breakout surge higher into September for the New High to at least Dow 28,000.

Dow Stock Market Forecast Conclusion

Therefore my forecast conclusion as illustrated by the below chart is for the Dow to target a trend to at least Dow 28,000 by Mid September 2019.

Initially the Dow looks set to correct during March to approx 24,500 before rallying to attempt to break above 27,000 during May, a correction from which should set the scene for an eventual breakout to 28,000 by Mid September.

Peering into the Mysts of Time

December is a LONG way of, but I do expect Santa to come this year! Of course I will come back with analysis updates and a forecast nearer the time as there are over 6 months of price data and economic news ahead of us before this forecast concludes with many questions to answer. For instance will US unemployment keep rising? Is the yield curve inversion panic now over? Will the Fed do another flip flop and start hiking interest rates again? All of which will have a baring on what happens later in the year. But for now I see a Santa rally as being probable, and likely to take the Dow to another new all time high, well beyond the 28k forecast above, and may even achieve the 30k milestone. Anyway everything will become clear with the benefit of hindsight which I am sure many will point out to me, perhaps asking why I did not forecast that the Dow would hit 30k in September 2019, when with hindsight it was so obvious!

Again for immediate first Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. Which includes my latest analysis on investing in the machine intelligence mega-trend i.e. the Top 10 AI stocks to invest in to profit from the machine intelligence mega-trend.

Your analyst

Nadeem Walayat

Copyright © 2005-2019 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.