4 Measures of Market Risk to Keep an Eye on

Stock-Markets / Stock Markets 2019 Aug 27, 2019 - 07:21 AM GMTBy: Submissions

It wasn't a big surprise that President Trump commented earlier today that trade negotiations with China have reopened. Had he not done so, it would have led to further losses in the equities markets and potentially a significant technical break in the S&P 500.

It wasn't a big surprise that President Trump commented earlier today that trade negotiations with China have reopened. Had he not done so, it would have led to further losses in the equities markets and potentially a significant technical break in the S&P 500.

The appetite for risk is back, the question is whether it is here to stay. Based on charts of some of the commonly traded assets in times of risk aversion, I think a case can be made that a bottom is in for risk appetite, or at least, we might be close to one.

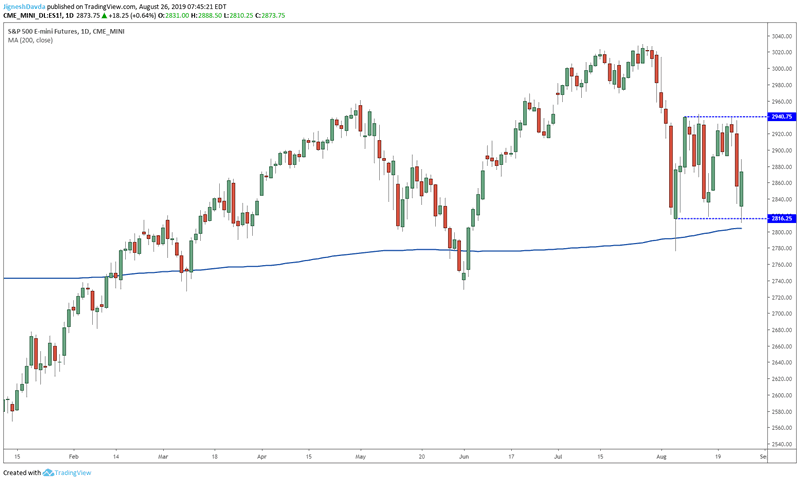

Starting with equities, the S&P 500 has traded in a range for most of the month. Friday's decline had momentum behind it. As mentioned, the absence of Trump's comment earlier today would have likely led to a downside continuation.

Had SPY opened lower today, I think it would have caused some panic among technical traders. A break below the mid-August low would have been inevitable. Perhaps the 200 DMA might have temporarily brought some buyers, but a downside range break would have been in the cards, and I expect such a scenario would have let to a further liquidation in equities. I also think it would have encouraged bears.

Instead, equities are catching a bid in pre-market trading. Sure, there was a break below the August 15th low in the futures market, but the US open won't reflect that. The upward momentum and overall shift in risk sentiment are likely to keep equities bid. At the very least, the range in SPY remains intact.

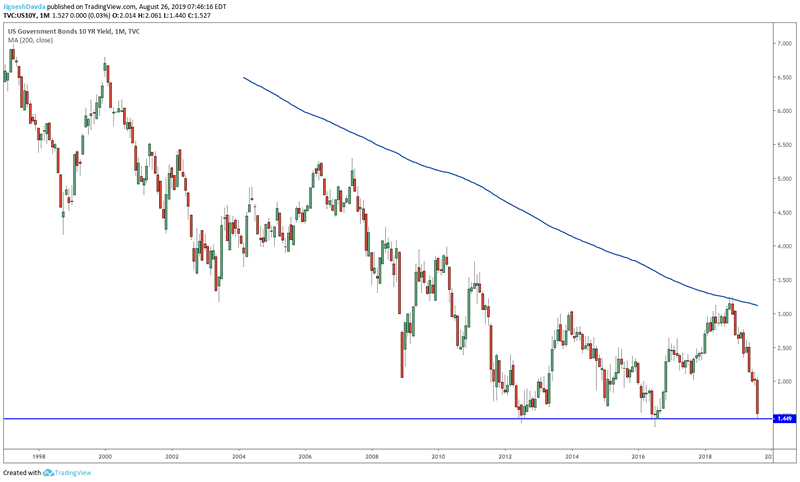

Turning over to bonds, there is some potential for a reversal. But to be clear, I'm not in the habit of making 'catch the falling knife' type of calls and suggesting that bonds have topped is exactly that. Rather, I'd like to point out to the technical significance of where the 10-year yield bounced today.

The above chart is a monthly view of the 10-year yield. Note the importance of support at around 1.45%. In 2012 it triggered a turn for a move back above 3%. It did the same once again in 2017.

But as mentioned, the momentum is down. There isn't enough technical evidence of a turn. But I do think this an important area for the instrument, and I would not be chasing it lower here.

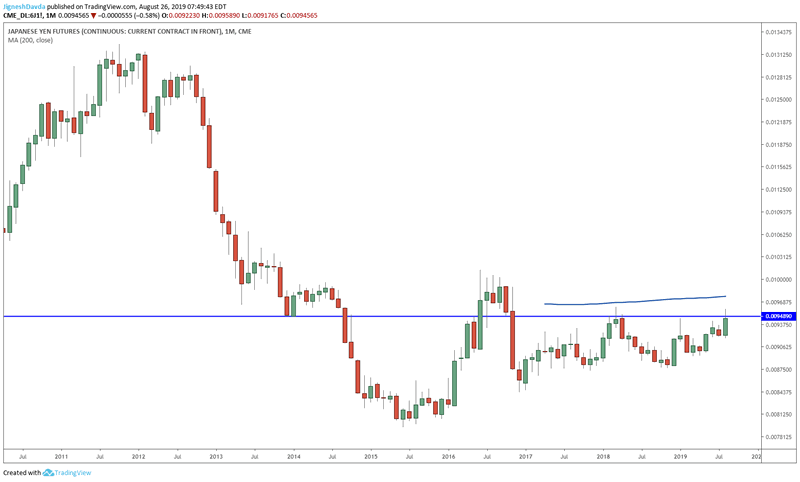

Next is the Japanese yen. Looking at the front-month futures contract, there is a level near 0.0095 that has capped rallies for the last three weeks. This is a level that acted as support in 2013 and has been a major hurdle since 2018.

At the same time, the momentum is clearly to the upside here. Making a case that a meaningful reversal is likely to take place here is a tough one. At the same time, going into the end of the month, I think the yen will struggle to make further gains.

There is not enough technical evidence of a turn in all of the above, but I think the technical picture suggests that there is no reason to be aggressively bearish risk. It is very possible that a divergence can even take place where some instruments continue while others reverse.

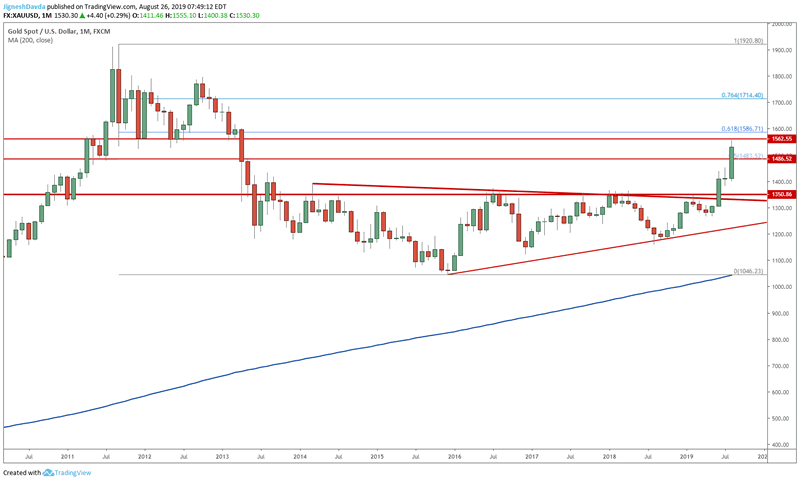

Having said that, it seems like Gold might have some further upside, but there is certainly a significant amount of resistance in place.

Looking at the monthly chart of spot gold below, there is a fairly significant resistance confluence up above. It stems from a horizontal level at $1562 which was well respected during 2011 and 2012. Slightly above it, the 61.8% Fibonacci retracement of the drop from 2011 highs comes into play.

From a fundamental perspective, progress in trade talks with China will ultimately remain a major driver for risk. There have been talks that Trump will want to wrap up negotiations so as not to cause damage to the economy and the equity markets ahead of the elections. I agree with this view, and I expect that he will continue to try and intervene whenever possible during periods of risk aversion, either through his twitter account or press releases. He did exactly this ahead of the market open today, perhaps it’s the start of a new trend.

By Jignesh Davda

The Gold Analyst

Quality Analysis of the Price of Gold

© 2019 Jignesh Davda - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.