Gold and Silver Taking a Breather

Commodities / Gold & Silver 2019 Oct 07, 2019 - 02:07 PM GMTBy: Richard_Mills

This year at AOTH we have tackled a number of reasons for gold and silver’s rise, aiming to explain “in layman’s terms” what is behind the seemingly relentless move upward - despite the trend-busting reality of a high US dollar. We’ll get to that further down this article, but for now, we are summarizing all that we know about why now might be, in our opinion, an excellent time to be beefing up our gold/ silver bullion hoard, and doubling down on promising juniors exploring for precious metals.

This year at AOTH we have tackled a number of reasons for gold and silver’s rise, aiming to explain “in layman’s terms” what is behind the seemingly relentless move upward - despite the trend-busting reality of a high US dollar. We’ll get to that further down this article, but for now, we are summarizing all that we know about why now might be, in our opinion, an excellent time to be beefing up our gold/ silver bullion hoard, and doubling down on promising juniors exploring for precious metals.

Gold

Impeachment safe haven

Washington, DC is once again in turmoil. The talking news heads are all a-twitter over a whistleblower’s statement that President Donald J. Trump had a conversation with the president of Ukraine, about former vice-president Joe Biden, who is seeking the Democratic nomination to run against Trump in 2020.

Trump alleges that Biden used his influence to benefit his son’s private sector work in Ukraine. But the president is also being accused, of withholding $400 million in aid to Ukraine as a cudgel for Ukraine to probe Biden and his family.

The contents of the phone conversation are being vigorously discussed, as explained by NBC News, but the upshot is the whistleblower’s complaint has led to the launch of a formal impeachment inquiry in the House of Representatives.

A majority of House members reportedly back some form of impeachment, which would happen in two steps: If a majority of the House votes in favor of impeachment, the Senate conducts a trial. Impeachment can only occur if two-thirds of senators vote to convict and remove the president from office.

Only two US presidents have been impeached, Andrew Jackson and Bill Clinton, but neither were removed from office, due to acquittals by the Senate. The current numbers are lining up for the same outcome, with Democrats controlling the House of Representatives and Republicans holding a Senate majority.

Gold investors love nothing more than a war, economic crisis or any type of geopolitical instability to watch the value of their bullion grow. Heightened global tensions such as terrorist attacks, border skirmishes or trade wars scare investors into putting their funds into safe havens like gold and stable sovereign debt such as US Treasuries.

The yellow metal might be heading for a fifth straight month of gains, benefiting from monetary easing on the part of central banks that have been cutting interest rates to stimulate flagging economic growth, and to cushion blows economies have suffered from the US-China trade war, which shows no signs of ending.

Trade talks stumble

It looked like progress was being made on talks, with China agreeing to buy US pork and soybeans (China currently has a severe pork shortage due to African swine fever) as a kind of peace offering.

But Trump then disparaged the country in a speech to the UN General Assembly, saying “China is starting to buy our agricultural product again. They’re starting to go with the beef and all of the different things … pork, very big on pork. You know they want to make a deal and they should want to make a deal. The question is, do we want to make a deal?”

The president’s contradictory statements about trade talks progress is perplexing to political observers and damaging to markets that loathe indecision. Earlier this month Trump agreed to delay a $250-billion round of tariffs on Chinese products, to mid-October, then came the UN speech, followed by his statement the day after that a deal “could happen sooner than you think”.

The spectre of a sitting president being impeached and possibly removed from office for the first time in US history just adds to the uncertainty.

“The move in gold looks convincing enough to warrant some attention as it’s unlikely the political storm clouds over Washington are about to dissipate any time soon.” Bloomberg quoted an Asia-Pacific market strategist at AxiTrader, Thursday.

Other safe-haven demand drivers

Beyond the trade dispute, there are other reasons for owning gold. They include safe-haven demand driven by such dangerous conflicts as the war in Yemen, the frequent tensions between the US and Chinese navies in the South China Sea, and the ongoing flare-ups between the United States and Iran, most recently over a multiple-drone attack on two Saudi Arabian oil facilities.

According to al Jazeera, Iran’s President Rouhani rejected a meeting with President Trump despite an attempt by France to broker talks. Rouhani blames Washington for being rigid over its sanctions on Iran - re-imposed by the US after the Iran nuclear deal was scrubbed in May, 2018.

The Trump administration has frozen all of Venezuela’s assets, putting the South American failed state in the same company as Cuba, North Korea, Syria and Iran. The ban blocks US companies and individuals from doing business with the Maduro regime and its top supporters.

There is also a brewing confrontation between South Korea and Japan over a set of disputed islands in the Sea of Japan. The South Korean Military wants to conduct defense drills at the Takeshima islands which are claimed by Japan but controlled by South Korea. The conflict is the latest in a series between the two former WWII adversaries, that stem from court rulings last year ordering Japanese firms to pay compensation to South Koreans, forced to work for them during the war.

Finally, an arms buildup between the US and Russia. In August the US formally withdrew from the 1987 Intermediate Nuclear Forces Agreement (INF), which restricted missile launches from the two Cold War enemies. Without a new agreement in place, there is nothing stopping Russia from developing new missiles pointing at Europe, and the US responding in kind, or vice versa.

When doves fly

Earlier this year, our reasons for being bullish on gold, the “barbarous relic”, were mostly to do with negative economic news coming out of the United States, including a bond yield curve inversion, signaling a recession is on its way.

Gold’s current movement is not so much related to economic malaise, but rather, is being judged against bond yields and what the Federal Reserve is going to do next (on Sept. 18 the US Federal Reserve cut interest rates another quarter point, to 2%). Gold generally climbs, becoming more valuable to investors looking for income from their investments, when interest rates and bond yields fall.

The precious metal is trading just below $1,500 as US real Treasury yields skid along at practically 0%. (the 10-year is currently yielding a net 0% and the 3-year is -0.1%). That would normally be terrible for US Treasuries but they are in fact attractive among the world’s sovereign debt, in offering a positive yield. Currently a quarter of all sovereign debt, worth a shocking $17 trillion, is paying a negative yield.

Inflation hedge

Gold is often bought as a hedge against what investors see as government policies that drag down the dollar and create inflation. The most obvious example, quantitative easing programs imposed by the United States, the European Central Bank and Japan, to deal with the fallout from the financial crisis.

During QE a central bank “prints money” by adding credit to its member banks’ deposits, which has the effect of increasing the money supply, ergo, creating inflation. Between December 2008 and October 2014, the US Federal Reserve added $4 trillion to the money supply by buying Treasuries from its member banks.

The US inflation rate currently sits at 1.7% - certainly too low for concern, but even the suggestion of bond-buying (QE) by a central bank usually pushes up gold.

On Sept. 12 the European Central Bank cut its interest rate to -0.5%, and also promised to buy 20 billion euros a month in bonds starting in November, for “as long as necessary.” Spot gold rose to $1,498/oz that day, on the news.

ETF inflows

The gold price partly rises and falls based on the amount of gold that moves into and out of gold exchange-traded funds (ETFs), aka “paper gold”.

On June 24 gold investors bought a record $1.6 billion worth of SPDR Gold Shares (GLD), the world’s largest physical gold-backed exchange traded fund. The inflow was the largest since the fund was launched in 2004 - pushing total holdings stored as Good Delivery Bars in London warehouses, to 25.7 million ounces.

As the gold rally that started in the third week of June continues, investors are piling into gold ETFs. While we wouldn’t advise buying one, the current froth in the paper market is worth mentioning.

In early September Frank Holmes reported SPDR Gold Shares added 924.9 tonnes in a single day. The CEO of US Global Investors also wrote that Mark Mobius, a veteran investor, endorsed gold on Bloomberg TV, and that a $2.1 billion Sandler Capital Management hedge fund “just made gold its top holding by increasing its investment in the SPDR Gold Trust by 180 percent.”

As of early last week, the amount of gold in ETF holdings worldwide, 2,494.3 tons, is the biggest second-quarter rise since Q2 2016, according to Bloomberg data.

Bullion rush

Prudent money is also moving to the safety of physical gold bars and coins.

According to the World Gold Council, the first quarter of 2019 saw relatively flat purchases of gold coins and bars, but spikes in the United States and the United Kingdom. US purchases were up 38% year on year, while in the UK, demand rose 58%, as Britons looked to protect themselves from a Brexit hard landing. Bar and coin demand in Europe rose 10% as people became aware of the economic slowdown and possibility of a recession.

Amid this context, sales of American Eagle gold and silver coins rose sharply in the first quarter compared to January-April 2018, with Gold Eagles up 33% and Silver Eagles increasing 37.9%. March was a particularly strong month for Gold Eagles, which sold at triple the volumes of March 2018.

In February, the US Mint actually ran out of 2018 and 2019 American Eagles, having sold over 6 million coins year to date, the best start to the year since 2017.

And this just in: Russian President Putin has reportedly signed a law that removes the 20% VAT on investments in gold and other precious metals. The Russian newspaper Izvestia has predicted demand for precious metals over the next five could surge 15 times current levels to 50 tonnes a year - around the same amount held in Turkey’s central bank.

Central bank buying frenzy

According to the World Council, central banks are continuing a gold buying spree that continues 2018’s record haul. A total of 651 tons was accumulated last year, 74% more than 2017 and the highest amount since 1967. All of the world’s central banks are estimated to hold, wait for it, 34,000 tons of gold (there are 29,166.7 troy ounces in a ton). That works out to nearly a billion ounces held by central banks (991,667,800 oz). Another crazy stat: at $1,500 an ounce, the global central bank bullion bonanza is estimated at $14,875,017,000,000 ie. $14.875 trillion.

So far in 2019, central banks have squirreled away 247.3 tons in bank vaults, the highest year-to-date purchases since central banks became net gold buyers in 2010. (before that they were net sellers, selling more gold than purchased).

On a quarterly basis, central banks bought way more gold in the first quarter of 2019 than Q1 2018. The WGC reports first-quarter purchases were the highest in six years, rising 68% above the year-ago quarter. It was the strongest start to a year for gold buying since 2013.

Year to date, as of July, reported central bank net purchases totaled 247.3 tons, a 73% increase over the same period in 2018.

China was the largest purchaser in May, adding 15.9 tons, while Russia purchased 6.7 tons. Russia has been trying every means available to diversify away from the US dollar - such as selling US Treasuries and signing energy deals with China whereby the transactions are in yuan or rubles, not USD. The Central Bank of Russia loaded up on 300,000 oz in July. China has increased its monthly gold purchases by nearly 50%, to 15 tonnes a month.

Notably, emerging-market countries represented 93% of the 145.5 tonnes of gold purchased in the first quarter of 2019, according to the World Gold Council report.

The latest WGC numbers show that the top gold buyers in the second quarter were all emerging-market economies: Poland, Russia, China, Turkey, Kazakhstan and the Kyrgyz Republic.

Peak gold is real

Peak gold is the point at which gold production reaches a top, then begins falling, never to return to previous levels. If supplies can’t keep up with demand gold prices will only go higher. On the flip side, if there’s still plenty of gold to be found, theoretically the market could face a glut, pushing prices down.

There is in fact some evidence of a peak. A Thomson Reuters report said 2016 was the first year since 2008 that gold mine output actually fell - by 22 tonnes or 3%.

A compelling argument for peak gold is the fact that, while gold production has been increasing every year (except for 2016) - it’s been growing in smaller and smaller amounts. That is, while gold output in 2018 was higher than 2017, it was only 1% higher - 3,347 versus 3,318 tonnes, according to the World Gold Council. Gold production of 3,318t in 2017 was 1.3% more than 2016’s output of 3,274t.

It’s not surprising that gold companies are finding it tougher to add to global reserves. The fact is, all of the easy, low-hanging fruit has been picked. Even with a six-fold increase in exploration spending between 2002 and 2012, there has been a significant dearth of new discoveries.

According to McKinsey, in the 1970s, ‘80s and ‘90s, the gold industry found at least one +50 Moz gold deposit and at least ten +30Moz deposits. However, since 2000, no deposits of this size have been found, and very few 15Moz deposits.

Any new deposits will cost much more to discover. This is because they are in far-flung or dangerous locations, in orebodies that are technically very challenging, such as deep underground veins or refractory ore, or so far off the beaten path as to require the building of new infrastructure from scratch, at great expense.

The costs of mining this gold may simply be too high.

Along with a lack of large discoveries, McKinsey & Co. offer three more reasons for why the gold reserve situation has worsened so much: funding for juniors has dried up, majors slashed exploration budgets and focused on brownfield development, and high-grading deposits has accelerated depletion.

The absence of major discoveries over the past several years, combined with reserve depletion, has put the gold industry in a real pickle. In the 1970s, every ounce of gold that got depleted was replaced by 2.6 ounces of new gold. Today, for every ounce of reserve depletion, only half an ounce is discovered.

At that rate of depletion, and without meaningful discoveries, reserves and production will continue to drop. In fact, gold production is expected to peak in 2019, followed by a steady decline. Peak gold this year? Why not.

The low rate of discovery along with drastically less capital to put towards exploration, has left the industry with a weak pipeline of development projects. Of these future mines, many are lower grade than previous discoveries, in 2016 the average reserve grade for 266 producing primary gold mines (ie. no co/ by-product metals) was 1.47 grams per tonne, compared to 1.02 g/t for 310 undeveloped deposits.

Potentially less viable than high-grade operations, these future lower-grade mines will contribute less to global gold production.

And there’s another problem: It is taking longer, much longer, to commission greenfield mines. While it used to take 12 years to bring a new discovery to production a decade ago, today it will be 20 years. Some mines in sensitive jurisdictions, like the US and Canada, requiring copious environmental studies and special interest group sign-offs, could take up to 30 years!

Another key point to realize about peak gold is the practice of high-grading. High-grading is what often occurs when a gold-mining company's costs are higher than it would like them to be, cutting into profitability and market capitalization.

With high-grading, instead of mining a deposit as it should be, economically, by extracting, blending both low-grade and high-grade ore at a given strip ratio of waste rock to ore – the company “high-grades” the orebody by taking only the best ore, leaving the rest in the ground.

The implication of high grading is a dramatic improvement in a company's margins, but at a huge loss of ounces to its reserve base, as well as lowering the deposit's average grade, since all the best material has been removed.

According to McKinsey, in 2016, about 60% of gold operations were mining with mill grades above the mine’s reserve grade – in other words, they were high grading. Large mines where this was occurring included Goldfields' Granny Smith mine in Australia, Goldcorp’s Cerro Negro, Argentina and Barrick's Turquoise Ridge operation in Nevada.

High grading their reserves is terrible for the industry, because short term profits are made while inflicting long-term pain, in that millions of ounces are left unrecovered, and likely never will be, unless the gold price rises enough for those lower-grade reserves to be economically mined.

In sum, the combination of high grading, which lowers both reserves and grades, a drastic reduction in new discoveries due to a lack of exploration spending, and decreased mine lives, means the industry will be extremely challenged to maintain current production levels. According to the background report, by 2020 global mine production is expected to drop 3% to 95 million ounces and keep falling after that – in other words – peak gold. The report estimates that by 2025 production will be one-third lower than 2020’s output.

We are already seeing evidence, this year, of reduced mine supply. According to BN Americas, via Frank Holmes, production from the 10 biggest gold miners in Mexico fell in the second quarter due to declining reserves, technical challenges and lower grades. The top 10 miners produced 675,450 ounces of gold in the second quarter, compared to 709,385 ounces in the same period last year.

Silver

Silver demand > supply

The rarity of both gold and silver becomes apparent when we consider how little of each have been mined throughout history - just 6.1 billion ounces of gold and 51.3 billion oz of silver. All the gold ever mined in the world could fit into a cube 21.6 meters on each side, and all the above-ground silver could fit into a 52m cube.

According to the Silver Institute’s annual silver survey, in 2018, the latest data available, there were 2.457 billion ounces of silver being held in vaults, silver ETFs or ETPs, government silver holdings and industrial silver stockpiles.

The all-time estimated mined gold-silver ratio is 8.8:1 - for every 8.8 ounces of silver mined we have mined 1 ounce of gold. We would expect there to be roughly eight times more silver than gold. But there isn’t, instead, above ground stocks of investment-grade gold and silver bullion are virtually even.

The reason is industrial demand for silver. The white metal/ devil’s metal is used in a mind-boggling 10,000 industrial applications.

While most of the mined gold is still around, either cast as jewelry, or smelted into bullion and stored for investment purposes, the same cannot be said for silver. It’s estimated around 60% of silver is utilized in industrial applications, leaving only 40% for investing. And of the 60% demanded by industry, 8 of 10 ounces is either used up in manufactured products or discarded in landfills. Some silver researchers say closer to 90% has been lost to landfills. Perhaps we should be mining them?

In sum, both silver and gold have roughly the same amount above-ground supply available for investment purposes. However, since very little gold is used by industry, it trades as an investment commodity - moving up and down in relation to factors like the US dollar, inflation, interest rates and sovereign bond yields.

In comparison, silver has a relatively small amount for investment, just 40% of total supply. Because over half of global supply is needed for industrial applications, silver trades much more like an industrial metal than an investment commodity. When gold is over-valued compared to silver, investors take advantage of the arbitrage opportunity, by selling some of their gold holdings to buy silver. To learn how to trade the gold-silver ratio, read Silver continues to gain in tight market

This also explains silver’s volatility. Because the investment market for silver is so small (60% is locked up in industrial uses) it swings up and down wildly with relatively low volumes.

A record amount of silver was sought in 2018. According to the Silver Institute’s annual survey, total physical demand last year rose 4% to 1,033.5 million ounces - a three-year high. The need for silver was driven mostly by purchases of bars and coins, jewelry and silverware.

Unlike gold which serves primarily an investment function and as material for jewelry (known as “the fear trade and the love trade”), silver’s properties make it ideal for a number of applications - almost as many as oil. The metal is strong, malleable and conducts heat and electricity better than any other material. Gold also has these properties but it is too expensive to use in circuit boards, solar panels, electric cars, etc.

The amount of silver produced from mines fell by 21.2 million ounces last year, the third consecutive drop after 13 years of uninterrupted supply growth. The 2019 World Silver Survey attributes the 855.7Moz loss to falling production at lead and zinc mines; 75% of silver is mined as a by-product, mostly of gold, copper, lead and zinc.

As for 2019, mine supply from the top three silver-producing countries, Peru, Chile and Mexico, all dropped in the first half of this year. Data collected from each country showed Peru’s H1 silver production was down 10%, Chile fell 7% and Mexico saw a 4% decrease from January to May.

Analytics company GlobalData crunched the silver numbers and came out with a positive outlook for silver producers, right up until 2023. The firm says that year, global silver production should top a billion ounces (compared to 920Moz in 2018), with 50 new projects in the pipeline expected to produce silver either as a primary or secondary metal. The largest mines to come online in the next three years include the El Cajon mine in Mexico, Lundin Gold’s Fruta del Norte and the Mirabel mine in Ecuador, plus the Oernoe and Udokan mines in Russia.

Silver output in 2019 is expected to decline to 913.5Moz.

US dollar strength?

We left a discussion of the US dollar versus precious metals to the end, because it is the current strength of the dollar, in my opinion, that is really the only head-wind for gold and silver at the present time. If the dollar was weaker and heading downward, as it was for most of 2017, precious metal prices would be even higher than they are today.

Normally when the dollar falls, investors flock to gold, hence the inverse relationship between the two - when the dollar slumped between 1998 and 2008, gold prices nearly tripled, reaching $1,000 an ounce in early 2008 and nearly doubling between 2008 and November 2011, when gold hit $1,903 on the risk of the U.S. defaulting on its debt.

But the fact of the matter is, the US dollar was gaining at the same time as gold was pushing higher. What gives?

We present two reasons. The first concerns the dollar’s relative value compared to other currencies. The dollar automatically strengthens when the euro weakens, because the euro makes up just over half (56.6%) of the US dollar index DXY. A one-year chart plotting the EUR to USD exchange rate shows the euro falling steadily against the dollar, as the Eurozone struggles to ward off a continent-wide recession.

According to the IHS Markit PMI surveys for September, Germany is likely to fall into recession in the third quarter, with manufacturing in the doldrums, and the Eurozone is at risk of recession in the months ahead.

A key factor in Europe’s weakness right now is the trade war, Pound Sterling Live reports:

The U.S.-China trade war has hurt Germany and Europe's export-dependent economies more so than it has the two protagonists in the last year and the impact that the ongoing tariff fight has had on the Eurozone growth and inflation outlook was a key driver behind the September European Central Bank (ECB) decision to cut its deposit rate further below zero and to restart the quantitative easing program only just wound up in December 2018.

The trade war has also hurt China’s currency, the yuan. In early August the yuan slipped to below 7 yuan to the USD for the first time in a decade, prompting Trump to call China a currency manipulator. While the cheaper yuan boosts exports, offsetting the billions in US tariffs levied on Chinese goods, it also makes imports into China more expensive, putting pressure on an already strained economy.

The Asian superpower is experiencing much slower economic growth compared to the decade of double-digit figures posted from 2008-18, as China moves from an export-based to a consumer-oriented economy, and a trade war that has slapped hundreds of billions worth of tariffs on Chinese imports to the US. The latest round kicked in September 2 - $112 billion directed at imports such as diapers, shoes and food.

South China Morning Post quotes Capital Economics predicting that these new import duties will chop about 0.2 percentage points off China’s economic growth in 2019, and another 0.3% in 2020. Importantly, the research firm cut its 2020 growth estimate to 5.7%, below the 6% minimum growth target set by the government for this year.

Capital Economics reports that growth in China’s industrial production kept falling to just 4.4% in August, a 17-and-a-half-year low. The country’s manufacturing Purchasing Managers’ Index (PMI) also worsened, slumping to 49.5%. Any number under 50 represents an economic contraction.

Like central banks in the United States and elsewhere that are lowering interest rates to fight stalled growth, the People’s Bank of China did the same - earlier this month lowering its borrowing costs for a second month in a row - to 4.2%. The effect of lower rates has been to pull down the value of the yuan.

The bottom line is, with both China and the EU in a slump, versus its own economic growth humming along at 3.1% in the first quarter, the US currency is comparatively strong.

Steady demand for US Treasuries whose yields have escaped falling below zero, amid $17 trillion worth of negative-yielding sovereign debt, is another reason the dollar has remained strong. The surprising thing though is who is buying US T-bills. Barrron’s reported in May that during the first four months of the year, foreigners bought just 12% of the Treasuries auctioned, down from 22% in 2011. The slack though was taken up by US fund managers, who according to Treasury Department data, have bought 55% of Treasuries this year, more than double the 21% in 2011.

The financial publication also notes that, while an extended trade war could spur more demand for T-bills, or prompt China to sell hers to defend its peg against the dollar, trade-related Treasury demand will likely persist—foreign central banks need dollars, as most global trade is invoiced in dollars whether or not U.S. firms are involved.

Engineering a dollar collapse

We know that President Donald Trump wants a massively lower dollar and will do anything to get it. Why? Trump thinks a low dollar is the way to bring jobs back to the US after so many were exported abroad to take advantage of lower labor costs. He wants to rebuild the US manufacturing sector, primarily through cheaper exports. He’s particularly targeted China for competitively devaluing its currency to dump cheap exports into the US, such as steel and aluminum. All Chinese imports into the US are now subject to tariffs of between 10 and 25%.

Throughout the past several years, the dollar has remained high in relation to other currencies, and that has created a large US trade deficit – $825 billion for 2018. Trump wants to get rid of the trade deficit, especially the deficit with China.

So was it a coincidence that Trump ordered 10% tariffs on $300 billion worth of Chinese imports, the day after the US Federal Reserve didn’t give him what he wanted, a 50-point rate cut? We think not!

Just look at what happened to the dollar. Exactly what Trump wished.

When Trump entered the White House in January 2017, the dollar initially fell, to as low as 88.45 on the DXY (dollar versus a basket of other currencies), in January 2018. Since then it’s been on a relentless upward climb, coming within a whisker of 99 at the end of July. After Trump’s tariff announcement, however, the greenback plunged to 97.12 on Aug. 5.

The dollar and gold move in opposite directions, with both going their separate ways due to increasing trade war tensions. On Aug. 5, gold hit record highs in a number of currencies including the British pound, the Japanese yen and the Australian and Canadian dollars.

But what is the connection between the Fed’s interest rate reduction, Trump’s trade war escalation and the falling buck?

It starts with Jerome Powell’s explanation that the rate cut was due to “global developments” (ie. the trade war), not anything to do with the US economy - the Fed’s normal reasoning for interest rate decisions.

That was like a dog whistle to Trump, who came a runnin’ with his reply.

Within 24 hours, the unconventional president announced that the trade truce was over and his administration was planning a full court press on the Chinese with 10% tariffs on $300 billion of their products - a 180-degree turn from his climb-down on more tariffs, following the recent G20 meeting in Japan.

It all points to one conclusion: President Trump thinks he has found a way to lower the dollar and fix the trade deficit.

Trump will force the Fed to keep cutting rates all the way up to the election in the fall of 2020, using trade wars ie. China and the EU, as the reason to do it.

At Ahead of the Herd we think real interest rates will fall deep into negative territory (the 10-year Treasury real yield is already scraping zero), the US dollar will fall off its podium of exorbitant privilege, as the world’s reserve currency, and stock market participants will suffer horrendous losses.

Happy Birthday China! PM breather

Wanna buy or sell some gold in China? I’m afraid you’re out of luck, because the world’s second biggest economy has closed up shop for a week.

The annual Golden Week is one of two traditional holidays celebrated by the Chinese, the other being the Spring Festival (aka Chinese New Year) which starts in either January or February depending on how it falls on the “lunisolar” calendar. This year marks the 70th anniversary of Communist Party rule, which was celebrated Tuesday, Oct. 1 with a large military parade in Beijing.

The Chinese government created the first Golden Week in 2000, as a means of expanding domestic tourism (mission accomplished! See the trip-from-hell statistics on people movement below), allowing families to re-unite (often city workers head back to their home towns in rural or semi-urban areas), and to improve the nation’s standard of living. Golden Week usually starts on or around Oct. 1; three days of paid holiday are given, and the dates are arranged so that workers can get seven days leave in a row.

South Korea has something similar in mid-September known as “chuseok”. The three-day harvest festival and national holiday is akin to Canadian or American Thanksgiving. China’s Golden Week is longer though, typically 7 days.

The holiday is long enough, and represents such a colossal value of financial activity, to move markets, including gold. Here we’re taking a look at Golden Week’s impact on precious metals, which at time of writing, were sucking wind.

Spot gold lost up to $30 during the trading session, before regaining a few dollars to finish at $1,471.50 in New York - a difference of $24.40/oz between Friday and Monday. It was much the same story for silver, with the white metal slipping from Friday’s $17.50/oz close to $16.90, before rebounding a nickel near day’s end.

Palladium swung wildly between a range of $1,679/oz and $1,640, settling around the same as Friday's close, $1,661/oz. Platinum plunged 4.8%, with the last bid showing $885/oz, $43 lower than Friday.

The Mother of all traffic jams

Golden Week commemorates the founding of mainland China in 1949, when Communist Party leader Mao Zedong, victorious from the Chinese Civil War, proclaimed the People’s Republic of China from atop Tiananmen Square. This year marks the 70th anniversary of the founding.

A few interesting facts about the holiday make the (relatively) minor travel hassles that go along with upcoming Canadian Thanksgiving pale in comparison.

In 2000 during the first Golden Week, an estimated 28 million people traveled to see families; in October 2017, those en route had mushroomed to 705 million! That’s 19 times the population of Canada, all traveling at once. Some calculations put half of China on the move at the beginning of October.

For each Golden Week, Chinese people make between 12 and 15 million rail trips, 335 million travel on toll highways, and around 13 million fly to their hometowns. (statistics courtesy of the South China Morning Post) Millions also travel to Hong Kong and overseas to mark the founding of the nation of 1.3 billion.

Zerohedge.com

Golden Week is not actually golden

So with hundreds of millions of people including traders shutting down their computers for an entire week - something that would be unheard of in the United States or, say, Germany - it is no surprise that the lack of economic activity would dent the gold market. And that is what we find.

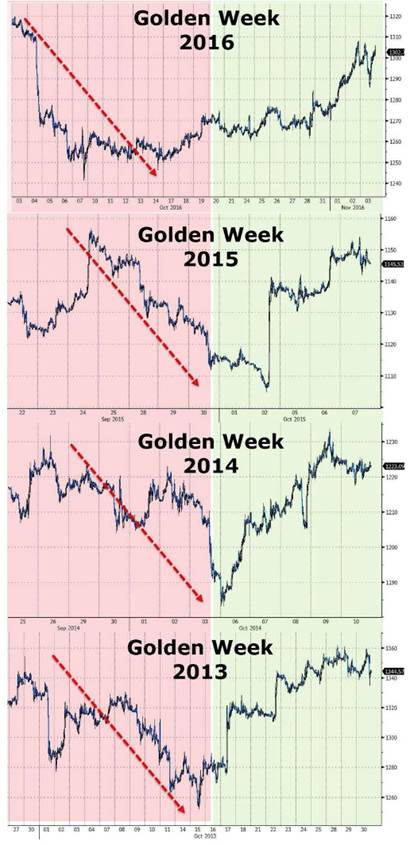

This morning while reading Zero Hedge, I came upon a very interesting set of gold charts. They show a definite downward trend during the Golden Week national holiday, going back every year until 2013.

Zerohedge.com

How to explain this phenomenon? Well, Chinese traders account for a large portion of gold demand, buying tons of physical gold for both investment purposes and jewelry. China and India vie for the jewelry buyer top country spot every year.

Thus, with so many traders and financial employees off for the week, the gold market takes a hit in demand, causing oversupply, and lower prices. When traders return to their desks a week later, gold is back in demand, lifting prices up.

There’s another notable trend observed since 2017 - gold prices are sinking before the holiday even starts, likely as a result of traders front-running in anticipation of lower prices. The front-running, which is when a broker/ trader makes trades before a non-publicized order to gain a price advantage, has been happening earlier and earlier every year. This year the gold selling started on Sunday, a full two days before the start of the holiday, and continued with relish throughout most of Monday before it turned upward around 2 pm New York time.

China’s stock market is normally volatile in the days leading up to Golden Week. Bloomberg notes that this year, China’s stock market closed in the red ahead of the week-long National Day holiday for the first time since 2011. Equity traders were in no festive mood, after reports Friday that the White House is considering ways to limit U.S. investors’ exposure to China. The benchmark Shanghai Composite Index slid 0.9% Monday to its lowest in a month as investors seized the last chance to price in the possibility of worsening tensions with the U.S. during the holiday.

Conclusion

Gold and silver’s strength right now is due to a “perfect storm” of factors that are underpinned by strong market fundamentals for both precious metals. On the demand side, gold is seeing safe-haven demand coming from a number of directions, including political turmoil in Washington, little progress in trade talks with China, and several hot spots around the world especially Iran.

We also have an easy monetary environment that is pushing down yields around the globe to record-low, even negative levels. That is enticing central banks and other investors to bulk up on gold - both ETFs and physical gold ie. bars and coins. The US Mint even had a run on American Eagle gold and silver coins.

On the supply side we are looking at tightening for both gold and silver. Above-ground stocks of both precious metals are virtually even. The combination of high grading, which lowers both reserves and grades, a drastic reduction in new discoveries due to a lack of exploration spending, and decreased mine lives, means the gold mining industry will be extremely challenged to maintain current production levels.

Silver supply is also challenged to meet demand. The amount of silver produced from mines fell by 21.2 million ounces last year, the third consecutive drop after 13 years of uninterrupted supply growth. Mine supply from the top three silver-producing countries, Peru, Chile and Mexico, all dropped in the first half of this year.

Naturally I follow the usual factors that influence gold prices: the US dollar, bond yields, interest rates, inflation, ETF inflows/ outflows, central bank bullion purchases, safe haven demand, etc. As the charts above show, a lower gold price before and during Golden Week is an established trend going back seven years, as is the upward price acceleration just after the week ends.

This is an environment tailor-made for gold investments.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2019 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.