Our Long-Anticipated Gold Momentum Rally Begins

Commodities / Gold & Silver 2019 May 15, 2019 - 11:24 AM GMTBy: Chris_Vermeulen

Over the past 6+ months, we’ve been covering the price rotations in precious metals very closely. We’ve issued a number of amazing calls regarding Gold and Silver over the past few months. Two of the biggest calls we’ve made were the late 2018 research post that suggested Gold would rally to above $1300, then stall. The other amazing call was our research team’s suggestion that April 21~24 would see Gold setup an Ultimate Base, or what we were calling a “Momentum Base”, near $1250 to $1275.

Over the past 6+ months, we’ve been covering the price rotations in precious metals very closely. We’ve issued a number of amazing calls regarding Gold and Silver over the past few months. Two of the biggest calls we’ve made were the late 2018 research post that suggested Gold would rally to above $1300, then stall. The other amazing call was our research team’s suggestion that April 21~24 would see Gold setup an Ultimate Base, or what we were calling a “Momentum Base”, near $1250 to $1275.

We issued both of these markets calls many months in advance of these dates/price levels targeting these moves. In both cases, we issued these market calls well over 60 days prior to the move actually taking place. The accuracy of these calls can be attributed to our proprietary price modeling solutions as well as the skill and techniques of our research team. Don’t mind us while we take a few seconds to take credit for some truly amazing precious metals calls over the past 6+ months.

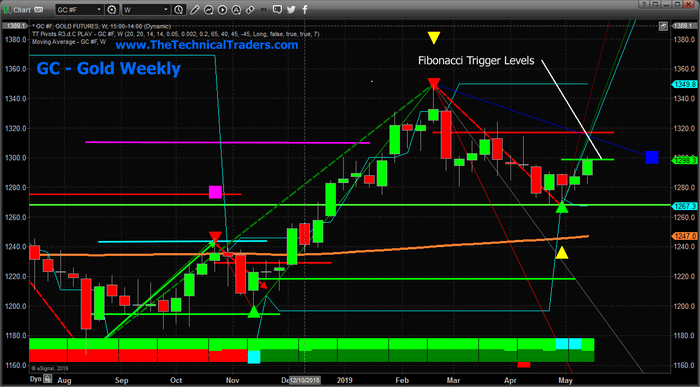

This Weekly Gold chart highlights just about everything we have been suggesting would happen over the past 12+ months. The rally in Gold from below $1200 to almost $1350 setup an upside price leg that we believe is still just beginning. The rotation lower, after the February 2019 highs, setup the Momentum Base near April 24 – RIGHT ON TARGET. Now, the upside price advance that we’ve been predicting should launch Gold well above the $1400 price level appears to be setting up.

Our Adaptive Dynamic Learning price modeling system, as well as our Adaptive Fibonacci Price modeling system, have been key elements to unlocking these early calls. You can read more about our earlier Gold and Silver calls by reading this article: https://www.thetechnicaltraders.com/adl-predictions-for-price-of-gold/

The next leg higher for Gold will see a price peak near $1450 before another brief sideways/stalling pattern sets up. After that, our research suggests a rally will quickly drive Gold prices above $1550 (or much higher).

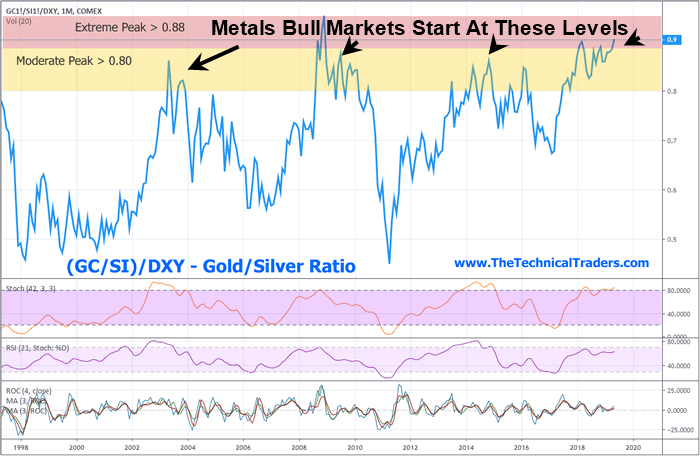

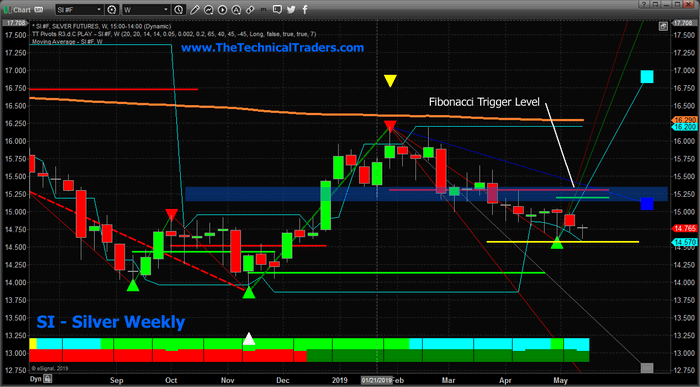

As we’ve been suggesting, Silver will likely lag behind Gold by about 20+ days. We believe Silver is going to see an incredible upside price move – even bigger than Gold in percentage terms. Our belief is that Silver will be trading above $26 to $28 per ounce – almost DOUBLE the recent low price level, when Gold will be trading just above $2000 per ounce. The reason for this is the relationship between the Gold/Silver/US Dollar pricing levels – called the Gold/Silver Ratio. The chart is below

When the ratio is above 0.80, we consider this to be a “Moderate Peak” zone for Gold. Where the price of Gold (per ounce) represents more than 80 ounces of Silver. The ratio of the price of Gold to the price of Silver is a fairly common measure to determine when Silver is very undervalued compared to Gold. When the ratio typically falls above 0.80, then the price of Silver is very cheap compared to the price of Gold. When this ration move above 0.90, these levels are Extreme Peaks in the disparity of pricing between Gold and Silver. These are the areas where both Gold and Silver rally back to restore a ratio level closer to 0.60 or 0.65 (or lower).

This would indicate that the price of Silver will rally much faster than the price of Gold and in order for this ratio to move back to the 0.06 level, Silver would have to rally at a rate of 1.35:1 or 1.45:1 compared to Gold.

Custom Index – chart by TradingView

This Weekly Silver chart highlights the levels we are watching for the upside breakout in Silver to begin – $15.40 or higher and we believe the upside price move in Silver till accelerate well above $18 per ounce very quickly. Again, the move in Silver will likely lag behind Gold by at least 20+ days. So now if the time to buy Silver in physical form (or any form) as we prepare for this move. Once it starts, we can promise you that the rally will be impressive and quick.

Watch how Gold and Oil react over the next few weeks as Fear re-enters the global markets. Our belief is that Oil will fall while Gold initiates the first leg higher, towards $1400 to $1450 before stalling. Once this happens, we can be certain a new upside price advance is beginning in Gold and this could be a fairly strong indicator that the markets are weakening and there is increased global fear.

This is proving to be an incredible trading year for traders who follow our trade alerts newsletter.

For active swing traders, you are going to love our daily trading analysis. On May 1st we talked about the old saying goes, “Sell in May and Go Away!” and that is exactly what is happening now right on queue. In fact, we closed out our SDS position on Thursday for a quick 3.9% profit and our other new trade started Thursday is up 18% already.

Second, my birthday is only three days away and I think its time I open the doors for a once a year opportunity for everyone to get a gift that could have some considerable value in the future.

Right now I am going to give away and shipping out silver rounds to anyone who buys a 1-year, or 2-year subscription to my Wealth Trading Newsletter. I only have 4 left as they are going fast so be sure to upgrade your membership to a longer-term subscription or if you are new, join one of these two plans, and you will receive:

1-Year Subscription Gets One 1oz Silver Round FREE (Could be worth hundreds of dollars)

2-Year Subscription Gets TWO 1oz Silver Rounds FREE (Could be worth a lot in the future)

I only have 13 more silver rounds I’m giving away so upgrade or join now before its too late!

SUBSCRIBE TO MY TRADE ALERTS AND GET YOUR FREE SILVER ROUNDS!

Happy May Everyone!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.