GOLD to Fall 10% as Dollar at Support

Commodities / Gold & Silver 2019 Jun 27, 2019 - 02:28 PM GMTBy: Submissions

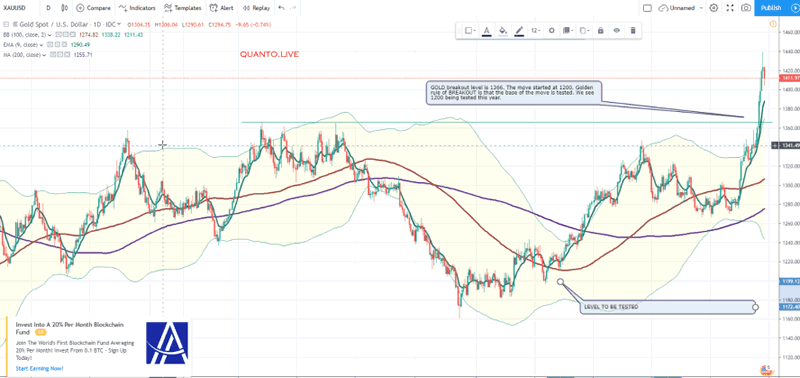

GOLD has been rising sharply and has hit 1430 highs. Much of the move is on the back of apparent news that central banks are buying Gold.

GOLD has been rising sharply and has hit 1430 highs. Much of the move is on the back of apparent news that central banks are buying Gold.

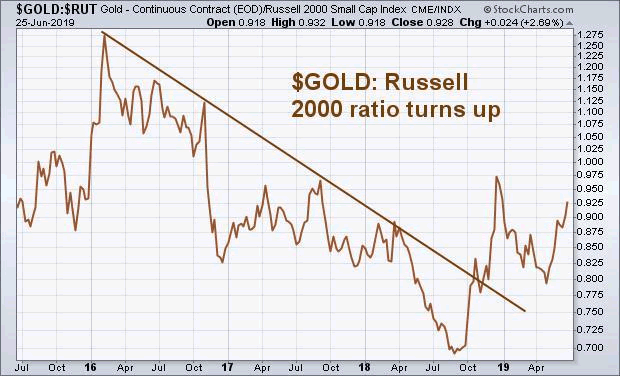

Falling interest rates (and a weaker dollar) also explain the recent surge into gold. Renewed interest in gold usually happens when investors are looking for alternatives to stocks and bonds (as well as global currencies). Which suggests that they may be losing confidence in the global economy. And reducing exposure to riskier smaller stocks; while prospecting in safer havens like gold.

Chart above shows a ratio of gold divided by the Russell 2000 having the strongest upturn in three years.

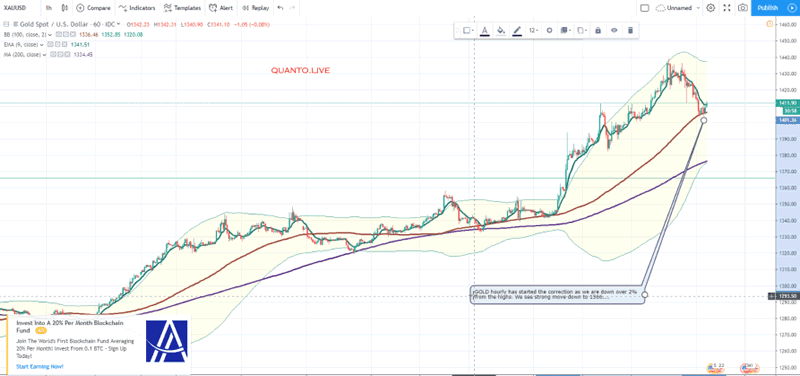

However that move in GOLD might have run out. See below.

GOLD proceeded to 1440 on thin volumes and a few central banks buying. Prices reacting to old news is a classic trap move and we suspect to be the case in GOLD.

US GDP

The US growth is solid and is still trending higher. The FED has been rightfully holding onto its hike path because the growth has not shown any sign of weakness. This when combined with decade low unemployment rate could lead to overheating. The US unemployment rate stood at 3.6 percent in May 2019, unchanged from the previous month’s 49-year low and matching market expectations. The number of unemployed increased by 64 thousand to 5.9 million while employment rose by 113 thousand to 156.8 million. Unemployment Rate in the United States averaged 5.75 percent from 1948 until 2019, reaching an all time high of 10.80 percent in November of 1982 and a record low of 2.50 percent in May of 1953.

Nonfarm payrolls in the US increased by 75 thousand in May 2019, following a downwardly revised 224 thousand rise in April and missing market expectations of 185 thousand. Employment continued to trend up in professional and business services and in health care. Monthly job gains have averaged 164 thousand in 2019, compared with an average gain of 223 thousand per month in 2018. Non Farm Payrolls in the United States averaged 125.70 Thousand from 1939 until 2019, reaching an all time high of 1118 Thousand in September of 1983 and a record low of -1959 Thousand in September of 1945.

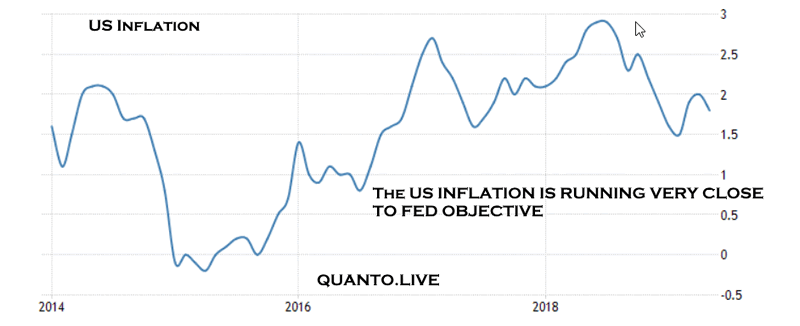

The US annual inflation rate fell to 1.8 percent in May 2019 from a five-month high in the previous month and just below forecasts of 1.9 percent. The core inflation rate, which excludes volatile items such as food and energy, edged down to 2.0 percent, also below market consensus of 2.1 percent. The inflation rate is hovering near FED objective of 2% and we dont see FED cutting rates in 2019 any further than a 25 bps unless a clear fall in inflation.

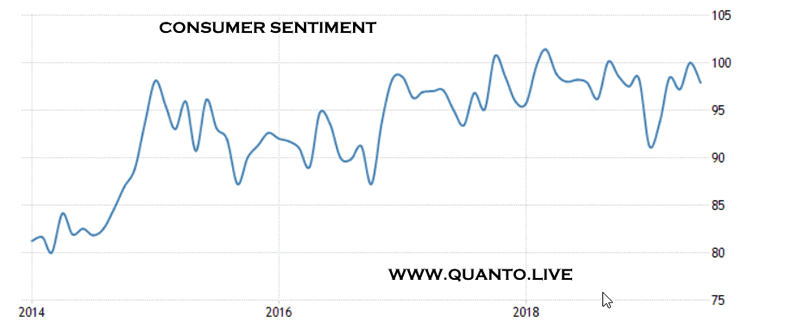

The University of Michigan's consumer sentiment for the US dropped to 97.9 in June 2019 from 100.0 in the previous month, slightly missing market consensus of 98.0, a preliminary estimate showed. Consumer expectations deteriorated sharply due to concerns about tariffs as well as slowing gains in employment. Consumer Confidence in the United States averaged 86.55 Index Points from 1952 until 2019, reaching an all time high of 111.40 Index Points in January of 2000 and a record low of 51.70 Index Points in May of 1980.

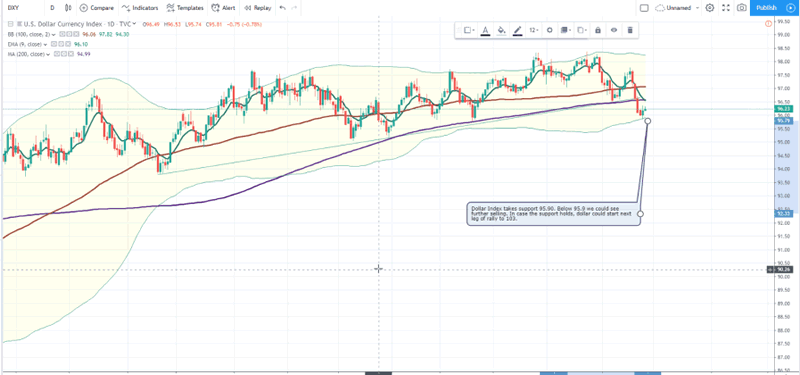

Dollar Index

Dollar index is at support of oversold levels of 95.9. If the support holds, dollar could start next leg of rally to 103.

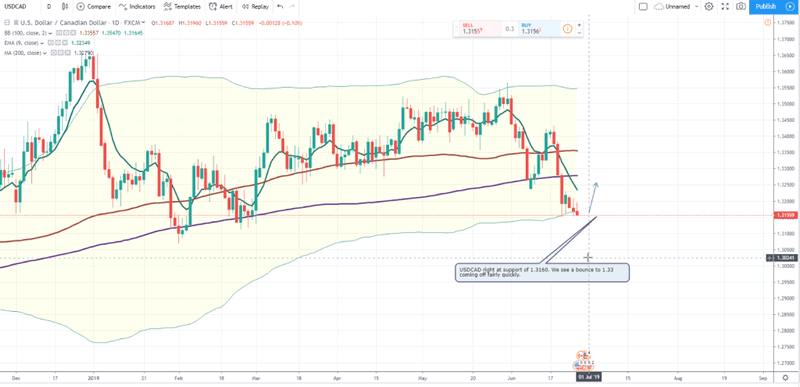

USDCAD sitting at support

The QUANTO system is working brilliantly as shown. The June month trading returns tare at +9%

The returns are steady and rising as per historical return profile of the system. The system makes over 10% every month. See the historical on EURUSD.

The historical performance on EURUSD is shown. This is only EURUSD and it makes over 7% every month just on EURUSD.

QUANTO system is uniquely high performance. It uses the market profile theory in a automated trading system and combines with risk management to turn out winners. The system has a sharpe ratio above 0.2 on long term trading. It makes +200% CAGR returns every year.

If you want to start trading, please contact us at : TRADE COPIER MEMBERSHIP

By Quanto

Quanto.live is a Investment Management firm with active Trading for clients including Forex, Crypto. We send our trades via trade copiers which are copied to clients trading terminals. Top notch fundamental analysis and trading analysis help our clients to generate superior returns. Reach out to us: http://quanto.live/reach-us/

© 2019 Copyright Quanto - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.