Is Your Financial Security Based On A Double Aberration?

Personal_Finance / Financial Risk Jun 11, 2019 - 02:52 PM GMTBy: Dan_Amerman

One way of looking at financial history is as the battle of two four word phrases: "this time is different" versus "reversion to the mean." "This time is different" is enormously popular, and it has become the dominant belief system many times over the centuries. It has also ultimately led to crushing and life-changing losses for throngs of investors, many times over the centuries.

One way of looking at financial history is as the battle of two four word phrases: "this time is different" versus "reversion to the mean." "This time is different" is enormously popular, and it has become the dominant belief system many times over the centuries. It has also ultimately led to crushing and life-changing losses for throngs of investors, many times over the centuries.

"Reversion to the mean", which is simply a return to average valuations, is a bit more on the geeky side. It is often unpopular, particularly when its opposite is in the ascendancy. But it nonetheless has consistently ended up being the winner, as a return to the normal and usual almost always triumphs over the aberrations, given enough time.

So, which four word phrase is the source of genuine financial security?

As we will explore in this analysis, the financial security of many millions of retirees and retirement investors is currently based upon the indefinite continuation what are quite clearly two historical aberrations. For many investors, a return to the historically average with either aberration could be quite painful, and a double return to average could be financially devastating.

This situation is currently widely viewed as being normal - but is it normal? Is it safe?

This analysis is part of a series of related analyses, an overview of the rest of the series is linked here.

Aberration #1: The Current Economic Expansion

In July, the current economic expansion will become the longest in the history of the United States. The previous record holder was the expansion of March, 1991 to March, 2001. The National Bureau of Economic Research says that this current expansion began in June of 2009, it has equaled the prior record as of June of 2019, and with each subsequent month - a new record will be set.

As readers will recall, 2000 and 2001 were also a time of record stock market prices, and deeply held beliefs by most market commentators, as well as millions of investors, that "this time is different."

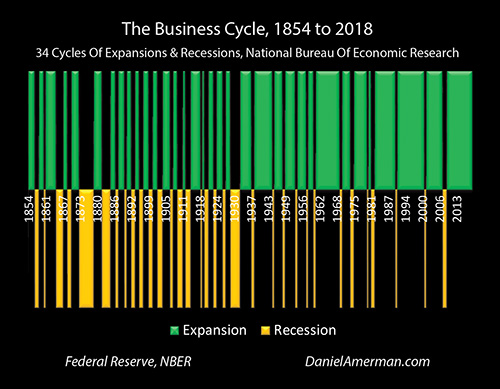

As explored in the analysis linked here, since 1854 there have been 34 cycles of expansion and recession. Starting in July - we have never had an expansion go this long before.

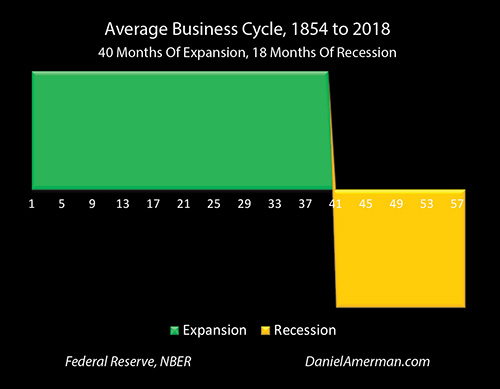

Indeed, since 1854, the average economic expansion has lasted 40 months, the average recession has lasted 18 months, and the average business cycle has been 58 months.

We currently have an economic expansion that is three times as long as average. Indeed, average would have required fitting two entire business cycles inside our current official single expansion, with two expansions, two recessions, and now a third expansion starting.

The dictionary definition of aberration is: “an instance of being different from what is normal or usual”. Language matters, and the correct description for the instance that is our current expansion is that it is an aberration.

With the last recession officially ending in 2009, a recession that had started anytime between 2013 and 2015 would have been historically normal and average. To continue from here forward without a recession, would as a simple matter of correct language usage, indeed be an aberration.

Now, aberrations can continue. And yes, we could go another year, or two years, or three years without a recession (just as we could enter another recession within the next six months). But the simple historical facts are that a return to normal would be the recession, and the correct labeling of an extension of the expansion would be that it would be growing steadily more aberrant, as it grew ever farther from the “normal or usual”.

Where this becomes important is in assigning the correct labeling for an investment strategy that is implicitly based on the assumption of the indefinite continuation of the current expansion. Because it merely projects forward what we have been experiencing in recent years, for many people, this might seem to be a normal or even conservative assumption.

However, what economic and financial history shows is that the indefinite continuation of what has been experienced recently - never happens. Never. It is a always a cycle. The only way for there not be a cycle this time around would be require the usage of those four most infamous words in finance: "this time is different."

This could happen, but to be clear - the financial security of a person fully invested for the continuation of this expansion would be based on the indefinite continuation of an aberration, that would deviate ever more from normality.

That is a wager - but is it genuine financial security?

Aberration #2: Current Rates & Asset Prices

We have another aberration as well - interest rates are at extremely low levels. For seven years after the financial crisis of 2008 - we had the historical aberration of zero percent interest rates. We still have abnormally low interest rates.

This was reinforced by the aberration of the quantitative easings (QEs), with the Fed for the first time ever effectively creating trillions of dollars out of the nothingness, and using those dollars to (eventually) buy U.S. Treasuries while forcing down medium and long term interest rates.

Withdraw those aberrations of very low interest rates and the Fed's vast holdings of Treasury and mortgage-backed securities - and the market collapses. This is why the Fed is backing away from both raising interest rates and unwinding its balance sheet, as those actions would represent an incremental movement back towards the average and normal - and current stock and real estate investment prices can’t handle that.

The link between interest rates and securities prices is part of the fundamental bedrock of financial mathematics. All else being equal, the lower the rate, then the higher the prices - for not just bonds, but also stocks and real estate. The corollary then is the higher the rate, the lower the investment prices for bonds, stocks and real estate.

Interest rates are in an aberrant range - far outside of what has been “normal or usual” for most of our lifetimes. So what would happen to the prices of our investments with a return to normal interest rates?

Fair question?

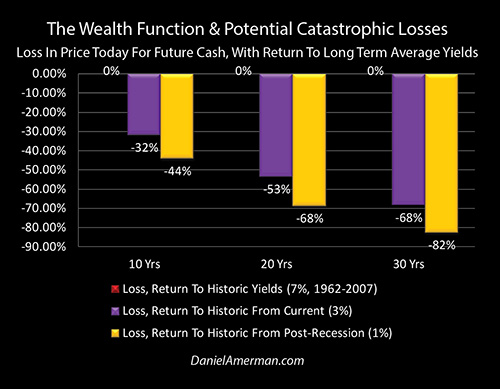

The average interest rate on 10 year U.S. Treasuries between 1962 and 2007, the year before the financial crisis, was a little over 7%.

As shown in the graph above and explored in the analysis linked here, the losses associated with a return to the normal and average are shown in the purple bars. As can be seen with the left purple bar, any cash flow ten years out is worth 32% less with a 7% interest rate than with a 3% interest rate, and this applies in modified form to stocks and real estate as well, all else being equal.

As is shown with the middle and right purple bars, cash flows 20 years out would be worth 53% less, and cash flows 30 years out would be worth 68% less.

In round numbers (and with a good bit of simplification), a return to “normal or usual” interest rates would lead to a reduction in investment prices in the 30% to 70% range, for cash flows 10 to 30 years out. Because all investment prices are in theory the sum of future cash flows discounted at a rate, this reduction in value at normal interest rates would apply (in various forms) to stocks, bonds and real estate.

So, if your current investment portfolio value is based on aberrations in interest rates, and a simple return to averages and normality would have potentially catastrophic results for the value of that portfolio - is that genuine financial security?

Or is it gambling on the indefinite continuation of an aberration?

Financial Security & Aberrations

We are clearly in an economic aberration, as we are far, far beyond the average length of an economic expansion, and each month after July would bring us ever farther into the record range.

We are clearly in a financial aberration, with unusually high investment prices being supported by and dependent upon unusually low interest rates. Indeed, at the beginning of 2019 the stock market was on the verge of collapse at the prospect of a still historically very low Fed Funds rate of 2.75%, and has recently been surging on the hopes of interest rates being forced back down ever further below historic averages.

Phrased another way, we are in a financial aberration that is caused by an economic aberration, with the Federal Reserve pursuing aberrant policies - never seen before - that are leading to aberrant investment valuations, that have also never been seen before.

So what is the big deal?

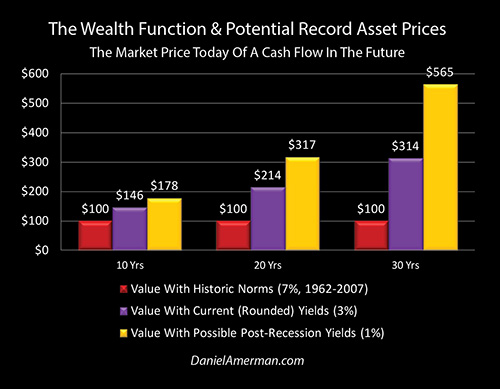

Aberrations do happen, and as regular readers know, I have been writing extensively about how the biggest aberrations - and the biggest profits - may still be ahead of us. Indeed, if we do get another round of recession, the Fed intends to get even more aberrant, to go further beyond what it has ever done before - and could create the highest investment prices in history as a result.

They could move us from the purple bars to the gold bars of record prices, as explored in the analysis linked here, instead of back down to red bars of normal investment valuations.

That perspective is, incidentally, entirely logical and self consistent with the previous graph showing major losses. Current aberrant economic policies - extremely low interest rates while maintaining a multitrillion dollar distortion of the markets in the form of the QE that is still out there - are creating and supporting aberrant investment prices.

Even more aberrant Fed policies, with still lower rates and higher and more aggressive degrees of QE being used to fund a maturity extension program (MEP) that distorts all investment prices (link here), could then lead to even more aberrant investment pricing and still higher record prices.

That said, devastating, pervasive and potentially "permanent" losses when the current aberration is ultimately replaced by a "reversion to the mean" and a return to historically normal interest rates - is the logically necessary flip side.

Genuine Financial Security Is Not An Aberration

While still greater aberrations are indeed possible - let me suggest that common sense shows us that depending on the indefinite continuation of those aberrations is not genuine financial security. As a starting point to explore the differences - what would a normal person define as being genuine financial security?

In my opinion, financial security is at a minimum - being able to handle the average and the normal. To pay our bills in normal conditions, to be able to handle emergencies in normal conditions.

To be truly financially secure - we need to be able to do this in economic or financial situations that are not normal.

So a truly financially secure person could handle an unexpected event with themselves or their family, in abnormal economic and financial conditions - and still not have a negative impact to their standard of living.

The greater the range of uncertainty that can be handled going out from the average and the normal - whether in the expenditure or in the economic and financial conditions - then the greater the genuine financial security.

Fair enough in terms of a definition?

So that gets us back to the starting question in this analysis - is a person who cannot withstand the average and the normal actually financially secure?

Is someone who would be financially devastated by simple act of both the economy and investment valuations returning to long term historical averages - actually financially secure?

If someone is financially comfortable on the fringe, in the midst of aberration, but increasingly hurt the closer we get to the long term average and normal - are they financially secure - or are they the inverse of financially secure?

This is a “self-graded exam”, but let me suggest it is a critical exam.

Because we don’t want to be surprised, and if a mere return to normal would be devastating - now is the time to be fully aware of that risk.

The corollary is that if we are not invested for normality but continuing aberrations - then the precise words do matter and they matter greatly. We need to be fully aware that we are investing for historical aberrations being the dominant source of our investment security, and that means we had better thoroughly understand those aberrations, inside and out. We need to understand the investment implications of those double aberrations forwards, backwards and sideways.

Because risking our security on the mistaken premise that current times are normal, and then just coasting along without paying attention to the aberrations that are the actual source of our current financial status - is in my opinion, a dangerous, dangerous self-deception, that is likely to work out very badly at some point, and unfortunately, this is likely to hold true for millions of investors.

Daniel R. Amerman, CFA

Website: http://danielamerman.com/

E-mail: mail@the-great-retirement-experiment.com

Daniel R. Amerman, Chartered Financial Analyst with MBA and BSBA degrees in finance, is a former investment banker who developed sophisticated new financial products for institutional investors (in the 1980s), and was the author of McGraw-Hill's lead reference book on mortgage derivatives in the mid-1990s. An outspoken critic of the conventional wisdom about long-term investing and retirement planning, Mr. Amerman has spent more than a decade creating a radically different set of individual investor solutions designed to prosper in an environment of economic turmoil, broken government promises, repressive government taxation and collapsing conventional retirement portfolios

© 2019 Copyright Dan Amerman - All Rights Reserved

Disclaimer: This article contains the ideas and opinions of the author. It is a conceptual exploration of financial and general economic principles. As with any financial discussion of the future, there cannot be any absolute certainty. What this article does not contain is specific investment, legal, tax or any other form of professional advice. If specific advice is needed, it should be sought from an appropriate professional. Any liability, responsibility or warranty for the results of the application of principles contained in the article, website, readings, videos, DVDs, books and related materials, either directly or indirectly, are expressly disclaimed by the author.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.