Growing Inequality Unrest Threatens Mining Industry

Commodities / Metals & Mining Nov 30, 2019 - 04:10 PM GMTBy: Richard_Mills

In the 1986 classic ‘Platoon’, Charlie Sheen’s character Chris Taylor tells everyone that he dropped out of college to serve in the Vietnam War. This sets him apart from the other grunts and makes Taylor seem noble and patriotic, giving up school to go fight in a war. But his credo is soon shot down by a black soldier nick-named King, played by Keith David, who tells him:

“You got to be rich in the first place to think like that. Everybody know, the poor are always being f&$#8! over by the rich. Always have, always will.”

Thirty-five years later, King’s world-weary cynicism is just as relevant. The rich are getting richer, inequality is on the rise, and the middle class, which since the 1950s has been the backbone of the US economy, is shrinking.

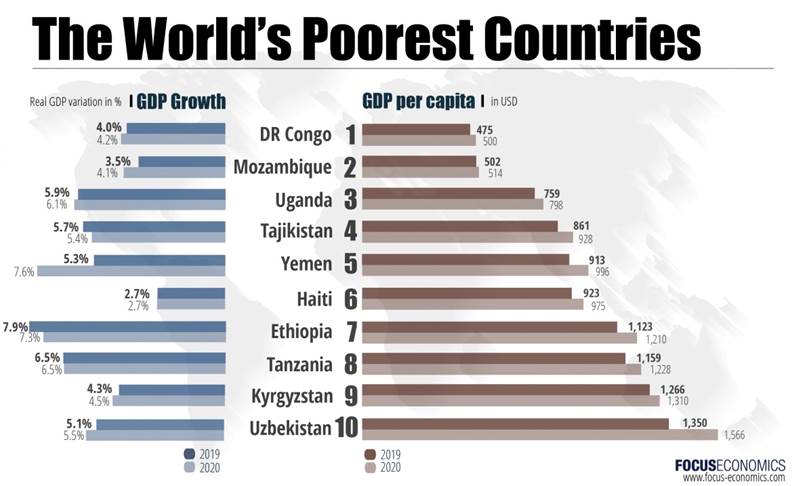

In 2018 the three highest-paid chief executives in the United States earned more than the output of several countries. Tesla’s Elon Musk (#1 @ $513.3 million), Brendan Kennedy (#2 at $256M), the CEO of pot success story Tilray, and Bob Eger (#3 @ $146.6M), the boss of Walt Disney Co., made a combined $914 million, more than each of 11 countries that rank among the poorest in the world.

Celebrities are also raking it in like never before. Last year Taylor Swift earned $185 million. The 29-year-old’s ‘Reputation’ stadium tour grossed $266.1 million, the highest in US history. Argentinian soccer star Lionel Messi scored $127 million including $35M in endorsements, Mexican boxer Canelo Alvarez weighed in at $94 million, and Swiss tennis star Roger Federer pocketed a cool $93.4 million.

Meanwhile the average North American is going deeper and deeper in debt - their confidence to spend fueled by continued low interest rates.

Earlier this year consumer debt in the United States hit $4 trillion for the first time. Total credit card debt surpassed $1 trillion, with the average American holding a balance of $4,923. A credit card survey quoted by CNBC says more than one third of Americans, 86 million people, are afraid they’ll max out their credit card when making a large purchase, which most considered to be anything over $100. The interest rate on credit cards has risen from 15.11% in 2017 to a current average of 21.4%. That is despite the US Federal Reserve lowering interest rates three times since August.

Canadians are also loading up on debt with vigor. In March of this year Statistics Canada reported the average Canuck household was using a record 14.9% of its disposable income to meet debt obligations. Household net worth, which is the value of Canadians’ assets minus liabilities, declined by 2.8% in the last quarter of 2018, the largest drop on record, StatsCan says.

As incomes fail to keep up with spending, the difference financed by credit, the middle class is eroding - made worse by a drop in the number of middle-income jobs, through off-shoring and automation.

The share of adults living in middle-income households declined from 61% in 1971 to just 50% in 2015. Two-thirds of the 11% that were no longer middle class, migrated to upper-income levels, while a third became poorer.

And that gap continues to widen. The richest 400 Americans now control more wealth than the bottom 60% - it’s the greatest rich-poor divide since the 1920s.

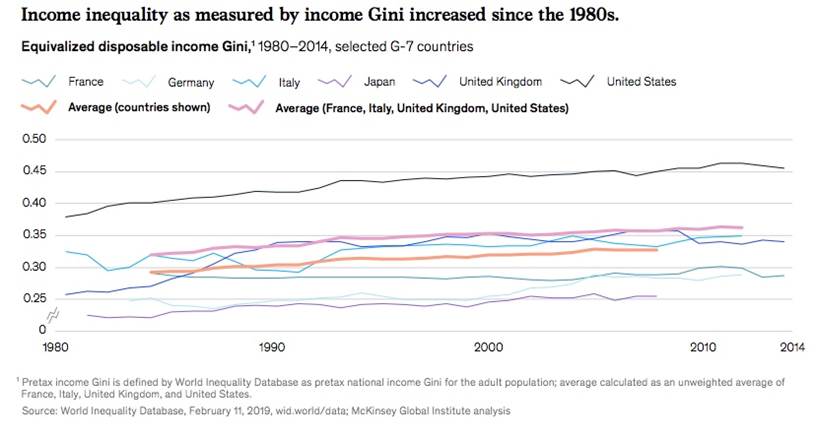

A 2019 report by McKinsey Global Institute piles on more evidence of inequality getting worse. While the consulting firm notes the gap between developed and developing economies is shrinking, particularly with the rise of China and India, in many advanced economies, the trend is for the rich to pull away from the middling and the poor:

For example, in 2014, the wealthiest 1 percent of people in G-7 countries owned about 27 percent of the total wealth… In the OECD, wealth inequality has risen since 2000 on average in two-thirds of the member countries, as measured by the ratio of mean-to-median wealth

Economic disruptions and the widening of inequality over the past several decades have affected large segments of the population in G-7 countries. Wages have stagnated for many, male employment has declined, and the economy may have become more fragile, as market incomes increasingly fail to lift people out of poverty. Market incomes for households were flat or fell for around 70 percent of households in advanced economies in 2014 compared with similar households in 2005… At the same time, the cost of basic goods and services, such as education and healthcare, has risen faster than overall inflation.

A 2016 report by the OECD examining the effects of the Great Recession found that the poorest 10% were unable to recover from the blow dealt by the financial crisis. These people remain stuck in low-quality jobs, had more job insecurity and experienced higher long-term unemployment.

In contrast, the richest 10% rapidly bounced back, states the OECD report, via The Guardian: “By 2013/14, incomes at the bottom of the distribution were still well below pre-crisis levels while top and middle incomes had recovered much of the ground lost during the crisis.”

In the three years of the recession, 2017-10, the bottom 10% saw their incomes decline the most, 5.3%, while the top 10% only dropped 3.6% drop. From 2010-16, the incomes of the richest 10% grew an average 2.3 versus the poorest whose paycheques only increased by 1.1% - exacerbating inequality.

Chile, a warning

Why should we as resource investors care? The cold hard fact is, we aren’t investing in the poor. The reason is the connection between inequality and social unrest, which certainly affects mining. We only have to look at Chile to see this dynamic in action.

In October, a week of protests, riots and arson resulted in 19 dead and 7,000 arrested, with damage to businesses and public transportation nearing $2 billion.

Thousands of people turned out to show their frustration not only with rising transportation costs, but widening inequality and what some see as the government’s attack on the poor.

A state of emergency was declared and armed forces mobilized on the streets of Santiago for the first time in nearly 30 years. Chile, the world’s largest producer of copper and with the most lithium reserves, is considered among the most stable and business-friendly Latin American nations.

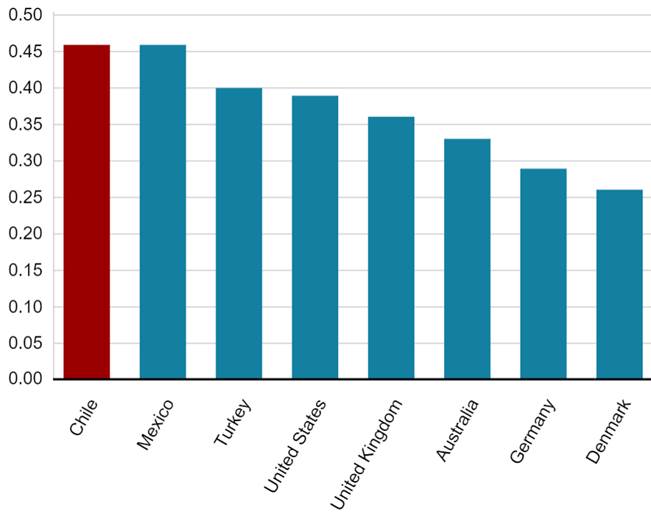

But many Chilean are poor. In fact Chile leads the OECD’s 30 wealthiest nations in inequality, followed by Mexico, Turkey and the US. The richest 1% of Chilean society earns one-third of the nation’s wealth. Half of the country’s workers earn less than 400,000 pesos per month (roughly US$550).

Privatization is also an issue. Many Chilean industries, including water, are in the hands of private companies.

While some believe the situation in Chile to be temporary and confined to cities, there are unsettling signs this is far from the truth. Earlier this month a nation-wide strike caused delays and disruption across several industries, including mining supply chains. Continued civil unrest could exacerbate copper supply constraints, according to research firm CFRA, via Marketwatch.

Last month protesters from indigenous communities blockaded a road, thus shutting down state-run lithium miner SQM’s operations. On Nov. 12, amid calls for a general strike, barricades blocked some roads and the entry of buses and trucks carrying workers to mines in the Atacama Desert.

Globalization backlash

Growing inequality is to a large extent behind a negative reaction to globalization that has been morphing into shape over the past several years.

Modern-day globalization is seen as the inter-dependence of national economies through cross-border movement of goods, services, technology, capital and workers.

But 173 years of globalization has not resulted in its promised rewards. Income inequality, in the UK and the US particularly, has never been higher, companies have left their home countries to set up factories where labor is cheaper, and the ideal of the European Union offering free movement of labor leading to economic growth has been lost amongst the wave of migrants turning up on European shores. These migrants compete with locals for scarce jobs and are dependent, at least initially, on government handouts.

Globalization has also been assailed by automation, in particular the increasing use of robotics in factories, which have displaced thousands of well-paid manufacturing jobs.

Donald Trump and other right-wing populists particularly in Europe such as France’s Marine LePen, Viktor Orbán from Hungary and Norbert Hofer, leader of Austria's far-right Freedom Party, have said enough of globalism - it’s time to go back to the idea of the nation-state where local workers and industries are protected, and the rest of the world is walled off.

Inequality and populism

Inequality leading to populism is a trend most often observed in right-wing political parties and their leaders, but it is also behind a groundswell of support on the left.

Consider the ‘Occupy Wall Street’ movement. Started by counter-culture magazine Adbusters with a campaign encouraging thousands of Americans to hold protests in Lower Manhattan, the group’s messaging against inequality, corporate greed and the influence of money in politics spread nation-wide, and across the world.

Occupy Wall Street is credited with spawning Black Lives Matter, NFL “take a knee” protests started by San Francisco 49’ers quarterback Colin Kaepernicke, a campaign for a $15 per hour minimum wage, and the ascent of Bernie Sanders.

In 2016 the forces of Occupy Wall Street reunited in support of Sanders, a Vermont senator, as a Democratic presidential candidate. “Without a doubt, people who had been excited and frustrated by the [Occupy Wall Street] encampment got sort of agitated to think about what they wanted to do next,” CNN quotes Todd Gitlin, a Columbia University professor and author of ‘Occupy Nation: The Roots, the Spirit, and the Promise of Occupy Wall Street.’ “Obviously, some of that spirit and some of those persons gravitated into the Bernie Sanders movement,” he added.

Recently the American left has been energized by the Democratic Party’s run-off for a 2020 presidential candidate to challenge Republican President Donald Trump.

Following the October Democratic presidential debate, Business Insider reported that A majority of the American public, a handful of presidential candidates, and a group of ultra-wealthy Americans agree that the United States needs a wealth tax to help close the growing wealth gap. In June, a group of 18 ultra-wealthy Americans referred to Warren's plan in an open letter begging to be taxed more.

Leading contenders Sanders and Sen. Elizabeth Warren are both in favor of a wealth tax that would make the richest Americans pay the federal government a percentage of their net worth every year.

As for whether the fall in incomes, living standards and the chances of getting ahead in society, viz a viz the expanding wealth of the 1%, have resulted in any change politically, the evidence is mixed.

The Conversation argues that, while persistent inequality over decades can be blamed for populist causes such as the election of Donald Trump, the rise of right-wing nationalists and the results of the Brexit referendum, it’s too simplistic to make a direct causal link. For example economic insecurity may lead to a backlash against immigrants, translating to votes for a populist with an anti-immigrant platform.

Another interesting question is whether populism, driven by inequality, has meant more representation by members of “the 99%”. In the US, so far the answer is no. In a piece following the 2018 mid-term elections, the New York Times observes that “Congress is made up of people who have credentials vastly different from those of most citizens.”

Meaning, while the new House of Representatives has a number of political novices, and more women and minorities than any Congress in history, over 70% are lawyers, business-people with white-collar jobs, and medical professionals.

Lawyers are way over-represented. They are under 1% of the voting population but comprise one-third of the House, compared to 10% of the legislatures in Sweden, France and Denmark. The product of having so many lawyers and business-people, is an assembly of law-makers likely to create and pass laws that benefit themselves and their professions. The op-ed states:

In part because Congress is filled with successful white-collar professionals, the House is much, much richer than the people it represents, and affluent politicians support legislation that benefits their own class.

“The rosy notion that lawmakers from business and professional backgrounds want what is best for everyone is seriously out of line with the realities of legislative decision-making in the United States,” wrote Nicholas Carnes, a Duke professor of public policy, in his book “White-Collar Government.”

Conclusion

For many the fruits of capitalism have shown up as spoilt goods. It’s harder to buy a house, get ahead, save for retirement. Working people are mad as hell, and they aren’t going to take it anymore.

Social upheaval is becoming more common in a greater number of countries. We’ve seen it in Chile, there is also social unrest in France, Spain, Germany, the UK (Brexit), Algeria, Iraq, Lebanon, Egypt, Russia, Hong Kong, Venezuela, Chile and Bolivia.

Especially in developing nations, ie. South America and Africa, politicians are pressured by their base, to enact policies that benefit everyday citizens. Inequality is a key driver of what is often a government-led attempt to download wealth from rich corporations to the poor.

Mining companies are targeted by governments intent on reaping more profits from them, expropriating mines, denying permits, or putting more restrictions on miners, all in the name of “the will of the people”. Indonesia’s ban on the export of raw ores, so they can be beneficiated locally, is one example, the closing of 23 nickel mines by Philippines President Duterte’s government is another.

Miners are easy targets because mining is a long-term investment and especially capital intensive. Mines are also immobile, so mining companies are at the mercy of the countries in which they operate. Outright seizure of assets often happens using the twin excuses of historical injustice and contractual misdeeds. There is no compensation offered and no recourse.

Countries are getting creative in how to bleed away miners’ profits. Governments have gone beyond taxation in getting more out of the mining sector with a wave of requirements such as mandated beneficiation (where ore is processed locally rather than exported raw), export restrictions and increased state ownership of mines.

As the demand by Western countries for these raw materials grows, the connections between inequality, social unrest and mining are tightening.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2019 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.