Currencies Show A Shift to Safety And Maturity – What Does It Mean?

Currencies / Forex Trading Oct 17, 2019 - 03:34 PM GMTBy: Chris_Vermeulen

Recent rotation in multiple foreign currencies hints at the fact that a new stage of the “Capital Shift” process is taking place and that skilled technical investors need to pay very close attention to how these currencies continue to react over the next 3 to 6+ months. In the recent past, most of the world’s foreign currencies were declining in value while the US Dollar continued to strengthen. In fact, we authored many research articles about these trends and how weakness in foreign currencies will drive new foreign investment into the US stock markets for two simple reasons; strength and security.

Recent rotation in multiple foreign currencies hints at the fact that a new stage of the “Capital Shift” process is taking place and that skilled technical investors need to pay very close attention to how these currencies continue to react over the next 3 to 6+ months. In the recent past, most of the world’s foreign currencies were declining in value while the US Dollar continued to strengthen. In fact, we authored many research articles about these trends and how weakness in foreign currencies will drive new foreign investment into the US stock markets for two simple reasons; strength and security.

Now that a few of the world’s most mature economies, and some that may surprise you, are starting to change directions, we may be beginning a new stage of the “capital shift” process that may open up multiple new opportunities for skilled technical traders. As the old saying goes, “follow the money”. At this point, if our research team is correct about these price trend changes, following the money may mean opening our eyes to new investment opportunities across the Pacific and Atlantic – as well as very near to the US.

Before we continue, we suggest reading the following research post to understand a bit about the history of our research and be sure to opt-in to our free market trend signals newsletter.

September 10, 2019: METALS & THE US DOLLAR: HOW IT ALL RELATES – PART I

The first thing we want to highlight is our belief that the US Dollar and US stock market should continue to provide price strength and upward price opportunity – even throughout any price correction or contraction that our researchers may identify. Our predictive modeling systems have shown us what we believe to be an incredibly accurate prediction of future price activity over the next 3 to 5+ years.

Even though we are not going to share that research with you today, the one thing we want all of our followers to understand is that the US stock market, and likely the US Dollar, are poised to continue to see longer-term upward price growth over the next 3+ years. Yes, there may be a few price rotations/declines throughout this process and we need to be aware that price naturally attempts these types of rotations in an effort to provide future price support, price exploration and future price trends. The price must always attempt to establish new highs or lows throughout a trending process.

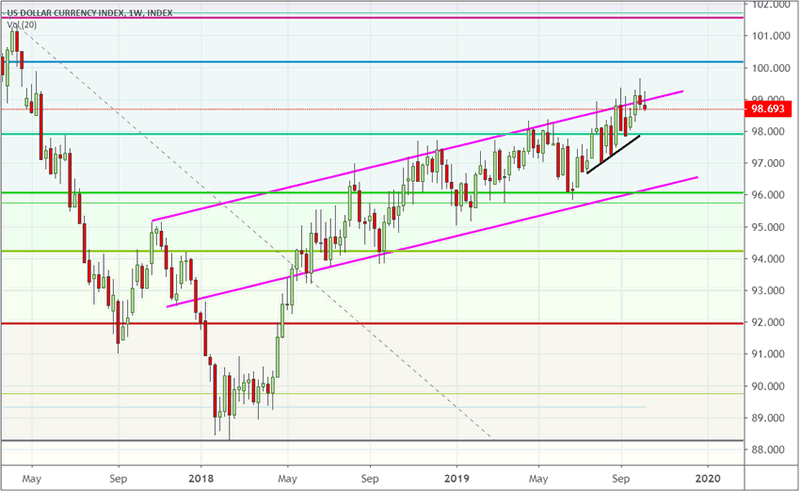

US DOLLAR

The US Dollar has been trending higher since early 2018. We believe the US Dollar will continue to push higher within the price channels we’ve drawn on this chart and, eventually, attempt to move to levels above 100 near the end of 2020 (or slightly after this date). We don’t believe anything will disrupt the continued strength of the US Dollar unless some major economic/credit crisis completely destroys the support of the global economic markets and takes everything down with it.

Our researchers believe the new shift in the “capital shift” process of global investing is centered around the concept that certain global currencies, as well as their associated stock markets and strategic stock sectors, may have reached a point where price is exceedingly below fair value and when one considers the fundamental economic strengths related to maturity, economic capabilities, geopolitical or proximity economic factors and future leadership/opportunity factors – investors are suddenly viewing these currencies and stock markets as “uniquely positioned for potential upside growth”. Thus, this change in perspective could drive a new upside price trend throughout a number of undervalued currencies as well as present a very real possibility that skilled technical traders may find real value and real opportunity by expanding their search criteria into assets related to these currencies.

One of the most basic elements of investing is understanding how supply-demand economic functions work and where the current “equilibrium” is at. The easiest way for us to try to explain this concept is to think of a very sought-after product (let us assume one ounce of gold) and the price of that gold as a measure of the price level in relation to demand. When the price of gold is very low, buyers rush into the market to buy up as much as they can afford because the perception is that gold prices should be higher (thus gold is undervalued). This means the equilibrium level is higher than the current price level of gold. When the price of gold is very high, buyers stay away from purchasing (or can’t purchase because it is too high) and the price will eventually begin to fall lower because demand is very low. This means the equilibrium level is lower than the current high price of gold.

Price always moves from above or below the equilibrium level to price levels on the opposite side of the equilibrium level. Think of the equilibrium level as the optimal price level where demand meets supply and where future expectations of price are minimized. This equilibrium level is where the price would be if we removed all the hype, fear, greed and speculation out of the market. The equilibrium level fluctuates as true fundamentals and true price exploration takes place across the supply-demand curve. Almost like the average temperature fluctuates throughout the seasons of the year.

When a shift in investor sentiment happens, much like a shift in seasons, price changes direction begins to rally of decline and this shift in trend changes the supply-demand equilibrium level as investors pile into or pull out of a market. Thus, if our researchers are correct and this change in the longer-term opportunity for selected currencies is a true longer-term capital shift, it may be a very early opportunity for investors to begin focusing on the opportunities that will become present in the near future.

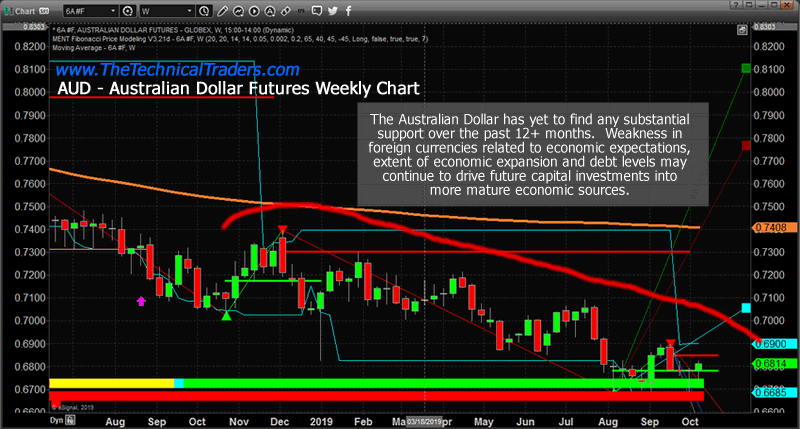

Australian Dollar

The first currency we want to focus on is the Australian Dollar. Historically, the Australian Dollar has continued to trend lower over the past 18+ months and currently shows very little strength or opportunity to form a bottom. The lows near 0.67 may prove to become a future bottom in price, but the trend has not confirmed this yet and because of that, we believe weakness is still prevalent in price.

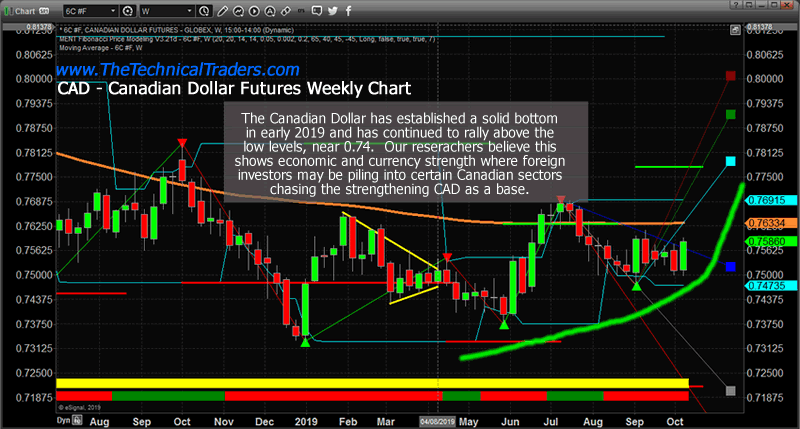

Canadian Dollar

The Canadian Dollar, on the other hand, has set up an intermediate price bottom in early 2019 and has continued to strengthen moderately over the past 10+ months. One thing that we want to point out about our research is that we believe currencies and nations that have strong economic ties and proximity advantages (being close to the US and having strong economic ties with the US) are very likely to perform well or begin to strengthen in the near future. Canada has a number of factors that may prove to be advantageous going forward. Strong economic ties with the US, a booming cannabis and resource market, strong agriculture exports and a very mature economy compared to other nations.

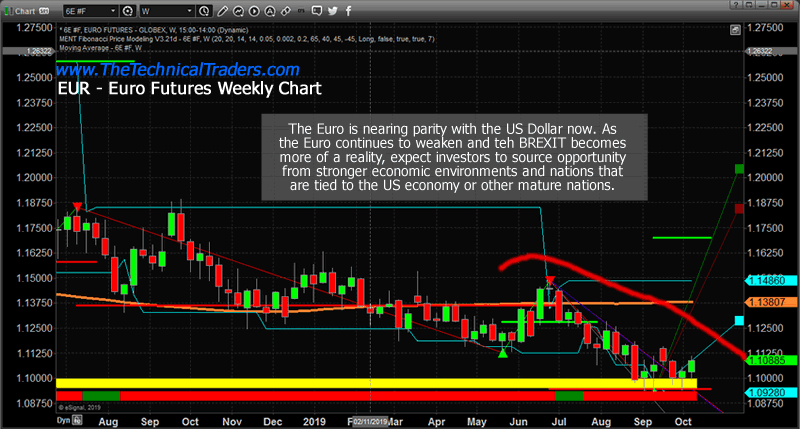

Euro

The Euro price chart continues to illustrate price weakness as future expectations of economic strength is very far off. The interesting facet related to the Euro is that a weakening Euro will eventually present a very clear opportunity for investors the instant the European-union enters any type of economic recovery or strength. Until that happens, we believe the continued price weakness will potentially drive the Euro lower – eventually attempting true parity with the US Dollar.

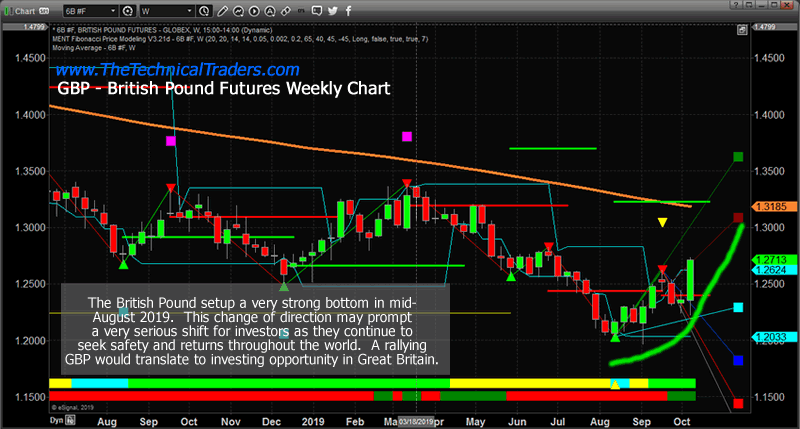

British Pound

The British Pound has recently rebounded to the upside with some level of ferocity. Of course, this 6+ week upside price rally does not make a new longer-term price trend yet – but we believe this upside price move may be related to the future BREXIT deal and renewed economic ties/trade with the US. In other words, investors may be shifting expectations and price levels into acceptance that the British Pound may become a very solid future investment assuming the BREXIT deal creates a renewed economic cooperation between Great Britain and the US.

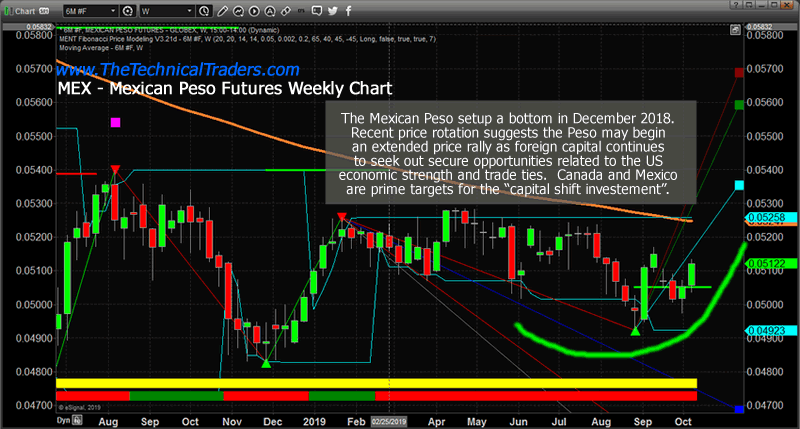

Mexican Peso

Lastly, the Mexican Peso has recently started to base near 0.049 and may possibly attempt to move above longer-term resistance near 0.053 on renewed expectations of a stronger economy, stronger economic ties with the US and a post-US 2020 Presidential election rally. Currently, the bottom in the Peso occurred in 2017 near 0.04785. We believe the Peso could rally above 0.061 over the next 18+ months – resulting in an 18%+ upside price rally related to stronger US economic growth and stronger economic ties between the US and Mexico.

Concluding Thoughts:

These changed in direction in the Mexican Peso, Canadian Dollar and British Pound suggest that global investors may begin shifting capital into the strongest sectors and/or the value sectors of these countries attempting to capture a late 2020 price rally that may carry forward into the 2021 and beyond economic recovery that we expect to take place after the 2020 US Presidential elections.

Please keep in mind that quite a bit hinges of the outcome of the US Presidential elections in 2020. Just like we saw on election night in November 2016, global investors and global corporate leaders will react to any fear or opportunity related to who is expected to win the US elections in 2020. More taxes, more regulation, more uncertainty will immediately derail any attempted economic recovery that sets up over the next 10+ months. We need to watch how these currencies strengthen before the election, then become very cautious 2 to 3 weeks before the election takes place in 2020.

I urge you visit my ETF Wealth Building Newsletter and if you like what I offer, join me with the 1-year subscription to lock in the lowest rate possible and ride my coattails as I navigate these financial market and build wealth while others lose nearly everything they own during the next financial crisis. Join Now and Get a Free 1oz Silver Bar!

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for both short-term swing trading and long-term investment capital. The opportunities are massive/life-changing if handled properly.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.