After 2nd Quarter Economic Carnage, the Quest for Philippine Recovery

Economics / Coronavirus Depression Jul 02, 2020 - 01:52 PM GMTBy: Dan_Steinbock

Recently, the IMF downgraded most growth projections, due to weaker private consumption and elevated uncertainty in investment. Those are the twin engines of the Philippine economy. So, what’s ahead for economic recovery?

As I wrote in a report 2 months ago (click here), the global economic outlook of the International Monetary Fund (April 2020) was too optimistic. Last week, the IMF downgraded most of its projections. Now global growth is projected at -4.9% in 2020, almost 2 percentage points below the previous forecast.

Consumption growth has been downgraded for most economies, due to the larger-than-anticipated disruption to domestic activity. Worse, investment is expected to remain subdued as firms defer capital expenditures amid elevated uncertainty.

If consumption growth has historically been central in the Philippines, while investment has fueled the country’s “Build, Build, Build” infrastructure drive, what’s ahead for economic recovery?

Pandemic liabilities of consumption-led growth

In the Philippines, the impact of the great coronavirus contraction began already in the 1st quarter, when the economy shrank by 0.2% on year-on-year basis.

The effect was dramatic, even though the official number of cases was still relatively low (less than 2,100 versus more than 35,000 today) and nationwide quarantine began to dampen demand only toward the end of the quarter. With plunging international conditions, travel and tourism, retail and transportation took heavy hits.

For years, the conventional wisdom was that economic growth in the Philippines is fueled by consumption. In the West, observers saw the status quo as positive because it supported foreign exports into the country.

Nevertheless, for years, I have been warning that under adverse conditions consumption-reliant economy can prove a severe liability because, without a vibrant domestic manufacturing base, such growth keeps the country under dependency.

When international conditions are positive and global economy thrives, so will Philippine consumption and economy. Unfortunately, the reverse applies as well – and that’s what we have seen in the course of the past few months.

In the 1st quarter, growth in household consumption, which accounts three-fourths of the GDP, fell flat. As the global economy has been frozen, Philippine business, investment and consumer confidence have been impaired as well.

But there’s much worse to come.

1st quarter plunge only prelude to 2nd quarter carnage

As the global coronavirus contraction spread in the first half of the year, the plunge is reflected by the revised Philippine economic outlook.

The fall of both exports and imports was only to be expected following the rapid deterioration in external demand and the disruption of supply chains.

Obviously, months of lockdowns and quarantines around the world have reverberated adversely on the supply side as well. Economic growth has decelerated in all sectors. Growth in services fell four-fifths to 1.4% on a quarterly basis, mainly as net effect of the plunge in transport and accommodation, food services, and trade.

In the past, construction, perhaps even manufacturing, was thriving. Now both fell, as did agriculture.

The current forecast for 2020 has been downgraded to -3.8%. Both household consumption and investment have slowed more than expected. And the contraction in the global economy will continue to drag external trade, tourism and remittances.

Nevertheless, the Asian Development Bank’s (current) forecast for 2021 is maintained at 6.5%, supported by public infrastructure spending and anticipated recovery in consumer and business confidence.

Thanks to its secular economic potential, the Philippines certainly could experience a strong V-shaped recovery. But it will not prove as smooth as currently anticipated. In the global economy, the plunge of the 1st quarter is just a prelude to the massive collateral damage in the 2nd quarter, which is almost over.

In the Philippines, too, new downgrades are likely to reflect the new normal in the coming months.

Hollow “lives vs livelihoods” debates

In the past few months, critics of the Duterte government first downplayed the impending economic damage associated with the coronavirus contraction. When the stance proved flawed, the tactic was reversed. More recently, they have pushed for even longer lockdowns and quarantines, despite prohibitive economic costs.

These debates are not predicated on the recovery of the Philippine economy and the well-being of its citizens. Rather, such debates, which blame the government for the global pandemic, reflect early positioning for the 2022 election – that is, political exploitation of dire economic realities.

In 2019, the budget debacle proved extraordinarily costly because it weakened Philippine output potential right before the global pandemic and the coronavirus contraction. Should they result in real political polarizations, current “lives versus livelihoods” divisions could contribute to a slower than expected recovery.

Today, all economies in Southeast Asia hope to gradually ease lockdowns, quarantines and restrictive measures. Yet, in the Philippines, some argue that the quarantines should continue longer to ensure adequate bending of the epidemic curve. They believe that lives precede livelihoods.

In contrast, others claim that such measures would be foolish because they downplay the adverse economic consequences of the quarantines. They claim that without livelihoods lives will be lost.

In reality, both sides have a point, but neither is right. Without lives, there are no livelihoods. Conversely, without livelihoods, lives will be lost. The challenge is not to choose between one or the other. The challenge is the right and timely balance between the two.

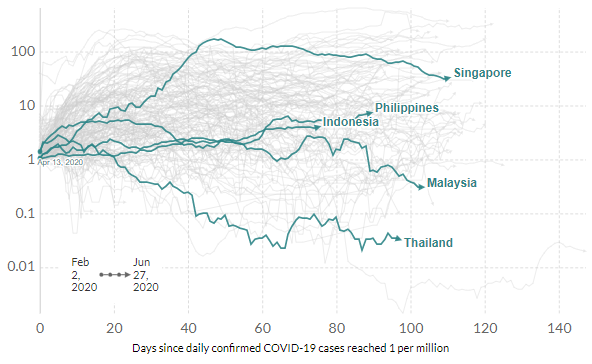

While the recent surges in confirmed cases reflect intensified testing rather than changes in the pandemic status quo, Philippine recovery cannot fully move ahead until the epidemic curve is effectively bending. And the reality is that while the Philippines is getting closer to bending the curve, it hasn’t succeeded yet in per capita terms (Figure).

Figure Getting closer to bending the curve*

Daily Covid-19 cases per million: ASEAN economies

Source: European CDC, June 27, 2020

Fiscal and monetary flexibility facing stress tests

Obviously, household consumption and investment growth has plunged in the 2nd quarter. But if the pandemic can be kept in check in the coming months and the epidemic curve finally bends, infrastructure investment and household consumption could intensify the hoped-for recovery.

The Duterte government’s infrastructure and fiscal economic changes have lifted the share of investment growth up to 27% of GDP from barely 20% in the Aquino era (2010-16). However, since the government must now allocate more to the struggle against the pandemic, public expenditure and construction outlays will be delayed.

Consequently, now it’s the time to push even harder the infrastructure drive and fiscal economic changes. If this effort proves successful, the growth forecast for the current year is still likely to hover at around -3.5% to -4.5% on a year-to-year basis. But the coming recovery could prove stronger than expected.

In the past months, the Bangko Sentral (BSP) has cut the policy rate by 125 basis points, pushing the benchmark rate down to a record low 2.75% (which is likely to cut closer to 2.0% in the coming months). The reserve requirement ratio (RRR) has been cut down to 12% (with another 200 basis-points reduction likely ahead).

Obviously, the BSP has tried to neutralize the pandemic impact on economic growth.

Recently, lower energy prices and reduced imports have offset the fall in remittances. But since global recovery is likely to prove more challenging than expected, weaker government revenues (and rising deficit) and impending stimulus package (3.1% of GDP) will stress-test fiscal policies in the second half of the year.

Challenging scenarios

If, in addition to the catastrophic consequences of the Trump administration’s failed pandemic policies, the White House willaccelerate its trade wars against China and US allies in Europe and East Asia, global economic headwinds will prove much worse than expected.

In that scenario, the anticipated global recovery would prove subdued in the second half of the year and a multi-year global recession could no longer be excluded, especially as the heavily-indebted advanced economies’ recent and huge debt-taking may result in new debt crises, which could spill over to poorer countries.

Furthermore, such negative scenarios would be reinforced if the development of vaccine and viral therapies will take longer than expected.

In the coming months, the Philippines, like so many other countries, will face the greatest risks (and opportunities) since World War II. Now the margin for error in economic policies and pandemic containment is slim to nil.

Dr. Dan Steinbock is the founder of Difference Group and has served at the India, China and America Institute (US), Shanghai Institute for International Studies (China) and the EU Center (Singapore). For more, see http://www.differencegroup.net/

© 2020 Copyright Dan Steinbock - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Dan Steinbock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.