Market Action Suggests Downside in Precious Metals

Commodities / Gold & Silver 2019 Oct 15, 2019 - 08:09 AM GMTBy: Jordan_Roy_Byrne

At present, there could be a number of positive developments for precious metals.

At present, there could be a number of positive developments for precious metals.

Last Friday, the US Dollar cracked lower and could be at risk of lower levels into year end.

Days earlier the Federal Reserve announced new “QE-like” measures just as they told us it was not really QE.

In addition, the market is showing a nearly 68% chance of a rate cut later this month.

Isn’t all this bullish for precious metals? Shouldn’t precious metals be challenging recent highs on this news, rather than fading?

The market is a discounting mechanism. It anticipates and discounts news and fundamental developments in advance.

QE is not necessarily bullish for precious metals unless it directly leads to inflation through increased government spending or helicopter drops.

Dollar weakness should help precious metals but it hasn’t been the primary driving force lately.

Fed policy and rate cuts are the primary driver for precious metals and the market already anticipated these rate cuts over the summer. The potential October rate cut is largely priced in and the market now could be discounting a pause in rate cuts into 2020.

This interpretation aligns with the technicals.

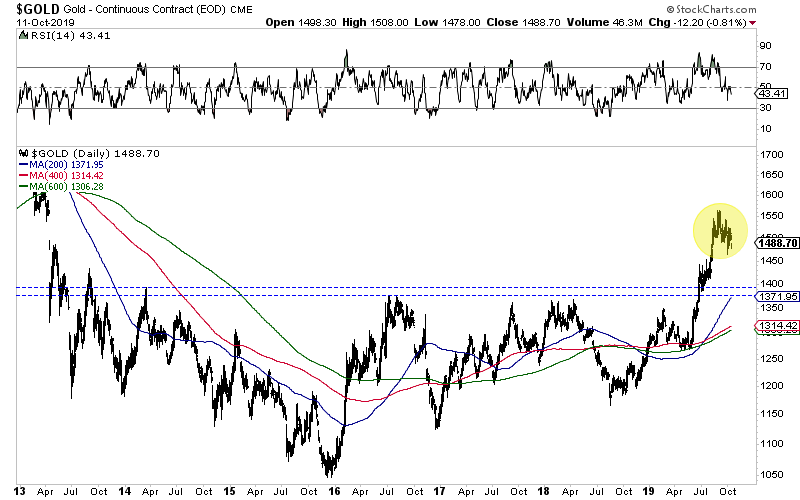

Gold has been battling around $1500/oz but cracked last Friday. It was its first weekly close below $1500 for the first time since July.

Gold has initial support at $1420 to $1425 with strong support at $1370 and $1400.

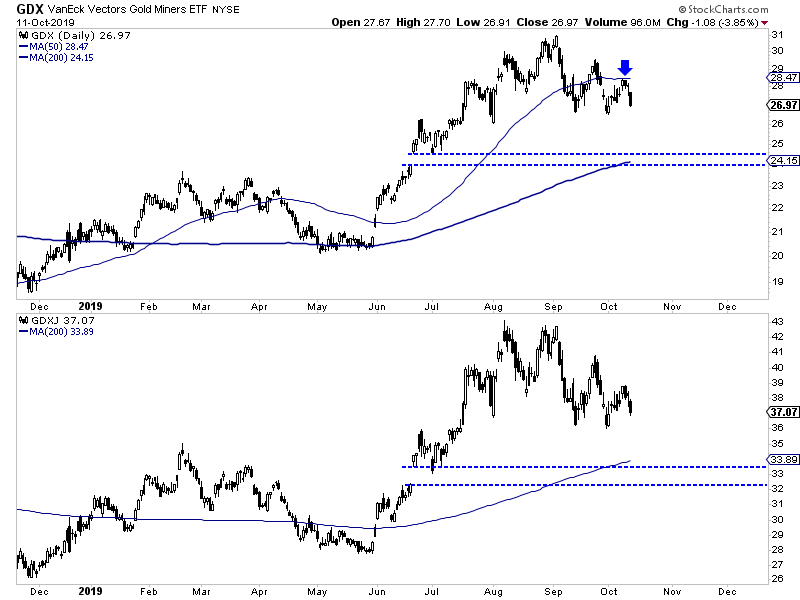

Last week the oversold rally in the miner ETFs (GDX, GDXJ, SIL) peaked and reversed course at 50-day moving averages. The miners remain in a short-term downtrend and still have room to fall to their 200-day moving averages.

GDX closed just below $27.00. It has a confluence of strong support at $24-$25.

GDXJ closed just above $37.00. It has a confluence of strong support at $33-$34.

The precious metals sector has not reacted positively to potential favorable developments and the technicals continue to argue for lower prices. As bulls we need to respect this near-term outlook rather than fight it.

In the meantime, wait for Gold and gold stocks to get more oversold and approach the key support levels. Better value and new opportunities will continue to emerge.

Use this time to tweak your portfolio and err on the side of buying quality at a discount.

To learn the stocks we own and intend to buy during the next correction that have 3x to 5x potential, consider learning more about our premium service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.