Bitcoin Halving Passes with no Fanfare, but Smart Money is Accumulating

Currencies / Bitcoin May 14, 2020 - 11:10 PM GMTBy: Submissions

After flirting with the 10k level, bitcoin has retraced to find support around $8,700 as the long-awaited halving event passes.

This milestone sees the block reward sliced in half, effectively acting as a supply shock by reducing the profits of miners by 50% and halving the amount of new bitcoin that enters the network.

With central banks embarking on massive money printing operations to tide over stalled economies, this event makes bitcoin look increasingly attractive as a deflationary asset — and this is reflected by the increased presence of institutions.

Big investors—known as 'whales' in crypto parlance—have been making a splash on the CME exchange, where open interest in bitcoin futures hit an all-time high last week.

As a regulated platform, CME is home to well-heeled hedge fund traders like Paul Tudor Jones II, who told CNBC that he has allocated 1-2% of his assets to bitcoin. He sees the leading cryptocurrency as a possible hedge against the inflationary activities of central banks, and wrote in a letter to investors that the cryptocurrency reminds him of the role gold played as a hedge against inflation in the seventies.

Pioneering investor Tudor Jones is not the first mainstream hedge fund manager to consider bitcoin, and he joins one of the most successful hedge funds ever—Renaissance Technologies' Medallion—which has been eying the bitcoin futures market since April.

BTC/USD Daily Chart

On the chart, bitcoin is now sitting at the 0.236 Fibonacci retracement level, after printing a 'darth maul' candle with long wicks on either side indicating short-term indecision.

Immediate resistance lies at $10k. Once this level is surpassed, we may see more traders enter the market with the expectation that bigger players—miners and large investors—are now holding on to their bitcoin in the hopes of price once again surpassing previous all-time-highs.

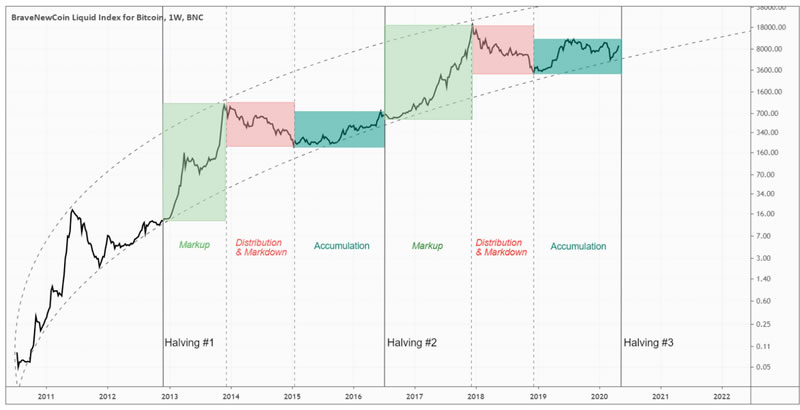

BTC/USD Long-term Log Chart

After previous halving events in November 2012 and July 2016, bitcoin consolidated for several weeks before embarking on a bull run. But based on a sample size of only two, expecting a similar trajectory to play out again would be a foregone conclusion.

By Kieran Smith

Website: http://www.bitcopy.co.uk

Bio: Bitcoin writer, analyst and content marketing consultant, Kieran Smith is the founder of Bitcopy.

© 2020 Copyright Kieran Smith - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.