Did the Stock Market Bubble Just Pop?

Stock-Markets / Stock Markets 2020 Jul 19, 2020 - 07:02 PM GMTBy: Doug_Wakefield

It has been 18 months since I closed Best Minds Inc. Today I am teaching math. I love math because even when opinions appear totally wrong, math is still based on proofs.

So let’s prove that we are in a massive financial bubble that today, may have finally popped, even with all the “help” from central planners of market manipulation.

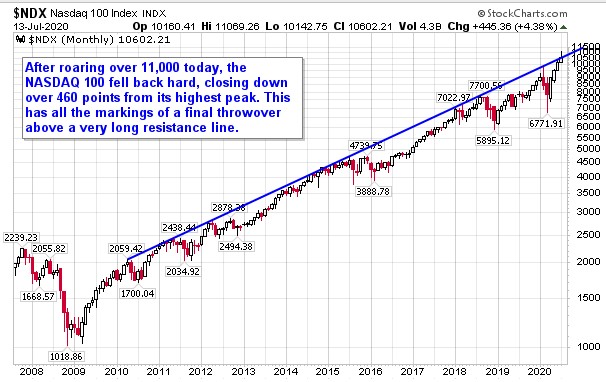

Exhibit 1 – The faster a stock or market rises, the more it produces a parabola. Parabolic spikes have been warnings signs repeatedly. History has been here before, and the outcome was not “more sunny skies ahead”.

Exhibit 2 – For every action there is an equal and opposite reaction – 3rd law of thermodynamics

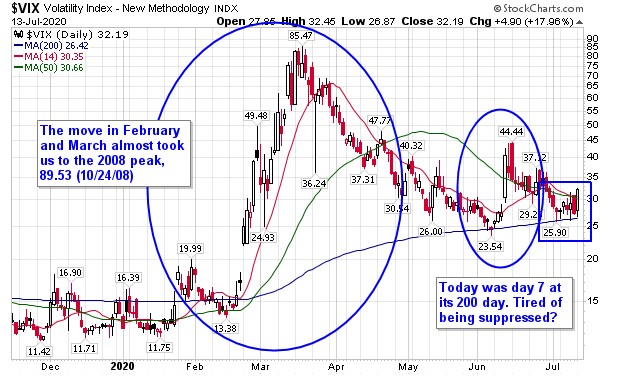

We can see from the two charts below that there has been a resistance level for 10 years in the NASDAQ 100. We have arrived at this level several times since 2010. Every time we slowed or stalled. However, the NASDAQ 100 burst through this line last week. Was this a sign of extreme exuberance and market “assistance”, or merely savvy investors who understand that economic news since March is not important anymore?

Beyond these two exhibits, I would like to share some other warning signs.

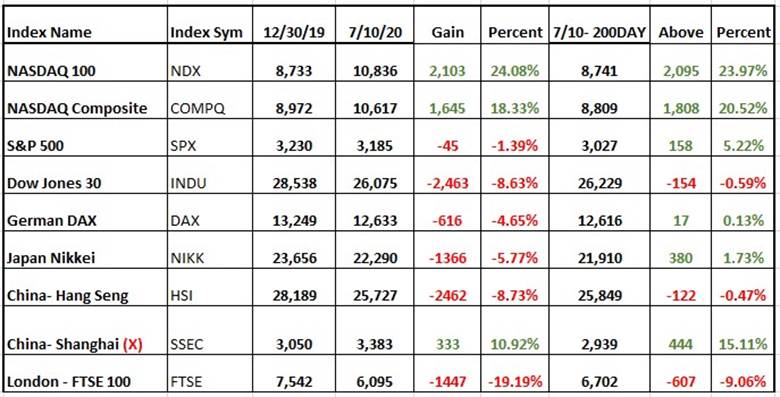

We can see from the chart below that the NASDAQ is the only one of these major equity markets that is in double digits this year. Shanghai is too, but only because of July. I am leaving this chart in that I developed this weekend since today’s closing numbers were below these from Friday.

The Shanghai Stock Index was below its 3,000 mark at the close of June, so all its annual gain came in the last 2 weeks! Ready to dive in?

Next is the problem with extreme crowding as the top holdings in the NASDAQ 100 and S&P 500 reveal.

Millions of investors in index funds based on the performance of the S&P 500 and the NASDAQ 100 are heavily dependent on these same 5 companies. For S&P 500 investors this is almost one fourth of their money. For NDX 100 investors this is close to one half of their money. Since these are two of the most traded indices in the world, it appears that global financial markets are heavily dependent on their recent performance continuing into the indefinite future.

500 years of market history reveal that every cheap money bull market has been followed by a serious bear market. Every major US market will be 2 years longer than any of their past bull markets in American history if they make it until September.

However, one thing is for sure. We are depending on a few global tech giants to keep up the illusion that economic pain for main street does not need to impact investors.

But is that smart for investors as we come through so many painful headlines this year?

Can the millions of investors who have come to spout the religious mantra, “It always comes back”, continue depending on even more debt from central banks to push their statement values higher? Not if gravity still exist and history is still relevant.

Three recent articles from individuals who have impacted my thinking for years:

- The Bubble, Sven Heinrich, Northman Trader, July 6

- QE Unwind Speeds Up: Fed’s Assets Drop $85 Billion. Four-Week Total - $248 Billion, Wolf Richter, Wolf Report, July 9

- You are Now Leaving FantasyLand: The Losses Will Be Taken By Somebody, Charles Hugh Smith, Off Two Minds.com, July 9

Doug Wakefield

President

Best Minds Inc. a Registered Investment Advisor

1104 Indian Ridge

Denton, Texas 76205

http://www.bestmindsinc.com/

doug@bestmindsinc.com

Phone - (940) 591 - 3000

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology

Doug Wakefield Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.