Bitcoin Is Far Too Risky for Most Investors

Currencies / Bitcoin Jul 17, 2019 - 10:36 AM GMTBy: Robert_Ross

Bitcoin is a polarizing topic. Some economists think Bitcoin’s value should be $0. Others think it’s as revolutionary as the internet.

Bitcoin is a polarizing topic. Some economists think Bitcoin’s value should be $0. Others think it’s as revolutionary as the internet.

But one thing is certain: The price of Bitcoin is incredibly volatile. This makes it a non-starter for most income investors.

Fortunately, I’ve zeroed in on a company that actually benefits from Bitcoin’s volatility. It’s a safe and stable way to profit from Bitcoin without exposing yourself to a lot of risk.

But first, let’s take a closer look at Bitcoin’s wild price swings…

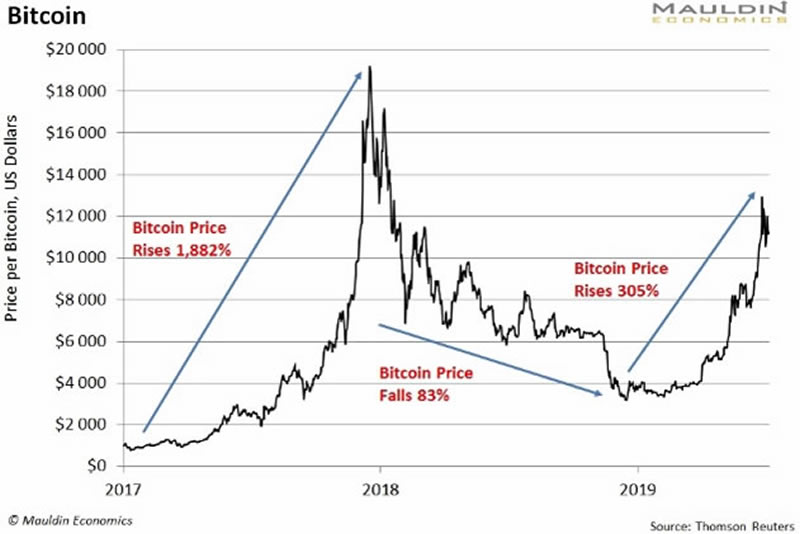

Bitcoin once shot up 1,882% in a little under a year.

It went from $998 in January 2017 to $19,783 in December 2017. That’s incredible. But it didn’t last.

One year later, Bitcoin had dropped around 83% to $4,935. You can see this in the next chart.

Now we’re back in a Bitcoin bull market. Over the last six months, Bitcoin’s price has rallied over 300%.

I’m not sure about you, but most people can’t stomach that much volatility. And frankly, they shouldn’t. Buying Bitcoin is simply too risky for most investors.

That’s why we’re coming at this from a different angle…

The Low-Risk Way to Profit from Bitcoin’s Volatility

Instead of buying Bitcoin directly, we’re looking at companies that benefit from Bitcoin’s volatility.

One of the best ways to do this is through Bitcoin’s “picks-and-shovels” stocks.

The term comes from the California Gold Rush. Most of the miners who flooded into California during the 19thcentury never struck it rich. And many went broke.

But smart businessmen figured out that selling picks, shovels, and other essentials to the miners was much more profitable—and far less risky.

The same concept applies here…

In the Bitcoin universe, the best picks-and-shovels stock is CME Group (CME). The company operates the leading Bitcoin futures exchange. (It’s also one of the only exchanges of its type.)

At its simplest level, futures contracts let people bet on how much the price of something will rise or fall.

Futures contracts also act as a form of insurance. For example, say you own one bitcoin. You don’t want to sell it. But you want to protect yourself in case the price falls. You can do that through a futures contract. It lets you lock in gains and limit your losses.

With an asset like Bitcoin, where the price could go up or down dramatically, having the option to lock in gains like that is a big plus.

CME Group is the leading company offering this big plus. And that means big money for the company...

A Billion-Dollar (Plus) Record Day

When Bitcoin’s price is on a run, as it is right now, CME makes a lot more money.

See, every time someone buys or sells a CME Group Bitcoin contract, the company takes a small fee. So when trading volume goes up, so does CME’s bottom line.

And volume is on the rise. In fact, the company reported record volume on its Bitcoin futures exchange on May 13. It processed 33,700 contracts, equal to $1.35 billion.

So clearly, there’s rising demand for CME’s services.

All Volatility Is Good for This Company

Another good thing about CME is that it doesn’t just benefit from Bitcoin’s volatility. It also benefits from stock, bond, and currency volatility.

With trade war news rag dolling markets and stocks at all-time highs, now is a good time to hold companies that benefit from volatility.

CME group also pays a safe and stable 1.6% dividend. Then there’s the cherry on top: The company has a history of paying a special dividend every year. So a special dividend could more than double CME’s dividend yield.

While Bitcoin futures only make up a small part of CME’s business, the rising interest in cryptocurrencies—which are now a $350-billion market—should continue to drive interest in their platform.

So, while Bitcoin is too risky for most investors—remember that 83% price drop—you still have an opportunity to profit from Bitcoin’s bull run by investing in a safe and stable company like CME Group.

The Sin Stock Anomaly: Collect Big, Safe Profits with These 3 Hated Stocks

My brand-new special report tells you everything about profiting from “sin stocks” (gambling, tobacco, and alcohol). These stocks are much safer and do twice as well as other stocks simply because most investors try to avoid them. Claim your free copy.

By Robert Ross

© 2019 Copyright Robert Ross. - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.