Global Banking System Black Hole Being Exposed - PART II

Stock-Markets / Financial Crisis 2019 Jul 25, 2019 - 01:55 PM GMTBy: Chris_Vermeulen

Nearly a decade ago, the globe experienced the biggest banking system failures we had seen in nearly a century. The exposure to risk that was inherent throughout the global banking system was so completely ignored that when the crisis unfolded, hardly anyone completely understood the depth of the risks at play. Could it happen again? Now?

Nearly a decade ago, the globe experienced the biggest banking system failures we had seen in nearly a century. The exposure to risk that was inherent throughout the global banking system was so completely ignored that when the crisis unfolded, hardly anyone completely understood the depth of the risks at play. Could it happen again? Now?

Have foreign banking institutions extended credit and debt risks beyond safe levels again? Are Deutsche Bank risk factors going to complicate an already fractured Asia, China, and Europe? What are the signs we should be looking for in terms of extended weakness or a breaking point?

In the first part of this research article, we highlighted the risk factors detailed by two separate public articles we found interesting. Deutsche Bank derivatives risk is listed at $49 trillion and extends across the globe into the global banking sector. We believe the economic slowdown being experienced throughout must of the globe could quickly expose a great chance for some type of contagion event to unfold.

Our research suggests the US banking sector and economy may be somewhat immune from this event this time having already learned its lesson from 2008-09. Still, we believe this potential event should be on every trader’s mind going forward – especially in relation to our August 19 stock market prediction.

This second part of the article will attempt to investigate how the US Fed and US interest rates may complicate the speed of this potential contagion event and how it may have compounded the credit crisis of 2008-09. Additionally, we’ll consider how multiple QE processes over the past 8+ years may have created the perfect setup for a new foreign banking/credit contagion event in the near future.

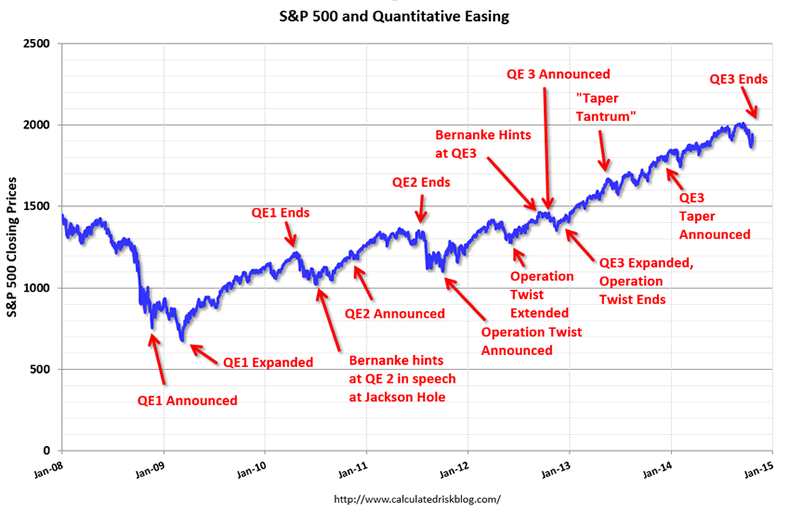

First, we’ll explore exactly when QE actions took place and ended. Secondly, we’ll compare these with the derivatives and risk exposure activities to attempt to determine a correlative comparison.

This chart of the S&P 500 highlights exactly when QE activities started and ended. It also highlights US fed debt investment activities (taper).

Have the global markets been fading the US Fed and decreasing leverage when the QE functions are at risk of ending or when the US Fed pushes rates higher? What are the risk factors for the global markets if the foundation of the global economy is based on “fading the Fed” and this easy US Dollar carry-trade/economic boom cycle expectation?

If our analysis is correct, then we can state that foreign nations and governments are hooked on the easy US Dollar/US Fed QE functions even more so than the US is dependent on a strong US economy and a strong US Dollar. It would appear that foreign banks, governments, and financial institutions became addicted to the idea that easy US Dollars would allow them to run a massive debt expansion scheme where they could borrow US Dollars for near 0% interest and deploy this capital as credit into their economies. This credit quickly entered their shadow banking and gray banking processes where it ran through various forms with limited restrictions and oversight. Could the easy-money policies of the past 8 years actually have created one of the biggest global credit risks in our future?

CONCLUDING THOUGHTS:

In short, it certainly seems as though the global banking institutions could get caught with their pants down if certain economic processes continue. First, if commodities continue to collapse (oil, copper, steel and other infrastructure/transport essentials), then commodity-backed loans will continue to default – sending shock-waves through the shadow and traditional banking systems.

If the US Fed continues to keep rates near current levels and when borrowers need to extend terms at current rates, this creates a scenario where borrowers may need to pay rates far greater than they can offset as profits – creating a negative return and extended defaults.

If foreign banks have extended loans into the shadow/gray banking system under the expectation that the US Federal Reserve would never attempt to move rates above 1% to 1.5% while foreign trade and economic activities continue to decline, the potential for decreased income/revenues pushing debt default levels higher becomes a real risk going forward.

A contagion event could become a much more real possibility of two or more of these events continue to extend out into 2020 or longer.

We believe we are already nearing a minor contagion event within the EU and Asia/China. We believe the debt/banking sectors are about to experience a wave of continued defaults and shake-outs as the US Fed navigates future expectations. Deutsche Bank is the one to watch in Europe because the extended debt risks associated with DB could become the black hole that sucks the rest of the foreign financial sector into an abyss.

Pay attention to the news and risk factors at play over the next few weeks and months. Plan and prepare for increased volatility as this event continues to unfold. Follow our research to learn how to protect your assets and find ways to profit from these events.

You should be starting to get a feel of where stocks are headed along with precious metals for the next 8-24 months. The next step is knowing when and what to buy and sell as these turning points take place, and this is the hard part. If you want someone to guide you through the next 12-24 months complete with detailed market analysis and trade alerts (entry, targets and exit price levels) join my ETF Trading Newsletter.

This bear market has been a long time coming, but finally, almost all the signs are showing that it’s about to start. As a technical analyst since 1997 having lost a fortune and made fortunes from bull and bear markets I have a good understanding of how to best attack the market during its various stages.

Be prepared for these incredible price swings before they happen and learn how you can identify and trade these fantastic trading opportunities in 2019, 2020, and beyond with our Wealth Building & Global Financial Reset Newsletter. You won’t want to miss this big move, folks. As you can see from our research, everything has been setting up for this move for many months – most traders/investors have simply not been looking for it.

Join me with a 1 or 2-year subscription to lock in the lowest rate possible and ride my coattails as I navigate these financial market and build wealth while others lose nearly everything they own during the next financial crisis.

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for both short-term swing trading and long-term investment capital. The opportunities are massive/life-changing if handled properly.

FREE GOLD & SILVER WITH MEMBERSHIPS

So kill two birds with one stone and subscribe for two years to get your FREE PRECIOUS METAL and get enough trades to profit through the next metals bull market and financial crisis!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.