Why US Dollar Strength is Long Term Catalyst for Gold

Commodities / Gold & Silver 2019 May 01, 2019 - 02:46 PM GMTBy: Jordan_Roy_Byrne

As we know, Gold and the US Dollar have an inverse relationship. Gold is priced in US Dollars and the drivers of each are similar (from an inverse point of view). Over long-term periods both trend in the same direction but the magnitude of the moves can vary and be quite different.

As we know, Gold and the US Dollar have an inverse relationship. Gold is priced in US Dollars and the drivers of each are similar (from an inverse point of view). Over long-term periods both trend in the same direction but the magnitude of the moves can vary and be quite different.

The standard inverse relationship has not been a perfect one in recent months or years.

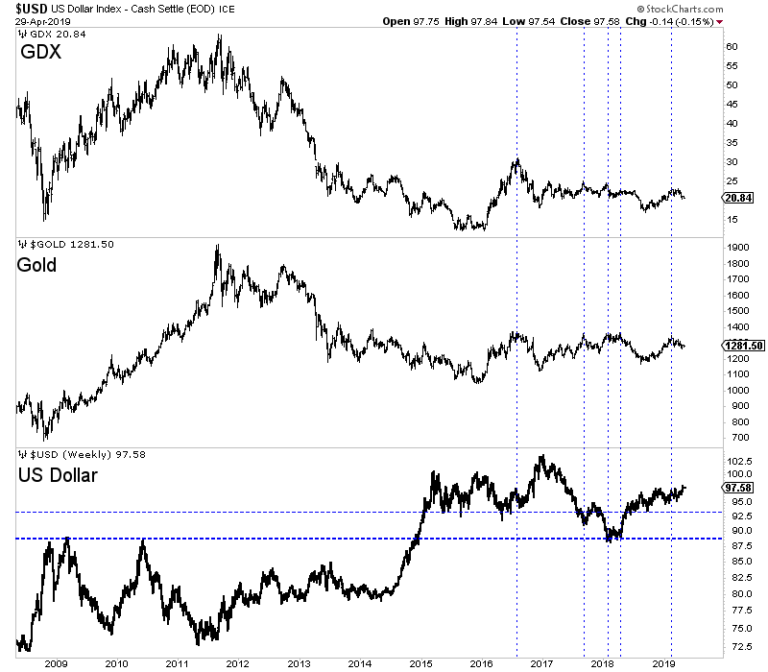

In the chart below we plot Gold, gold stocks and the US Dollar.

We highlight (with vertical lines) the points at which Gold tested the wall of resistance. As you can see, the relationship with the dollar hasn’t been uniform.

GDX, Gold & US Dollar

In particular, note what transpired in 2017. The dollar declined sharply and penetrated its 2016 low to the downside yet Gold didn’t make a new high and gold stocks didn’t even come close to their 2016 high.

Recently, the reverse has transpired. The US Dollar has or is breaking out to a new high yet Gold is much closer to its 52-week high rather than its 52-week low.

Gold bulls hope the breakout will reverse course and lead to a big decline. Surely, a big decline would push Gold to a massive breakout. Or would it?

Recall 2017. Gold did not breakout and gold stocks performed even worse. Gold’s fundamentals were not bullish because real interest rates increased throughout 2017. Dollar weakness simply prevented Gold and gold stocks from faring worse.

If the dollar declines again and for similar reasons as in 2017 (global recovery and global risks averted) then we should not expect Gold to breakout. If strength in US stocks and global stocks continues then Gold is not going to breakout regardless of what happens to the US dollar.

If the US Dollar were to continue rising throughout 2019 then it would eventually cause a myriad of problems that would lead to softer policy and Fed rate cuts. Gold may not breakout initially but eventually it would.

The best scenario for Gold would be a dollar decline coupled with a decrease in real interest rates, which would be driven by Fed rate cuts or a consistent rise in inflation as the Fed stands pat.

Keep an eye on the US Dollar over the weeks ahead as its fate could give us a sense of where things are going for the balance of 2019 and then we could assess how Gold may react.

The weeks or months ahead should continue to be an opportune time to position yourself in the Gold sector. We are looking for deep values and anything we missed in recent months that gives us a second chance opportunity.

To learn what stocks we are buying and have 3x to 5x potential, consider learning more about our premium service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.