Crude Oil Cuts Get Another Saudi Boost as Oil Demand Begins to Show Signs of Life

Commodities / Crude Oil May 27, 2020 - 11:42 AM GMTThough gasoline demand remains historically weak, commuters are beginning to head back to their offices, opting for the isolation of their personal vehicles and abandoning public transit, reports McAlinden Research.

Saudi Arabia enhanced their commitment to OPEC+ supply cuts as the Kingdom said they'd shut production of additional 1 million barrels of crude oil per day next month. Most of the OPEC+ countries have already come close to compliance with the deal that took effect this month and cuts from non-member states like Norway, Brazil, Canada, and the US are compounding the already steep curbs on production. Though gasoline demand remains historically weak, commuters are beginning to head back to their offices, opting for the isolation of their personal vehicles and abandoning public transit.

Crude Cuts Continue to Deepen

As part of its latest efforts to reign in the global glut of crude oil, Saudi Arabia's energy ministry ordered the Kingdom's oil giant Aramco to reduce its crude oil production in June "by an extra voluntary amount of one million barrels per day (bpd), in addition to the reduction committed by the Kingdom in the latest OPEC+ agreement," the official Saudi Press Agency reported.

The 23-country OPEC/non-OPEC coalition known as OPEC+ agreed to cut output by 9.7 million bpd for two months from an agreed baseline level starting May 1. These countries will also cut 7.7 million bpd between July and December and 5.8 million bpd from January 2021 to April 2022.

Under this OPEC+ deal, Saudi Arabia has pledged to cut its oil production to 8.5 million bpd, beginning this month. With the voluntary additional reduction in June, the Saudis would produce 7.492 million bpd next month, down from more than 12 million bpd in April.

Russia, also committed to the OPEC+ syndicate, saw oil output fall to 8.75 million bpd in the first 5 days of May, just shy of the 8.5 million bpd target set for this month and next.

However, as executive director of the International Energy Agency (IEA) Faith Birol recently stated, non-OPEC+ reductions in output "may well be similar to reductions that will be coming from OPEC+ throughout the year… We are not yet there but we seeing some [production cuts] already." Cuts from non-OPEC+ partners industries, such as Brazil, Norway, Canada and the United States, the total reduction in supply could double global output curbs to around 20 million bpd when fully-implemented.

Norway, Europe's largest oil producer, said it would cut production by 250,000 bpd in June and by 134,000 bpd in the second half of the year.

Brazil's Petrobras initially reduced output by 200,000 bpd, which accounts for 20% of Brazil oil exports, after shutting down production at 62 offshore platforms last month. However, those cuts have been partially reversed.

The most significant non-OPEC market to watch, however, is North America where crude oil output is set to fall by 1.7 million bpd in June, which would mark a decrease of about 10% from its all-time high in March.

Analysts have estimated Canada may need to shut-in about 1 million to 1.5 million barrels of oil per day, from an average daily production of about 4 million bpd in 2019. Given the lack of crude demand coupled with low Canadian pricing and little in the way of extra storage capacity, "it is hard for us to fathom how Western Canadian crude production can avoid a ~1 million+ bbl/d drop in output in the coming weeks," Stifel FirstEnergy analyst Michael Dunn told clients in a note.

US Energy Secretary Dan Brouillette said in April that the department expected US production to drop by 2 to 3 million bpd by year-end without any government-enforced cuts. The number of active oil rigs decreased last week by 33 rigs, according to Baker Hughes data, bringing the total to 292 — a 513-rig loss year over year. It is the fewest number of active oil rigs since late 2009.

The heaviest reductions are coming from Texas, the largest US producing-state, with 5 million bpd of output. Texas output is likely to drop by 20%, or 1 million barrels, by the end of May, Karr Ingham, executive vice president of the Texas Alliance of Energy Producers, told Reuters. "Operators are shutting in anywhere from 20% to 50%, and some more than that, based on what they think they can get to market," Ingham said.

Signs of Life

While positive stories in crude markets have been few and far between, glimmers of hope have begun popping up around the world.

Crude inventories in China, the world's largest buyer of oil, have shrunk in recent weeks after rising to record levels, according to analysts and satellite observations. "The trend in April was a net withdrawal driven by higher refinery runs and lucrative margins," said Yao Li, chief executive officer of consultancy SIA Energy, which estimated inventories fell by 9.5 million barrels in April after growing by 161 million in the first quarter.

Though inventories have yet to enter a decline, the actual increases in storage have certainly begun to slow. Crude builds peaked in mid-April at more than 19 million barrels, but have since fallen to just 4.6 million barrels in the most recent week.

Shrinking inventories are even more critical than production cuts in today's oil industry. Inventory numbers will be the primary evidence for the effectiveness of the cuts by illustrating an increasing or decreasing balance of supply and demand.

The main catalyst in April's unprecedented oil collapse that sent prices into negative territory for the first time ever was actually lack of storage above all else. At the time, MRP wrote that the negative pricing could be more so chalked up to a short-term inefficiency in the rolling over of the May WTI contract on the crude futures market, resulting in the United States Oil Fund LP (USO), who owned 25% of all outstanding shares in the contract, not actually having facilities to accept or store physical barrels of crude as any other crude processing or storage facility were already overflowing. Therefore, the only way for the USO to rid themselves of their newfound oil barrels was to offer compensation to take it off their hands.

One of the most positive demand-side developments has been the increasing use of cars, as opposed to public transit, in the age of COVID.

Subway ridership remained about 50% below pre-virus levels in Beijing and about 30% below in Shanghai, according to data compiled by BloombergNEF, as fears of large crowds push commuters toward the relative isolation of cars.

Bloomberg writes that this pattern can be observed across the world:

In Berlin, among the first European cities to relax its lockdown, public transit use remains down 61% while the number of people driving has recovered to 28% below normal, according to data from Apple Inc., which tracks request for directions on its popular Maps app.

In Madrid, driving is only 68% below normal levels, up from about 80% in April, while use of public transport remains down 87%, largely the same level as last month.

The same is occurring in Ottawa, the Canadian capital, where driving directions on the app have recovered to 40% of normal levels, up from a decline of 60% in April, while directions for mass transit remain flat from April at 80% below normal levels.

Apple Maps data for 27 world cities shows that driving directions are recovering more quickly than directions for mass transit.

In the U.S., gasoline consumption is clawing back from record lows, rising by 400,000 barrels a day during the week ended May 1. Cities in Florida, one of the first American states to re-open, has seen fuel sales rebound to 30% below normal levels, from 50% weeks ago, according to the Florida Petroleum Marketers Association.

Oil demand will certainly not be what it was in prior years for some time, but the use of automobiles could play a significant role in drawing down gasoline inventories and allowing refiners to start processing new crude oil orders. The amount of total motor gasoline in storage, per EIA data, accounts for the largest share of finished crude and petroleum product inventories, roughly 6.5 times the size of outstanding jet fuel stocks.

Long-Term Supply Shortage?

Some may say it's a bit early to be thinking about the long-term implications of all of these production shutdowns, but it is important to note that there are undoubtedly going to be some negative side effects to such a cataclysmic disruption.

Though Goldman Sachs is predicting a V-shaped bounce back in oil demand, supply will exhibit an L shaped recovery. Effectively, the Investment Bank expects supply to be suppressed for some time as, not only does shutting in oil wells damage their output capacity and take work to get them back online, but declines in capital expenditure and access to capital will suppress new exploration and drilling for some time. A combination of poor returns means people are unlikely to line up capital to work in this space, according to Goldman's head of global commodities research, Jeff Currie. "Now investors do not want to hear anything about oil. They have been beaten up they are done with this space, it is going to take a lot for them to come back."

Oilprice.com writes that investments in exploration and new production are set to be delayed because companies are looking to preserve cash and avoid cutting dividends–something oil majors Equinor and Shell just did. So, global investments and project sanctioning activity are already drying up this year.

Due to the oil price crash, Rystad Energy expected at the end of March that exploration and production (E&P) companies were likely to reduce project sanctioning by up to $131 billion, or down about 68% on the year, compared to $192 billion in projects approved in 2019.

Muted investment levels and new project activity will combine with the rebound in global oil demand once the coronavirus crisis is over to swing the global oil market into a potential oil supply deficit of some 5 million bpd, according to Rystad Energy's latest estimates. Oil prices would top $68 a barrel to balance the market, the consultancy said.

MRP continues to believe these early supply-side measures taken by oil producing nations are a sign of more measures to come, holding the market over until sufficient demand can return. We also believe that the most well-positioned firms to withstand the intermediate period will be large-scale operators with diversified, productive assets.

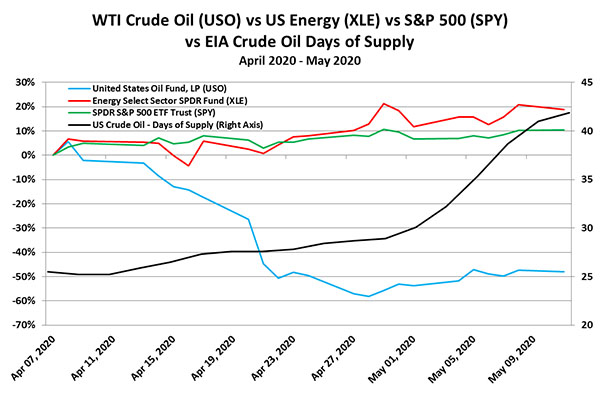

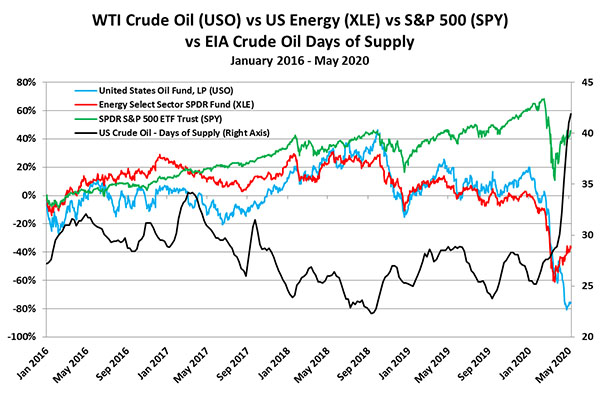

We will continue to track these themes with the United States Oil Fund, LP (USO) and Energy Select Sector SPDR Fund (XLE). Since we launched the theme on April 7, the USO is has unsurprisingly declined a steep 48%. However, the XLE has actually garnered a 19% return over the same period, outperforming the S&P 500's 10% gain.

This content was delivered to McAlinden Research Partners clients.. To receive all of MRP's insights in your inbox Monday - Friday, follow this link for a free 30-day trial.

McAlinden Research Partners (MRP) provides independent investment strategy research to investors worldwide. The firm's mission is to identify alpha-generating investment themes early in their unfolding and bring them to its clients' attention. MRP's research process reflects founder Joe McAlinden's 50 years of experience on Wall Street. The methodologies he developed as chief investment officer of Morgan Stanley Investment Management, where he oversaw more than $400 billion in assets, provide the foundation for the strategy research MRP now brings to hedge funds, pension funds, sovereign wealth funds and other asset managers around the globe.

Disclosure: 1) McAlinden Research Partners disclosures are below. 2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

McAlinden Research Partners: This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.