Shifting Undercurrents In The US Stock Market

Stock-Markets / UK Stock Market Jan 16, 2020 - 04:20 PM GMTBy: Chris_Vermeulen

Even as we write this post, the US Stock Market continues to push higher as global traders and investors pour capital into the continued US rally. The strong US Dollar continued to attract capital from around the globe and with fresh earning about to hit from Q4 2019, investors are expecting another round of solid income and earnings growth.

Yet, underlying all of this is the undercurrent of shifting capital into safe-havens like precious metals, Cryptos, and under-valued foreign markets. This shift started to happen late in Q4 2019 and accelerated early in 2019.

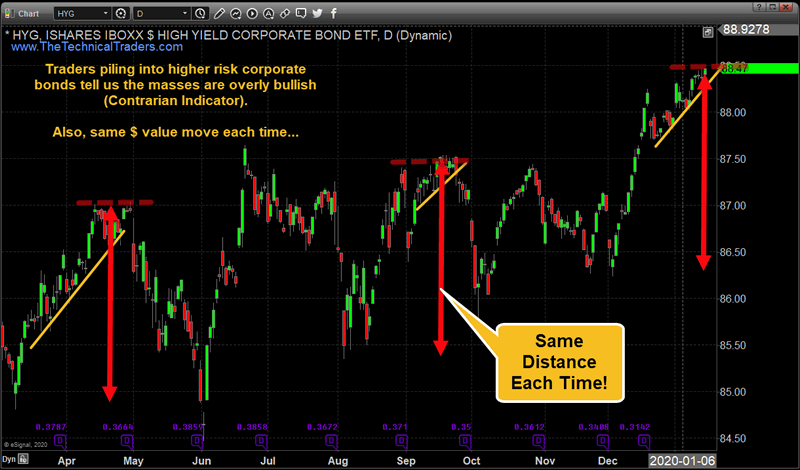

HYG – High Yield Corporate Bonds Daily Chart

One of our favorite measures of extreme bullishness is the scope of capital/trend pouring into High Yield Corporate Bonds. This chart below highlights the scale of the rallies that take place before a price reversion event. You’ll notice that each rally in HYG is nearly identical in size – and that each rally is followed by a fairly deep price reversion event.

The likelihood of some surprise earnings collapse from Q4 2019 is somewhat muted. Other than the retail sector reporting some missed earnings expectations related to Christmas 2019, generally most market sectors should report earnings and growth near an average 2% to 3% growth expectation annually.

Still, with Rhodium, Platinum and Palladium rallying extensively and Gold and Silver recently setting up an upside breakout pattern (see our recent Gold and Silver research), we believe undercurrents are already at play in the markets where skilled traders are preparing for a price reversion event – attempting to mitigate risk.

Over the past 20 years, the DOW JONES INDUSTRIAL has been positive in January by a ratio of 1.2:1. In other words, the odds of a positive January for the DOW is near 60%. The average upside price advance in January for the DOW is a little over 600 points. As of right now, the DOW has advanced a bit over 525 points since the end of 2019. We believe the undercurrent trends may result in a moderate price reversion event if our analysis is correct.

We’ll wait to see what happens with earnings data and other news, yet our proprietary technical price modeling systems are suggesting a reversion/rotation event should happen fairly early in 2020.

Join my Wealth Building Newsletter if you like what you read here and ride my coattails as I navigate these financial markets and build wealth while others lose nearly everything they own.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.