Aussie Dollar Soars to Multi-Month High: You Can't Have Your Fed Stimulus Boost AND Eat It Too

Currencies / Austrailia Aug 18, 2020 - 03:23 PM GMTBy: EWI

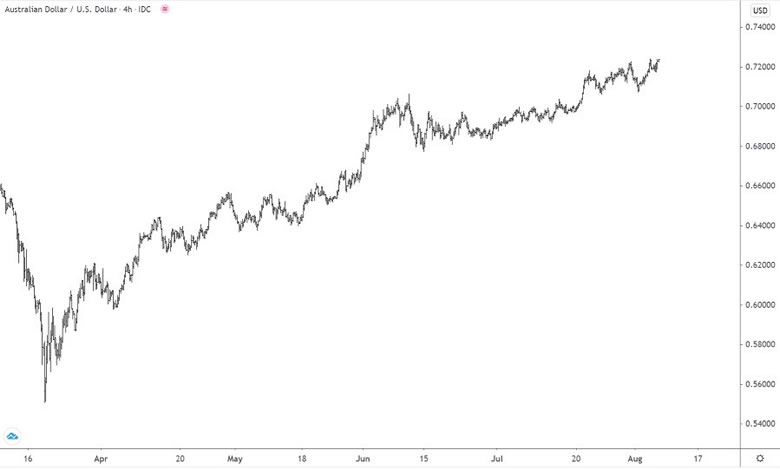

This chart of the Australian Dollar/US Dollar exchange shows that since late March, the dollar-down-under has trended:

UP... to its highest level in 15 -- no, make that 18 months.

What explains the Aussie dollar's strength?

News accounts cite the Federal Reserve's $2.2 trillion (and counting) megawatt coronavirus stimulus policies, which supposedly pressured the U.S. dollar.

"Australian Dollar Looks to Federal Reserve and Gold Price for Lift to New Highs as Rally Ebbs" (PoundSterlingLive.com, July 29)

"AUD/USD bulls reaching for the blue skies in the 0.72 area post Fed, best since April 2019" (FXStreet.com, July 29)

One news source even likens the US central bank to the Star Wars "Death Star," armed with a stimulus laser strong enough to take out entire economies. It writes: "The Fed is sailing global forex markets in a money printing Death Star that is aiming a deflationary cannon at any economy in its path that does not match it."

We can recall a very different story back in March and April. Then, the Aussie dollar was near 17-year lows even as the same death star Fed policies threatened a death blow to the currency's upside.

One news source said the Fed's limitless lending tactics were quote "eviscerating" the Aussie note, while another said its emergency measures would fuel market turmoil and volatility:

"The overall backdrop is profoundly bearish for the Aussie dollar... Any rallies will be fragile. Central bank measures are very much welcome, but the uncertainty of the impact means the market will remain volatile." (afr.com, March 16)

In turn, the Aussie dollar's powerful rally can only be understood by disregarding the Fed as a "cause," and looking instead to the currency's price chart.

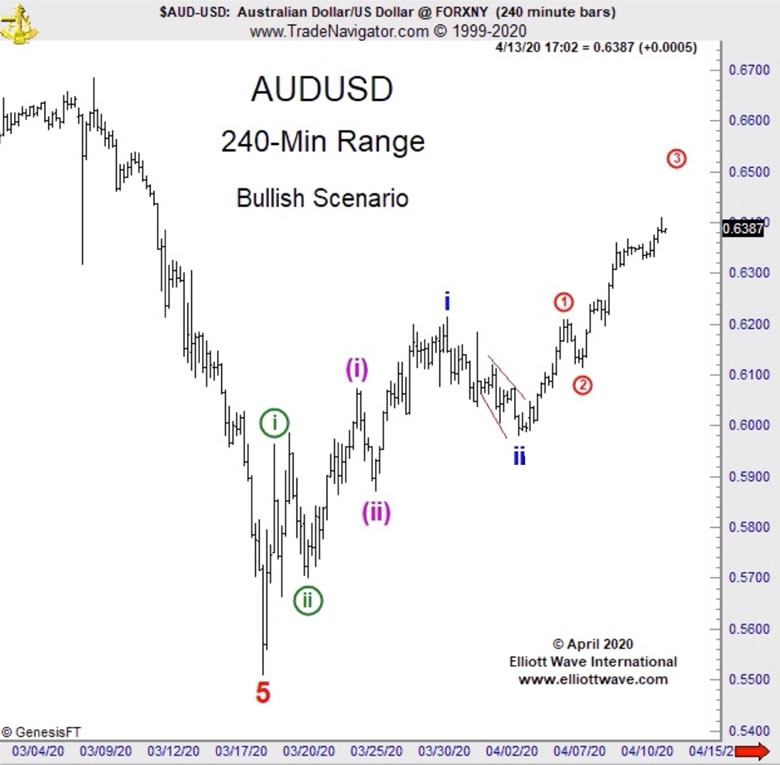

Here on April 13, Elliott Wave International's Currency Pro Service showed subscribers that a rising trend was emerging. We presented a version of this chart which counted five waves down in the Aussie/US dollar complete at this March 18 low.

EWI's analysis said, "Given the very impulsive advance, we [support] the bullish scenario" -- and our forecast called for a powerful Elliott Wave pattern known as "a third-of-a-third wave" higher.

Price did indeed rally strongly into June 10, followed by a brief pullback into June 15th. Their Pro Services comment on June 15th said the action "suggests a bottom is likely in place," and that our "bullish outlook calls for a turn higher from current levels."

From there, the Aussie dollar continued its powerful move higher thru August 6th.

The Aussie/US dollar pair is among the world's leading forex pairs. Others include the EURUSD, USDJPY, GBPUSD, USDCAD, and more! Right now, EWI's premier Currency Pro Service identifies high-confidence trade set-ups in these markets -- for intraday, daily, and weekly time frames.

If you need a FREE sample of first-rate analysis, sign up TODAY for EWI's August 12-19 Forex & Metals FreeWeek. That's 7 days of instant access to exclusive, action-oriented forecasts, analysis and videos. See below for all the details!

The timing couldn't be better. Gold and silver have been making headlines -- and aren't done according to EWI's analysts. They also say EURUSD and several other FX pairs are poised for big moves. You get a front-row seat to these new opportunities free.

EWI's promise to you: At the end of Forex & Metals FreeWeek, you'll see more clarity and predictability in the markets than ever before.

This article was syndicated by Elliott Wave International and was originally published under the headline Aussie Dollar Soars to Multi-Month High: You Can't Have Your Fed Stimulus Boost AND Eat It Too. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.