Trump Trade Tariffs US War with China Mega-trend Impact on Stock Markets

Stock-Markets / China US Conflict Aug 02, 2019 - 05:27 PM GMTBy: Nadeem_Walayat

For some reason there are still mainstream media journalists out there going on about how China is winning the trade war against the US. Perhaps they just want to pump out any propaganda that hurts trumps re-election prospects? Or more likely are clueless automatons whose primary purpose is to regurgitate the editorial line of media out fits they represent. Anyway they are still just as wrong as they have been for the duration of the Trump presidency.

For some reason there are still mainstream media journalists out there going on about how China is winning the trade war against the US. Perhaps they just want to pump out any propaganda that hurts trumps re-election prospects? Or more likely are clueless automatons whose primary purpose is to regurgitate the editorial line of media out fits they represent. Anyway they are still just as wrong as they have been for the duration of the Trump presidency.

First a reminder that the trade war is just one element of an unfolding multi-decade conflict between the emerging wannabe superpower China, attempting to break out of its box, against the worlds existing super power, the United States. And just to be clear there is no room for peaceful coexistence, that's not in the nature of super powers, instead they always seek full spectrum supremacy, economic, technological and military. As was the case with the Soviet Union, economic destruction that has left Russia a mere shell of its former self. A rust bucket of a former super power with rusting fleets of ships, now only able to express it's power through the hacking poorly protected desktop PC's or sending its military to places where they are unlikely to encounter much resistance such as Syria.

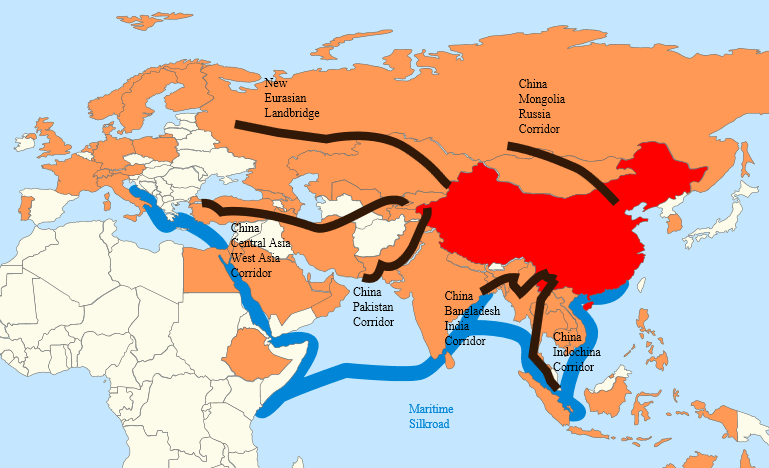

A reminder that China is busy building the infrastructure for it's Empire right across the world, fundamental to which is the One Belt Road and deep sea ports. That includes nations such as Pakistan (Gwadar), which just as the British Empire went from a series of trading companies to outright colonialism and theft of territory then so will China's trade roads and ports form the basis of a hoped for future Chinese military empire.

None of this is new of what Trump has done and what China is doing in the South China Sea, as in two pieces of in-depth analysis I set forth what I expected to follow in the US China War Mega-trend posted BEFORE Trump took office which are just as valid today as when first posted for the TREND firmly remains in the forecast direction! Trade, Economic, Cyber, Market, Corporate, Territory, Nuclear!

- 27 Dec 2016 - The Trump Reset - Regime Change, Russia the Over Hyped Fake News SuperPower (Part1)

- 28 Dec 2016 - US Empire's Coming Economic, Cyber and Military War With China (Part 2)

The Trump trade war with China is now into it's third year, and still the mainstream press remains largely clueless at to what is actually going on and its consequences, which is why they keep getting caught out by surprise announcements that the Trade War and the likes of the North Korea conflict have NOT BEEN RESOLVED! Because they CANNOT be resolved given the mega-trend fundamentals at work of an emerging Super Power seeking to displace the existing Super Power.

Whilst today the talk is about trade wars, unfortunately it is highly probable that sooner or later we will see military conflict between the two powers, the primary trigger for which will be when China starts to rival the US in terms of military power, that the US will likely seek to pre-empt.

Military and Economic Power

| United States | China | India | Russia | UK | Japan | France | Germany | Saudi Arabia | |

| Military Spending | $600bn | $220bn | $50bn | $66bn | $58bn | $45bn | $47bn | $40bn | $85bn |

| Economy | $18.6tr | $11.5tr | $2.25tr | $1.3tr | $2.7tr | $4.7tr | $2.5tr | $3.5tr | $0.65tr |

| Population | 0.33bn | 1.38bn | 1.35bn | 0.145 | 0.065 | 0.127 | 0.065 | 0.082 | 0.033 |

US / China Trade War

My consistent view right from the outset has remained that China will LOSE the Trump Trade War.

6th July 2018 - Trump Destroying US Empire in Trade War Against China, Europe and Canada

The strong statements out of China of tit for tat responses to US Tariffs should be taken with a giant pinch of salt for the performance of the Shanghai index makes it crystal clear of who is the big loser in this Trade War. China is and WILL continue to LOSE this Trade War! So it is highly likely there will at some point be a Trade War induced financial panic in China.

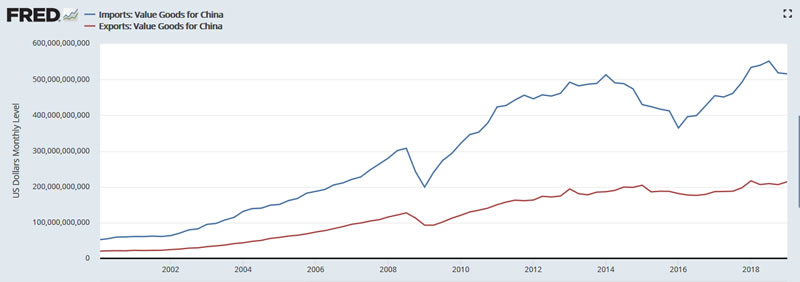

The following graph illustrates the huge trade imbalance that continues to persist between the US and China of over $300 billion that has had a devastating effect on the US jobs market as it converts into the US effectively employing upwards of a net 25 million Chinese workers, an imbalance that the Trump Presidency has been attempting to address through trade tariffs with limited results to date against what had been a run away trend.

The current state of the trade war has the US levying tariffs of 25% on $250 billion of Chinese imports, whilst China has retaliated with tariffs of 25% on $110 billion of US imports.

Whilst the mainstream media is once more convincing themselves that a resolution to the trade war could be just around the corner. However, Trump's latest tweets reveal someone who is reveling in the trade conflict. And likely aiming to use it as a corner stone of his re-election campaign.

Therefore rather than a resolution to the US China Trade war, instead it is highly probable that Trump will slap a new round of tariffs on the remaining $320 billion or so of tariff free Chinese imports so as to appeal to his voter base in the run up to the 2020 election.

China Stock Market Trade War Reality Check

The rest of this analysis has first been made available to Patrons who support my work China SSEC Stock Market Fundamentals and Trend Analysis Forecast

- China Stock Market Trade War Reality Check

- China Economy

- China SSEC Corporate Earnings

- Technical Analysis

- China SSEC Stock Market Conclusion

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Scheduled Analysis

- NASDAQ

- GBP/USD

- EuroDollar Futures

- Bitcoin Update

- UK Housing market series

- Machine Intelligence Investing stocks sub sector analysis

- EUR/RUB

Recent Analysis includes:

- China SSEC Stock Market Fundamentals and Trend Analysis Forecast

- Silver Investing Trend Analysis and Price Forecasts 2019 Update

- Gold Price Breakout - Trend Forecast 2019 July Update

- Dow Stock Market Trend Forecast July 2019 Update

- Investing to Profit and Benefit from Human Life Extension AI Stocks and Technologies

Your mega-trends investing analyst

Nadeem Walayat

Copyright © 2005-2019 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.