‘Power to the People’ and Mining Metals and Minerals

Commodities / Metals & Mining Nov 01, 2019 - 04:45 PM GMTBy: Richard_Mills

The 1960s and 70s were decades of incredible social upheaval.

The 1960s and 70s were decades of incredible social upheaval.

Fed up with wars, governments out of touch with their ideals, authority figures who didn’t get them, the “flower children” of the '60s took to the streets to demand equal rights for women, civil liberties for black Americans, an end to President Johnson and Nixon’s Vietnam quagmire - all fueled by a powerful new popular culture that called for peace and celebrated the freedom of the individual to do as he/ she pleased.

Fifty years on, the world has changed in ways the “hippy generation” could scarcely imagine.

Protests today tend to be in developing countries, places where greed, graft and corruption mix with inequality in a toxic brew that frequently boils over into the streets, and is just as often violently suppressed. I’m alluding here to the Arab Spring that demanded the reform of oppressed societies, but has for the most part failed to deliver - just look at Lebanon, Egypt and Saudi Arabia.

In the West it’s not so much regime change people are after, as a change in the way governments conduct themselves. Consider the mass demonstrations in Hong Kong directed at the former British colony’s Chinese overlords, or global climate change protests. In the US, bad memories of the 1960s race riots were stirred up when racists and anti-racists confronted one another in Charlotte, North Carolina.

Taking a run through the news, it appears that social tensions are increasing, there are more protests in more countries, extremism is on the rise, countries deemed safe for travel and conducting business are suddenly falling into chaos. Take Chile as an example. A week of protests, riots and arson over inequality has resulted in 19 dead and 7,000 arrested, with damage to businesses and public transportation nearing $2 billion.

Global growth is slowing - we seem to be on the cusp of some kind of major reset, as government, household and business debt spirals out of control, and central banks slash interest rates in an effort to re-start stalled economic engines.

For many the fruits of capitalism have shown up as spoilt goods. It’s harder to buy a house, get ahead, save for retirement. Working people are mad as hell, and they aren’t going to take it anymore.

There is social unrest in France, Spain (Catalonia), Germany with the 24% Alternative for Germany (AfD) vote in Thuringia, the UK (Brexit), Algeria, Iraq, Lebanon, Egypt, Russia, Hong Kong, Venezuela, Chile and Bolivia. To all of this we can add increasing polarization in the US, Extinction Rebellions (climate change), plus the latest conflict de jour, a Canada split between regions and control over natural resources.

This global trend of social agitation is noticed by us at Ahead of the Herd, but we wish to take it a step further. We’d like to know, if so many people are willing to stand up and demand more from their governments, how will this affect mining? We understand from our articles on resource nationalism, how mining companies are often targeted by governments intent on reaping more profits from them, expropriating mines, denying permits, or putting more restrictions on miners, all in the name of “the will of the people”. Indonesia’s ban on the export of raw ores, so they can be beneficiated locally, is one example, the closing of 20-odd nickel mines by Philippines President Duterte’s government is another.

Yet this seems different - something of a global movement of people demanding they get what they think they deserve. While the conditions in each country experiencing social change are diverse, there are common themes.

“While thousands of miles apart, protests have begun for similar reasons in several countries, and some have taken inspiration from each other on how to organize and advance their goals,” reads a recent analysis by the BBC.

The British broadcaster finds inequality, corruption, the need for political freedom and climate change are ideas that bind protesters together. The catalysts for social change, though, have been the passage of seemingly minor laws.

In Lebanon, people rose up over the government’s Orwellian decision to tax What’s App calls. Chileans donned balaclavas and dodged tear gas over a proposed increase in transit fares.

Why would citizens of Chile, a relatively well-off country, take to the streets over something this banal? It’s less surprising if one considers that half of Chilean workers earn less than 400,000 pesos per month (roughly US$550).

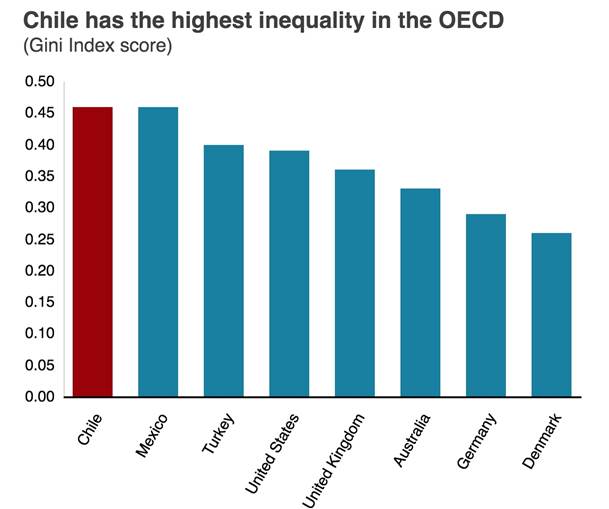

In fact Chile leads the OECD’s 30 wealthiest nations in inequality. The richest 1% of Chilean society earns one-third of the nation’s wealth, states a UN report.

The dissonance between perception and reality showed up in a photo, widely circulated on social media, of President Sebastián Piñera, pictured dining in an upmarket Italian restaurant, as rioters trashed supermarkets and subway stations.

In the Middle East, corruption runs rampant. The BBC states:

In Lebanon, protesters argue that while they are suffering under an economic crisis, the country's leaders have been using their positions of power to enrich themselves, through kickbacks and favourable deals.

People in Iraq have also been calling for the end of a political system that they say has failed them. One of the main points of contention there is the way government appointments are made on the basis of sectarian or ethnic quotas, instead of on merit.

Demonstrators argue that this has allowed leaders to abuse public funds to reward themselves and their followers, with very little benefit to most citizens.

Other countries host citizens bent on gaining a voice within a political system they feel silenced. The student-led demonstrations in Hong Kong are the obvious example; but their efforts and tactics, no doubt facilitated by social media, were reflected by hundreds of thousands of people in Barcelona, who rallied to express anger over Spain jailing Catalan separatists.

Resource nationalism

Resource nationalism is the tendency of people and governments to assert control, for strategic and economic reasons, over their natural resources.

Developing countries have seen the benefits of foreign companies coming in to extract their natural resource endowment, in the form of jobs and higher wages for their often-impoverished citizens, and government revenues through taxes, royalties or dividends.

Yet, for countries such as Ecuador and Venezuela, it’s not enough. Their governments were elected to help relieve the plight of the poor, and they intend to make good.

Miners are easy targets because mining is a long-term investment and especially capital intensive. Mines are also immobile, so mining companies are at the mercy of the countries in which they operate. Outright seizure of assets often happens using the twin excuses of historical injustice and contractual misdeeds. There is no compensation offered and no recourse.

Countries are getting creative in how to bleed away miners’ profits. Governments have gone beyond taxation in getting more out of the mining sector with a wave of requirements such as mandated beneficiation (where ore is processed locally rather than exported raw), export restrictions and increased state ownership of mines.

This is becoming a serious problem in the case of in-demand metals such as copper and nickel, needed for the new green economy, and critical minerals like rare earths, mined by countries with an itchy resource nationalism finger.

As the demand by Western countries for these raw materials grows, the connection between social unrest and mining is tightening.

Let’s look a look at lithium/ copper supply disruption caused by civil unrest and resource nationalism.

Lithium

The need for lithium is going through the roof, but the United States produces very little of the lightweight wonder-metal.

Chinese entities control 60% of the world’s electric battery production, and the majority of lithium hydroxide, the high-grade lithium product that goes into Tesla’s lithium-ion EV batteries, for example.

This has put the United States in a vulnerable position with respect to securing the lithium it will need for current and future electric vehicle production.

If China were to embargo all the lithium it mines or processes, destined for the United States, the result would be a serious setback for the country, just as it is taking steps to become a player in the lithium space.

In fact the more direct threat to the US lithium supply chain is Chile.

Chile’s vast northern salt flats, the Salar de Atacama, have operations run by the top two lithium mining producers in the world, state-owned SQM and Albemarle, a US chemicals company. The salar straddles Chile, Argentina and Bolivia and contains about three-quarters of the world’s lithium reserves.

The area’s high elevation, intense sunlight and steady, hot winds are ideal for lithium brine operations, where lithium and other minerals like potassium and potash are pumped up, stored in large ponds and concentrated through evaporation.

These advantages plus Chile’s perch on the Pacific Ocean have made it a leading supplier of low-cost, high-grade lithium. However over the past few years Chile has lost its competitive edge due in no small part to resource nationalism.

Back when Chile was governed by right-wing dictator Pinochet, lithium was classified as a strategic resource due to its use in nuclear fission. As a result, private mining companies are required to partner with the state, as Albemarle has done, or obtain a special permit to mine lithium on their own. However the government has yet to provide guidelines on obtaining this permit, called a CEOL, and that has spooked a number of would-be foreign investors. A uniform royalty and tax regime is also lacking.

Since lithium prices started climbing in 2014, Wealth Minerals is the only new player to receive permitting required to complete exploration work in the Salar de Atacama, having partnered with Chilean state mining company Enami.

And despite strong global demand for lithium, Chile’s output has remained flat; in 2017 the country lost its crown to Australia, home to the largest hard-rock lithium mining operation in the world, Greenbushes. A number of other spodumene mining operations outputting lithium hydroxide needed for EV batteries, have sprung up in Australia over the past couple of years.

Earlier this year Santiago-based SQM delayed a planned expansion to more than double its production of lithium carbonate to 120,000 tonnes, until the end of 2021. Competitor Albemarle has sparred with the Chilean Economic Development Agency (CORFU) over increasing its quota to 2 million tonnes lithium carbonate equivalent (LCE), finally reaching an agreement this past January. However the US company with the only operating lithium mine in America, Silver Peak, expects this year’s lithium production from Chile to be unchanged, when it should be growing.

Reuters quotes Joe Lowry, an independent lithium industry consultant, saying that Chile is “disappointing the industry” and that if expansion plans keep getting pushed farther out, it could cause “uncertainty and complexity in supply chains”. What would Tesla/ Panasonic, Chevy or Nissan do if they no longer had a steady supply of lithium?

Chile has already lost marketshare to its competitors; it now produces about 20% of the world’s lithium compared to 36% four years ago.

Meanwhile indigenous groups that draw water from the same sources as mining companies are pressuring the government to put a cap on lithium production.

Chile’s underground lithium reservoirs need to be recharged by rainfall and snow melt from the Andes, but a study found more water was leaving the salar than returning, prompting restrictions.

In the summer of 2018 Chile clamped down on water usage, imposing a rare ban on new permits to extract water from an aquifer that supplies water to BHP’s Escondida, the world’s biggest copper mine.

Albemarle abandoned its plan to nearly double production of lithium carbonate to 145,000 tonnes, after Chilean regulators questioned its water-saving technology and environmental studies.

SQM wasn’t given any special treatment as a state-owned company. A spat over whether the company had overdrawn its water quota resulted in an agreement to reduce the amount it pumps and open its operations to increased scrutiny.

The crack-down on water use has been seen as a success for indigenous peoples. The president of the Atacama Indigenous Council, representing 18 communities, told Reuters it will block any new mines, due to a lack of understanding about their environmental impacts. A new government water study is due out this year.

Reuters notes that Canada’s LiCo Energy Metals scrapped its Purickuta project in the Atacama due to resistance from the local indigenous community.

Now enter the recent civil unrest. On the Atacama salt flats, indigenous protesters blocked access to SQM’s operations. Earlier in the week, Escondida was reportedly operating at a reduced rate after union workers walked off the job in solidarity with protesters around the country. Other copper miners were able to maintain production, “though continuing protests had hobbled port facilities, public transportation and supply chains, impacting operations,” according to a media report.

The breakdown of normality in Chile is perhaps best symbolized by the cancelation, on Thursday, of an important meeting of world leaders. The Asian-Pacific Cooperation Summit, intended to be the forum at which Donald Trump and Chinese President Xi Jinping signed the first phase of a trade deal, was supposed to take place in Santiago on Nov. 16-17. A UN climate change conference scheduled for December was also scrubbed.

It is clear, from all the above-mentioned reasons, that Chile’s risk profile for investors has risen considerably. Even Albemarle, a company with a market cap of $6 billion, is having trouble maintaining production levels, due to increased government oversight over output and water usage.

Copper

Chile being the largest copper producer, social unrest threatens to have a big impact on the world’s copper supply. Though impacts to production so far are limited, mining unions in Chile frequently strike and there is no reason to suggest they won’t continue to walk picket lines in support of fellow workers.

The copper industry typically sees millions of tonnes of the red metal left in the ground when workers down tools seeking higher wages and benefits, and mines declare ‘force majeure’ for other reasons, typically weather-related.

Analysts have apparently penciled in disruptions of 1.2 million tonnes this year that will be stripped from the copper market, likely resulting in higher prices.

In September 2018 the Indonesian government, Freeport McMoran and Rio Tinto finally came to an agreement over ownership of Grasberg. The long-running dispute ended with Indonesia gaining a controlling interest in 51% of the world’s second largest copper mine.

The latest round of copper resource nationalism appears to be occurring in Africa.

In Zambia, an economic crisis is forcing the country to consider seizing copper mines. Africa’s second largest copper producer is expecting copper production this year to be up to 100,000 tonnes less than in 2018.

Zambia’s Chamber of Mines attributes the production drop to changes in mining taxes which have driven up costs and forced copper miners to reduce output. The country’s copper production tumbled 11.3% in the first quarter of 2019.

The government wants to liquidate Vedanta’s Konkola Copper Mines (KCM) which it accuses of breaching its operating license and polluting the lands of nearly 2,000 villagers, Reuters said. A court hearing in England is pending.

For its part, Vedanta claims it is owed nearly $180 million in value-added tax refunds.

Meanwhile First Quantum Minerals, which is offering to buy the Zambian government’s 20% stake in the country’s largest copper mine, Kansanshi, giving the company 100% control, is also fighting with the government over a $7.9 billion tax bill. The 1.5% increase in mining royalties this year prompted First Quantum to announce plans to fire 2,500 workers, but it later backtracked on the proposal, according to the Financial Post.

Last year the Democratic Republic of Congo (DRC) raised taxes and royalties on copper and cobalt amid fierce opposition from mining companies. A new mining code giving more power to the state has put a freeze on new mining projects.

Reports of child labor at Congolese mines are rampant, as well as hordes of artisanal miners. This summer soldiers were sent to clear out tens of thousands of hard-scrabble diggers who eke out a living by illegally hand-mining minerals, with dangerous consequences to themselves and the environment.

Ebola is another good reason to stay well clear of the DRC. According to the Center for Infectious Disease Research and Policy, four new cases of the deadly, highly contagious disease were reported last week - from the North Kivu and Mandina provinces. Much of the DRC’s mining activities take place in the North Kivu. So far the Ebola outbreak has reached 3,264, including 117 probable cases.

The DRC is the world’s fourth largest copper producer and mines the most cobalt of any country - about 60% of global output.

The number of countries on copper’s “do not enter” list is definitely growing. To recap, they include Chile, Indonesia, Zambia and the DRC - all major copper-mining countries with large reserves.

However we also know that copper is heading towards a supply crunch.

By 2035, without major new mines up and running to replace the ore that is being depleted from existing copper mines, we are looking at a 15-million-tonne supply deficit. Copper grades have declined about 25% in Chile in the last decade - highlighting the urgent need for grassroots exploration to arrest the trend.

Conclusion

Country risk is one of the most serious and unpredictable risks facing mining operations and investor interests - where the political and economic stability of the host country is questionable and abrupt changes in the business environment could adversely affect profits or the value of the company’s assets.

We’ve seen many instances of companies losing assets that were lawfully theirs. Several countries come to mind as places where shareholders could, without warning, receive news that their investment's operations have been taken over by the government or its friends, or where permits get delayed or canceled outright.

This is not a static list. The Fraser Institute does a good job of ranking countries annually according to their attractiveness to investors. Last year Chile ranked sixth, above copper competitor Peru, all Canadian provinces/ territories with the exception of Saskatchewan and Quebec, and every US state but Alaska and Nevada. Where will the lithium and copper power-house fall in the next Fraser Institute rankings, given how far the long arm of the state has reached into the mining industry, along with fresh uncertainty caused by wide-spread protests, property damage, deaths and injuries?

It’s a reminder that we, as junior resource investors, must constantly assess, and re-assess, where we put our hard-earned cash. Knowledge is power. Having the right information will save you from making mistakes and hopefully guide you in the direction of shareholder profits.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2019 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.