Currency Wars Are Wars That Gold Wins in the End

Commodities / Gold & Silver 2019 Aug 08, 2019 - 11:24 AM GMTBy: Arkadiusz_Sieron

July nonfarm payrolls came in line with expectations, confirming the strength of the U.S. labor market. So far so good. With the markets more focused now on the escalation of the trade war triggered by Trump’s tweet on Thursday., she stock market plunged while gold rallied. Can the upcoming news take gold higher still?

July Payrolls in Line with Expectations

The U.S. created 164,000 jobs in July, following a strong increase of 193,000 in June (after a downward revision). The nonfarm payrolls were in line with expectations and widespread, but with a leading role of education and health services (+66,000) and professional and business services (+38,000). Retail trade, mining, utilities, and information cut jobs.

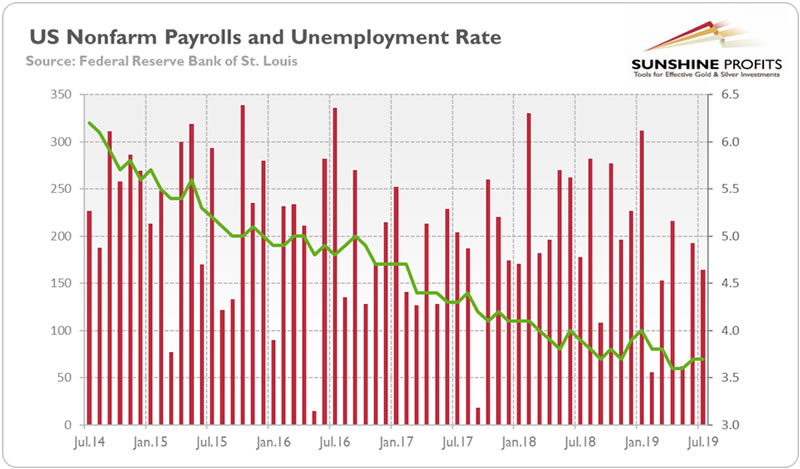

However, theheadline number was accompanied by downward revisions in June and May. Counting these, employment gains in these two months combined were 41,000 lower than previously reported. Consequently, job gains have averaged 140,000 per month over the last three months, which is lower than several months ago (in 2018, the average gain was 223,000 per month). Although the pace of hiring has slowed (see the chart below), the U.S. economy is still creating jobs at a reasonable pace. The job creation keptthe unemployment rate at 3.7 percent, near a 50-year low. Simultaneously, more people entered the labor force in search of work, while the wage inflation increased from 3.1 to 3.2 percent. Hence, the US labor market is strong and fuels the record-long expansion. From the macroeconomic point of view, the domestic economy is still doing reasonably well. This is bad for the gold prices.

Chart 1: U.S. nonfarm payrolls (red bars, left axis, change in thousands of persons) and the unemployment rate (green line, right axis, %) from July 2014 to July 2019.

Who Cares about the Labor Market during Currency Wars?

However, investors focus now on the concern over weak global growth and trade policy. On Thursday, Trump threatened to apply more tariffs to Chinese goods amid a stalemate in talks over trade rules. President tweeted that “small” additional tariff of 10 percent on the on the remaining US$300 billion in Chinese imports will be imposed from September 1:

(…) We thought we had a deal with China three months ago, but sadly, China decided to renegotiate the deal prior to signing. More recently, China agreed to buy agriculture product[s] from the US in large quantities, but did not do so (…) Trade talks are continuing, and during the talks the US will start, on September 1st, putting a small additional tariff of 10 percent on the remaining 300 billion dollars of goods and products coming from China into our Country. This does not include the 250 Billion Dollars already Tariffed at 25%...

The stock market plunged, as investors repriced the risk to the economy from the trade war. Yesterday, the S&P 500 fell further, after the decline in the value of yuan against the U.S. dollar. The exchange rate tumbled below 7-per-dollar, the lowest level in more than a decade. In response, the U.S. government has designated China as currency manipulator for the first time since 1994. Adding to the tensions, China’s Commerce Ministry said Chinese companies have stopped buying U.S. agricultural products and that China will not rule out imposing import tariffs on U.S. farm products that were bought after August 3. It will hurt Trump, who counts onthe farmers’ votes.

Implications for Gold

The escalating trade tensions between the U.S. and China added fuel to the gold’s rally. It should not be surprising, as the trade war has entered a new phase. The fact that People’s Bank of China allowed the yuan to depreciate is a sign that China has thrown in the towel on any trade agreement with the U.S. coming anytime soon. As trade wars have just transformed into currency wars, investors turned into safe havens. In a world of negative bond yields, gold looks relatively attractive.

Moreover, the renewed conflict with China increases the odds of more interest rate cuts from the Fed. Indeed, the markets now see the dovish move as certain (with almost 25 percent chances of 50 basis points cut) compared to 67.5 percent one week ago. These expectations may be slightly exaggerated, but they should support the gold prices in the very short term. Our view remains that the Fed will cut interest rates only once more this year, in December, if at all. That would make for a decline in gold prices later on. Fundamentally though, the escalating trade war provides support to gold.

If you enjoyed the above analysis, we invite you to check out our other services. We provide detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.