Rigged Markets - Central Bank Hypnosis

Stock-Markets / Financial Markets 2020 Jun 05, 2020 - 06:45 PM GMTBy: The_Gold_Report

Sector expert Michael Ballanger bemoans the panic-inducing influence of politicians and the influx of "counterfeit currency" from central banks on the money and commodities markets.

One look at the chart of the U.S. financial markets against the backdrop of economic paralysis and suffering, and one is immediately filled with a myriad of emotions. Sympathy for those that have been afflicted by the most recent pandemic; fear for the families whose primary breadwinner is now unemployed; confusion toward the proper course of action going forward; and finally outrage at the abject timidity of our citizens in responding to the orders laid down by these insipid politicians in response to the crisis.

As the welfare of future generations hangs in the balance, its tentativeness the direct result of government ineptitude, I keep asking myself a critical question: "When did the backbone of our people turn to mush?" If someone holding political office had told my grandfather to stop ploughing his fields or tending to his livestock because a sickness was spreading throughout the community, that charlatan would have wound up with buckshot adorning his gluteus maximus. How dare any group of elected bureaucrats ordain the shutdown of an economy? Telling citizens to "stay home" and "avoid contact" was tantamount to telling my grandfather to cease and desist in providing for his family. That he should shutter the ploughs and the reapers and the milking stations, that his sons and daughters need not feed the chickens or slop the hogs because the government was going to "protect them" from harm? Well, not only would promises like that go unheeded by the generations that preceded us; they would be treated with the utmost of distrust and the vilest of response.

The reason that citizens of North America fled Europe and the British Isles to become settlers in the New World was because acceding to government orders and laws and rules and edicts had left them wallowing in a sewer of social and economic slavery while the elites inhabiting the privileged classes prospered. Sadly, over the last century or so, starting around 1934 with the creation of the first U.S. "central bank" (the Federal Reserve), citizens have been purposefully softened by the availability of social safety nets that started innocently and well intentioned in the 1930s, with programs like the Tennessee Valley Authority and later Freddie Mac and Fannie Mae.

But at every sniff of an economic downturn, political responses have grown progressively more rapid and more extreme. With the mainstream media (which is now social media more than print or TV/radio media) providing a wonderful symphony of accompaniment, the political grandstanders have been able to generate a cavalcade of panic, which has provided the perfect cover for clandestine enrichment of the corporate sector, once again, as in 2009, from the public purses on the pretense of economic Armageddon.

Fellow citizens, I ask you: How many times must you be subjected to this moral hazard rot before you arm yourselves with torches and pitchforks and enact change?

Back in late February, when the fear-mongering was just shifting into gear, I was ranting and raving about the REPO operations back in late September and asking why the Fed was bailing out the hedge funds. I was waving the red warning flag long before COVID-19 conveniently arrived on our doorsteps to present a "clear and present danger" to all aspects of Western civilization, to the extent that the U.S. central bank alone has authorized an injection of $10 trillion into the corporate pig trough. That is a pittance when one adds the Bank of Japan (BOJ), the Bank of China (BOC), the European Central Bank (ECB), the People's Bank of China (PBOC), and all of the other purveyors of counterfeit currency to the mix.

Where was it ever written that an elected official has the right to impair the purchasing power of years of labor and prudence and savings of the average citizen? What gives any politician the right to debase my money, upon which I deserve to rely as I move into retirement?

You must forgive me for sounding like a bitter, disillusioned old man but the events of the New Millennium are growing more and more apocalyptic as the days wear on. Today I read that the CDC (Centers for Disease Control and Prevention) has agreed with the findings of scientists from Yale and John Hopkins, and has determined that the mortality rate for the current pandemic is no different than for any other strain of infectious virus.

In other words, whether or not these political wand wavers ordered work stoppages or not, the same rate of fatalities would have occurred. Whipped up into a media-frenzied print-fest, the Fed and the U.S. Treasury just trashed your savings, your pensions and your Social Security by assuming leadership of a crisis for which not one person was either qualified to assess nor capable of managing. The "clear and present danger" was not the pandemic; it was the politicians and the money changers inhabiting the temple.

Markets

What markets? There are no "markets" anymore. All I see when my quote terminal starts flashing these days is the New York Fed's omnipotent computer programs whirling away, assigning their desired price objectives to literally everything. Yield curve moving back to inverted? Nope—buy all short-dated bonds until the two-year yield is down. Thirty-year yield moving lower? Nope—sell the hell out of the 30-year until we get that yield well above the two-year. Stocks looking a tad weepy? Nope—buy a 500-lot of the E-minis and trigger the algos to the buy side.

And gold! What the hell is it doing at $1,750/ounce? Offer three times annual global production $40 under cash, and we can easily fix that problem, too! Everywhere I look I see criminal interventions making it impossible for me to apply the skills I learned over 40 years to the practice of managing risk.

The near-term outlook for stocks is now locked within the walls of the Eccles Building in Washington; the models that have been constructed have no historical precedent upon which to rely. These economists all disagree on every point except one: credit creation. Since all they really understand is the process of debt application to solve all problems of a fiscal and monetary nature, the pandemic now provides an entirely new bogeyman to be vanquished through monetization. Adding a health crisis to the banking crisis of 2008 and the liquidity crisis of October 2019 (when the REPO ops began in earnest), their models completely and conveniently omitted the underlying systemic cause of disruptions—which, of course, is debt.

I learned long ago that after periods of sustained credit creation in any society, there comes a moment when the marginal benefit of one additional dollar of debt has zero impact on either gross domestic product (GDP) or money velocity, with the latter more important than the former. The world passed that threshold in 2008, and was beginning the violent and deflationary process of debt destruction when the international banking cartel, led by the Wall Street/Washington ringleaders, held out their hands. After using the MSM (mainstream media) to spread panic throughout the campaign headquarters of the political classes, they secured permission to reverse the debt elimination process through an unprecedented credit creation orgy that papered over the insolvency and illiquidity of the purging process.

Sure enough, the policymakers discovered the impossibility of reversing an exploding debt bubble, and that you can no more assuredly reverse a credit bubble's popping than you can the direction of the St. Lawrence River. You can divert the flows temporarily, but you can never reverse them.

The first signs of the return of the credit reckoning came last autumn with the "not QE" REPO operations that were all centered around the growing illiquidity in the treasuries markets, which then began to bubble over into corporate high yield. As the size and scale of the REPO actions were escalating wildly as late as February, the debt destruction monster was starting to become an unpopular narrative that was threatening to overshadow the China trade war and talks of impeachment. In an election year, the last thing any Republican could handle was the re-emergence of this credit "hydra."

Enter the Wuhan pandemic and what arrived in the nick of time was the perfect cover for yet another debt-fueled diversion of the credit reckoning—but this time, unlike 2009, the money-printing bazooka used by Hank Paulson has been replaced by a fifty-megaton nuclear weapon of mass distraction designed to keep the citizenry terrorized and under control.

In past times, the layering of large swaths of counterfeit currency on top of systemic insolvency was done so delicately, and usually with little drama or fanfare. In the '80s, when the savings and loan industry was buried in bad loans that threatened the big Wall Street counterparties, they deftly and surgically moved the problem "off balance sheet," which is a polite way of saying that they lifted the corporate governance carpet and with the flick of the broom, swept the rotting remnants of corruption, bribery, and boardroom malfeasance under, never to be seen or spoken of again.

Fast forward to 2020. There are now daily press conferences with the thespian thought-managers front and center, all giving opinions and pronouncements on issues over which they have no control and about which they have no knowledge. To say that I am irked by the arrogance of the self-professed "experts" in espousing forecasts on everything from mortality rates to economic recovery rates is an understatement; these blowhards have zero understanding of, nor ability to predict, anything related to the pandemic. Therefore, they had zero authority to make decisions affecting millions of citizens in countries all over the world. Yet they did, and now we must live with their gambles on how we should live our lives.

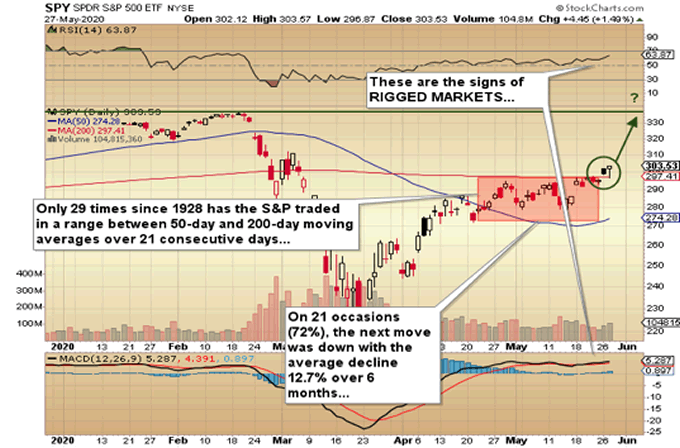

There is only one chart to show, and it is one that depicts the insanity of the day. Thanks to this coordinated orgy of preventative credit expansion, equity markets, led by the S&P 500, have roared back from the abyss. Debt-to-GDP at 140% and forward P/Es (price-to-earnings ratios) in the never-before-seen 24 ranges are today the "new normal," and not to be feared but rather embraced, because at the end of the day, there can never ever again be bankruptcies of a corporate origin. These might impact the unemployment rate and, more importantly, stocks, and if stocks are in decline, people will be afraid to spend the money they no longer have, and that they lost while providing for their families after the government forced their employers to stop all operations.

I watch riots breaking out in Minneapolis, and now L.A., over yet another racially charged police action causing the death of a citizen, and firmly believe that this is going to become an accelerant to the outrage that is simmering on the back burners in households all across the globe. The SPY looks like it wants to probe higher, and quite possibly test the February pre-COVID highs, but from my perspective, valuations are absurd and joined by risks that are now even higher than I sensed in February, when I urged subscribers to short the SPY at 326.

Will I short the SPY again any time soon? Well, if I am in a Las Vegas casino and I see the pit boss whispering to a croupier about a player on a "roll," I can promise you that I will not be joining that table any time soon. There are just too many big players who want to see stocks higher, and bonds and gold "controlled," and until I have certainty that the trillions upon trillions of Fed credit bestowed upon the Wall Street crowd is not aimed at the stock market and Donald Trump's reelection, I will be happy to keep the bulk of my investible cash exactly that—in cash—with an overweight position in gold and silver junior developers with ounces in the ground and fortunes to be made when the levee finally breaks and the oceans of toxic debt flood the fields.

The sooner, the better. . .

Follow Michael Ballanger on Twitter ;@MiningJunkie.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure: 1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. 2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.

Michael Ballanger Disclaimer: This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.