Gold and Silver Wounded Animals, Indeed

Commodities / Gold & Silver 2019 Sep 11, 2019 - 04:25 PM GMTBy: Clive_Maund

Sector expert Michael Ballanger offers his observations of recent activity in the gold and silver markets. "The permabulls will tell you that the bullion banks and their treasury department conspirators have lost all power in this 'new paradigm' and we should relax and refrain from worry. I tend to disagree because wounded animals are the singular most dangerous of all creatures on this debt-ravaged planet, and with gold at $1,552, these cartel cretins are now wounded, angry and very desperate animals." —Michael Ballanger, Sept. 2, 2019; silver at $19.00 one day before the top

Sector expert Michael Ballanger offers his observations of recent activity in the gold and silver markets. "The permabulls will tell you that the bullion banks and their treasury department conspirators have lost all power in this 'new paradigm' and we should relax and refrain from worry. I tend to disagree because wounded animals are the singular most dangerous of all creatures on this debt-ravaged planet, and with gold at $1,552, these cartel cretins are now wounded, angry and very desperate animals." —Michael Ballanger, Sept. 2, 2019; silver at $19.00 one day before the top

OK, so now that there is zero doubt surrounding the recent demise of the bullion banks, I was reminded yesterday (amidst the gnarling and gnashing of many a silver bulls' incisors) of a famous Mark Twain quote surrounding rumors of his passing: "The reports of my death are greatly exaggerated."

That is exactly the reply of the criminal cartel last week as bullion bank shenanigans took a page out of the Carpe Diem playbook and absolutely pounded the precious metals with such feral ferocity that they quite predictably set off a retail panic of the highest order. One very prominent gold and silver bull tweeted out, "It should be noted that Crimex silver is still up on the week!", to which I quickly and cynically replied, "Tell that to my margin clerk."

Tweets defending the tape action were furious all day Friday after noticeable calm on Thursday, and the fact that every single tweet was of the "BTFD!" or "buying opportunity" vintage, I would have felt a great deal better had there been a few "Get me the $#$% out!" tweets implying the arrival of panic, and not of the "buying" kind we saw on Wednesday. It would seem that the Millennials and GenX-ers suddenly discovered the precious metals over the Labor Day weekend and were abruptly punished for their tardiness. Empty vodka bottles and used vaping dispensers were everywhere. . .

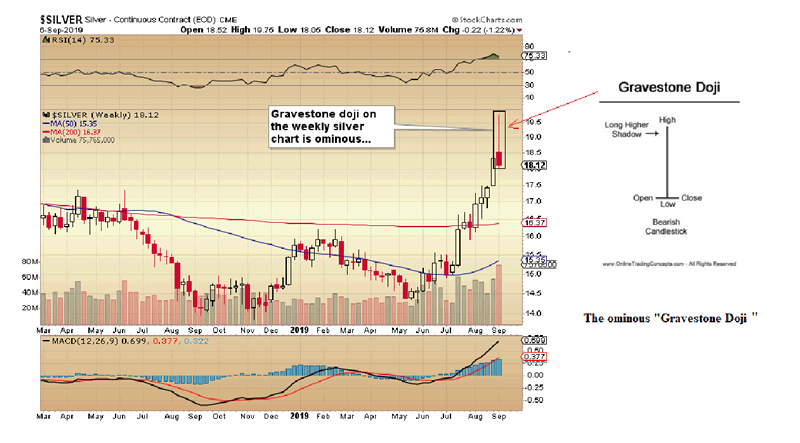

The daily charts for gold and silver have recorded but a mere blip on the long-term radar screen and remain in beautifully choreographed uptrends. But there is one chart that has me a tad rattled and it is the weekly silver chart, where the arrival of the dreaded and most-foul "gravestone doji" marks a powerful reversal signal to a market that has been trending higher in orderly fashion since my July 2 bullish call at $15.00 silver at $14.20 SLV. The gravestone doji is one of the most reliable reversal indicators and is always found at the tail end of a bull move. When accompanied by the big volume spike we had last week in silver, it suggests that my re-entry into the silver market is going to be farther away and possibly a bit lower than I initially expected.

Going into Thursday, the number of tweets from newly minted gold "experts" (most of whom you know) that were the literary equivalent of a NASCAR victory lap, complete with buxomy girls and flowing champagne, were voluminous to the point where I actually tweeted this during the final orgasmic spike in silver on Wednesday: "Not ONE—repeat—NOT ONE bearish tweet on the PM sector in the past two sessions—everyone now long and strong with bows taken and egos fully erect."

Whenever highly emotional extremes of either greed or fear enter the market—any market—I have learned over the years to be prepared to take the opposite side of the trade. Certainly there was an extreme last July when people were revolted by the prospect of owning silver, with more than a few of the "enlightened ones" calling for a 100 GSR (gold-silver ratio), which was the equivalent of capitulation.

I took the other side of that trade and remain short the GSR from 92.40 (currently 82.68). Similarly, I counted somewhere in the order of 75 bullish articles on silver and over 200 on gold by Wednesday of last week, and answered over 50 e-mail queries asking whether they should add to Aftermath Silver Ltd. (AAG:TSX.V) at $0.30 per share (up from $0.10 60 days prior).

The abject terror of early July was replaced with unwavering avarice last week, so naturally, seeing, feeling and smelling the odious presence of greed slithering its way into the gold and silver trading pits compelled me to take the other side of that trade as well. And I offer this not as a self-laudatory handwave but more as an educational lesson in human behavior.

What has annoyed me to no end in the past few weeks has been the presence of hubris in the collective psyches of many precious metals bulls, and it is not surprising that an attitude of "There! Take that, ya bastards!" was prevalent with regard to the bullion banks after year-after-year of intervention, interference and criminal collusion. I, too, was delighted in July when the $1,375 cap for gold was blown to smithereens by the combination of physical demand and rising mistrust. Notwithstanding the many thousands of dollars I left on the table by exercising the same prudence that saved my sexagenarian ass in past campaigns, the move into the $1,500s has been at once both vindication and celebration for a gold "opinionator" known to launch quote monitors from ninth-floor windows in search of banker craniums with alarming regularity.

However, the camaraderie among we gold bulls turned ugly when I started to read about a "new paradigm," to the point where I wanted to take the term and install it in my lavatory. Just as pride cometh before a fall, tweaking the bulbous, red-veined noses of the bullion bank sloths is analogous to shuffling deck chairs on the Titanic; it invites a negative outcome.

That is why I started this week's missive with a quote not from Ayn Rand or John Maynard Keynes but from last week's missive. By last Wednesday, the bullion bank traders weren't just irritated canines; they were bruised and bloodied wolverines, backed into a corner of the underground garage with nary a path for escape save launching a final desperate attack—and attack they did, sending the gold and silver bulls reeling into urgent and intensified retreat after weeks of complacency and control.

If there is one thing I have learned over the years, you do not tempt fate. In the minds of those who control governments and their military-industrial complexes, gold is the enemy. Rising gold prices are the financial equivalent of nuclear missiles being shipped to and installed in Cuba. Neither will be tolerated (for very long) by those wielding the baton of power and if we, for one millisecond, forget that, we are doomed to margin call miasma and deflated dreams.

Wall Street symbolizes the American Way of Life and all that is good that separates them from the heathens in Afghanistan or Venezuela. When rising gold prices hijack the financial news headlines, you had better prepare yourselves (and your margin clerk) for a change of venue. The most dangerous phrase in all of trading is "It's different this time." It is never, ever, "different". . .

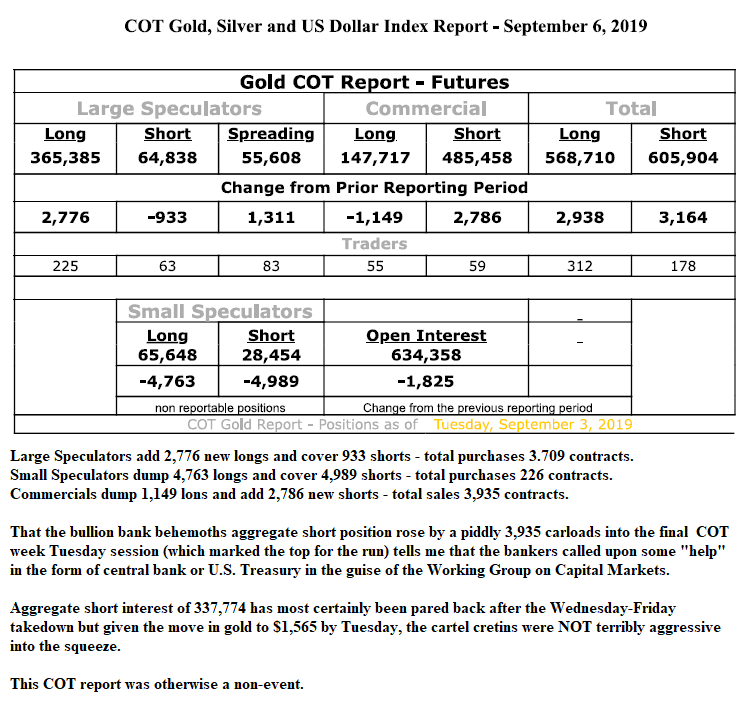

Cot Report

The September 2 COT had only one notable item: The bullion banks were afraid of adding more than 4,000 new shorts to their positions despite a massive price surge on Tuesday. That is informative. (See below.)

To summarize what I deem as a "watershed week," I go into Monday morning with a 53.7% cash position my unleveraged trading account and 85% cash in the leveraged account. The GGMA portfolio is essentially my unleveraged account and is now up 163% year to date. But what is important for me is being able to resist the temptation of buying back all positions that I put on in the first half of the year too early.

In an election year, the incumbent president (and particularly DJT) will be acutely aware of the S&P 500 and of gold prices. I do not trust these insidious serial manipulators because the most mind-numbing and alluring narcotic of all is power, and with the addictive personalities sported by all politicians, there is little if anything they will not do to lose their grasp of it.

Therein lies the danger in assuming that physical demand alone will give way to unimpeded advances in gold and silver; the central banking global cabal has many tools at its disposal, and to underestimate its willingness to use them to advance its own agenda would be abject folly. What we witnessed late last week was most certainly a healthy and well-deserved spate of gold ol' all-American profit-taking in the metals but the manner in which it closed out the week, and particularly the post-Crimex Access market, reeked of the all-too-familiar odor of interference.

While natural forces may have initiated the pullback, a malevolent and purposeful force exacerbated it and that was clearly evident in the final hours on Friday. While the bullion bank behemoths were blatantly timid earlier in the week, someone or something gave them great confidence in pressing their bearish bets late Friday, and I think readers of this publication have a pretty good idea who or what that presence might be.

Wounded animals, indeed.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure: 1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Aftermath Silver Ltd., Great Bear Resources, Western Uranium, Stakeholder Gold, Getchell Gold. My company has a financial relationship with the following companies referred to in this article: Getchell Gold Corp. and Western Uranium & Vanadium Corp. My firm no longer does consulting work for Stakeholder Gold.. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below. 2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Great Bear Resources. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Western Uranium and Vanadium and Aftermath. Please click here for more information. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports (including members of their household) own securities of Getchell Gold, Western Uranium and Stakeholder Gold and Aftermath, companies mentioned in this article.

Charts courtesy of Michael Ballanger.

Michael Ballanger Disclaimer: This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.