Gold and Understanding the Current Investment Reality

Commodities / Gold & Silver 2020 Apr 10, 2020 - 01:04 PM GMTBy: Nick_Barisheff

Gold has been misunderstood and ignored by retail investors, financial advisors and pension managers as a critical portfolio asset during normal market conditions. However, during periods of market stress, such as we are experiencing now, gold becomes a safe haven asset that will mitigate losses in the portfolio. For a number of years, many experts have been warning about overinflated markets that were just waiting for a spark to ignite the entire system.

I warned investors that we were in a triple bubble in stocks, bonds and real estate that was created by central bank policies. Although I concluded that a market crash was inevitable, I didn’t foresee that the spark to ignite all three bubbles would be the Coronavirus. While the virus itself is life threatening and will result in large demographic changes across the globe, the economic implications may be worse than the disease. Major economies in Europe, Canada and the United States have been shut down. Every industry—airlines, hotels, manufacturing, entertainment, sports, schools and retail—is in lockdown. Most of the western world is ravaged by fear, isolation, loss of employment, loss of income and the psychological effect of this massive lockdown situation. Employees have either been terminated or laid off indefinitely. The scale of this unemployment crunch and financial crisis is beyond the reach of governments’ assistance. Many businesses will not be able to reopen once the health issues have been controlled.

When the health crisis subsides, the economic effects will last for years; we may, in fact, never recover.

While there is a great deal of uncertainty because of the Coronavirus, there are two things that we know for sure. Many industry sectors have no revenue, and governments will print enormous amounts of money in an attempt to mitigate the financial crisis. Most companies with no earnings will see enormous declines in share prices. Bonds, particularly corporate bonds, will default and become worthless. Even real estate is likely to suffer dramatic declines as both commercial and residential tenants are likely to default on rent payments. This in turn will result in mortgage defaults at every level, and properties will be sold at fire sale prices. These conditions create a perfect storm for an increasing gold price.

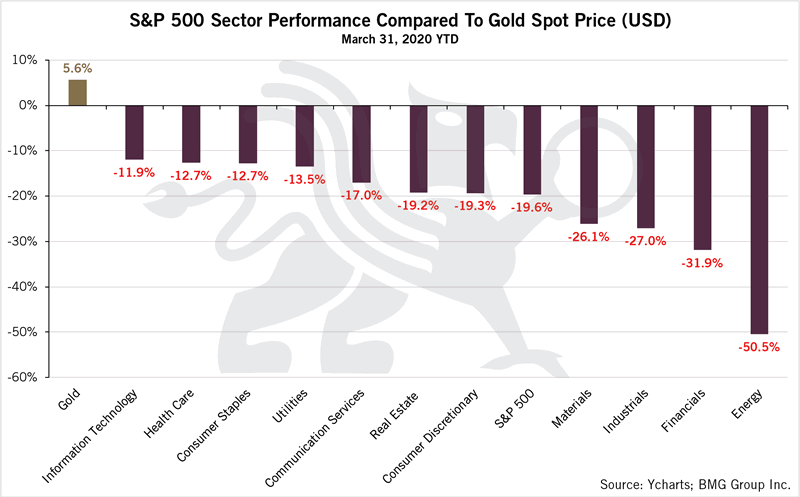

Stock markets around the world have suffered the worst first quarter in history. Every sector, other than gold, has suffered losses from 12% to 50%.

These declines will be particularly hard on individual retirement portfolios, as well as pension funds. The baby boomer’s dreams of retirement are quickly evaporating. I wrote about the coming pension problem in September 2019. Even the largest pension funds, which have more diversified portfolios due to their real estate holdings as well as stocks and bonds, will experience dramatic increases in unfunded liabilities. Most smaller pension funds that only hold stocks and bonds will be devastated. Even before the Coronavirus implication, many municipal pension funds in California had already sent notices to retirees informing them that their future pension cheques would be reduced by 50%. Riots had already started in France and Chile.

For North American public companies, the increases in unfunded pension liabilities will negatively impact balance sheets, and the unfunded liabilities will have to be amortized over five years, thereby reducing corporate profits at a time when they may be non-existent due to the Coronavirus lockdown. This will put additional downward pressure on stock prices at a time when they are experiencing ongoing declines.

For current retirees, there is the double whammy of declining pension assets together with unemployed workers no longer contributing to the pension funds. The reduction in monthly payments is inevitable, and so are the lawsuits that will follow.

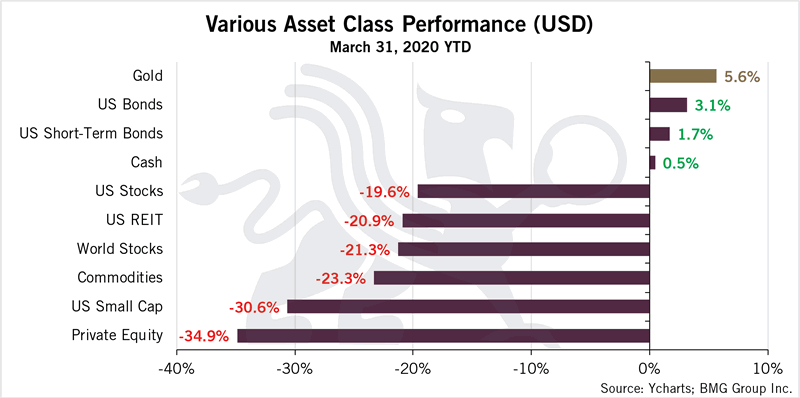

Most pension funds and individual retirement portfolios consist of only financial assets – stocks and bonds. These have already suffered significant declines; REITs and oil have been hard hit, too.

Even bank stocks, which are considered safe for conservative investors, have suffered significant declines.

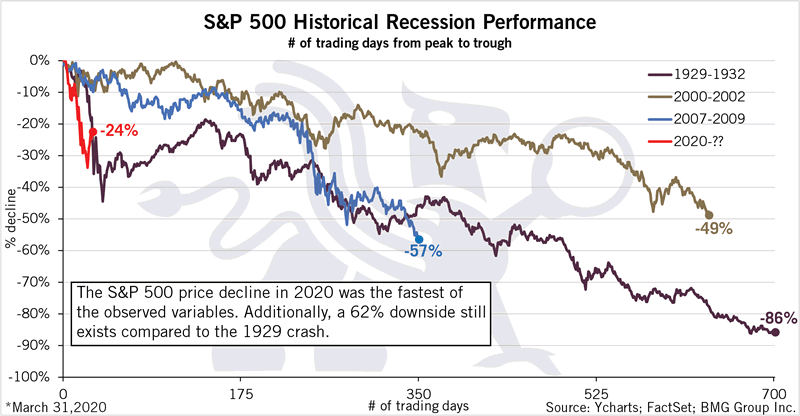

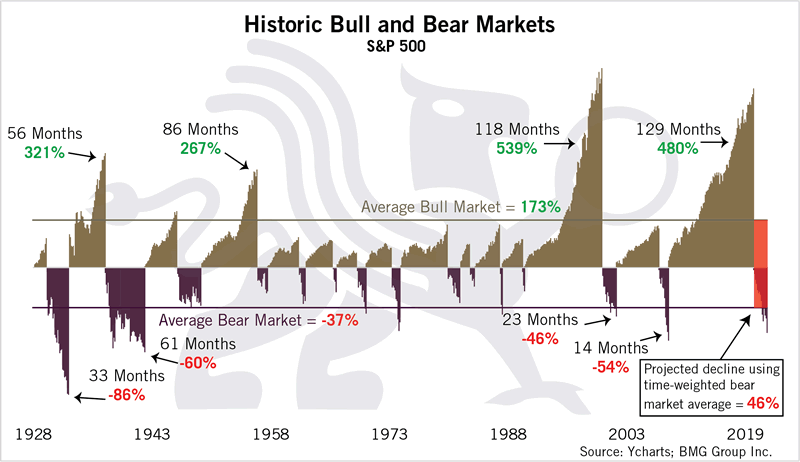

It is critical to note that there is no recovery in sight, and corporate earnings will be non-existent for the foreseeable future. Many experts believe this crash will be worse than that of 1929, and that we have just experienced the first phase.

The only asset class that will do well in the foreseeable future is precious metals, particularly gold.

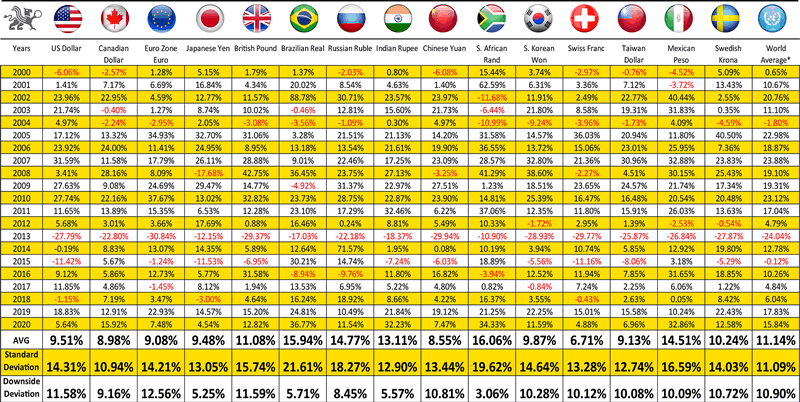

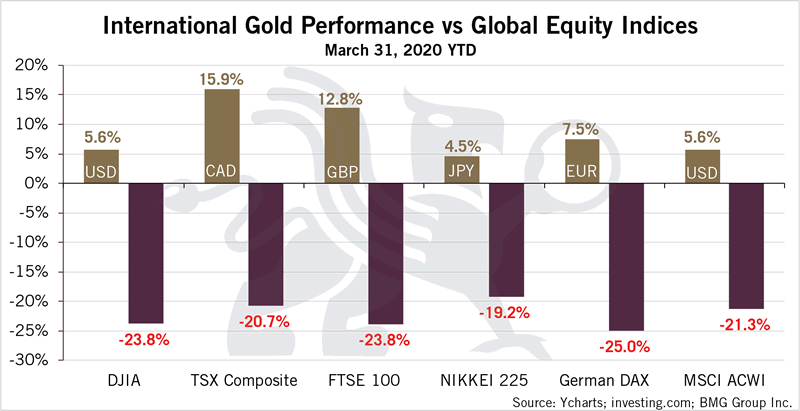

While there have been years of losses, particularly in 2013, gold has risen in all currencies since 2000 (see chart), and many investors are surprised by its steady performance. If you’d purchased gold in 2000 at $350, it’s now worth around $1,700, which gives you an average compounded return of about 9%. Most pension funds have target performance requirements of 6% yet have totally ignored gold in their portfolios. From its low in 2018 gold’s performance has dramatically improved. In 2019, the average increase was 17.8%. The YTD average for 2020 is 15.8% in the first quarter alone. This should annualize at about 63% per annum. Since the US dollar is often used as a safe haven by citizens all over the world, the gold performance in US dollars has been the lowest at 5.6% in Q1 2020. In Canadian dollars, gold is up 15.9% YTD.

When compared to stocks, we can see that gold has performed extremely well against all major stock exchanges.

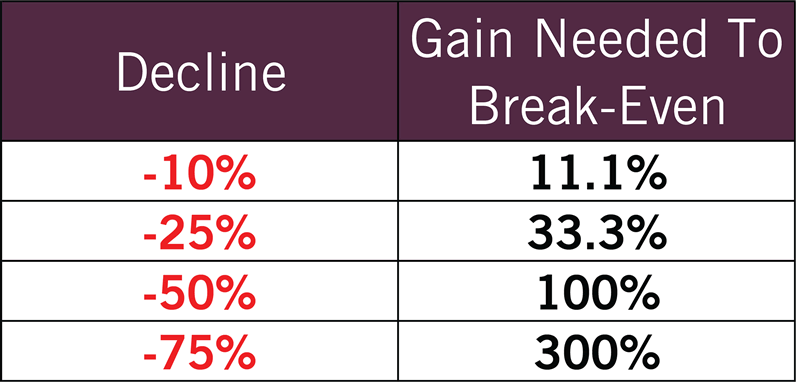

Today, the mainstream media is misleading investors by encouraging them to stay invested for the long term. While it is a good strategy not to trade in and out during a bull market, it is completely misguided in today’s environment. The market is poised to fall much farther, and it makes no sense to stay invested in financial assets and sustain further losses. This chart shows how long it has taken to break even after major declines.

What many investors don’t realize is that if a portfolio declines by 50%, it would have to increase by 100% just to break even.

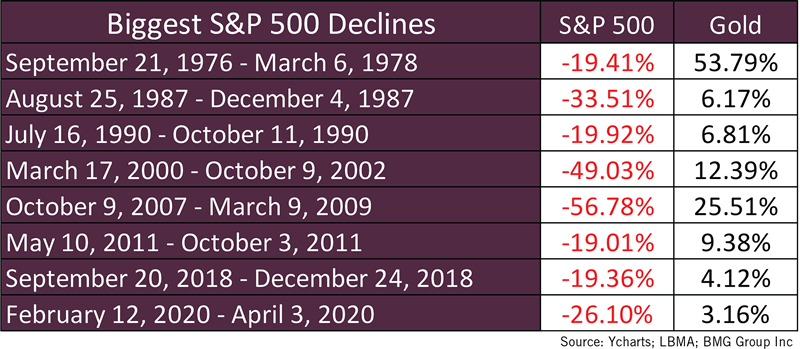

Most baby boomers will simply not live long enough to break even after this market crash. Investors would be better off switching to cash, and then reinvesting at close to the bottom. What is the point of staying invested in order to get dividends of 3-4%, while risking capital losses of 50-70%? Better still would be switching to gold, experiencing significant gains and then redeploying the gains to a diversified portfolio of stocks, bonds, REITs, gold and silver when the market has finished correcting. Gold will rise dramatically while everything else will sustain massive losses, as in every market decline.

BMG has spent three years analyzing this approach, and it has established a hedge fund to implement this strategy for accredited investors and institutions. BMG’s back-tested model for implementing this policy during the 2008 crash would have yielded returns of over 20% per annum.

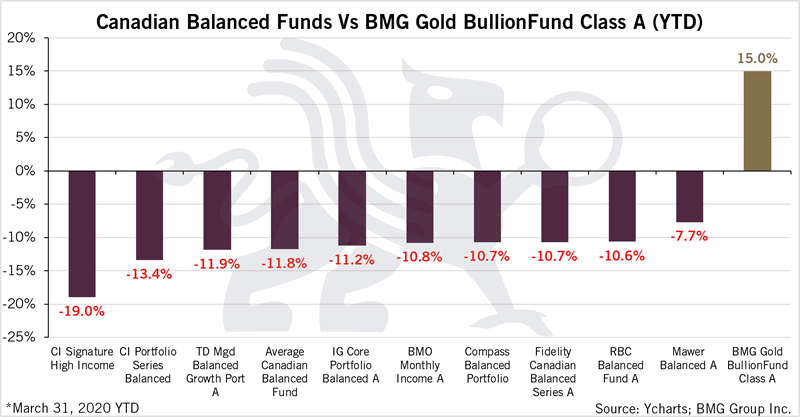

Over the past few years, many retail investors were forced into selling their bullion holdings by their advisor’s compliance department because their stated risk tolerance in their KYCs didn’t match the mandatory risk rating of their portfolio investments based on standard deviation. Many were persuaded by their advisors to sell their bullion holdings and purchase equities—particularly Balanced Funds. This chart clearly shows how bad this advice has been.

The only way investors could avoid these forced losses would be to open a discount brokerage account and make their own investing decisions by purchasing Class D units in a BMG Fund. Not only would this reduce fees, but investors could allocate their portfolio as they saw fit and not be impeded by the rules imposed by the advisor’s compliance department. I have written about how these regulations were misleading investors.

To summarize: Under the current conditions, do you believe that now is not the time to stay invested? Would it be prudent to take whatever losses you have incurred and move to cash to preserve what you have left? Maybe it is time to become educated on the subject of gold by reading everything you can. When comfortable with what you have learned, do you think that a 20% allocation or more to gold makes sense? Here are some educational resources to help you start on your gold journey, the BullionBuzz, will keep you informed, and my book, $10,000 Gold—Why Gold’s Inevitable Rise Is The Investor’s Safe Haven, will give you a complete background.

By Nick Barisheff

Nick Barisheff is the founder, president and CEO of Bullion Management Group Inc., a company dedicated to providing investors with a secure, cost-effective, transparent way to purchase and hold physical bullion. BMG is an Associate Member of the London Bullion Market Association (LBMA).

Widely recognized as international bullion expert, Nick has written numerous articles on bullion and current market trends, which have been published on various news and business websites. Nick has appeared on BNN, CBC, CNBC and Sun Media, and has been interviewed for countless articles by leading business publications across North America, Europe and Asia. His first book $10,000 Gold: Why Gold’s Inevitable Rise is the Investors Safe Haven, was published in the spring of 2013. Every investor who seeks the safety of sound money will benefit from Nick’s insights into the portfolio-preserving power of gold. www.bmgbullion.com

© 2020 Copyright Nick Barisheff - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.