King Dollar Rides Higher Creating Pressures On Foreign Economies

Currencies / US Dollar Jun 17, 2019 - 08:24 AM GMTBy: Chris_Vermeulen

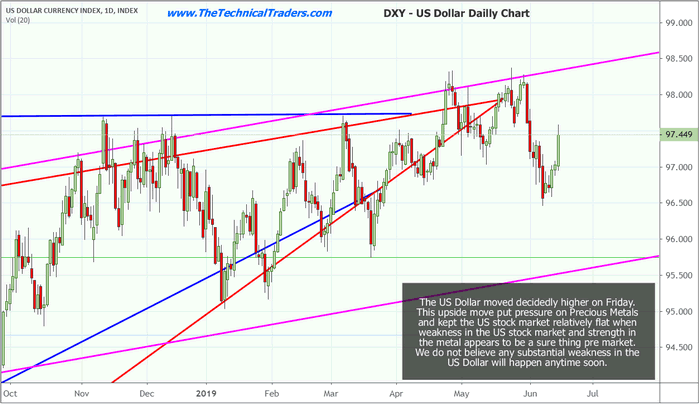

One of the biggest movers of the day on Friday was the US dollar. The US stock market appeared very weak prior to the opening bell and precious metals, especially gold, appeared to be rocketing higher. Almost right from the open, the markets washed out the fear and changed direction. The US dollar did the same thing.

One of the biggest movers of the day on Friday was the US dollar. The US stock market appeared very weak prior to the opening bell and precious metals, especially gold, appeared to be rocketing higher. Almost right from the open, the markets washed out the fear and changed direction. The US dollar did the same thing.

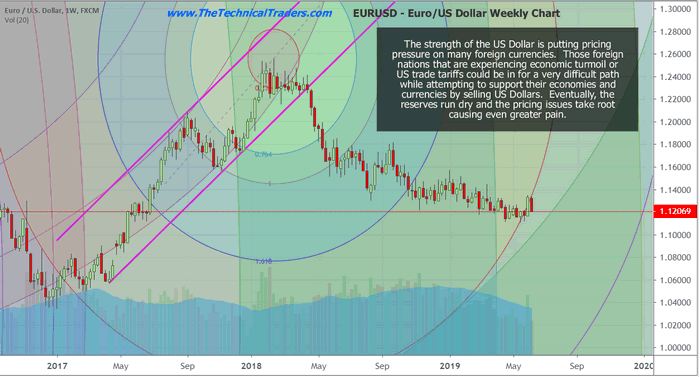

This renewed strength in the US dollar continues to baffle foreign investors and foreign governments as they continue to try to support their economies and currencies against a stronger and more agile US economy and currency. Even as the US dollar strength is frustrating many investors, it is also attempting to keep a lid on traditional safe havens such as precious metals.

This further complicates many foreign nations because their gold reserves are not appreciating at the same rate that their currencies are devaluing. Couple that with capital outflows, consumer protectionism, waning economic outputs, and the need to protect local currencies to avoid populist panic, and King Dollar seems to be riding high.

A friend of ours and foreign currency trader suggested we read the article below today.

Does China have enough US dollars to survive the US trade war?

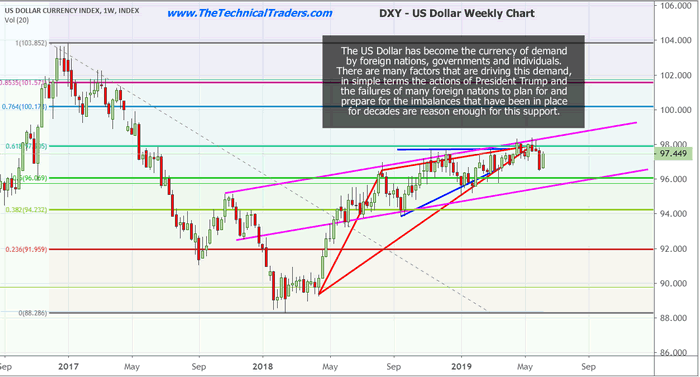

We’ve authored many articles about the US dollar over the past few months. We believe the strength in the US dollar will continue and that a support level above $92 is likely to continue to support the price for some time. That being said, the current price rotation near $96.50 provides a recent low price rotation level that could turn into future support after recent highs near $98.40 are broken.

Many times you’ve probably read our comments about a “capital shift” and how this shifting capital across the planet will be driving future investment in the US and other foreign markets. At this point in time, it’s almost like a dog chasing its tail. The more support the US dollar receives, the more pressure there is for foreign markets to support their currencies and economies. The weaker foreign economies become and foreign currencies devalue, the more demand for US dollars increases to help offset local weakness. It starting to become a vicious cycle.

We believe the defined price channel between the two magenta colored lines will continue to dominate US dollar price activity until price breaks through either the upper or lower range of this price channel. The current support near $96.50, will likely turn into a new price floor once price breaks above $99.

There are a number of factors that could ease the upward pricing pressure in the US dollar. First, increased economic output and activity in foreign markets illustrating economic growth and prosperity would likely ease the capital shift into the US stock market and US dollar. Once foreign markets begin to act as though real opportunity exists over an extended period of time, then the dominance of the US dollar may begin to weaken.

Additionally, suitable trade deals, such as we witnessed between the US and Mexico recently, will help to alleviate currency pricing pressures on foreign currencies. This strength in foreign currencies presents an opportunity for global investors to take advantage of pricing gains.

Stronger foreign currency valuations and economic output will help to ease the US dollar dominance eventually. Until that happens, as traders we need to be aware of the pricing issues related to the capital shift that is taking place, the pricing pressures on precious metals, and the likelihood that foreign investors will continue to pile into US equities while King Dollar is dominating.

Pay very close attention to foreign market weakness and news of banking issues or government bailouts of foreign banks. Much like the US credit crisis in 2008/2009, bank failures and extended credit risk exposure can lead to waterfall events. This would be our biggest fear for the global economy if foreign governments and banking institutions are not properly prepared for extended devaluation periods. If things really started to crumble overseas we could see gold and the dollar move up together, it has happened before in times of crisis.

We’ll keep you informed as we see things transpire. In the meantime, King Dollar rides high end of the sunset and foreign governments/nations will continue to attempt to support their economies and currencies. Eventually, the fear factor will push precious metals broadly higher.

We have a good pulse on the major markets and can profit during times when most others can’t which is why you should join my Wealth Trading Newsletter for index, metals, and energy trade alerts.

I can tell you that huge moves are about to start unfolding not only in metals, or stocks but globally and some of these super cycles are going to last years. These super cycles starting to take place will go into 2020 and beyond which we lay out in our new PDF guide: 2020 Cycles – The Greatest Opportunity Of Your Lifetime

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.