Setting Gold Market Expectations for 2020 Right

Commodities / Gold & Silver 2019 Jan 04, 2020 - 06:14 PM GMTBy: Arkadiusz_Sieron

Hooray, the twenties are here! But what will the 2020 bring for the gold market? Shall we see the beginning of the Belle Époque for the yellow metal?

Gold at the End of 2019

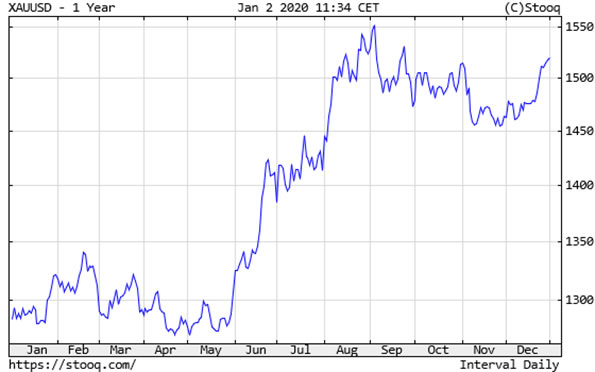

The last year was a very good one for the gold bulls, as one can clearly see in the chart below. Despite the soaring equities, the price of the yellow metal rose from $1279 to around $1520, or more than 18 percent. Bravo!

Chart 1: Gold prices in 2019.

In particular, gold managed to jump again above $1,500 at the very end of December, which confirms that the turn of the year is usually positive for gold prices. In the last few years, gold rallied in the beginning of year. So, looking at gold’s seasonality, January could be positive for the price of the yellow metal. But what about the rest of the year? Below I offer a few key insight. The more detailed fundamental outlook for gold in 2020, I provide in January edition of the Gold Market Overview.

Fundamental Outlook for Gold in 2020

From the fundamental point of view, 2020 may be worse for the yellow metal than in 2019. This is because the dovish central bank pivot that drove precious market in 2019 is largely behind us. The impact of existing accommodative U.S. fiscal policy is fading. The fears of recession are receding. The risks of the full blown U.S.-China trade war and a hard Brexit have diminished.

In other words, the monetary policy will be more hawkish than in 2019, while the fiscal policy will be similarly easy, supporting the U.S. dollar. The geopolitical headwinds have softened, which should help the risky assets and bond yields. So, we could see strong dollar, higher real interest rates and lower risk aversion – a very bad combination for the price of gold.

On the other hand, the next Fed move will be an interest rate cut, which can happen as early as this year. The expectation of a dovish move could support gold prices. Moreover, the U.S. GDP growth is expected to slow down, while inflation may finally rise. Meanwhile, growth may accelerate in other countries – if that happens, the greenback may weaken. Flatter U.S. growth with higher inflation and weakening dollar seems to be a positive combination for the gold prices.

However, the dovish expectations are already priced in to some extent, while inflation will not soar, but edge up, if at all. Given the dovish stance of the ECB and Bank of Japan, the U.S. dollar may remain relatively strong. This is why our base case is that fundamental outlook has deteriorated somewhat and after possibly pleasant beginning of the year, gold may struggle further down the road.

But black swans are flying just above the market surface. So, investors should be aware that they could be hit at some point with the harsh reality of economic slowdown in China and other countries, debt saturation, declining corporate profits, and uncertainty about the outcomes of the U.S. elections. In such an environment, gold will continue to be seen as an important safe-haven asset.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.