Gold Prices Stand to Rally on Brexit Delay

Commodities / Gold & Silver 2019 Oct 23, 2019 - 04:32 PM GMTBy: Submissions

With the odds of a Brexit deal by the October 31 deadline declining, gold bulls may stand to benefit.

With the odds of a Brexit deal by the October 31 deadline declining, gold bulls may stand to benefit.

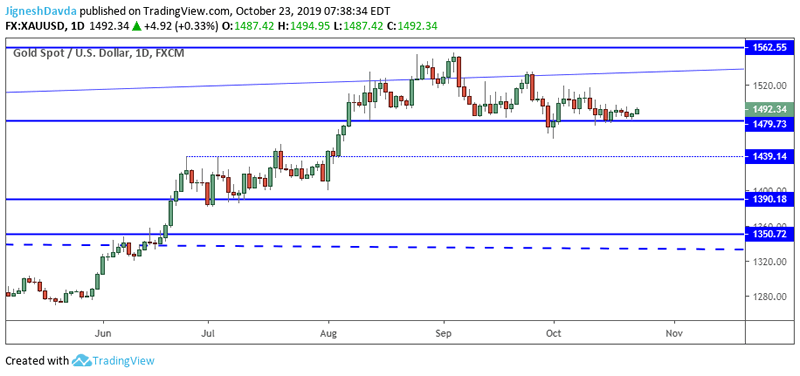

The price of gold has been in a narrow range over the past session with support at $1479 drawing buyers while the shiny metal continues to struggle to rally above the psychological $1500 level.

Gold prices have been held higher by a weaker dollar as of late while at the same time suppressed by positive developments in the US-China trade war and progress in Brexit. But that could change quickly.

Brexit Delay Appears Inevitable

UK Prime Minister Boris Johnson was victorious in progressing legislation required for an EU exit on Tuesday but failed to garnish the votes needed to expedite the timetable.

He had tried to pass legislation through within three days but lawmakers expressed concern that the time frame was too short considering the bill spans 115 pages.

This means it is not very likely that the UK will be able to finish what they need to do in order to exit the EU by the stipulated October 31 deadline.

Further, Johnson has now suspended work on the legislation, in a move to put pressure on the EU to respond to the request for an extension. This request was sent on Saturday after a special sitting in Parliament that was meant to decide on the actual Brexit vote. Lawmakers instead voted to pass legislation first in an attempt to minimize chances of a no-deal Brexit.

Key Support at $1479

So far, spot gold has held above $1479 support. The shiny metal could see some upside if EU officials grant the UK the extension that they asked for on Saturday.

The rationale being that an extension will trigger Johnson to call a snap election which effectively removes the current optimism in the market that a deal will be reached.

Gold prices will still be at risk of further positive trade developments, but a further defeat in Brexit proceedings stands to trigger an interim rally.

A major upside level on my radar for some time has been $1562. This level was important support in 2011 and in 2012. I consider this to be a major level for the yellow metal as there is further resistance just above it to create a confluence.

I am referring to resistance at $1586 which marks the 61.8% Fibonacci retracement as measured from the 2011 high to the 2015 low.

XAUUSD Oct 23 Daily ChartWhat Could Cause Gold Prices to Extend Losses?

Aside from positive trade developments that could cause pressure on gold prices, a positive Brexit development could do the same.

The EU may decide to offer a ‘technical extension’. This would be a short extension meant to facilitate the extra week or so it might take the UK parliament to put the current deal through.

An EU decision should be made fairly shortly, and I expect gold prices will react accordingly.

For a bearish scenario, I would look for a sustained break of $1479 to target the next level of support at $1439.

By Jignesh Davda

https://www.thegoldanalyst.com

Copyright 2019 © Jignesh Davda - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.