What is a Bigger Alchemists’ Dream: MMT or Transmutation Into Gold?

Commodities / Gold & Silver 2019 May 10, 2019 - 04:27 PM GMTBy: Arkadiusz_Sieron

Traditional alchemist always desired to turn lead into gold. The modern ones want to increase government spending without any limits. We invite you to read our today’s article about the Modern Monetary Theory and find out what is it and what would mean for the gold market, if implemented.

Traditional alchemist always desired to turn lead into gold. The modern ones want to increase government spending without any limits. We invite you to read our today’s article about the Modern Monetary Theory and find out what is it and what would mean for the gold market, if implemented.

Great news for all who oppose the House of Lannister’s rule in King’s Landing – the final season of the Game of Thrones has eventually began, so the status quo in Westeros will be certainly challenged. Similarly, we have joyous news for all who dislike the mainstream economics – the new theory has recently joined the game of thrones among the economic theories after the Great Recession. The fresh alternative which is quickly gaining popularity is the Modern Monetary Theory (MMT). What is it and what would it bring for the economy and the gold market, if implemented?

The core message of the heterodox macroeconomic theory called MMT is that the government which issues its own currency and in which denominate its debts simply cannot go bankrupt because it can always issue money to pay off its debts. Hence, tax revenues are unnecessary while budget deficits are meaningless – after all, the government can print money to cover its expenditures.

Well, in a sense, this is true. Governments can print money, so it cannot be “insolvent” like private individuals. This is why we hear about hyperinflations from time to time – Venezuela being the most recent example. And this is precisely why the Westerners took this power away from governments and handed it over to independent central banks. Surely, the central bankers are not fully free from political influence, but they are definitely less likely to mindlessly print money.

The MMT acknowledges the risk of inflation, but it assumes that inflationary genie can get out of the bottle only when the economy operates at its full potential. But even then we should not worry, as the government can curb inflation by increasing taxes. So we would have to pay more in both higher prices and in higher taxes – I do not know how about you, but I feel relieved! Apparently, the supporters of the MMT have not heard anything about neither all the problems with the determination of unobservable potential production, nor about the stagflation, i.e., a simultaneous occurrence of unemployment and inflation.

The MMT is fallacious at so multiple levels that it is impossible to examine it thoroughly in a short article. But we would like to point out one more fatal flaw: the fresh theory conflates money with capital. That’s true that the government has an extraordinary power to print money (however, in the contemporary monetary system, the commercial banks create the majority of the money supply), but money is not real capital. The banknotes or electronic records are not wealth – they are media of exchange. What really matters is the amount of goods (and services) we can afford. The government may pump any amount of money into the economy – but it cannot solve the problem of scarcity of resource and magically increase the pool of real capital goods, such as factories, trucks, computers, pipes, real estates, tractors, power plants, etc.

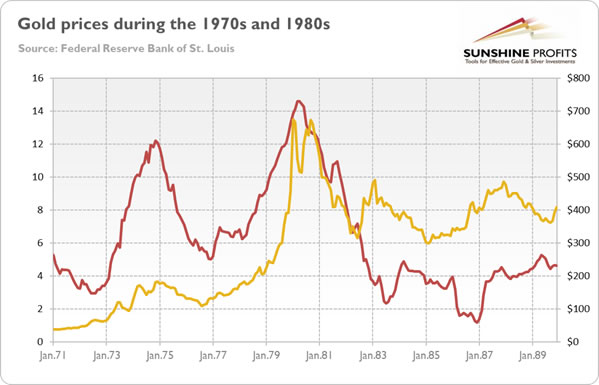

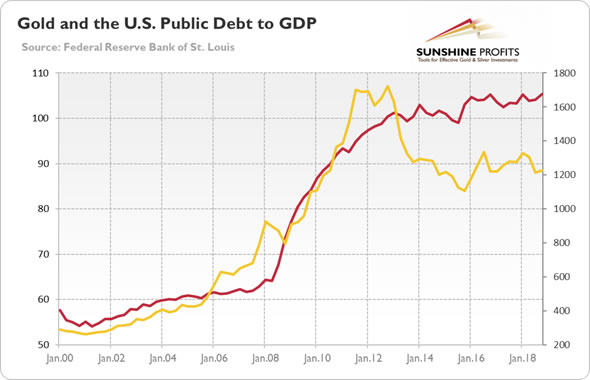

What would the implementation of the MMT imply for the economy and the gold market? As the theory calls for even looser fiscal policy, we could expect greater government spending and further increase in the public debt. It should be clear that gold would be among the biggest beneficiary of the introduction of the MMT. As the charts below show, the yellow metal, as the inflationary hedge, shined both during the stagflationary 1970s and during the rapid accumulation in the US public debt in the 2000s and 2010s.

Chart 1: Gold prices (yellow line, right axis, London P.M. Fix, in $) and inflation rates (red line, left axis, annual % change in CPI rate) from 1971 to 1989.

Chart 2: Gold price (yellow line, right axis, London P.M. Fix, $) and the U.S. public debt to GDP (red line, left axis, in %) from Q1 2000 to Q4 2018.

Fortunately for the economy, but unfortunately for the bullion, the MMT is still very far from being implemented in the US. However, the left wing of the Democratic Party is citing MMT to make the case for massive federal government spending funding a Green New Deal. Hence, the MMT would be one of the key themes during the election campaign in 2020, which could push the candidates toward promises of higher government spending.

To be clear, we are not saying that the introduction of the MMT would immediately cause an economic disaster. The US dollar is an international reserve currency which enjoys a great demand. However, American public debt is already above 100 percent of its GDP – at some point in time, investors could lose the confidence even in greenback, although it – when compared to other fiat monies such as the euro or the Japanese yen – still looks relatively solid. Then, from the fundamental perspective, gold should shine.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.