Gold Price Near March Highs and Ready to Breakout

Commodities / Gold & Silver 2020 Apr 15, 2020 - 11:24 AM GMTBy: Submissions

Recent shifts in the markets suggest gold prices are about to breakout in the same manner as they did over the summer last year.

The price of gold is a small distance away from the March highs ahead of the North American open on Monday and a fresh seven-year high looks to be probable.

Many factors impact the price of gold but there are few specific things that I am looking at that lead me to believe gold prices are about to break out.

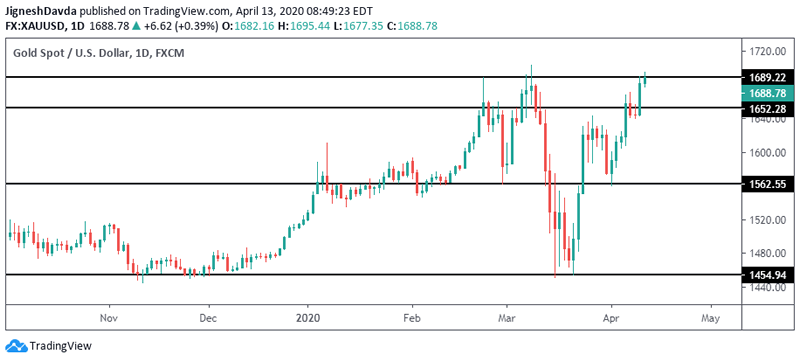

First off, the obvious signal is that gold is trading near it’s March high. This could result in a double top but, generally speaking, when you have a trend as strong as the one in gold over the past nine months or so, the odds of a double top aren’t favorable. For this reason, a bullish continuation appears likely and I expect near-term declines will be bought.

Gold Daily Chart

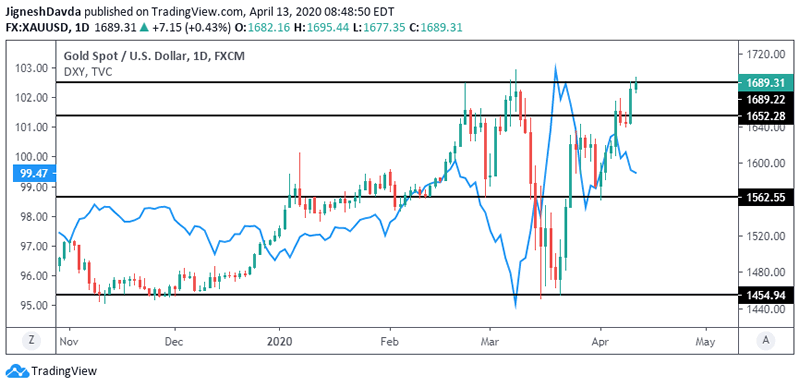

The less simplistic factor that makes me think gold prices are about to see an increase in upward momentum is the correlation with the dollar.

Back in March, gold prices fell sharply. The shiny metal lost nearly 15% of its value in less than two weeks. This was amid an escalation in Coronavirus fears which typically would have boosted safe-haven assets such as gold.

However, investors fled to the greenback instead and the trade-weighted dollar index (DXY) pushed firmly higher to test levels not seen since 2017. In the ten-day window that began on March 9, the dollar rallied for a gain of more than 8%.

To create some perspective, DXY barely rallied 5% in the first three quarters of 2019 before pulling back in the fourth quarter to close the year out for a gain of roughly 1.5%.

Needless to say, there was a sense of urgency in the dollar buying that happened in that short window last month. And it was strong enough to put pressure on gold prices during a period where they would otherwise be expected to rise.

Gold Daily Chart with DXY Overlay

But that sense of urgency has faded. Volatility has since slowed significantly in the dollar and I don’t expect it to return.

Investors have faced the initial shock brought to the markets from the Coronavirus. Even if things get worse from here, I would expect risk assets to decline and safe-havens to rise. But the important thing here is that there is little reason, at this point, to expect that will happen with urgency. Investors are very well aware at this point that there are still risks stemming from the virus.

But whichever way things progress with the virus from this point, I think gold prices stand to gain based on what has happened over the past month.

Central banks around the world have cut rates aggressively, and traditionally, this is a big positive for gold prices. It results in lower bond yields and reduces the costs of holding gold.

The only downside risk I see stems from a technical view. When looking at gold’s performance relative to silver, I’m of the opinion that gold has printed a blow-off top against silver. The weekly chart below shows the difference between the two metals at several deviations above the longer-term average around the middle of March. Since then, there has been a steady decline. This leads me to believe that gold will struggle to outperform silver over the near to medium-term.

Spot Gold vs Spot Silver

Frankly speaking, I have a hard time getting behind the view that silver is bullish simply because silver prices traded at a fresh decade low last month. I understand that this happened only in the spot markets and that it was pretty much impossible to buy physical silver at those prices. But it’s hard to turn a blind eye to the long term trend in silver.

Having said that, I think there is still enough reason to see more upside in metals, at least over the near-term. The next area I’m paying attention to is $1788 in spot gold. This level held the shiny metal lower on a few attempts between late 2011 and 2012 and so I think it is a level technical traders will be mindful of. On the downside, I’m looking at $1652 to contain any dips over the next few days.

By Jignesh Davda

https://www.thegoldanalyst.com

Copyright 2020 © Jignesh Davda - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.