Machine Intelligence Quantum AI Stocks Mega-Trend Forecast 2020 to 2035!

Stock-Markets / AI Jul 21, 2020 - 05:19 PM GMTBy: Nadeem_Walayat

This is the third and final article in my 3 part series of analysis that concludes in a detailed 15 year stock market trend forecast for AI stocks, including a stand alone forecast for Alphabet (Google) into 2027.

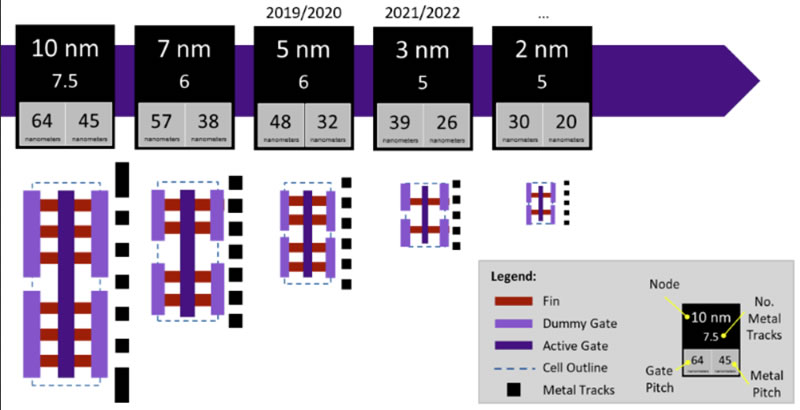

Part 1 The AI Stocks Mega-trend - Moores Law is NOT Dead!

Part 2 Tech Stocks Trending Towards the Quantum AI EXPLOSION!

However the whole of this extensive analysis was first made available to Patrons who support my work - Machine Intelligence Quantum AI Stocks Mega-Trend Forecast 2020 to 2035!.

- Why Investors Should Buy Deviations against the Bull Market Highs

- The AI Mega-trend - Moores Law is NOT Dead!

- QUANTUM COMPUTERS

- The Quantum AI EXPLOSION!

- Capitalising on the AI Mega-trend

- AI Stocks Mega-trend

- Formulating a AI Stocks Mega Trend Forecast

- AI Stocks Mega-tend 15 Year Trend Forecast Conclusion

- Dow Quick Technical Take

- Getting Started with Machine Learning

- Black Lives Matter Protests To trigger 2nd Covid-19 Wave?

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Including access to my latest analysis AI Tech Stocks Buying Levels and Valuations for Q3 2020

And access exclusive to Patrons only content :

How to Get Rich Investing in Stocks by Riding the Electron Wave.

Capitalising on the AI Mega-trend

Machine Intelligence has become a broad church that has fragmented or branched off into a myriad of sectors and the number keeps growing each year. Many years ago I broke the machine intelligence mega-trend down into 10 key sectors to invest in

Of the list the least development to date has been on Graphene and Nanobots. Where we are still waiting for Graphene to produce a world changing breakthrough. Ten years ago in my Inflation Mega-trend ebook I imagined Graphene would be a world changer by now, but it's gone nowhere for a decade! Which illustrates why investors should focus on the primary AI tech stocks rather then try to pick highly specialised smaller cap stocks such as plays on Graphene as they may go bust long before the technology matures. My best guess is that graphene breakthroughs are pending the silicon road block, which perhaps will take place at the 1nm scale, where smaller scale logic gates tend to produce too many errors due to likes of quantum tunneling to be useful. But I would not be surprised if innovation manages to push the use of silicon to well below 1nm towards the size of individual silicon atoms (0.1 nm).

So of the 10 sectors Artificial Intelligence should remain the PRIMARY FOCUS for investing. All of the other sectors remain DERIVATIVES of AI. Which means one could ignore most if not all of the other sectors and just focus on investing in Artificial Intelligence, for most of the AI stocks WILL expand to consume all of the above sectors because AI gives them a competitive advantage.

AI Stocks Mega-trend

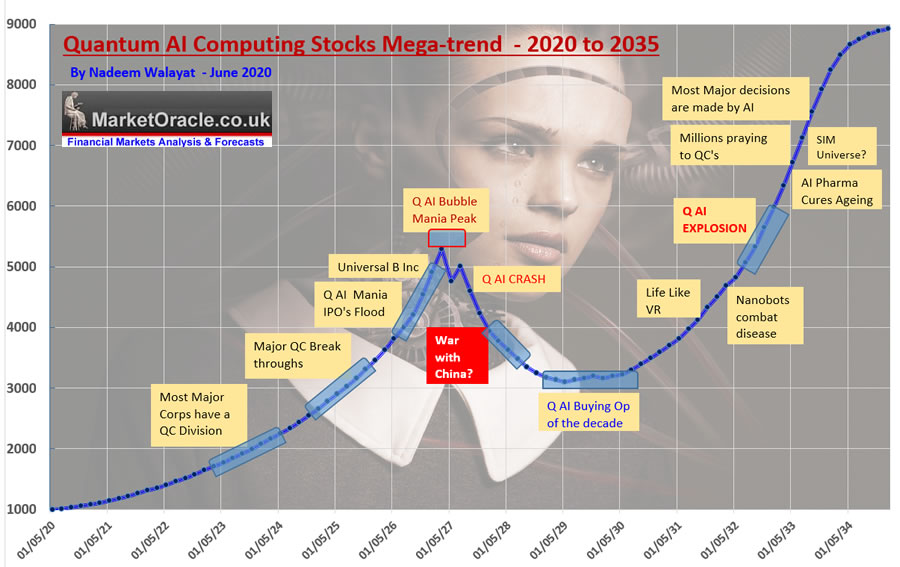

There are going to be 2 phases to the AI stocks megatrend.

Phase 1 will be during the 2020's when machine learning will continue it's exponential expansion virtually wholly reliant on classical computers that will continue to increase in processing power exponentially in terms of accuracy in modeling the real world that will put many more millions of humans out of work.

Phase 2 - Is when AI and Quantum computing start to merge into every greater co-development during the 2030's that will result in the explosion moment when AI and Quantum computing basically become one and the same thing.

So just as today's tech stocks will come be to known as AI stocks during the 2020's, so will the AI stocks during the 2030's come to be known as Quantum AI stocks.

So the tech stocks that comprise the Quantum AI mega-trend are set to experience two exponential waves, and then an explosion when they become part and parcel of the same thing as post classical computer machine intelligence will be far beyond that of human intelligence that see taking place around the mid 2030's, which 'should' send the mega-trend stocks substantially higher.

Now against this rosy picture of an exponential trends due to innovation driven breakthroughs culminating a Quantum AI explosion we have the dynamics of sentiment driven stock market trends. Where the fundamental rule is that stock markets DISCOUNT the FUTURE! And that trends tend to culminate in manias and panics, of which we recently got a reminder of during the corona crash where those stocks most able to profit from the corona lockdown's typically lost 1/3rd of their values during the panic events hence delivering to those who knew what to do at such times in a multi year buying opportunity to pile into AI stocks.

And no matter how intelligent the machine intelligence gets it's not gong to overcome stock market sentiment which is in fact the SUM of ALL INTELLIGENCES, at least until the explosion moment shortly after which most decisions will be taken by Quantum AI systems so out of the hands of 1350cc of brain power subject to primordial drivers of fear and greed.

Formulating a AI Stocks Mega Trend Forecast

1. AI stocks should continue to out perform the general stock market indices by a wide margin.

2. Given that AI stocks comprise an increasing share of the general stock market indices then the overall trend for the likes of the Dow and S&P should roughly track that of AI stocks.

3. Stocks will continue to trend and be subject to manias, bear markets and panic events just as we witnessed during March 2020. Where whilst panics cannot be forecast nevertheless should prove to be buying discount events and prove temporary.

4. Whilst it is uncertain how many mania's there will be, nevertheless the frequency of mania's is low enough that there will likely be 1 major mania event during the next 15 years that will result in a significant bear market that I expect will last more than year. But again in the terms of the mega-trend will be temporary. Nevertheless something to keep an eye out for when we see the likes of Google and Microsoft selling for more than 50X earnings as early warning signs that we have entered mania territory that has a high probability of resolving in a bear market that could see stocks lose as much as 50% of their value, that I am sure will confuse many as to how can AI stocks be falling when their revenues are increasing.

5. War with China Mega-trend. At some point this trend will turn hot, one of direct military conflict with China where my analysis of some 5 years concluded to expect a limited nuclear exchange. This is likely to occur during the post AI mania bear market that will act as one of the drivers for the bear market in all stocks.

6. The other negative driver for stocks is likely to make itself manifest over the coming decades is the climate change mega-trend, that 10 years from now is likely to be exhibit ever greater impact than today promoting emergency government actions to mitigate its consequences to some degree.

7. The Inflation mega-trend as a consequence of government money printing to finance growing number of unemployed populations that will likely grow as more and more jobs are lost to machine learning and automation will continue to bubble away under the surface to which AI mega-trend stocks will remain leveraged towards. At some point universal basic incomes are going to have to be introduced to keep the human masses from going on the rampage such as we are today witnessing with the black lives matter brigade.

8. Despite any misgivings today that Quantum Computers being largely expensive glorified chandeliers, nevertheless they WILL become a working reality and just as was the case with nuclear weapons will become the strategic weapons of the future and we are already in an arms race with the Chinese, which means the cost and size and scope of these machines will not be a consideration in the future. Look to the Manhattan project, look to the space race, that's the sort of project we will be looking at in a few short years time to huge benefit to the likes of IBM and NVIDIA. For who gets there first wins! We are going to see a Manhattan project level of resources deployed towards achieving Quantum Computing Supremacy by EVERY major nation! That is going to general a lot of business for ALL tech giants!

So for better or worse we ARE heading for Quantum AI world, and given the amount of resources I expect to be deployed by governments over the coming decade towards the Quantum AI arms race will mean that we will get their far sooner than even the QC scientists expect.

AI Stocks Mega-tend Forecast Conclusion

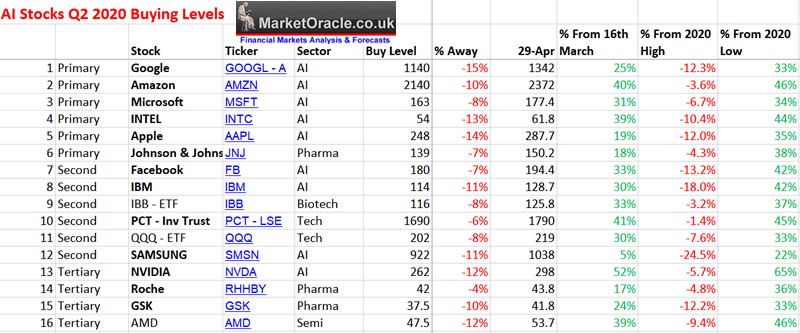

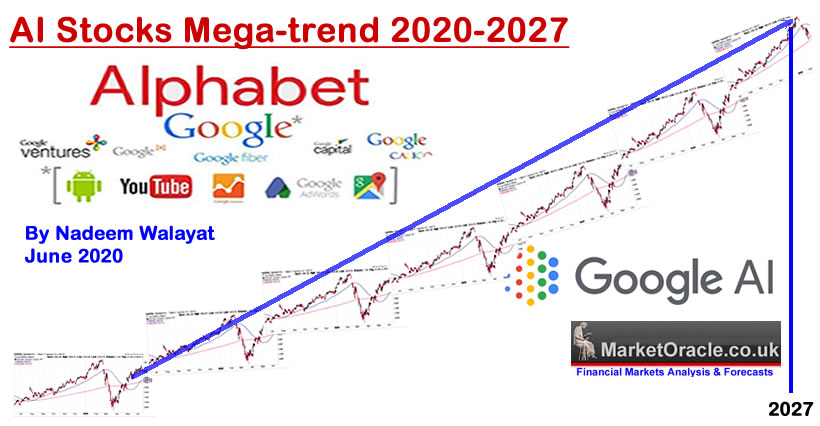

Therefore the following graph illustrates my road map forecast conclusion of how I expect the AI mega-trend to play out over the next 15 years and why I will continue the mantra of buy the dips and panics all the way towards liquidating holdings during the next mania peak when valuations go out the window and when I will likely heavily short these same stocks all the way down towards the buying opportunity of the 2030's.

This is a rough road map of what to expect that undoubtedly given it's long 15 year time span is likely to change in he wake of events many of which we will not even be aware of until they take place. Nevertheless it should better explain why I tend to keep things very simple which is to BUY AI stocks at every opportunity. And why I KNEW the crash during March was TEMPORARY and that the bear market in AI stocks at least would be over BEFORE the end of MARCH as I wrote several times ahead of the decline right into the bear market bottom.

In terms of the general stock market indices. AI stocks will obviously influence the trend of the general indices, that will continue to chug along with government support and as clients to the AI stocks, but as we are seeing today with the likes of Amazon that has put large parts of the high street out of business and shopping malls under huge stress. And which has already started copying products sold on its site by third party sellers then so will AI stocks in ever greater spread deploy their machine intelligence advantage to increasingly displace traditional businesses and corporations that lack their own AI and quantum computing divisions and ultimately put them out of business. For instance I would not be surprised if 5 years from now to see Amazon, Apple and Google flying their own AI operated airlines after having displaced traditional carriers reliant on human labour.

So expect the general stock market indices to follow the AI trend but to deviate below that which AI stocks will achieve the degree to which depends on their components.

The bottom line is the AI mega-tend as is only just beginning with huge innovations and breakthroughs to come over the next 15 years as Quantum computers start to leave the laboratories and take their baby steps into the real world. Thus does it matter if one buys stocks where they are trading today or to hope for a dip towards their corona crash lows ? After all we can all hope for better prices, look to technical indicators for over bought states as prices oscillate around an exponential trend. But as we have seen during May there is no guarantee that the exponential trend is going to give us even slightly better entry levels, not unless external events drive investors into a state of uncertainty and panic.

Therefore it is always better to have at least some exposure to the AI mega-trend rather than to perpetually wait for opportunities to materialise for which there are no guarantees and even when such opportunities do materialise many will still fail to act.

* Note above buying levels based on Dow correcting down to 21,000 during May when currently Dow at best suggests a correction to 23,000, for instance an achievable target for Google now is more like $1330 than $1140.

In the long-run does it it matter if one failed to buy Google at near $1000 mid March than today at $1400? As everything always looks clear with the benefit of hindsight. Which I am sure can act as psychological barriers for many, preventing accumulating / scaling into positions when all they see when they look at the stock charts are the March corona crash lows, hoping that somehow as if by magic the likes of Google will revisit $1000, though if it ever did most would once more be too fearful of worse to come to hit the buy button.

(Charts courtesy of stockcharts.com)

However, armed with the knowledge of the magnitude of the exponential AI mega-trend and what it implies for AI stock prices for this decade and beyond than would most still think twice about accumulating the likes of Google at today $1400? Given where I expect Google to trade upto over the coming decade?

So my message from this article is not to make the mistake of looking in the rear view mirror and make "only if I had bought Google at $1050" statements, and then perpetually wait for a magical buying opportunity to repeat all the way towards watching Google step trend it's way to $6,000 and beyond that I am sure will result in "if only I had bought Google at $1400" statements.

Dow Quick Technical Take

Dow has plunged towards support along a series of previous highs at just under 25,000 so offers potential for some sort of bounce form here given that the decline stopped at the support trendline. A break below the trend line and then below 24,800 would target a trend towards 23,000. But basically don't get carried away by focusing on the small picture by hoping for much lower prices as this AI driven bull market has shown exceptional strength during May and into early June where the most recent price action is definitely corrective, a reaction to the bull markets over bought state following it's run from the March lows.

Getting Started with Machine Learning

Of course investing in the AI stocks is just ONE means of profiting from the exponential machine learning mega-trend. Another way that everyone should consider is to LEARN to program and train neural nets which these days is a LOT easier to do than was the case 10 years ago!

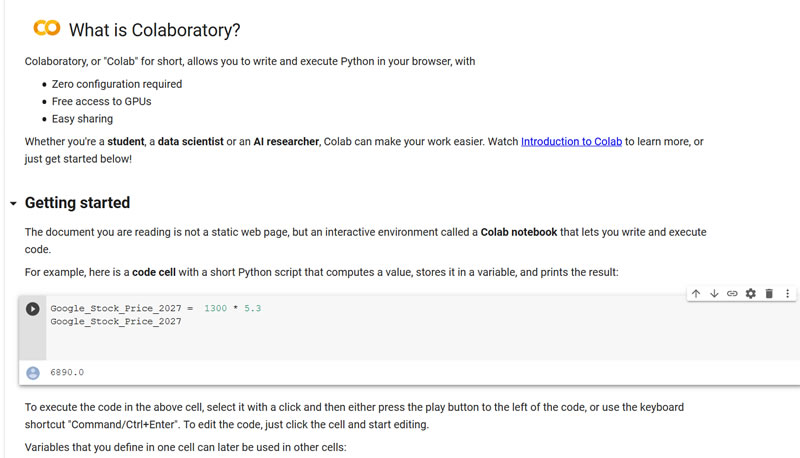

No, you don't need to rush out and invest in a $15,000 3990x system with 4 Titan GPU's and 256gb of ram to get started with machine learning.

You don't even need to go through the convoluted process of installing the various drivers and libraries to get Google's Tensor Flow or other libraries up and running on your desktop or laptop.

ALL you need to do to get started is head along to Google's machine learning cloud service to start developing deep learning applications using Google's own hardware all for FREE!

https://colab.research.google.com

They really could not make things any easier than this to get started with understanding and programming neural networks using python.

Again the whole of this extensive analysis was first made available to Patrons who support my work - Machine Intelligence Quantum AI Stocks Mega-Trend Forecast 2020 to 2035!.

- Why Investors Should Buy Deviations against the Bull Market Highs

- The AI Mega-trend - Moores Law is NOT Dead!

- QUANTUM COMPUTERS

- The Quantum AI EXPLOSION!

- Capitalising on the AI Mega-trend

- AI Stocks Mega-trend

- Formulating a AI Stocks Mega Trend Forecast

- AI Stocks Mega-tend 15 Year Trend Forecast Conclusion

- Dow Quick Technical Take

- Getting Started with Machine Learning

- Black Lives Matter Protests To trigger 2nd Covid-19 Wave?

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Including access to my latest analysis AI Tech Stocks Buying Levels and Valuations for Q3 2020

And access exclusive to Patrons only content:

How to Get Rich Investing in Stocks by Riding the Electron Wave.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your analyst waiting to see what new CPU's and GPU's AMD and Nvidia will announce later this year.

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.