Gold Surprise!

Commodities / Gold & Silver 2019 Jun 11, 2019 - 06:25 PM GMTBy: The_Gold_Report

Sector expert Michael Ballanger describes why he has swung from long to short on the precious metals and miners. Before we go any further, let it be known that in the days leading up to this missive, i have gone from "net long" to "net short" on gold, silver and the miners. Those receiving my email blasts and those following me on Twitter (@Miningjunkie) have been put on notice that this advance, while impressive in its blunt-force trauma, lacks the perfection of the Q4/2015 advance, which arrived from multiyear polar extremes in sentiment and COT structure setups.

Sector expert Michael Ballanger describes why he has swung from long to short on the precious metals and miners. Before we go any further, let it be known that in the days leading up to this missive, i have gone from "net long" to "net short" on gold, silver and the miners. Those receiving my email blasts and those following me on Twitter (@Miningjunkie) have been put on notice that this advance, while impressive in its blunt-force trauma, lacks the perfection of the Q4/2015 advance, which arrived from multiyear polar extremes in sentiment and COT structure setups.

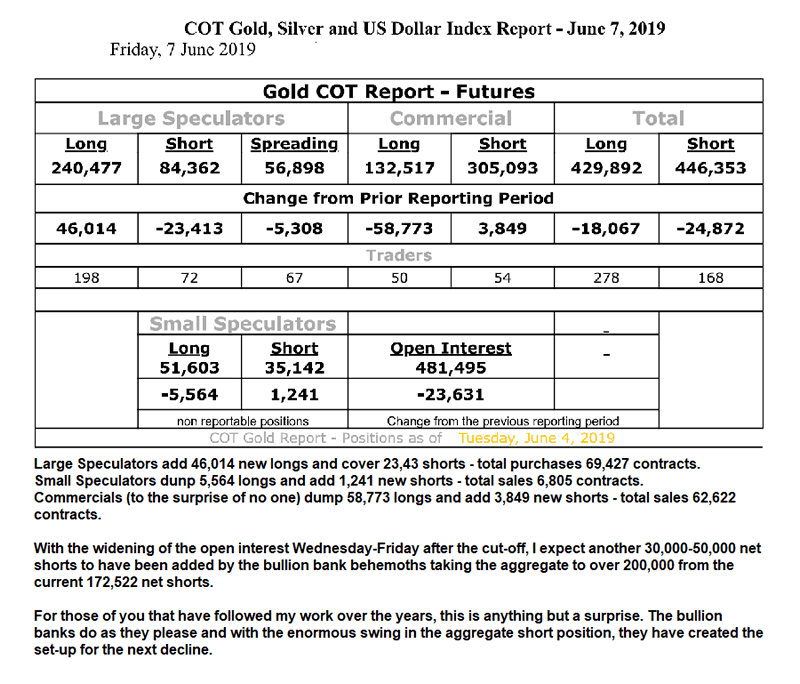

All last week I was emailing and tweeting how frail this advance looked and why I was a seller. With Friday's COT, you have the reason:

Now, I could spend the rest of the day explaining where they got 58,773 new longs representing 5,877,300 ounces of gold bullion—which they claim to have sold. But I won't. You all know the drill. There is zero defense nor advanced warning from a Cartel raid with exception of the COT report, which is, while helpful, nowhere near a perfect indicator. Even when the number looks favorable, it is still highly subjective. Because of the incessant flow of intervention and interference, interpreting the COT and acting upon it is at once both difficult and imperfect, and while it is relatively easy to short Goldman Sachs, it is painfully difficult to short precious metals because, for hard money advocates like me, it is like selling a family member.

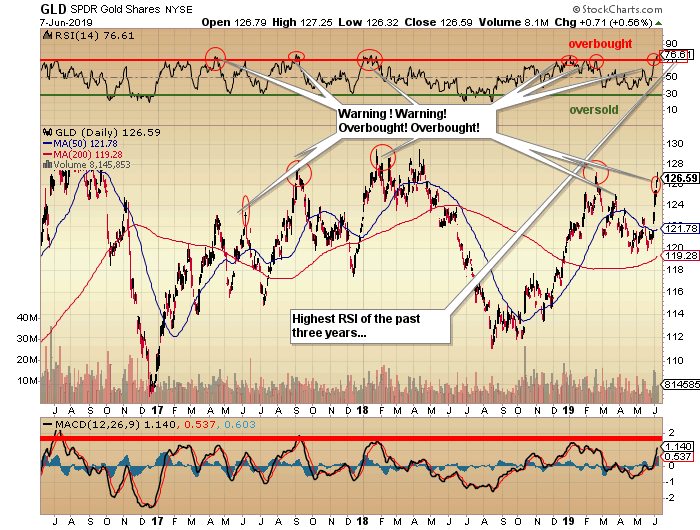

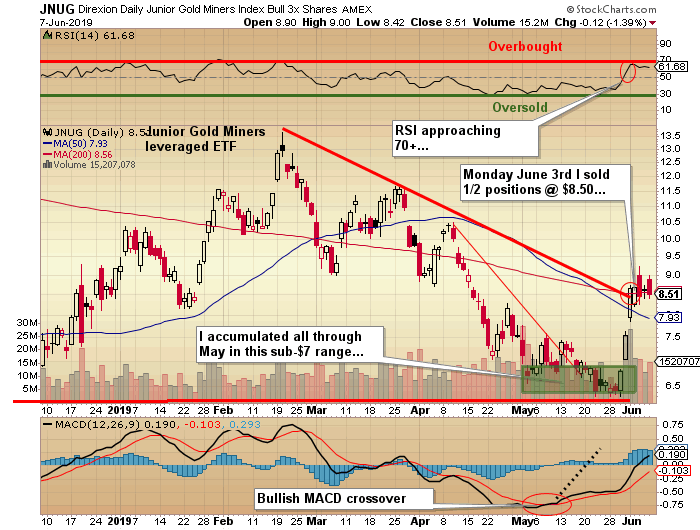

Monday morning is going to bring about a violent sell-off in the precious metals because they are considerably overbought as the chart below was clearly screaming late last week.

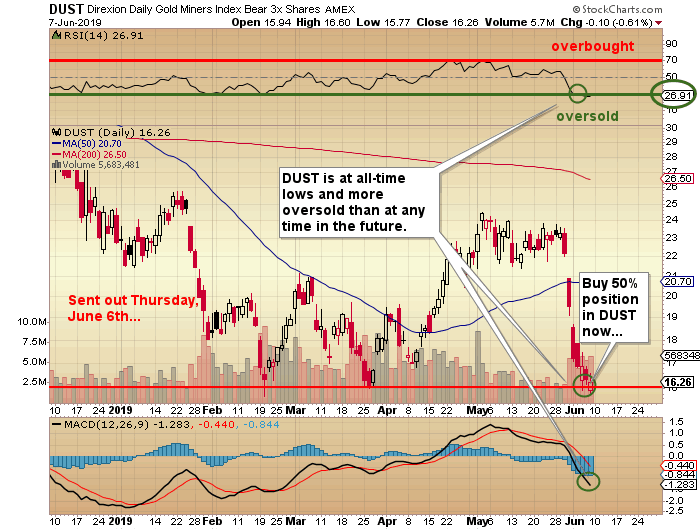

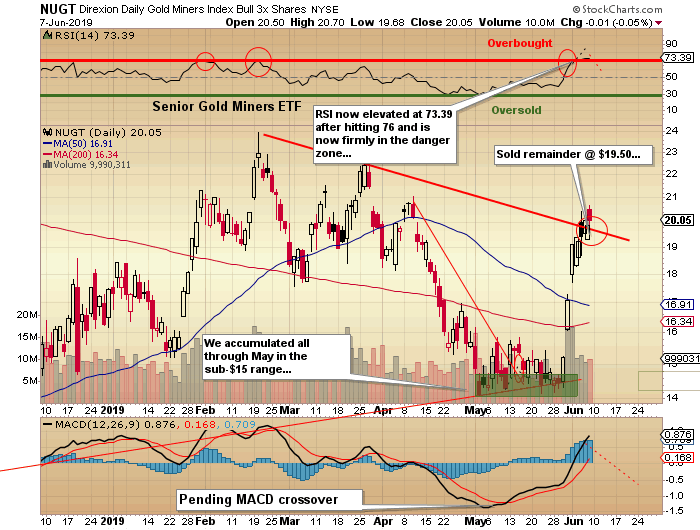

Gold miner ETFs (NUGT/JNUG) were both wildly overbought by last Friday, and while I was in awe of the impact of the buying, I added to the DUST and GLD July $125 put positions late week (confirmed by multiple tweets when action was taken), and now remain comfortably short with gold down $15 going into the Monday opening.

I will be adding to shorts on Monday, on any type of bounce in both the GLD and the miner ETFs. The DUST was bought at the $16.47 and $15.90 for an average of $16.18 and will probably open in the low $17s on Monday.

We have all seen this movie before, and while it is both maddening and infuriating, it in no way alters my longer-term bullishness on gold and silver. What this does illustrate is just how corrupt the Comex ("Crimex") has become and how important it is that you turn off CNBC and ignore the table-pounding gold bugs that would have us leveraging up at precisely the wrong time (like last Thursday/Friday), with RSI (relative strength index) readings in the mid-to-high 70s and the investment conference rock stars all feverishly tweeting out targets of $1,400-plus by July 4. When the bullion banks are sellers, you do not want to be long. Period.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure: 1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Getchell Gold Corp. My company has a financial relationship with the following companies referred to in this article: Getchell Gold Corp. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below. 2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp., a company mentioned in this article.

Charts courtesy of Michael Ballanger.

Michael Ballanger Disclaimer: This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.