Gold, the Shining Star Among Commodities

Commodities / Gold & Silver 2019 Oct 24, 2019 - 04:44 PM GMTBy: Arkadiusz_Sieron

Gold is the most effective commodity investment, yet it is under-invested, the WGC reports. What makes it special and deserving of our focus? And how to translate that focus into an appropriate allocation within one’s portfolio?

Gold is the most effective commodity investment, yet it is under-invested, the WGC reports. What makes it special and deserving of our focus? And how to translate that focus into an appropriate allocation within one’s portfolio?

Gold is Unique Commodity. Or… Maybe Not?

Gold is often included into commodities. It seems natural, gold is a metal, after all. And just like other raw materials, it is used in the production of manufactured goods. But gold is much more than that. According to the recent report published by World Gold Council, there are six features which differentiate gold from other commodities:

• Gold has delivered better long-term, risk-adjusted returns than other commodities;

• Gold is a more effective diversifier than other commodities

• Gold outperforms commodities in low inflation periods

• Gold has lower volatility

• Gold is a proven store of value

• Gold is highly liquid.

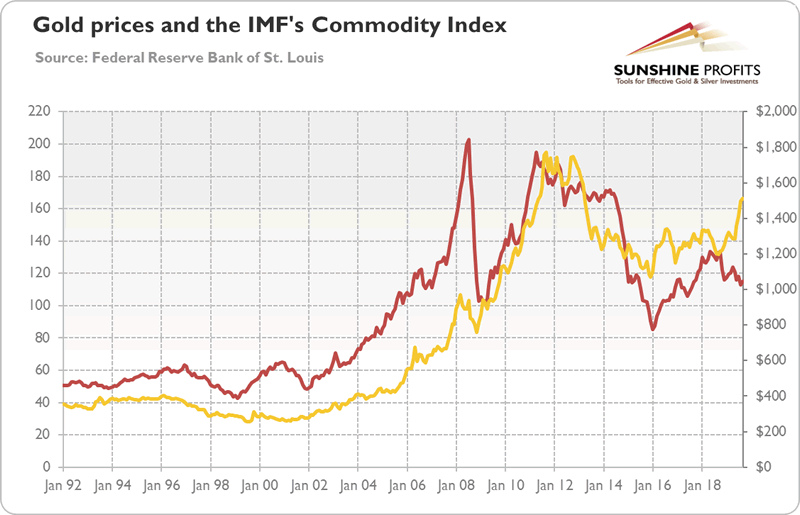

We generally agree. Gold has indeed outperformed not only broad-based indices but also sub-indices and most individual commodities over the last several years. In particular, as the chart below shows, the general commodity index has fallen since 2014, while gold prices have risen during that period.

Chart 1: Gold prices (yellow line, right axis, London P.M. Fix, $) and IMF’s Global Price Index for all commodities (red line, left axis, 2016 = 100) from January 1992 to September 2019.

Gold is also a better portfolio diversifier. This is because gold is negatively correlated with other assets during economic crises, hedging investors from tail risks. In contrast, industrial commodities are positively correlated to economic growth.

The yellow metal is also less volatile that other commodities. The WGC did not explain why, but we will do. One thing is that the gold market is very liquid. The average daily trading in the global gold market ranges between US$100bn and US$200bn a day. However, the oil market is also liquid, but oil is more volatile. You see, what is also important is that there are enormous gold holdings around the world. In other words, gold – in contrast to oil and other commodities – has very high ratio of stocks to flows. It means that changes in the annual mine production or in technological demand have miniscule impact on the gold market.

The WGC claims that gold is a better hedge against inflation. Although all commodities protect against high inflation, gold is said to perform better during periods of low inflation. We would be careful here. Although it’s true that gold has outperformed many commodities in recent few years of subdued inflation, the 1980s and 1990s showed that the yellow metal can struggle in periods of muted price pressure.

But we agree that gold is a store of value. We have actually repeated for years that gold should not be treated as commodity, but as monetary asset. This is because newly mined gold is not consumed but accumulated. So, the annual balance of supply and demand – although crucial in the copper or oil markets – is irrelevant for gold prices. The commodity approach is terribly wrong. Gold is a metal, just like copper or oil, but it has an exceptionally high stock-to-flow ratio. It makes gold behave much more as a currency than as a commodity.

Implications for Gold Investors

The investing implication is that gold should be differentiated from other commodities. Investors put gold into the commodities bucket, although it behaves differently – and better in many respects. It means that gold is very often underrepresented in investment portfolios. You see, the commodity indices have a very small allocation to gold, typically between 3 and 12 percent. As commodities tend to represent a small portion of investors’ overall portfolio – around 10 percent – gold’s weight is miniscule. Gold has unique features and – in order to substantially improve the performance of an investment portfolio – its share should be higher and, according to many experts, somewhere between 5 to 10 percent.

If you enjoyed the above analysis, we invite you to check out our other services. We provide detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.