How to Shrink Financial Market "Maybes" Down to a Minimum

Stock-Markets / Elliott Wave Theory Feb 07, 2020 - 03:19 PM GMTBy: EWI

No analytical method can offer 100% clarity about the market's future.

Yet critics of technical analysis, particularly Elliott waves, say that popular technical methods fail if they don't do just that. Of course, that's unreasonable. Perhaps you've noticed that the critics don't hold other analytical methods -- not least of all fundamental analysis -- to such an impossible standard.

However, as the Wall Street classic Elliott Wave Principle explains, Elliott wave analysis does offer what other market assessment methods do not:

What the Wave Principle provides is a means of first limiting the possibilities and then ordering the relative probabilities of possible future market paths. Elliott's highly specific rules reduce the number of valid alternatives to a minimum.

Do you know of another analytical approach that does this? Elliott Wave International's analysts don't.

Even so, the Elliott wave method of analyzing and forecasting financial markets has its critics. Some of them erroneously assert that two or more wave interpretations of the market's price pattern can be equally valid.

Yet, Robert Prechter's book, Prechter's Perspective, refutes this claim:

One shouldn't confuse the fact that the practical application of the Wave Principle is an exercise in ranking probabilities with the idea that different opinions are equally valid. Two possible paths for the market are almost never equally likely. So, two opinions are almost never equally valid. ... Occasionally, the less probable scenario works out, of course; that is what the word "probable" means. [emphasis added]

Determining the probabilities of a market's direction often requires patience. And it's during these times that critical voices are often loudest. But, as most experienced traders will tell you, patience has its rewards. Let's return to the book Elliott Wave Principle:

There are often times when, despite a rigorous analysis, there is no clearly preferred interpretation. At such times, you must wait until the count resolves itself. When after a while the apparent jumble gels into a clear picture, the probability that a turning point is at hand can suddenly and excitingly rise to nearly 100%.

Elliott wave practitioners know their discipline requires work. Yet that work can yield timely opportunities.

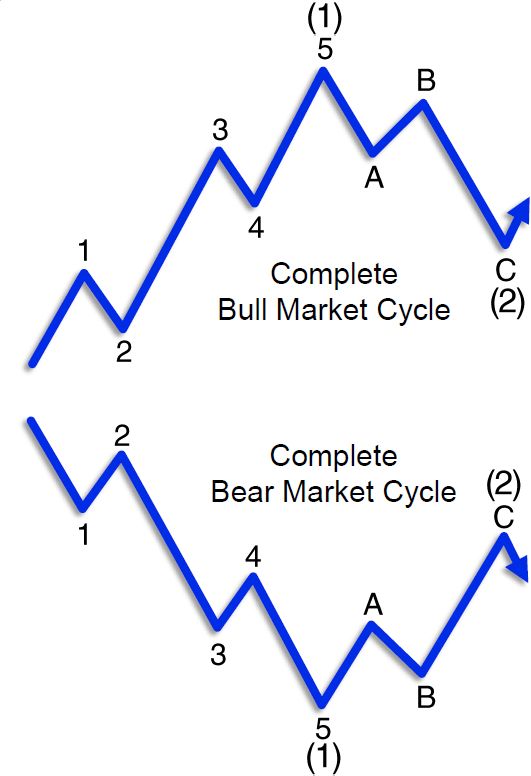

The basic Elliott wave pattern is five waves in the direction of the main trend followed by three corrective waves, as shown by this diagram:

When initial eight-wave cycles such as the ones above end, similar cycles ensue, which are followed by other five-wave movements.

Do realize that there are a number of specific variations on the basic design of five-and-three.

You can learn all about them with free access to the digital version of the Wall Street classic book, Elliott Wave Principle: Key to Market Behavior by Frost & Prechter.

This article was syndicated by Elliott Wave International and was originally published under the headline How to Shrink Market "Maybes" Down to a Minimum. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.