Stock Market SPX to Rise back to 3350

Stock-Markets / Stock Markets 2020 Feb 28, 2020 - 02:20 PM GMTBy: MEHABE

Global stocks tumbled to four-month lows, government debt yields sunk to unprecedented levels and crude oil extended declines as anxiety over the spread of the coronavirus surged. While climbing from the lows of the day, the six-day slide has still pushed the S&P 500 and Dow Jones Industrial Average indexes down by more than 10% from all-time highs set this month, a so-called correction. The drop of as much as 10% since Friday puts the S&P on pace for its worst week since the 2008 global financial crisis. The MSCI All-Country World Index fell to the lowest since October, while the Stoxx Europe 600 also entered a correction.

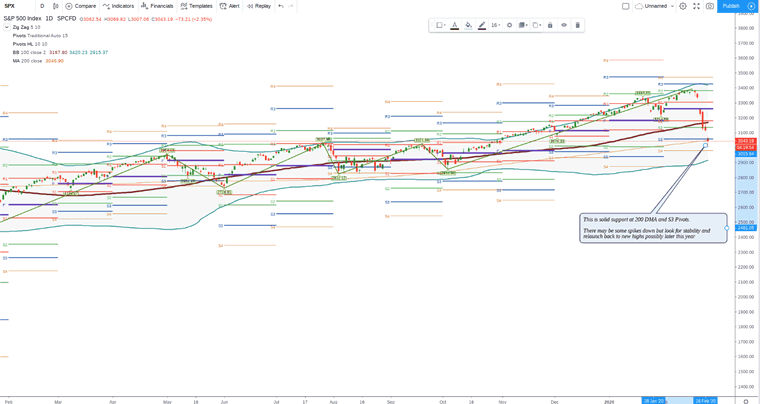

SPX: At support

This is solid support at 200 DMA and S3 Pivots. There may be some spikes down but look for stability and relaunch back to new highs possibly later this year. Below 2900, we can safely say the bull run is over and look for sell the rally,

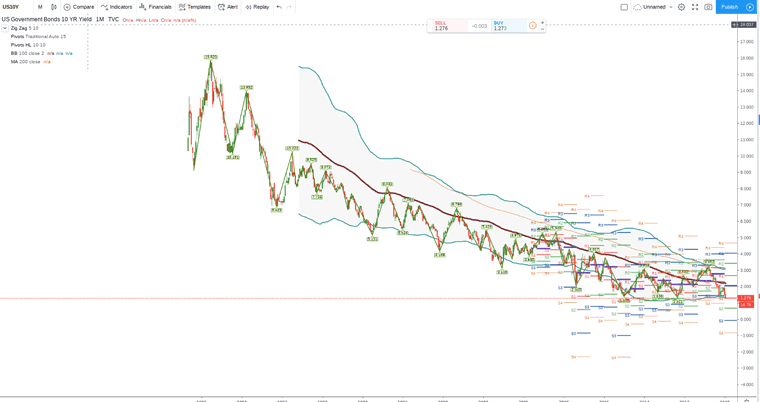

US 10 Year yield: All time lows

The US 10 Year yield has dropped to all time lows under 1.3%. There is nothing below and hence we see a drop to 1% before rise back to 1.3%. The safety haven flows as well FED rate expectations are driving the yields down.

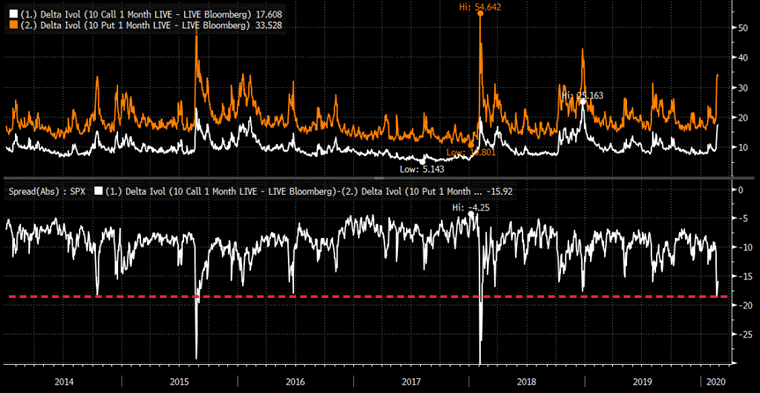

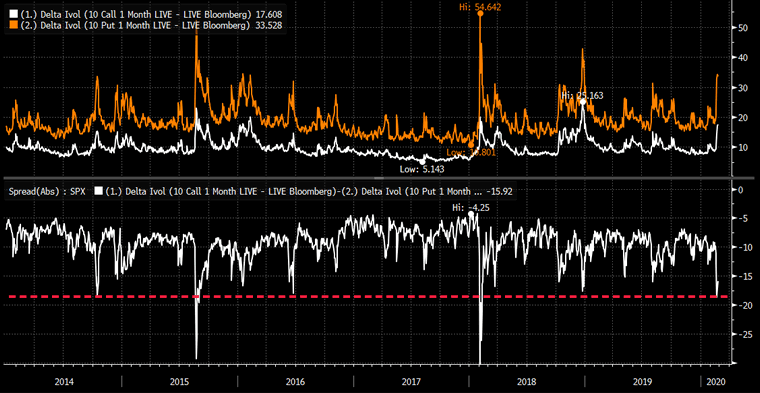

EURUSD call volumes

The eurdollar call volumes have pushed EURUSD higher to 1.10 levels. It is to be seen if the massive volumes on the upmove is simply short covering move or a reversal signal.

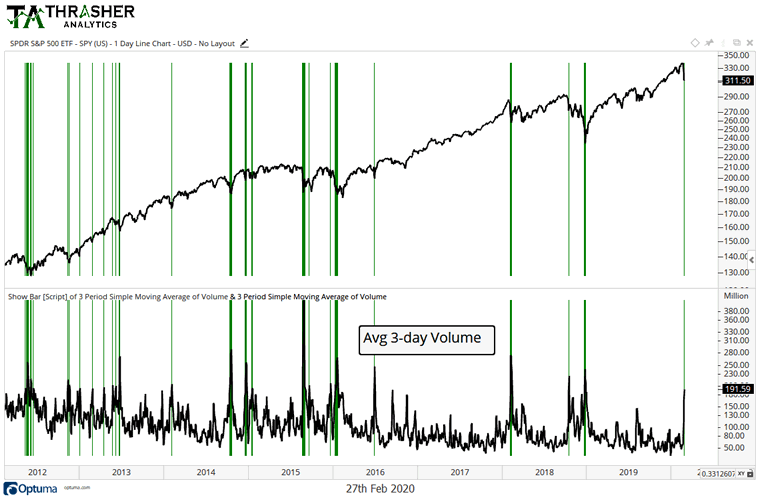

SPX volumes

The 3 Day average volumes in SPX has now reached the peaks of 2018 levels. However we are still not very concerned as it seems much of the volume is already done and stocks could rebound back from here.

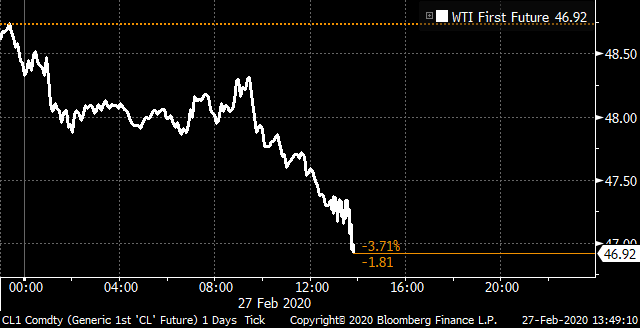

Oil

Oil has crashed below 50. There is no stability anywhere and we could see it fall into low 40s. Our expected target for Oil is under $20.

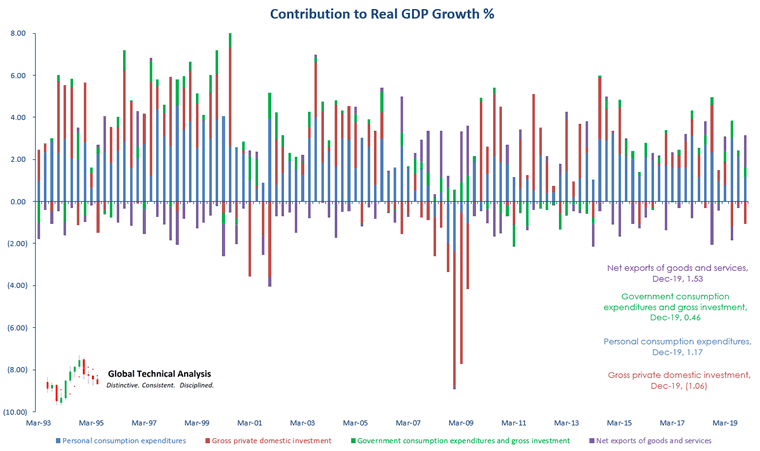

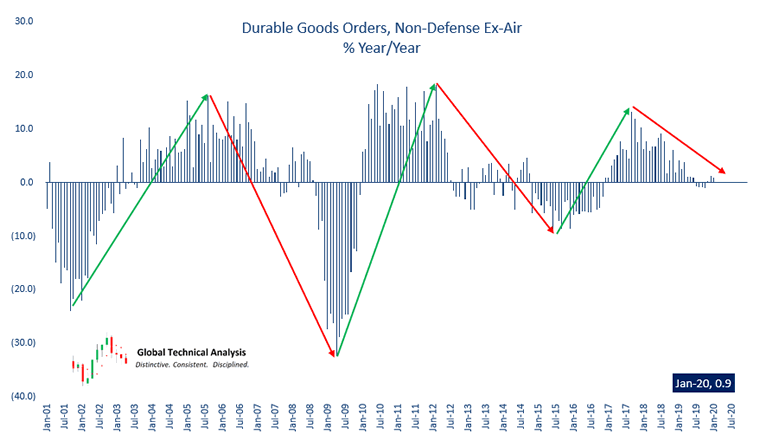

US ECONOMY

Durable growth is slowing dramatically. This in the past has often been the precursor to FED rate cuts. We see even more downside in durable as the virus effect has not yet been fully manifested.

FX Markets trading

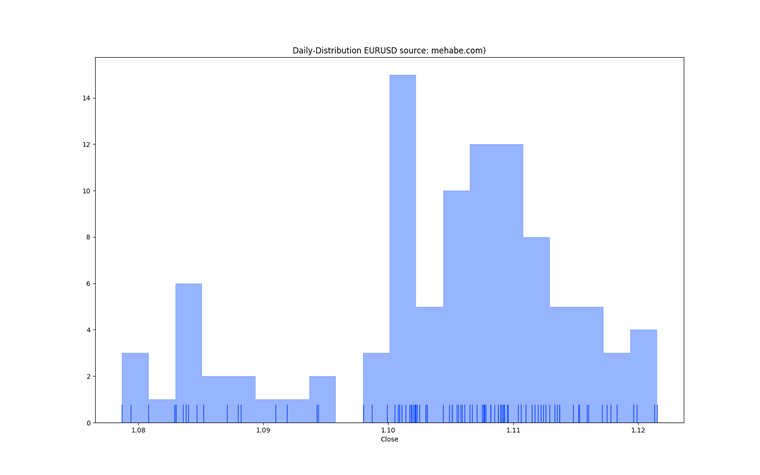

EURUSD Distribution

EURUSD has very little depth between 1.08 and 1.1 and it finds good trading opportunities above 1.1.

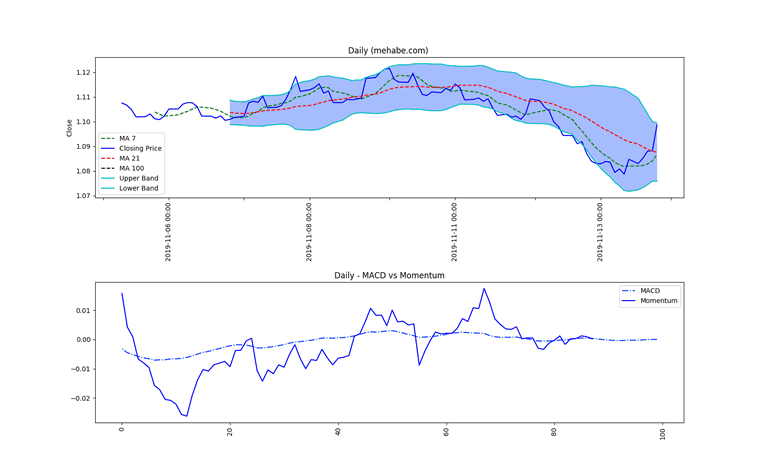

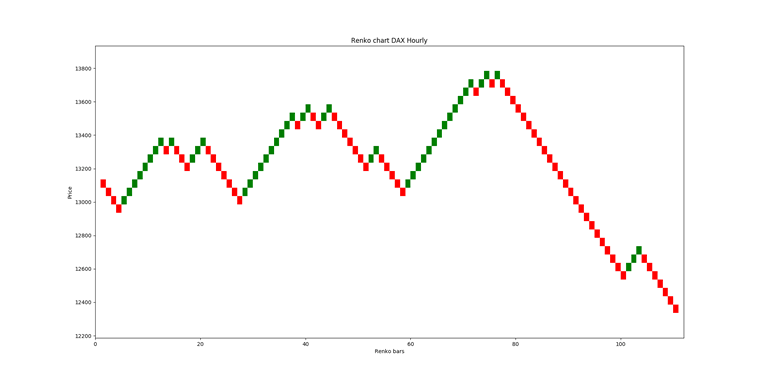

DAX Charts

The price currently is trading at 12329.11. This is below the hourly 100 MA. The 100 MA is at 13408.07 This suggests bearish pressure in the pair. The last hourly close was inside bollinger bands of 21 MA indicating that there may be balance of power between buyers and sellers in the short term. Unless a new move happens, clients are advised to be on the sideliness of this pair.

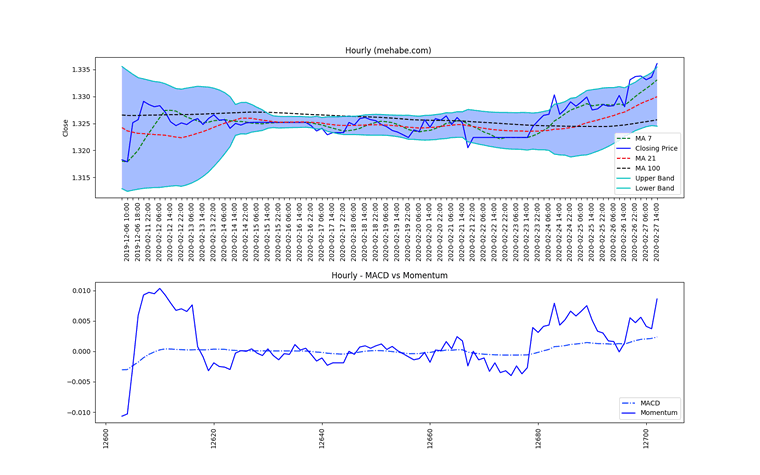

USDCAD Charts

The pair opened at 1.336 and closed at 1.3361 with a overall range of 26 pips. The high of the hourly timeframe was at 1.3375 while the low was at 1.3349. The price currently is trading at 1.3361. This is above the hourly 100 MA. The 100 MA is at 1.3257. The last hourly close was above the upper bollinger bands of 21 MA indicating that buyers remain in control on the hourly timeframe. Unless price closes below the 1.3354 , buy on dips will a better strategy. Stops are advised at 1.3257 The hourly trend score suggests that there is bullish pressure and hence clients can look to buy on the dips. Exercise good risk management. Cut your losses and let winners run. Make sure stops are in place and no trade should lose more than 2% of capital.

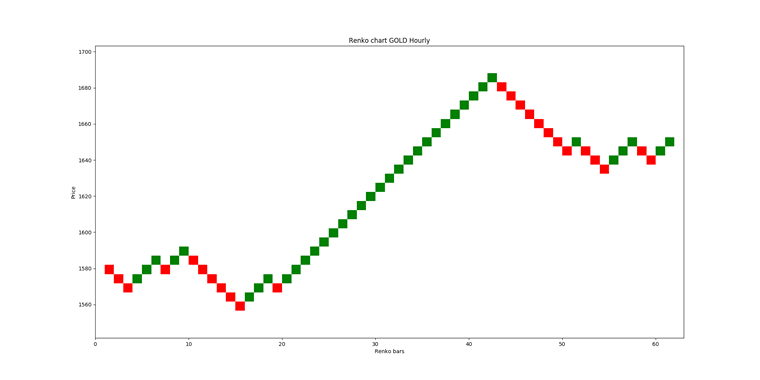

GOLD Charts

The price currently is trading at 1653.44. This is below the hourly 100 MA. The 100 MA is at 1653.54 This suggests bearish pressure in the pair. The last hourly close was inside bollinger bands of 21 MA indicating that there may be balance of power between buyers and sellers in the short term. Unless a new move happens, clients are advised to be on the sideliness of this pair.

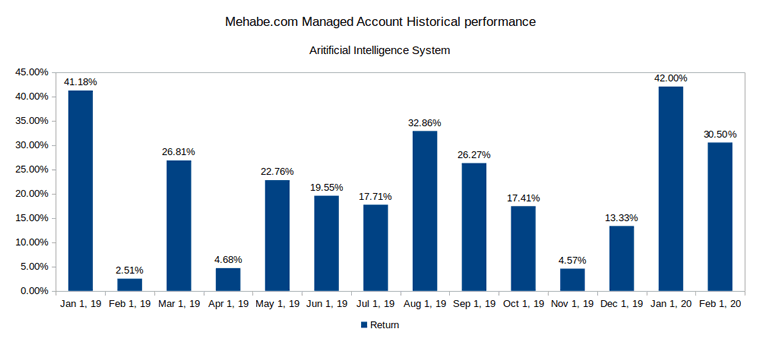

MEHABE ARTIFICIAL INTELLIGENCE MANAGED ACCOUNT

Mehabe is a high performance trading system operation on global clients forex accounts.

Trades are taken based on a powerful ECHO STATE NETWORK A.I. Program. The system has never had a negative month of returns. FEB returns have crossed +30%.

The system is trading on LIVE MASTER ACCOUNT.

If you want to get started email us at fundsupport@mehabe.com and we will help you get started and you will get same returns as above.

Mehabe is a Artificial Intelligence driven quantitative investing firm offering managed account, tradecopier and custom tailored investing solutions for global clients. We have a history of industry leading performance.

Website: https://mehabe.com

Email : fundsupport@mehabe.com

Copyright 2020 © Mehabe.com - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.