Five Gold Charts to Contemplate as We Prepare for the New Year

Commodities / Gold & Silver 2019 Nov 15, 2019 - 04:09 PM GMT 1. Gold’s annual returns 2000 to present

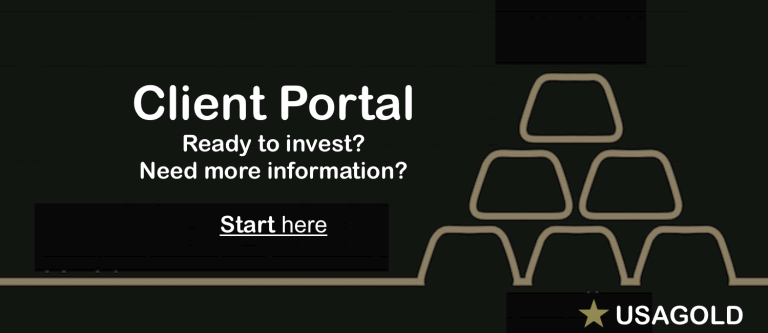

1. Gold’s annual returns 2000 to present

In the February edition of this newsletter, we ran an article under the headline: Will 2019 be the year of the big breakout for gold? Though we would not characterize gold’s move to the upside so far this year as ‘the big breakout,’ 2019 has been the best year for gold since 2010 even with the recent correction taken into account. Back in September when the price gold reached $1550 per ounce – up almost 22% on the year – 2019 was looking more like a breakout year. Now with the move back to the $1460 level, the market mood has become more restrained. As it is, gold is up 15 of the last 19 years and still up 14.45% so far this year.

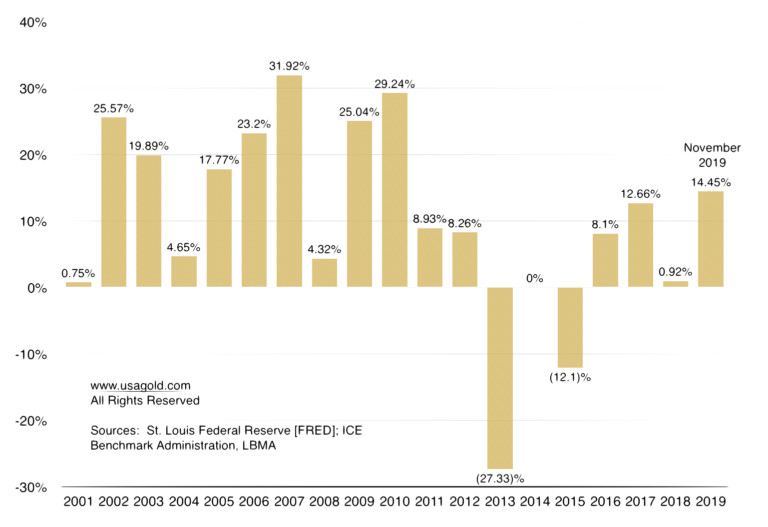

2. Gold’s seasonality

Chart courtesy of Gold ChartsRUs/Nick Laird

We are moving into the part of the seasonal cycle when historically gold regains price momentum. Whether or not that will be the case this year remains to be seen, but more there is more than enough uncertainty on the global economy’s plate to elevate the possibility. “The first thing to notice on the chart is that gold tends to go up quite strongly and with relatively little choppiness in the first two months of the year,” says analyst Mike Acra at FXStreet. “This fits in quite well with the ‘January story’ but if you take a look at the end of the year, you will notice that the move up actually starts in December, not January, so it might be beneficial to consider a ‘December-February story.’”

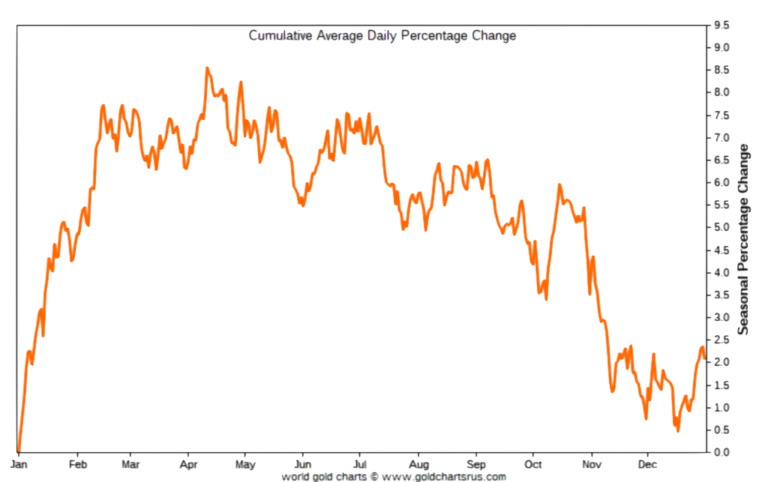

3. The correlation between global negative-yield debt and the price of gold

Chart courtesy of the World Gold Council

The World Gold Council recently released a timely report* tying gold’s sturdy performance this year to the rising tide of global negative-yielding debt and the demand it has already created among investors seeking safe haven. “Our research suggests,” says the Council, “that lower expected bond returns favor additional gold exposure in well-diversified portfolios.” The report concludes that “gold prices have responded to the surge in negative real-yielding debt, as evidenced by the strong positive correlation between the amount of debt and price of gold over the past four years. To some degree, this illustrates the erosion of confidence in fiat currencies related to monetary intervention.”

* It may be time to replace bonds with gold

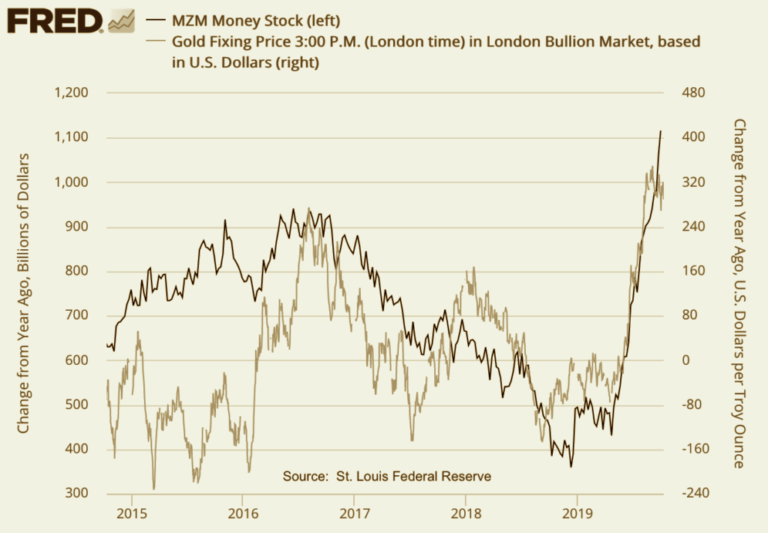

4. The NEW correlation between money supply growth and the price of gold

One of the principal points Degussa’s Thorsten Polleit makes in a recently published study is that gold has followed the money supply higher consistently since the early 1970s (what we often refer to as the fiat money era). Of late, the money supply has surged dramatically and gold is moving in tandem with it. “[S]ound economics,” says Polleit, “would inform us that central banks’ inflationary policies – and, no doubt, the expansion of the quantity of money is inflationary – do great harm to the economy and the purchasing power of money in particular. As long as central banks continue with their inflationary scheme, the savvy investor has good reason to consider keeping gold as part of his/her liquid means because the purchasing power of gold cannot be debased by central banks printing up ever greater amounts of currency.”

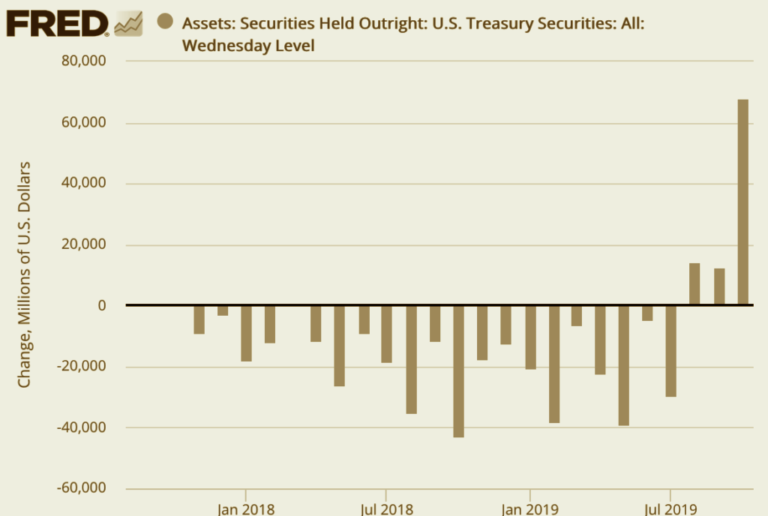

5. Additions to the Fed’s balance sheet

Chart courtesy of the St. Louis Federal Reserve [FRED] Source: Board of Governors Federal Reserve System [US]

This chart shows the abrupt reversal of the quantitative tightening program begun in early 2018. Current repo rescue operations, or QE Lite as it has been dubbed, is likely to further boost the Fed’s stockpile of U.S. Treasuries. “But clearly,” says Tocqueville’s John Hathaway in a recent interview, “I think the expectation of tightening – the pretense that they were going to be a responsible central bank is just totally out the window. And they’re joining the crowd and creating more and more liquidity. We saw what they recently did in terms of the repo market they’re not calling a QE. But I don’t know how they get away with that. $60 billion a month is bigger than QE 2, I think. So I think we’re back on a path towards monetary debasement. And that is what we in the gold world have always expected would take place. And now it’s sort of out there for everyone else to see.”

Thinking about buying gold and silver?

Wizard of Id cartoon reprinted with permission. All rights reserved. USAGOLD 2019

Gold in six easy lessons

1. Don’t buy it because you need to make money; buy it to protect the money you already have.

2. Don’t look at price as a barrier; look at it as an incentive.

3. Don’t buy the paper pretenders; buy the real thing in the form of coins and bullion.

4. Don’t fall prey to glitzy TV ads; do your due diligence instead.

5. Don’t allow naysayers to divert your interest; allow yourself the right to protect your interests as you see fit.

6. Don’t forget the golden rule: Those who own the gold make the rules!

QUESTIONS? ORDER DESK: 1-800-869-5115 x100/orderdesk@usagold.com

ORDER GOLD & SILVER ONLINE 24-7

The Power of Gold in Times of Crisis

Editor’s note: Ronan Manly’s incisive review of the uses of gold in a handful of contemporary worst-case scenarios – the fall of Saigon, South Korea’s national mobilization to erase its external debt, Argentina’s recurring economic disasters, Venezuela’s hyperinflation (plus two others we omit in this condensed version of his in-depth study) – is meant to instill the notion that the ordinary citizen-investor has options when full-out crisis comes knocking on the door. Of course, gold has its uses for crises that fall short of the ultimate worst case, as it showed globally during the 2007-2008 financial meltdown. Bullion Star offers the full article in the clear at the link just below. This article is reproduced with permission.

by Ronan Manly, Bullion Star

While physical gold is a well-known safe haven asset which investors flock to in times of market turbulence as a way of protecting their wealth, gold is also the ultimate asset to own and possess in times of crisis and emergency. These crisis situations can range from episodes in which fiat currencies collapse, to times in which gold buys safe passage across international borders, and even to periods in which only gold can bail out and rescue an entire nation. Sometimes gold even ensures self-survival and can literally be the difference between life and death.

History is replete with examples of gold being the ultimate asset in times of crisis and desperation, where time and time again, gold comes to the rescue and provides its holders with choice and freedom, choice and freedom that are not available to those who do not hold gold. This is not ancient but recent history, history in our lifetimes and in some cases even events ongoing now. . . .

Gold as a safe passage for refugees from Vietnam

Following the Vietnam War, the Fall of Saigon, and Vietnam’s reunification in 1976, the southern part of Vietnam experienced a mass exodus of people, driven by a crippled economy, government discrimination and forced departures. Hundreds of thousands of ethnic Chinese and Vietnamese fled to other parts of Asia over both land and sea, an exodus which peaked in 1978-1979.

Those refugees fleeing by sea sometimes did so in large ships organised by people smugglers and often with the support of the Vietnamese communist government. An exit route on these ships was only assured for those who could pay these government officials and people smugglers what they demanded. The price for safe passage? Between 10 and 12 taels of 24 karat gold for an adult and half that for a child (1 tael = 1.2 troy ounces).

This gold payment was often in the form of traditional Kim Thanh gold bars, two slim large bars and one small bar wrapped together in rice paper, making a total weight of 1 tael. While these bars were popular in Vietnam, they were also recognised and accepted across all of South East Asia as portable wealth and so were monetary liquidity for the region.

South Korea – Gold mobilization to pay external debt

As the Asian financial crisis spread to South Korea in late 1997 and torpedoed the country’s financial markets, it triggered a currency and banking crisis that decimated the Korean won and pushed the country to the verge of bankruptcy. Rapidly burning through its foreign exchange reserves and with international lenders circling, the government called in the International Monetary Fund (IMF) in December 1997 with a multi-billion rescue package to bail-out the country’s spiraling external debt. At that time the largest ever IMF bail-out, the rescue came as a massive blow to the Korean nation both economically and psychologically.

Embarrassed and at a loss to understand how a star Asian tiger economy could implode so quickly, the South Korean nation then did something quite extraordinary and spontaneous by collectively confronting the adversity via the mobilisation of a patriotic gold collection campaign to help pay off South Korea’s foreign debts. . . .

Running over four months from January to April 1998, the gold collection campaign collected 227 tonnes of gold worth $2.13 billion, with 165 tonnes alone collected in the first month January. The collection involved 3.5 million households, representing 23% of the nation’s 15 million households and 10% of the gold held in South Korea at that time, and the gold collection drive helped restore the nation’s credibility abroad, thereby allowing South Korea to fully repay the IMF-backed debt in August 2001, three years ahead of schedule.

If you think you could benefit from a concise review of the latest news, analysis, and opinion on the gold market from a variety of expert sources, then News & Views is the newsletter for you. Since the early 1990s, we have offered it free-of-charge as a monthly service to our regular clientele and as an incentive to prospective clients. By subscribing, you will automatically receive future editions and occasional in-depth Special Reports by e-mail.

Argentina – Accustomed to crisis, accustomed to gold Beyond providing safe passage and saving a nation, gold comes into its own during periods of hyperinflation, economic stagnation, currency collapses and frozen bank accounts. Events unfortunately all too familiar to the majority of Argentinians in South America´s third largest economy. Lurching from one economic crisis to the other as it does, at times the economic history of Argentina can appear to be a long drawn out car crash of hyperinflationary events, currency collapses, debt crises, and general market panic.”

Argentinians unfortunately are accustomed to this drama, having seen years of high inflation, hyperinflation in 1989-1990, a severe economic crisis in 2001-2002, and many instances of rapid loss of value and confidence in their currency, the peso. For example, during the hyperinflationary period in 1989, prices in Argentina rose by an annualized 5000%.”

“During the 2001-2002 crisis, the peso lost three-quarters of its value at the same time that bank accounts across Argentina (in both US dollars and pesos) were more or less frozen. With the local population accustomed to rapidly escalating prices, evaporating savings and a plummeting peso, Argentinians have on a number of occasions done what everyone across the world eventually does when confronted with this same problem: they buy hard currencies and gold.”

And when prevented from buying currencies such as the US dollar due to government-imposed capital controls, banking restrictions or bank account freezes (the Corralito), Argentinians take the only available option – they flock to buy physical gold as a form of saving and wealth preservation, buying locally refined gold bars and coins from banks such as Banco de Ciudad in Buenos Aires. Popular coins include Mexican and Chilean gold bullion coins, South African Krugerrands and British gold Sovereigns.

Venezuela – Gold the ‘go to asset’ in ongoing chaos

One place which is not on the verge of a crisis, since it is actually in one, is fellow South American nation Venezuela. Marked by a collapsing currency, hyperinflation, banknote scarcity, social unrest and shortages of essentials, gold has replaced paper currency across most aspects of Venezuela’s economic life as a means of payment, as a form of barter to acquire goods and services, and in some cases literally for day-to-day survival.

Sometimes it’s a direct exchange of gold for goods or food, but in Venezuela, gold is also money. For example, in the capital Caracas, in the central El Silencio district, citizens flock to the gold dealers who trade on the streets around the Esquinas of Padre Sierra, La Pedrera and La Bolsa. Amid the hyperinflation and rapid price rises, even previously well-off families and pensioners are now forced to sell their valuable gold jewelry and family treasures to supplement their incomes. . . .

In Venezuela, as the fiat currency bolivar has died and the economy collapsed, gold has emerged to perform the role that it has performed for thousands of years – which is a trusted form of money and a real form of wealth. In Venezuela’s case also, gold has become a survival mechanism for the struggling population.

Conclusion

Although each of the above examples are different, they all illustrate the power of gold in times of crises and emergency, a universal currency that is universally accepted and recognised, a universal asset that is borderless, liquid, and portable. In Vietnam, gold bought freedom of passage across international borders, with refuges using portable gold wealth to pay fares and as emergency money to start new lives.

In South Korea, an entire nation helped to rescue its economy using the only widely held asset which had held value and which was internationally liquid. Beyond the nationalism and patriotism, most Koreans sold their gold, albeit at a lower than market price, so for them too gold was emergency money as their economy imploded, a store of value that worked as expected and when expected.

Likewise in Argentina, Venezuela, Zimbabwe and Vietnam, physical gold was a safe haven and financial insurance for those that had the foresight to held it. Gold fulfilled its role of saving for those who had held it, a role that fiat currencies utterly failed in. Gold also played the role of medium of exchange in all of these situations, when trust in paper currencies had died.

The causes may differ – hyperinflation, death of paper currencies, economic mismanagement, capital controls, wars – but the outcome is always the same. People and economies instinctively turn to the ultimate asset gold as a safe harbour in times of crisis and emergency. Because only gold persists as a store of value and is trusted as a medium of exchange. Gold allows choices that are not available to those who do not hold gold. In crises, only gold provides economic freedom and liberty.

A word on USAGOLD – USAGOLD ranks among the most reputable gold companies in the United States. Founded in the 1970s and still family-owned, it is one of the oldest and most respected names in the gold industry. USAGOLD has always attracted a certain type of investor – one looking for a high degree of reliability and market insight coupled with a professional client (rather than customer) approach to precious metals ownership. We are large enough to provide the advantages of scale, but not so large that we do not have time for you. (We invite your visit to the Better Business Bureau website to review our five-star, zero-complaint record. The report includes a large number of verified customer reviews.)

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.