Bonds and Stocks vs Gold

Commodities / Gold & Silver 2019 Jun 27, 2019 - 05:03 PM GMTBy: Richard_Mills

North American stock markets continued to rise on Friday, as more investors took the opportunity to jump into equities on the back of a clear signal from the US Federal Reserve that interest rates are likely heading down. The S&P 500 hit a new record on Thursday, finishing 249 points higher, or 0.9%, to 2,954.

North American stock markets continued to rise on Friday, as more investors took the opportunity to jump into equities on the back of a clear signal from the US Federal Reserve that interest rates are likely heading down. The S&P 500 hit a new record on Thursday, finishing 249 points higher, or 0.9%, to 2,954.

The Federal Open Market Committee (FOMC) concluded on Wednesday that it will leave the federal funds rate unchanged, in the 2.25% to 2.5% range. Importantly however, the Fed dropped its pledge to be “patient” on a widely anticipated rate cut, meaning it could be poised to act. Also, Fed Chair Jerome Powell stopped referring to below-target 1.8% inflation as “transient”. Persistent inflation under 2% is a strong prompt for the Fed to raise interest rates, since part of its mandate is to keep inflation at the 2% sweet spot.

According to the CME Group’s FedWatch tool, traders are now pricing in a 100% chance of a rate cut in July, when the FOMC meets again.

The equities surge was at the expense of government bond yields, which dropped significantly. Domestic and foreign investors typically dump US Treasuries when interest rates are on a downward slide, since their lower yields make them less attractive. On Thursday the benchmark 10-year Treasury yield briefly sunk below 2% for the first time since November 2016; it currently sits at 2.01%.

The gold price, which fluctuates on bond yields, surged on the promise that investors will continue to shun bonds due to lower interest rates, and bulk up on bullion instead, even though it pays no yield.

At the time of this writing spot gold was up $10 to $1,397 an ounce, compared to Thursday's close, and almost $40 higher than Wednesday which set a new record of $1,360.10 – gold's best close since Jan. 25, 2018. The rise in gold futures was even more dramatic, with gold for August delivery touching a high of $1,415 an ounce overnight Thursday, but by noon Friday had backed off to just above $1,400. According to Mining.com that's $50 higher than the start of the week and the highest level gold has reached since 2013. Trading was frenzied, with 45 million ounces worth of contracts traded by 1 pm Friday. Monday and continuing into Tuesday (25th June) gold is on a tear.

In this article we're taking a hard look at stocks, bonds and gold. Curiously, all three are serving as safe havens in a time of rising economic, political and military tensions. We'll explain what is happening and why and give you our take on how to make gains in a low-yield environment, while staying out of harm's way if the markets take a turn for the worse.

Chasing yield

Global tensions such as a war with Iran, the fear of a Brexit hard landing, unresolved trade disputes and anemic global growth, to name just a few problems, are forcing investors into safe havens like government bonds, even though their rates are abysmal.

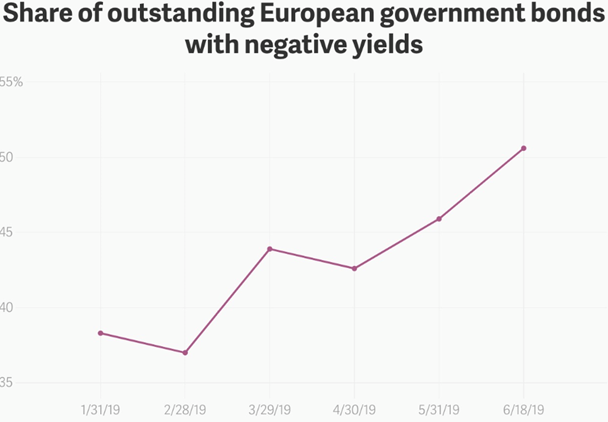

The dramatic bond rally we are currently seeing, is driving down yields across the world (bond prices and yields move in opposite directions). Investors are piling into sovereign debt based on expectations of new monetary stimulus similar to earlier quantitative easing programs that pushed down interest rates to zero and sparked a global bull market in stocks, that is still going 11 years later.

The most stunning example of this is the popularity of Greek government bonds which, despite being “speculative-grade” ie. risky, not particularly liquid, and offering the lowest yields among the entire Eurozone. It wasn't long ago that Greece went bankrupt and nearly crashed out of the EU.

Why take the risk? Everyone is chasing yield. Shorter-term bonds are especially hot right now since they offer higher rates of interest than longer-term debt.

Investors are holding their noses and buying bonds now, before rates go any lower. As the Financial Times reported, “highly rated bonds” like Germany’s “bunds” and US Treasuries, “have rallied in recent weeks as concern over the global economy - heightened by the US-China trade dispute - has sparked expectations that major central banks will assume a more dovish posture.”

And that is what we see happening. Struggling to deal with too-low inflation, the European Central Bank is promising to hold already rock-bottom interest rates until mid-2020; for the same reason the US Federal Reserve signaled a rate cut is on its way. Reuters points out that reducing interest rates or at least sounding off on the possibilities, is “in vogue at the moment.”

The news service notes that, along with the Fed, the ECB and the Bank of Japan pursuing a dovish monetary policy, so are emerging markets, such as India and Russia which have already started easing. Indonesia and the Philippines have flagged interest rate cuts in the near future. The fact that the Bank of Indonesia, which has been extremely cautious about easing, has cut banks' reserve ratio by half a percentage point, and is hinting at cheaper money, shows how dovish the world has gone.

Negative bond yields

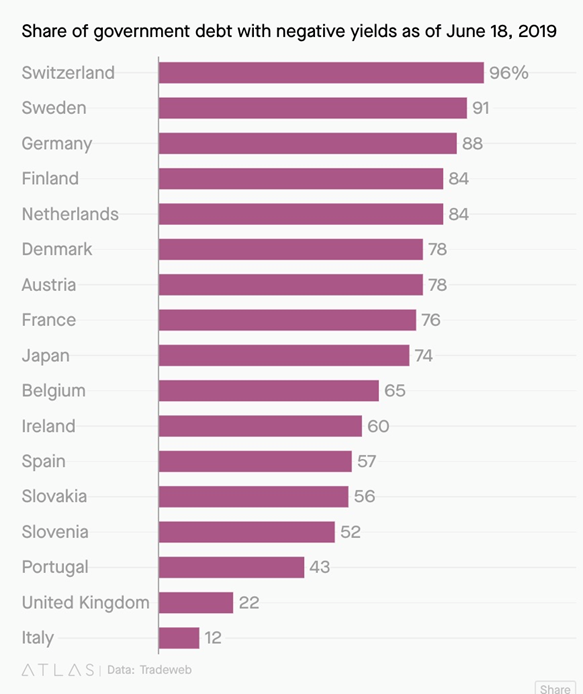

A lot of the debt being taken on has negative interest rates. Last week Germany auctioned its 10-year “bunds” for the lowest yield on record - negative 0.24%. Quite a fall from the 2.9% rate of interest the bonds commanded in January.

All the uncertainty around Britain leaving the EU has apparently damaged Europe’s largest economy; its manufacturing sector is reportedly heading for a recession.

Purchasers of German debt are almost guaranteed to incur a loss if they hold them until maturity. So why buy them? Fear. The global economic outlook is so scary, they would rather park their money in negative-yielding debt. It's insane.

Incredibly, the European Central Bank has already whittled its rates down to below zero, as have four other central banks: Swiss National Bank, Denmark, Sweden and the Bank of Japan. The rates range from -0.1% to -0.8%.

The value of government bonds with negative yields has swelled to over US$13 trillion.

Pavlov investors

Buying bonds in this highly volatile investing environment is something we don't understand. Even more perplexing though, is why investors are in equities.

Bloomberg reports that many household investors and non-profits are jumping on the stock market bull, hoping to ride it a little longer even though the beast has been bucking for over a decade now and is about ready to collapse. These two groups owned $17 trillion worth of stocks in the first quarter 2019, representing 110% of their disposable personal income. In fact, these investors are even more exposed than at the height of the dot-com market peak.

Therefore it's not a shock to see the same pattern of stock-buying now, especially since most non-equity investments pay such a low yield.

We’ve become so used to the stock market being in the green, we barely notice when the Dow, Nasdaq or S&P 500 have a bad day. Stocks have become like real estate - keep buying them because over time, they will always go up. That explains why the October 2018 sell-off didn't last long; investors were buying on the dip. Like Pavlov's dog, these investors salivated at the chance to grab a few bargains. When the bull market resumed in January, they figured they couldn't lose, and still don't.

Here's Bloomberg for an explanation of the Pavlov/zombie behaviour:

With any sort of risk-free yield largely zapped worldwide on the prospect of further monetary easing, is it any surprise what happened next? Investors turned to the tried-and-true playbook of grabbing anything risky. No matter that the global recovery has lasted nearly a decade, trade concerns abound and central banks see economic weakness — the S&P 500 Index promptly rose to a record high as investors mindlessly plowed in.

Effectively, the sharp rally in equities has turbocharged a resurgence in the overall wealth of Americans. The prospect of losing those gains is almost too painful to think about. Perhaps that’s why, as DoubleLine Capital’s Jeffrey Gundlach pointed out in January, investors were “panicking into stocks, not out of stocks” during the late-2018 sell-off. “People have been so programmed” to buy the dip, he said, that it reminded him a bit of how the financial crisis developed. Call investors programmed; call them zombies — it’s the same thing.

Inflection point

We can understand the logic of central banks, institutions, large corporations and private investors shoveling funds into safe havens right now, given all the political and economic uncertainty in the world. What we can’t understand is why they would choose a pitifully low/ negative interest-bearing bond, or equities that are dangling on a precipice, instead of gold.

At Ahead of the Herd we believe the global economy has reached an inflection point, that is very close to breaking down. Global growth has slowed, compounded by the trade war between the US and China, and fears over what hundreds of billions of tariffs will do. Central banks are worried about economies cooling, witnessed by low inflation, and are looking at monetary stimulus, in the form of interest rate cuts, and/or massive bond-buying programs like we went through with quantitative easing in the US, Europe and Japan.

Many think we can just go back to the days of nearly free money being offered on loans, but this time it is different. We have an unpredictable president in the White House that has already done much damage to the world economy, hurt the relationship between the US and its largest trading partner, and now appears heading towards competitive currency devaluation, aka a currency war, as both nations duke it out over who can out-export the other.

China's president has a vision for world domination and has shown more willingness to challenge the US in its Pacific theater of war. Though attention right now if focused on the Middle East and a potential shooting war with Iran. Meanwhile Brexit is the elephant in the room that threatens to stomp on any green shoots of economic growth, later on this year.

Recession

The most obvious evidence of this inflection is the inverted yield curve. The curve between short and longer-term US Treasury yields inverted last December, and did so again in May - meaning short-term yields are higher than longer-term yields. The curve between the three month and the 10 year T-bill remains inverted.

An inversion means bond investors prefer to park their money in bonds that will pay them back their principal, plus interest, in one months to three years, versus investing in a bond with a term of 10 to 30 years, in which case they would demand a higher yield for tying up their money so long. A yield curve inversion shows low confidence in the long-term performance of the US economy, among bond investors.

All of the post-WWII recessions except two were preceded by an inversion. We also know that nine out of the last 10 recessions saw oil prices spike immediately, or very close before the recession.

To us, being the keep it simple kind of folks we are, this proves 1. That yield curve inversions are excellent recession indicators – basically acting as energy price spike warnings and 2. That energy prices can both start recessions, and prevent them.

For more on this subject read Dancing closer to the exits

Inversions are harbingers of bad news. Savvy investors recognize the warning signs and take measures to protect their capital.

Currency war

With more central banks moving towards monetary easing, the issue of currency manipulation has loomed large. China has long been in President Trump's sights as a currency manipulator. Here’s what Trump said on the campaign trail in 2016:

“Our country’s in deep trouble. We don’t know what we’re doing when it comes to devaluations and all of these countries all over the world, especially China. They’re the best, the best ever at it. What they’re doing to us is a very, very sad thing.”

For Trump, a low dollar is the way to bring jobs back to the US after many were exported abroad to take advantage of lower labor costs, and therefore rebuild the US manufacturing sector, primarily, through cheaper exports. He’s particularly targeted China for competitively devaluing its currency, the yuan, to dump cheap exports into the US.

The question is, have we moved from a trade war to a currency war?

As one commentator writes, Trump is playing a dangerous game that could lead to a currency war, in which countries keep slashing the value of their money in order to gain a trade advantage ie. lower-priced exports.

“If several economies find themselves in the same boat coincidentally, the prerequisite conditions for a currency war are set,” Jane Foley, a senior foreign exchange strategist at Rabobank, was quoted by CNN Business.

Real war

Graham Allison, a professor at Harvard’s Kennedy School of Government, has been saying since 2015 that war between a rising power, China, and an established power, the United States, is inevitable, based on historical examples. The argument is fleshed out in his book, 'Destined for War: Can America and China Escape Thucydides’s Trap?'

Writing in The Atlantic, Allison states that “Based on the current trajectory, war between the United States and China in the decades ahead is not just possible, but much more likely than recognized at the moment.” That was written in 2015, before the trade war started, so the case for war is even stronger now.

Of course, Iran is more on people's minds lately, after Trump allegedly ordered a missile strike, then rescinded it. Recent oil tanker attacks in the Persian Gulf, blamed on Iran, have turned up the heat in the region – adding to economic conflict. Last summer the Trump administration re-implemented sanctions on Tehran after scrapping the Iran nuclear agreement signed by former President Obama and other major powers.

For more read Thucydides Trap and Gold

Central Bank gold buying

Along with the expectation of looser economic policies, the gold price is also currently being supported by major central bank buying. The purchases are taking place at the expense of US Treasuries.

The reason is simple: T-bills don’t offer a good return, and neither do other sovereign debt instruments - as mentioned, five important central banks are offering negative rates.

Looking at the 10-year yield chart, we see the yield starting to go down last November, falling steadily all the way to its current 2.02%. Subtract 1.8% inflation and the yield, just 0.22% begins to look pretty skinny.

There’s an old saying on Wall Street, “Six percent interest will draw money from the moon.” And it’s true, but what is also true is 1. As long as real interest rates are below 2% gold is in a bull market and 2. Real interest rates below 2% draws investors to gold.

Central banks know this, so do educated gold buyers.

With Treasury notes paying such low net yields, gold becomes an attractive investment. And while the precious metal offers no yield, its status as an inflation hedge and store of value not subject to fiat currency manipulation are good reasons for central banks to purchase gold.

It doesn’t take an economist to see what’s happening here. Central banks see Treasury yields slumping and real yields low, and likely on their way negative, so they are backing up the truck for gold. They see gold continuing to increase in value.

According to the World Gold Council, central banks are continuing a buying spree that stretches back to 2018. A total of 651 tons of gold was accumulated last year, 74% more than 2017 and the highest amount since the end of the gold standard in 1971.

So far in 2019, central banks have squirreled away 207 tons in bank vaults, the highest year-to-date purchases since central banks became net gold buyers in 2010. (before that they were net sellers, selling more gold than purchased).

The 2018-19 gold-buying spree is being driven by the “de-dollarization” of countries like Russia, China and Turkey which have an axe to grind with the US. They want to get out from under the boot of Uncle Sam.

For more on this subject read How central bank gold buying is undermining the dollar

The Central Bank of Russia sold 85% of its Treasuries last year while at the same time loading up on gold. China resumed adding gold to its reserves last December (and has continued to do so) while at the same time it dumped $69 billion in Treasuries in 2018.

Don’t buy paper gold

Even with gold finally breaking free of its chains after a long time in safe-haven prison, of the investors who gravitate towards the precious metal, some will accept poor investing counsel.

The advice will be to buy a gold ETF instead of bullion or gold stocks. Not a good idea if you want to own physical gold or maximize returns from stocks.

ETFs are popular because the investor doesn’t have to pick a stock. The ETF holds many investments, all get factored into its price. This reduces the risk of losing on one particular stock, but it also significantly dilutes the potential gains.

Some gold ETFs track the gold price, either through holding bullion or entering into future contracts. Others invest in gold companies - majors and mid-tiers, or juniors. If you are considering buying an ETF (at AOTH we don’t) make sure you understand what the ETF is investing in. Do your homework.

Not only do many investors not understand what they are buying, they also misunderstand how safe their investment is.

ETFs claim to be as secure as bullion because the shares are backstopped with bullion that is actually held in a gold vault somewhere. The problem comes if, when, the fund holder decides to go and collect his/her bullion.

What happens if you sell your gold ETF shares? Well if you sell your ETF, you will be paid back in cash, not gold. That’s because when an investor buys shares in an ETF, he becomes a shareholder of the trust, not a gold holder. No different than owning a stock.

A crisis of any severity may demand you have actual gold bullion in your possession. Selling for cash, kind of defeats the purpose of having gold in your portfolio as insurance against financial catastrophe, doesn’t it?

At Ahead of the Herd we love gold, but we hate ETFs. If you think the time is right to invest in precious metals, there are really only two alternatives:

- Physical gold or silver. Coins such as American Eagles or the gold and silver Maple Leaf coins sold through the Royal Canadian Mint are popular choices.

- Gold mining stocks. Historically, time after time shares of junior resource stocks in the precious metal sector offered the greatest leverage to rising gold/ silver prices

Remember - Gold is the only financial asset that is not simultaneously somebody else’s liability.

Know - Gold ETF shares represent a paper claim on gold, not gold itself.

For more read ETFs are the modern-day fools gold

Buying gold juniors

Historically, junior gold stocks offer the best leverage to a rising gold price because of the huge opportunity for gains.

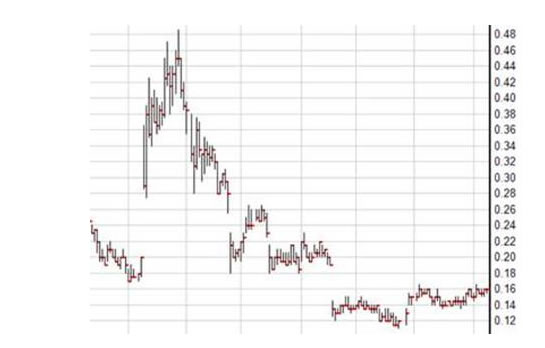

One of our junior gold picks, Aben Resources (TSX-V:ABN), hit multiple high-grade zones at its Forrest Kerr property, while drilling in BC’s Golden Triangle last summer. In the first 20 days of August Aben tripled in price from $0.14 to $0.48.

In early 2018 my readers were given an opportunity to get into ABN at a very good price ($0.15). They had ample opportunity to ride the stock into the high $0.40’s, to reap their rewards along the way up, and on the way down as the top was recognized.

When Aben fell back to $0.11 in January of this year I said I liked it again. On Monday the stock closed at $0.255, up very nicely on a major gold price surge. In six months of sitting, waiting for ABN’s summer exploration program to get underway, we’ve amassed a sizeable position and we’ve already made over a double. And I expect a lot more from ABN this year.

Conclusion

The point is, picking the right company, and selling at the right time, can be VERY rewarding for junior resource investors.

Owning physical gold is a way to preserve wealth against paper currencies which are subject to inflationary pressures and over time, lose their value. Gold is insurance against financial calamity, and at AOTH we think everyone should own some gold bullion, for their own safety.

We also thing that we are in a very important inflection point in history right now, when it behooves a smart investor to be extremely cautious. Over the past four years we have seen massive tightening from the US Federal Reserve, but it hasn't worked. The Fed has finally come around to accepting all the negative economic indicators showing that the American economy is slowing down, along with most other G20 countries. Interest rate cuts and loosening are in global vogue.

Central banks are piling up on gold and dumping Treasuries, knowing full well that buying low- or negative-yield bonds makes no sense.

Investors are running scared into all the wrong safe havens. The bond and equities trades are brisk, even though the former is a yield trap and the latter just might be like walking into the ocean as a tsunami wave is about to crash. A shooting war with Iran may be in the offing, trade wars continue, and the fallout from a hard Brexit landing looms. Now is not the time to be in stocks and bonds.

We aren't the only one thinking this way. Here's Stewart Thomson published on 321gold:

Simply put, the peak in the business cycle is when sane investors buy gold and silly children try to relive the 1950s by price-chasing the US stock market.

It’s been a great ten-year run for the stock market, and now it’s clearly time to book some profits, fade position size, buy gold, and wait for the next bear market in stocks to bring a major buying opportunity.

We've read the signs and we don't follow the lemmings. Of course we can't predict the future, but we can prepare for it. We don't like drama and we prefer to stick with what we know - analyzing macro-economic trends and quietly accumulating positions in quality junior resource companies.

We've decided to play it cautious, by investing in some physical gold, leaving a portion of our portfolio in cash, and following/ investing in gold juniors that are fully cashed up and going drilling, on good projects.

With all that is going on in the world, we believe the gold price will do well over the next few months - there might be a price correction, a reset after so many jumped on the gold bandwagon - but in our opinion the trade is gold, not bonds or equities, with the exception of junior gold stocks.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2019 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.